Financial inclusion is a global challenge, with billions of people lacking access to essential banking and financial services. However, technology is reshaping the financial landscape, and artificial intelligence (AI) is playing a crucial role in breaking barriers.

By harnessing AI-driven solutions, fintech startups are offering accessible, efficient, and cost-effective financial services to underserved populations.

The emergence of AI in fintech has led to innovative approaches such as AI-powered credit scoring, automated savings, fraud detection, and even AI-driven financial literacy programs. These innovations not only improve access to banking but also enhance financial decision-making, particularly for low-income and unbanked individuals.

This article explores 7 fintech startups using AI to improve financial inclusion, highlighting their innovative solutions, the impact they are making, and how they are shaping the future of financial accessibility worldwide.

How AI is Driving Financial Inclusion in Fintech?

AI is revolutionizing financial inclusion by making banking and financial services smarter, faster, and more efficient. Here’s how:

| AI-Driven Solution | Impact on Financial Inclusion |

| AI-Powered Credit Scoring | Enables those without credit history to access loans based on alternative data. |

| Personalized Banking Services | Helps individuals manage finances through AI-driven recommendations. |

| Fraud Detection & Security | Reduces financial fraud and improves transaction security for digital payments. |

| AI-Driven Financial Education | Educates users on budgeting, saving, and investing with AI chatbots. |

| Automated Savings & Wealth Management | Encourages better financial habits through automated AI-powered solutions. |

Now, let’s explore 7 fintech startups using AI to improve financial inclusion and how they are transforming the financial industry.

7 Fintech Startups Using AI to Improve Financial Inclusion

AI is rapidly transforming financial services by providing solutions that bridge the gap between traditional banking and underserved communities. Across the globe, fintech startups are utilizing AI to break financial barriers, offering innovative tools for credit scoring, fraud detection, personalized financial management, and digital banking.

The following seven fintech companies are at the forefront of leveraging AI to improve financial inclusion, making essential financial services accessible to a broader audience.

1. Tala – AI-Powered Microfinance Solutions

Tala is a fintech leader in AI-driven microfinance, helping individuals in developing countries access small loans. By analyzing smartphone data, including behavioral patterns and spending habits,

Tala determines creditworthiness without requiring a traditional credit score. This has significantly benefited unbanked populations, allowing them to build credit histories and improve their financial health.

| Key Features | Impact |

| AI-powered risk assessment using mobile data | Expands access to micro-loans for the unbanked |

| Fast loan approvals with minimal paperwork | Ensures quick financial assistance |

| Active in markets like Kenya, the Philippines, and Mexico | Supports economic development in emerging markets |

Case Study:

A recent study found that 70% of Tala borrowers were able to grow their small businesses or handle emergencies using AI-backed loans. This shows how AI can provide financial resilience to underserved communities.

2. LenddoEFL – AI-Driven Credit Scoring for the Unbanked

LenddoEFL specializes in alternative credit scoring using AI. It assesses creditworthiness by analyzing social media behavior, digital footprints, and smartphone activity, enabling financial institutions to offer loans to individuals without traditional banking histories. This AI model has been adopted in over 20 countries, helping banks and lenders mitigate risk while expanding financial access.

| Key Features | Impact |

| AI-powered behavioral credit scoring | Helps lenders reach customers with no credit history |

| Seamless integration with banks and fintech lenders | Reduces barriers to lending for financial institutions |

| Data-driven financial risk analysis | Lowers default rates while expanding financial inclusion |

Real-World Example:

A bank in the Philippines using LenddoEFL’s AI scoring increased loan approvals by 50% while reducing defaults by 35%. This showcases AI’s role in improving credit accessibility responsibly.

