You may feel stuck when you try to pick a field in Romania’s economy. You hear about growth but not the whole picture. Romania’s gross domestic product may rise 1.4% in 2025, a clear sign of stronger days ahead.

In this post, we map 10 fast-growing sectors like the IT sector, private medical care, and renewable energy. You will see how machine tools, hydroelectric power, and green energy shape change.

We break it down so you can aim for smart work and investment. Ready to find your next move?

Key Takeaways

- Romania’s GDP may rise 1.4% in 2025, driven by ten fast-growing fields such as IT, private medical services, renewable energy, auto and general manufacturing, agri-food, construction, services, energy, and tourism.

- The IT sector outpaced Romania’s 0.8% real GDP growth in 2024, with tech hubs in Bucharest, Cluj and Timișoara, tens of thousands of jobs, senior developers earning about 2,500 leu per month, and European Bank for Reconstruction and Development backing R&D labs.

- Private healthcare boomed to 160 clinics and 42 hospitals in 2023, as telehealth and electronic health records cut waits. The Recovery and Resilience Plan set aside €600 million for clinic upgrades and workforce training.

- Renewable energy saw EIB-backed wind parks in Dobruja and solar fields in Muntenia. The RRP will renovate 6.8 million m² of buildings for energy efficiency, while factories now make solar panels, turbine blades and battery cells despite retroactive levies up to 98%.

- Automotive and general manufacturing thrive on Dacia and Ford assembly lines, EV parts plants, CNC machine tools and robots. The auto sector accounts for over 15% of exports, and the RRP channels billions into machine tools, presses and heavy machinery.

Information Technology

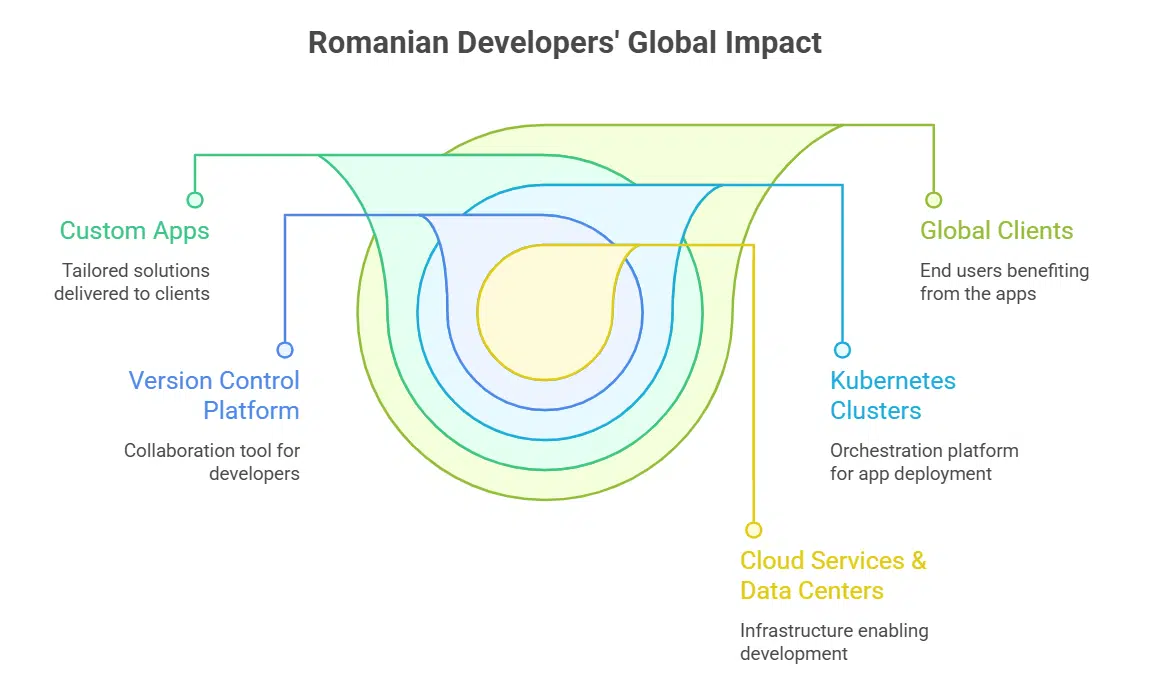

Romanian developers sprint through projects on cloud services and spin up servers in data centers, sending shockwaves through more than just local markets. They rally on a version control platform and Kubernetes clusters to deliver custom apps that land on global clients’ desks in record time.

