Health insurance can feel like a money pit. Premiums keep rising, and it’s hard to know if you’re getting your money’s worth. Many Australians are paying for coverage they don’t even need.

Starting April 1, premiums will increase by an average of 3.73%. This is the biggest jump in six years. The good news? You can still find ways to save without losing important benefits.

This guide will walk you through five easy tips to lower those costs and make smarter choices about your health cover. Ready to cut down on expenses? Keep reading!

Review Your Current Health Insurance

Take a good look at what you’re paying for. Cut out extras you don’t use to avoid wasting money.

Analyze your current coverage

Check your health insurance policy for extras you don’t use. Many people pay for services like dental or physio but never use them. If they’re unnecessary, cutting them can save money.

Look at your premium costs and coverage needs every year before prices rise on April 1. The average increase in 2025 is a hefty 3.73%. Switching to a different insurer with similar coverage won’t reset waiting periods, so it’s worth considering options that better match your budget and health needs.

Eliminate unnecessary extras

Some extras cost more than they are worth. In 2022/23, Australians paid $7,303 million in extras premiums but only got $5,967 million back in benefits. That’s a big gap. If you rarely use dental care or physio, why pay for it? Cutting unused extras can lower your premiums fast.

Think about splitting your hospital insurance and extras cover between different insurers. This may help you get better value for both plans. Be careful with removing maternity or other major services, though; reinstating them later might come with long waiting periods.

Only keep what fits your needs now and saves you money today.

Shop Around for Better Deals

Health insurance prices can vary a lot between providers. Comparing options might save you big bucks without losing important benefits.

Compare policies online

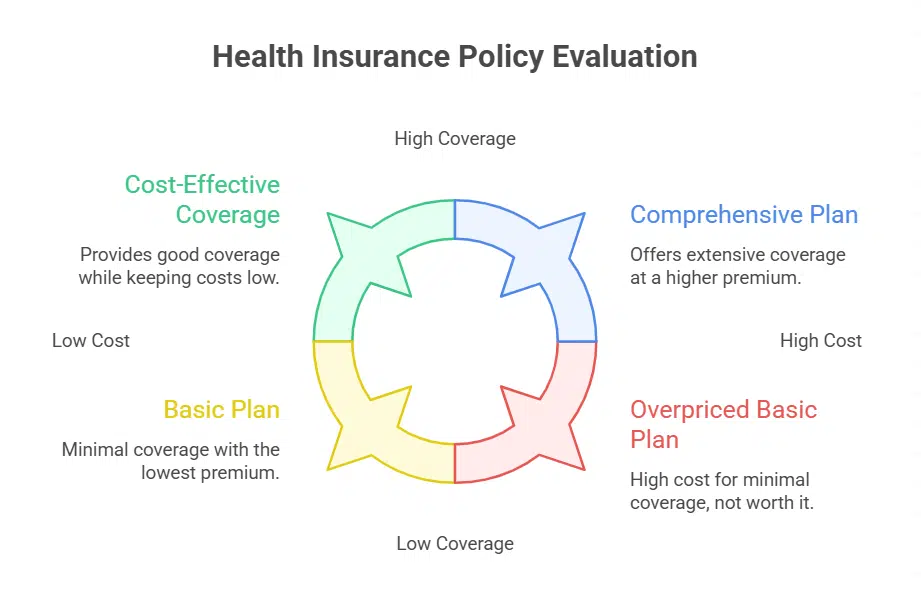

Your health insurance might not be the best fit anymore. Prices and policies often change. Comparing online is a quick way to explore better options. Let’s break it down for you below.

| Step | Details |

|---|---|

| Why Compare? | Rates change often, and sticking with an outdated policy could mean you’re overpaying. Online comparison tools can reveal savings in minutes. |

| How to Start? | Head to trusted platforms like Fair Health Care Alliance. They focus on privacy and give you quotes based on your needs, not someone else’s. |

| Things to Look For | Check premiums, excess amounts, included benefits, and any waiting periods. Some policies might look cheap but miss key features. |

| Switching Made Easy | In Australia, switching insurers won’t force you to re-serve waiting periods—provided coverage is like-for-like or lesser. Keep this in mind when comparing. |

| Time-Saving Tip | Use online tools or a broker to cut through options faster. Tools like Fair Health Care Alliance have won awards since 2017 for their ease of use. |

Comparing online isn’t about shiny features. It’s about finding value. A few clicks could save you a bundle.

Use brokers for tailored options

Brokers can make comparing insurance policies much easier. They know the ins and outs of different coverage plans. Aaron Savrone, founder of FHCA, has over 15 years of experience helping people find better value in health insurance.