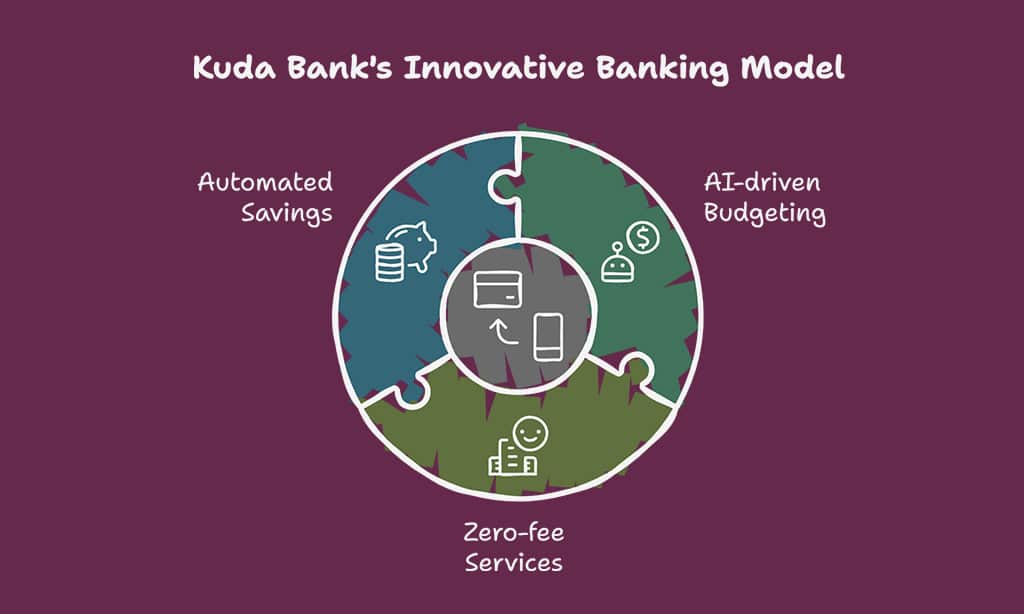

3. Kuda Bank – AI-Powered Digital Banking for Emerging Markets

Kuda Bank, a Nigeria-based neobank, provides free banking services using AI to automate savings, track expenses, and enhance financial management for individuals and small businesses.

Unlike traditional banks, Kuda does not rely on physical branches, making banking more accessible to remote populations.

| Key Features | Impact |

| AI-driven budgeting and spending insights | Helps users manage expenses effectively |

| Zero-fee banking services | Eliminates costs associated with traditional banks |

| Automated savings with personalized financial planning | Encourages smart financial habits |

Insight:

A study found that Kuda Bank users saved 30% more on average compared to traditional bank customers, thanks to AI-driven savings tools.

4. Flutterwave – AI for Cross-Border Payments & Remittances

Flutterwave simplifies global payments using AI to optimize cross-border transactions, ensuring lower fees, enhanced security, and faster processing times. This fintech giant enables small businesses and individuals to send and receive money seamlessly, even in regions with limited banking infrastructure. By integrating AI-driven fraud detection and risk assessment, Flutterwave ensures secure transactions while reducing operational costs for businesses and consumers.

Moreover, the platform’s user-friendly interface and scalability make it a preferred choice for startups and enterprises alike, strengthening financial inclusion across Africa and beyond.

| Key Features | Impact |

| AI-driven fraud detection for transactions | Enhances security for digital payments |

| Supports payments in 30+ currencies | Enables seamless cross-border transactions |

| Real-time remittance tracking | Ensures transparency in global payments |

Market Impact:

With over 900,000 businesses using Flutterwave, the platform has processed transactions worth $16 billion in Africa alone.

5. Feedzai – AI-Enabled Fraud Detection & Financial Security

Feedzai is revolutionizing financial security by leveraging advanced machine learning and artificial intelligence to detect, predict, and prevent fraudulent transactions in real time. This AI-driven platform continuously analyzes vast amounts of financial data to identify suspicious activities, reducing fraud-related losses significantly for banks, fintech firms, and digital payment providers.