Romania as a European tech hub

Bucharest, Cluj and Timisoara host many tech firms. The country ranks 26th out of 27 EU states on the Digital Economy and Society Index in 2021, but it shines in fixed connectivity with fast broadband and fiber networks.

Local engineers code in coworking hubs, and global names open branches in data analysis. Cloud platforms and GitHub speed up workflow. The European Bank for Reconstruction and Development backs several R&D labs.

The IT sector lifts gdp of romania by selling services worldwide, turning the sector into a growth engine for the romanian economy.

Kids join coding clubs after school. Universities team up with global firms to train entry-level developers. Public R&D fell to 0.47 percent of gdp in 2021, far below the 2.3 percent EU benchmark, yet fresh policies draw venture capital.

Cluj boasts rising fintech labs. Software exporters land deals in banking and health. Industry in romania looks set to climb faster.

Growth in software development and IT services

Tech parks in Cluj, Timisoara and Bucharest employ tens of thousands of staff. Firms use agile methods and on-demand servers to cut development time. Startups code e-commerce apps and enterprise platforms in local hubs.

The it sector grew faster than the 0.8 percent real GDP rise in 2024. This surge fuels Romania’s economy as it eyes 1.4 percent growth in 2025.

Digital exports now rival the manufacturing industry, lifting the industry of romania into new sectors. Local teams deploy AI, machine learning and security suites for clients in the eurozone.

Global corporations fund research labs and open service centers in major cities. Version control systems and automated pipelines improve code quality and delivery. Senior developers earn 2,500 new leu monthly, boosting purchasing power standards.

US tariffs on manufactured goods leave these digital exports largely untouched.

Private Medical Services

Private clinics now use telehealth platforms and electronic health record systems, to cut paperwork and speed up care. Patients buy health plans or pay out of pocket, so they can zip past long waits at state hospitals.

Rising demand for private healthcare

Romania’s weak public system leaves many patients waiting months. A high share of EU citizens report unmet medical needs, so families pay to skip the queue at fee-based clinics. The state faces a shortage of doctors and nurses, it struggles to staff wards.

Clinics hire specialists from abroad, they boost salaries in lei and euros. Demand jumps in line with the romanian economy’s growth rate, as more bani circulate, and folks crave quicker tests.

Building firms in the construction industry in Romania now add medical wings in new towers. Agritech cooperatives and finance houses in the services sector buy health plans for staff, they cover MRIs and dental checks.

Growth forecasts of 1.4% in 2025 and 2.2% in 2026 spark more clinic launches. Entrepreneurs open lab chains with CT scanners and operating theaters. This boom marches ahead, like a medical train reshaping the healthcare market.

Expansion of clinics and hospitals

Clinics popped up like mushrooms, reaching 160 in Bucharest, Cluj, and Iasi in 2023. A surge of private hospitals also rose to 42, the Health Ministry reports. State fiscal moves steered funds to private care, easing public budgets.

Recovery and Resilience Plan set aside 600 million euros for clinic upgrades and workforce training as economists eye 4.5 percent GDP growth.

Urban sprawl led to clinics near Bucharest Metro stops and Cluj universities. Some centers use 3D machine tools and host digital records on Google Cloud. Projects focus on rural zones and marginalized Roma families, cutting long unmet needs.

Strong output from automotive industry and IT sector lifts the economy of Romania, spurring more health builds.

