Buying your first home is an exciting and significant milestone. But in a tough housing market, finding the right home that fits your needs can be challenging and may take lots of time, work, and research. Knowing what to expect can go a long way toward making a smooth transition from home shopper to buyer. Here are the important things you need to know to buy your first home, including how to find and pay for it.

Assessing your finances

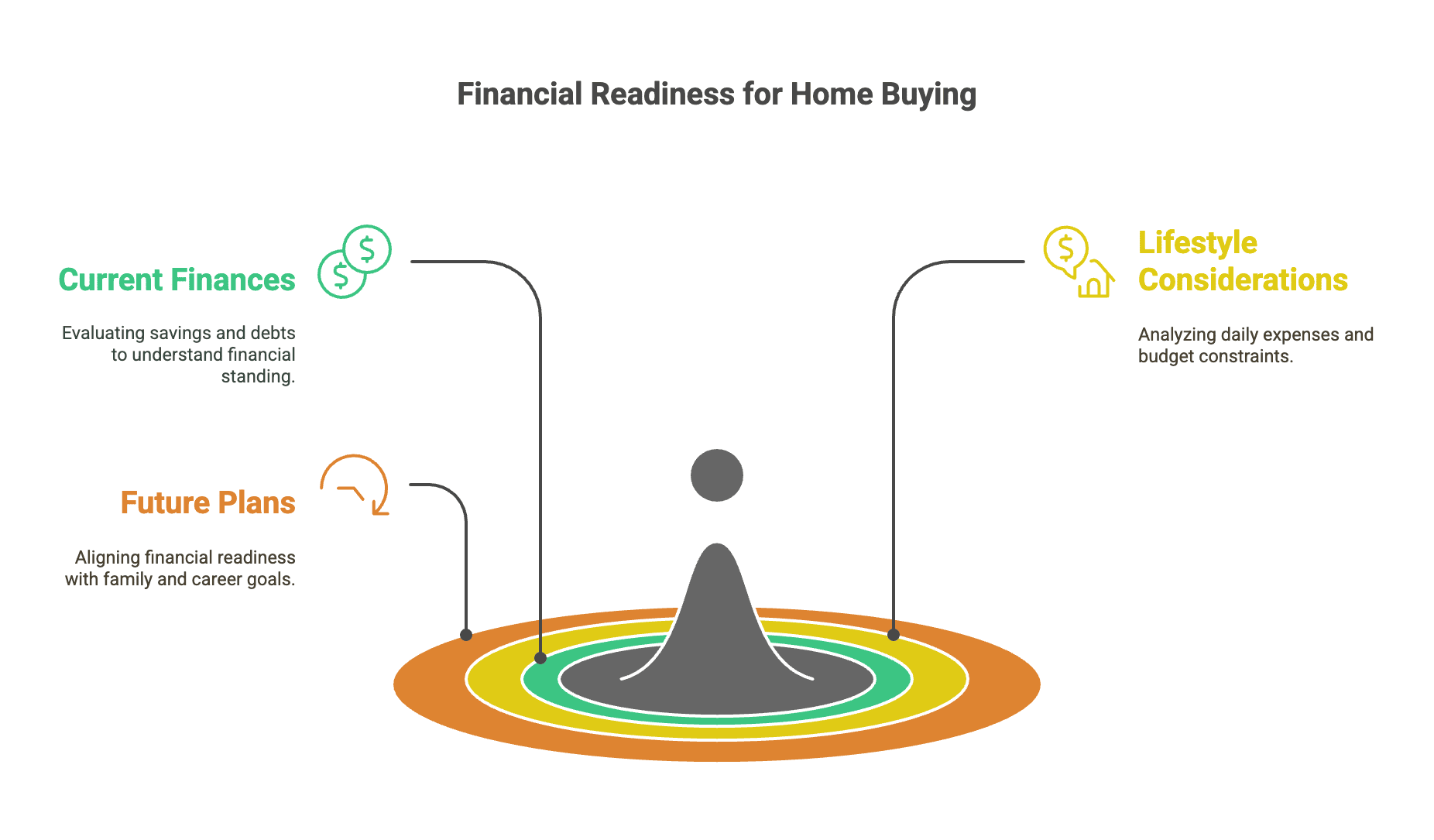

Before even getting ready to look for houses, you want to start with a check to ensure you’re in a good place to make this big purchase. You may want to look at:

- Your current finances, including your savings and any existing debts

- Your current lifestyle, including any budgetary constraints

- Your future plans, such as family or career goals

After checking in, analyze your financial situation and plan. You’ll also want to check your credit report and examine any issues that may be affecting your creditworthiness. Additionally, homebuyers will need money set aside for a down payment and other fees. Using an online mortgage calculator or talking to your bank can help determine what you can afford.