By automating fraud detection and risk management, Feedzai enables financial institutions to process transactions securely while minimizing false positives, ensuring a seamless experience for legitimate customers.

Its scalable security solutions provide robust protection against evolving cyber threats, reinforcing trust in digital financial services worldwide.

| Key Features | Impact |

| AI-powered real-time transaction monitoring | Reduces financial fraud cases significantly |

| Automated fraud risk assessment | Improves security for fintech platforms |

| Scalable security solutions for banks | Helps banks mitigate financial risks |

Security Advancement:

Financial institutions using Feedzai have reported an 80% reduction in fraud-related losses, showcasing the effectiveness of AI in financial security.

6. Wealthfront – AI-Powered Wealth Management for Low-Income Groups

Wealthfront provides AI-driven robo-advisory services, offering automated investment solutions tailored to individuals who lack access to traditional financial advisors. Using cutting-edge AI algorithms, Wealthfront analyzes user financial data to create customized investment portfolios that align with personal goals, risk tolerance, and market trends. The platform offers features such as automatic rebalancing, tax-loss harvesting, and smart savings tools that help users maximize their returns while minimizing risks.

Additionally, its AI-driven financial planning services provide guidance on budgeting, saving for major life events, and retirement planning.

With no minimum investment requirement, Wealthfront democratizes wealth management, ensuring that financial growth opportunities are accessible to a broader audience, including those with limited financial literacy or capital.

| Key Features | Impact |

| AI-powered portfolio optimization | Helps users build investment strategies with minimal effort |

| Automatic rebalancing and tax-loss harvesting | Maximizes returns while minimizing risks |

| No minimum investment requirement | Makes investing accessible to everyone |

Market Insight:

Wealthfront manages over $30 billion in assets, helping individuals grow their wealth through AI-driven financial planning.

7. Cleo – AI-Based Financial Literacy & Advisory Services

Cleo, an AI-powered chatbot, is revolutionizing personal finance management by providing users with real-time budgeting assistance, personalized savings recommendations, and intuitive expense tracking through conversational AI. Unlike traditional budgeting apps, Cleo interacts with users in a fun and engaging way, using humor and gamification to encourage better financial habits. Through AI-driven analytics, Cleo offers insights on spending patterns, sets budget goals, and even nudges users to save money effortlessly.

The platform’s AI-powered automation also enables users to link their bank accounts, track their expenses seamlessly, and receive tailored advice on how to cut unnecessary spending.

By making financial literacy more interactive and accessible, Cleo is particularly popular among younger generations who prefer a more personalized and less intimidating approach to managing money.

| Key Features | Impact |

| AI-powered budgeting assistant | Helps users track and manage expenses effectively |

| Gamified savings challenges | Encourages better financial habits |

| Personalized spending insights via chat | Provides tailored financial advice |

User Engagement:

With over 4 million users, Cleo has become a trusted financial assistant for younger demographics, particularly Millennials and Gen Z.

Final Words

AI is reshaping the fintech industry, making financial services more accessible and inclusive for underserved populations. From AI-powered credit scoring to automated wealth management and fraud detection, artificial intelligence is breaking down traditional financial barriers.

7 fintech startups using AI to improve financial inclusion—Tala, LenddoEFL, Kuda Bank, Flutterwave, Feedzai, Wealthfront, and Cleo—are at the forefront of this transformation, using AI-driven innovations to create a more inclusive global economy.

Each of these companies is leveraging AI in unique ways, from providing microfinance solutions to streamlining cross-border transactions and enhancing financial literacy. Their collective impact is helping millions gain access to essential financial services, fostering economic growth in underserved communities.

As AI continues to evolve, its role in financial inclusion will only expand, offering new opportunities for innovation and empowerment. By embracing these AI-driven solutions, individuals and businesses alike can benefit from a more connected and financially secure future.

Are you ready to explore AI-powered fintech solutions? The future of financial accessibility is just a click away.