Renewable Energy

Romania saw wind generators spring up near the Black Sea, and solar cells light fields in Transylvania, as green power grabs more headlines. Engineers use supervisory control software to track output in real time, and they tap geographic information tools to plan new projects.

Investments in wind and solar power

Loans from the European Investment Bank fuel new wind parks in Dobruja and solar fields in Muntenia. The projects cut imports of Russian gas by boosting domestic energy production.

Wind turbines and solar panels feed power into the grid managed by Hidroelectrica and Nuclearelectrica. Industry players in automotive manufacturing and machine tools benefit from a stable energy source.

The Recovery and Resilience Plan commits to renovating 6.8 million square meters of buildings for energy efficiency. It supports green energy manufacturing and growth in the Romanian economy and the energy sector.

Renewable resources like wind and solar attract foreign direct investment and cut value-added tax burdens. Local salaries in related trades, from construction to maintenance, see steady rises as GDP per capita climbs.

Growth in green energy manufacturing

Romania boosts production of solar panels, turbine blades and battery cells. Factories ship parts to wind farms and solar power stations in Europe. The Romanian economy adds jobs in green energy manufacturing.

Workshops use machine tools to craft frames and towers. Growth expands the manufacturing industry and strengthens the energy sector.

Lawmakers imposed a 98% retroactive tax on wholesale electricity and gas market participants in 2022. They added a 100% windfall tax on electricity profits that year. A 60% solidarity tax hit producers’ additional revenues soon after.

High levies cut profits, yet firms keep building machines for renewable energy. Investors count on EU incentives and steady demand for clean energy sources.

Automotive Manufacturing

Dacia and Ford crank out cars in Romania on a modern assembly line, powered by automation and machine tools that hum like busy bees. Local shops roll out EV parts with design software guiding high-precision cutters, making growth look as easy as pie.

Role of Dacia and Ford in the industry

Dacia builds low-cost cars in Romania. It hires thousands each year. Workers learn advanced skills on automation equipment and machining. The brand drives growth in auto manufacturing.

It adds value to the romanian economy. Ford runs a big plant in Craiova. The site crafts vehicles and drivetrain systems. Engineers use computer-aided design to speed up innovation.

Both firms add electric vehicles to their lineups. They meet stricter emission rules and rising consumer demand. Their output fuels the manufacturing industry and boosts exports. The automotive industry now drives export growth.

It makes up over fifteen percent of total shipments. Machine tools and smart assembly lines power this export push. This growth helps Romania’s trade balance.

Focus on electric vehicle (EV) parts production

Romania’s auto plants crank out electric motor parts and battery housings. Government plans back this push with green rules from the Recovery and Resilience Plan (RRP). Skilled ICT and engineering teams join forces on new components.

Demand for EV parts jumps as the world chases green energy.

Investors inject money in infrastructure and circular economy projects. These moves spur machine tools makers to adapt fast. This push aims to cut carbon and speed car shifts. It levels up Romania’s automotive industry and the romanian economy.

General Manufacturing

Lean manufacturing drives small shops that cut and shape sheet metal brackets on CNC milling machines. They use articulated robots to weld axle housings at warp speed, and they ship them to drive export growth.

Growth in metal parts and industrial equipment

Public finance from the Recovery and Resilience Plan fuels growth in metal parts and industrial equipment. The plan channels billions of euros into machine tools and heavy machinery.

Small and mid-size firms in the manufacturing industry use grants for research and development. Companies modernize workshops with robots, drills, and presses. These upgrades boost output for the automotive industry and the energy sector.

The wave lifts Romania’s economy to new heights.

Factories face a skilled labor gap. Local plants lack welders and machinists trained for green tech. Tight salary budgets and low purchasing power scare off talent. The romanian state offers training programs under EU legislation.

Officials plan better motorways and expressways to speed up distribution. Business leaders hope faster logistics will cut parts delays.