Setting your homebuying goals

Knowing what you can afford is important, but knowing what you want in your first home is just as crucial. This is why many homeowners start the process by listing their priorities with must-haves and nice-to-haves.

Factors can include location, property type, house size, number of bedrooms and bathrooms, add-ons such as a pool or deck, and access to neighborhood amenities and points of interest. Separating the most important needs in a priority list will help you balance your dreams with your budget and financial goals.

Understanding the homebuying process

Buying a home is a major decision, and the process involves many steps to ensure that all parties – you, the seller, and the mortgage provider – participate fairly.

Many buyers start by finding a real estate agent. It’s their job to find homes in your price range that fit your needs. They typically work on commission and may help you negotiate throughout the sale process, complete the required paperwork, and find financing.

From there, many buyers choose to get pre-qualified for a loan. For anyone buying a home with amortgage instead of cash, a pre-qualification will help you see what mortgage payments you can and can’t afford. Lenders will look at your debt-to-income (DTI) ratio, bank statements, credit cards, student loans, and tax documents to understand your personal finances. From there, some buyers will take the next step and get pre-approved for a loan, gaining a conditional commitment from the lender to give them a mortgage. A real estate attorney can help you navigate the paperwork and legal process.

Once you’ve found the house that sparks the right kind of joy, it’s time to make the offer. The offer involves figuring out how much money you can pay for the house and any conditions on the sale.

Before closing, you might opt for a home inspection. The home inspection will verify the state of the property, including elements like the house’s structural soundness and the state of key utilities like plumbing and electrical. It will also help you determine if the home will need any major repairs, such as a roof replacement or mold removal, that will cost you more money in the future. Based on the results of the inspection, you can decide whether to move forward with the sale and to negotiate the price further.

An inspection is optional, but hiring an appraiser is typically mandatory. The lender will send an appraiser to assess the home’s market value. If the appraiser’s report comes back at your offer price, you’re in good shape to close the sale. If it comes in higher, you’re getting a good deal on the home. But if it comes in lower, the lender may not approve the full price of the loan, or you may have to pay the difference out of pocket.

A closing can also include contingencies. Contingencies are agreements between you, the seller, or the bank, listing things that need to happen for the sale to go forward. For example, a contingency can include requiring an inspection or requiring confirmation of financing before the sale is finalized.

Exploring financing options

Figuring out how to finance the home purchase can be the most daunting part, but there are several options for different budgets and situations. A conventional loan is typically for buyers who have good credit. For anyone who needs financial help, the United States government offers some assistance, such as:

- FHA loans: These mortgages can have lower down payments than conventional loans.

- VA loans: These mortgages are intended for veterans and military service members. They may allow for no down payment at all.

- USDA loans: These loans provide no-money-down loans for buyers in rural areas.

Several other local, state, and federal programs are available to help first-time buyers navigate the process. Some buyers buy mortgage points, which lower the interest rate.

Understanding which loan strategy is right for you will help you budget for the process based on your financial situation and long-term goals.

Finding your first home

Finding your first home can be a fun process. Online home browsing allows potential homebuyers to take their time and find the perfect property for their needs. Others opt for the classic approach, attending open houses or working with a real estate agent to view available homes.

Using the priority list of must-have features and nice-to-have options will help narrow down the process. Buyers typically want to evaluate the potential properties for amenities, assess the neighborhood, and consider factors such as resale value and potential renovations. You may also want to make sure you can make a competitive offer that puts you in the running for closing on the property, but you can still negotiate some closing costs with the lender. Other things can be negotiated with the seller, including conditional repairs or renovations.

Navigating the closing process

Once you reach the closing, you’re almost done buying your first home. Buyers should have the necessary documents on hand. These usually include the purchase agreement, loan documents, and closing disclosures.

Buyers should also be prepared to pay for closing costs, which can include the costs of appraisal, inspection, title search, and insurance fees. Using an online calculator can help you prepare for these fees ahead of time and transition to the next step in the homebuying process.

After the purchase: what to consider

After closing, settling into your new home is a great feeling. It’s also time to prepare for more tasks and expenses that might pop up once the purchase is complete. You may have to transfer utilities, update your address, buy new insurance, or set up new maintenance routines. Investing in the long-term health of the home will help you build equity and increase the value of your home over time.

Disclaimer: Article content is intended for information only. It may not reflect the publisher nor employees’ views. Consult a mortgage professional before making financial decisions. Publishers or platforms may be compensated for access to third party websites.