Unexpected expenses can disrupt even the most well-managed financial plans. Medical bills, car repairs, or sudden travel needs may require quick access to money. When traditional funding takes too long, short-term options can help cover the gap.

Emergency same day loans provide fast access to funds during critical moments. They aim to provide quick approval and same-day disbursement. Approval normally takes just a few hours, and disbursement may occur on the same business day. Their speed and accessibility are what make them appealing in moments of financial pressure.

When Timing Becomes Critical

Some expenses demand prompt action. A broken refrigerator, a missed utility payment, or last-minute housing needs can’t be delayed. In such cases, waiting several days for approval from conventional institutions may cause further complications.

Short-term financial options fill this timing gap by offering quick application reviews and minimal processing hurdles. Applicants typically need to meet basic eligibility requirements, including proof of income and identification. These straightforward steps help minimize delays and provide peace of mind when time is limited.

What Makes Emergency Loans a Practical Short-Term Option

Emergency same-day loans serve as a bridge when unexpected expenses arise between paychecks or when savings are not readily available. The ability to apply for and receive funds in one day helps reduce delays that could exacerbate a situation. This makes them a practical option for urgent needs, provided borrowers understand the short-term nature of the support.

These loans are most effective when used in conjunction with a clear repayment plan. Since they are not intended for ongoing financial support, it’s important to borrow only what can be repaid within the agreed-upon timeframe. Many individuals use them for one-time situations, such as emergency travel or critical home repairs.

Appropriate Uses for Short-Term Cash Access

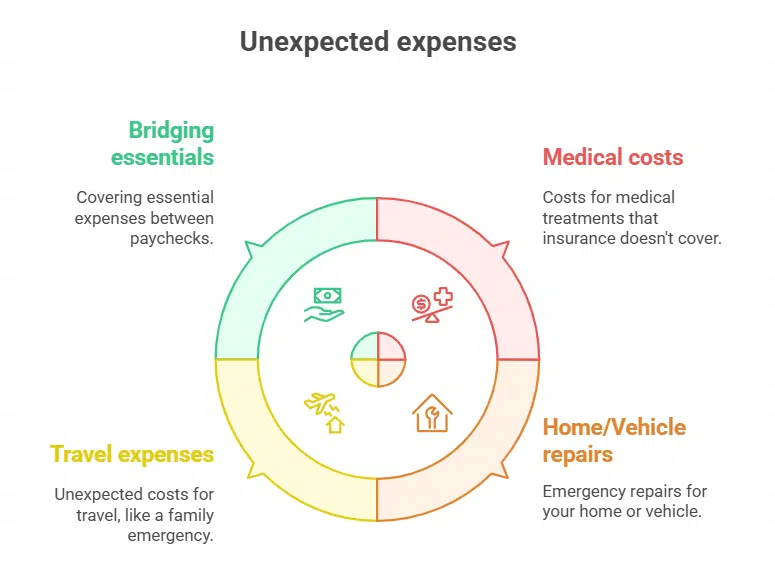

Emergency funding is best reserved for situations that demand immediate resolution. It works best as a temporary cushion rather than a long-term financial strategy. These may include:

- Medical costs not covered by insurance

- Urgent home or vehicle repairs

- Unforeseen travel expenses

- Bridging essentials between pay cycles

Speed and Convenience of the Process

One of the main advantages is the speed of access. Submitting a brief application and receiving a decision within hours can simplify access during time-sensitive situations. Money is usually sent straight to a bank account, so there’s no need to visit a location or wait for a paper check.

Convenience is another key advantage. Most providers now support fully online processes, including ID checks, e-signatures, and electronic transfers. These features streamline the process and eliminate the need for physical paperwork or phone verification calls. The application process is divided into three steps.

First, the application is completed online with basic personal and financial information. Next, the review team checks eligibility, usually verifying employment status and monthly income. Finally, once approved, the borrower receives funds through direct deposit or a similar method.

Where and How to Apply

Same-day emergency funding is often available through both digital platforms and in-person locations. Once submitted, applicants may receive a decision within hours, followed by electronic disbursement if approved. Here are the qualifications necessary for the application:

- A valid, open, and active checking account

- A steady source of income

- A government-issued photo ID

- An active phone number

- A valid email address

These requirements help ensure a quick and efficient approval process while maintaining verification standards. Clear terms and transparent timelines are part of the process to help applicants make informed choices. Customer service support is typically available for those who have questions or need additional guidance.

Temporary financial gaps can occur without warning. In such cases, access to options with straightforward processes can help manage urgent expenses more effectively. For individuals navigating urgent situations, emergency same day loans serve as a practical resource when handled with care. Choosing the right time and reason to apply can ensure that short-term borrowing remains a helpful financial tool without a long-term impact.