Contribution to Romania’s exports

General manufacturing sends metal parts, industrial equipment, and machine tools across the European Union. This sector forms a large slice of Romania’s economy and export value.

It helped shrink the current account deficit in 2023. Analysts expect moderate growth for 2024, boosting prospects for machine tool exports. Ten fast-growing fields, from private medical gear to electric vehicle parts, fuel this rise.

Infrastructure upgrades and EU Schengen membership can widen trade lanes. The Recovery and Resilience Plan funds green tech and skills training. It dedicates tens of billions in grants to upgrade roads and rail for factories.

Vocational programs train welders and CNC operators. Firms link with schools to tackle skill shortages in green transition sectors. This push lifts quality and cuts export lead times.

Agriculture and Agri-Food

Growers use soil probes and crop-dusting quad-copters to seal nutrient gaps fast. They drive organic agriculture into smart processing lines and slash supply chain lags.

Advancements in food processing and logistics

EU funding backs new infrastructure like roads, cold stores and food processing plants. It speeds up fruit and veg runs to stores. The RRP team funds packing hubs and cool rooms. This drive boosts organic agriculture and logistics in the agri-food sector of Romania’s economy.

Farm coops use RFID tags in crates and GPS tracking in vans. Companies invest in machine tools along sorting lines. Digitalization initiatives teach SME owners how to fit robot arms and conveyors.

Productivity climbs, and Romania’s economy sees more fresh goods on shop shelves.

Expansion in organic farming

Organic farms in Romania sow seeds for big gains in the agriculture and agri-food sector. Investment climbs as EU funds and new infrastructure projects pour in, boosting growth by double digits on some plots.

Farmers in Bessarabia and Transylvania embrace machine learning to map soil, cut waste, and lift yields. They pair data with unmanned aerial vehicles and Jupyter Notebook analysis for real-time checks.

Challenges bubble up too, from labor shortages to shaky property rights that slow progress.

EU membership acts like a bridge, opening markets under the european free trade association and the generalized system of preferences. The Recovery and Resilience Plan injects support for sustainable practices, giving organic fields a shot in the arm.

Consumers pay a premium, as Romania’s economy sees organic labels pop up in Carrefour aisles, driving demand for local produce.

Construction

Builders race like sprinters against a tight schedule on fresh flats and new roads. They tap CAD software, aerial surveys, and prefabricated panels.

Urban development and infrastructure projects

EU funding fuels road and rail upgrades. The Recovery Plan spans 64 reforms and 107 investments. It grants EUR 14.24 billion and lends EUR 14.94 billion. City crews set new water lines and power grids.

IT sector gets new data centers near transit hubs. Such upgrades aid the romanian economy.

A wage freeze in December 2024 steadies project budgets. New minimum wage rules in February 2025 curb private sector wage growth. The automotive industry adds electric bus lanes. Local factories for machine tools and steel plants rise near new housing sites.

Government-backed housing initiatives

The government launched a plan in December 2024. The parliament approved a fiscal consolidation package of roughly 2% of nominal GDP. This move freed funds for mass housing. Banks now offer low-rate loans.

House builders can invest in sustainable building. They add energy-efficient windows and renewable arrays. The plan ties to Romania’s economy and purchasing power. Finance experts view it as a mix of social benefits and market research.

Inflation fell to 9.7% in 2023. That drop bolstered consumer confidence. Staff in the automotive industry and IT sector see new homes near factories and tech hubs. Prefab units use machinery from local workshops.

Urban areas expand with new roads and parks. The scheme meets Maastricht criteria and may attract ECB support. Young families in major cities order apartments with state-backed mortgages.

Services Sector

Romania’s finance, trade, and support hubs roar ahead, pulling GDP up and luring fresh foreign funds. Banks tap predictive models and cloud solutions, while e-shops run on distant servers to speed service.