His company even holds a 5-star Google Review score for its work.

Experts like this offer custom recommendations based on your needs and budget. They save you time while finding savings that might not be obvious online. Using a broker means tapping into their expertise to uncover options with real value.

A broker’s job is to match your needs with the right policy, says Aaron Savrone from FHCA.

Adjust Your Excess

Raising your excess can shrink your premiums fast. Just be mindful of what you can afford if a claim pops up!

Opt for a higher excess to lower premiums

Choosing a higher excess can drop what you pay monthly. For example, selecting a $500 excess often means lower premiums without breaking the bank during hospital visits. Singles can go up to $750, while families may set theirs at $1,500.

Always pick an amount you can easily afford if you need to claim. Balancing affordable insurance with out-of-pocket costs is key. This strategy works best for people who do not expect frequent hospital stays or claims.

Balance affordability with potential out-of-pocket costs

A higher excess lowers health insurance premiums, but it can mean bigger bills during claims. Choosing this path requires balancing upfront savings and potential treatment costs. For example, Australians paid $7,303 million in extras premiums last year yet received only $5,967 million back.

This shows that not all coverage is worth the price.

Avoid overpaying for extras cover unless you often claim these benefits. Think about your current health needs and future risks before increasing your excess. Paying less now may feel great, but unexpected medical bills could stretch your wallet later if you’re not careful.

Take Advantage of Discounts and Rebates

Look out for deals that can lower your health insurance costs. Some perks might be hiding in plain sight, so keep an eye open!

Check for government rebates

Government rebates can make health insurance more affordable. In Australia, your income decides if you qualify. For singles earning under $97,000 or families making less than $194,000, you may get up to 24.288% off your premiums.

This rebate lowers out-of-pocket expenses and helps manage healthcare costs.

Check the latest rules since these figures may change yearly. Make sure to update your details with Medicare or your insurer to get the right benefits. Lowering insurance costs this way leaves more room in your budget for other needs like better coverage or savings.

Look for loyalty or early payment discounts

Loyalty discounts can save money for long-term policyholders. Some insurers, like HBF, reward customer loyalty with savings. HBF offers a 4% discount for using direct debit and an extra 3.84% discount if you prepay your insurance annually.

Together, that’s a 7.84% total savings.

Paying early might also lower premiums. For instance, NIB provides a 4% discount when paying through direct debit options. These small steps add up over time, helping reduce costs while keeping coverage intact!

Prepay Your Premium and Automate Payments

Paying your premiums upfront can stop rate hikes from sneaking up on you. Automating payments means less hassle and fewer late fees.

Pay annually to avoid premium increases

Health insurance premiums in Australia rise each year. Lock in your rate by prepaying a full year’s premium before April 1, 2025. This can freeze your current cost for up to 18 months and save you money.

The average increase expected is 3.73%. Paying upfront helps keep your budget steady without surprises. If this fits into your financial plan, it’s worth doing. Next, explore how automating payments could bring extra savings!

Set up direct debit for additional savings

Set up direct debit to manage payments with ease and save money. Some insurers, like HBF, offer small discounts for this option. For example, HBF gives a 4% discount just for using direct debit.

Pay your yearly premium upfront to stack even more savings. HBF adds an extra 3.84% discount for annual prepayment, making it a total of 7.84%. Automatic payments also keep you on track and prevent missed bills.

This helps with budgeting while lowering costs over time!

Takeaway

Saving money on health insurance doesn’t have to be hard. Review your plan, cut extras, and compare policies for a better deal. Raise your excess if it makes sense for you, and grab any discounts or rebates offered.

Paying ahead can lock in lower rates too, which helps avoid rising costs. Start small today, and watch the savings stack up!

FAQs on Health Insurance In Australia

1. How can I save money on health insurance in Australia?

Compare plans from different providers to find the best value. Look for policies that match your needs without extra features you don’t use. Opt for higher deductibles if it makes sense financially, and pay premiums annually instead of monthly when possible.

2. Is private health insurance worth it in Australia?

It depends on your situation. If you need specific treatments or want shorter wait times, private coverage might help. But review your budget and consider whether public healthcare covers most of what you need before deciding.

3. Can switching health funds really save me money?

Yes, switching can often lower costs or get better benefits at a similar price point. Many funds offer discounts or perks to attract new members, so shop around regularly to avoid overpaying.

4. Are there government incentives for having private health insurance?

Yes, Australians may qualify for rebates based on income levels when they hold eligible private coverage. Avoiding the Medicare Levy Surcharge is another potential benefit if your income is above a certain threshold while holding appropriate insurance plans.