Growth in trade, finance, and IT services

Trade volumes climbed on EU corridors in 2022. Exports of machine tools and food products jumped by double digits. The Bucharest Stock Exchange added five issuers last year. Banks such as Raiffeisen and Banca Transilvania expanded credit lines by over ten percent.

Growth in the it sector signaled a major shift in the romanian economy. Offshore programming hubs in Cluj and Bucharest hired thousands of specialists. Companies like UiPath and Bitdefender scaled up cloud computing and data analytics services.

That trend lifted employment to 68.5% and cut unemployment to 5.6%, below the EU average.

Services as a key GDP contributor

The services sector drives most of the Romanian economy. Business, finance, and IT services account for over half of gdp (ppp). Banks and fintech firms use cloud computing and SQL databases to speed transactions.

Small consultancies coach new managers on EU rules. Call centers in Bucharest handle customer calls in multiple languages.

Fast growth in the it sector raised real GDP per capita from 8,360 euros in 2017 to 10,110 euros in 2022. High spending by households, plus strong investment, pushed real GDP growth to 4.7 percent in 2022.

Firms with most favored nation status added AI chatbots and digital assistants. Lower unemployment lifted purchasing power (ppp). New data centers in Cluj and Timișoara prepare for more cloud computing.

Energy Sector

Big state dam firms rebuild our power network, swapping old gates for modern hydro gear. Green investors plant wind mills and sun fields like farmers sowing energy seeds, cutting coal use and lighting new growth.

Role of state-owned companies like Hidroelectrica

Hidroelectrica runs hydropower dams across Romania. It feeds water through large turbines to make electricity. It shapes the energy sector and aids the manufacturing industry and automotive industry with clean power.

The state plans to close all coal and lignite plants by 2032. EU funds via the RRP cover building fixes, rail upgrades, carbon cuts, and smart grid tech.

Hidroelectrica taps the reservoir to balance wind power and feed solar park output. It hires skilled teams to update machine tools and turbine units. It helps raise gdp ( ppp ) by cutting power costs for businesses.

It moved from an eastern bloc relic to a core of romania’s economy. It grew past the soviet-style command economy of the communist period and drove growth since the romanian revolution.

Investments in modernizing energy infrastructure

Romania adds new power poles and digital meters. The network sees fresh cables and modern transformers. This upgrade feels like fitting the heart of a body with fresh valves. It aims at lifting grid capacity.

Low renewable installs and tight wires hold back wind farms and solar parks. Public R&D spending hit just 0.47% of GDP in 2021, well below the EU’s 2.3%. That gap drags down any green shift in the energy sector.

Readers in the romanian economy know slow feeds hamper economic growth.

Grid updates use control systems and digital control centers. Workers link solar panels, wind turbines and substations. Local banks approve int$200 million in green bonds for the task.

EU grants top up the pot, easing funding woes. New cables will carry hydro output from Hidroelectrica, a key source of energy for Romania. EV plants, machine tool shops and it sector hubs can draw power without blackouts.

Fast, steady juice will spark growth across the energy sector and beyond.

Tourism

Travelers swarm to Transylvania’s castle trails and the Danube Delta, driven by stellar TripAdvisor tips on green travel and heritage trails. Guides share local legends, spin jokes, and even teach a folk dance under starry skies.

Increase in international and domestic visitors

Hotels report a surge in bookings. The Romanian government funneled over €30 billion through the Recovery and Resilience Plan to boost roads, airports, and marinas. This drive upgrades train terminals and broadband networks, so agents can book trips on mobile apps.

Domestic travelers pack city tours on weekends, and foreign guests zap off to Danube cruises. Visits climbed as the romanian economy grew, boosting services in villages and cities.

Urban centers host more festivals, and national parks sign more permits for eco-tourism. New rules cut red tape for tour operators and guide firms. Private sector hiring raised paychecks, and families spend more on trips.

Smartphone maps run on EU funded digital infrastructure upgrades, so travelers see real time event alerts. Business owners cheer a tourism boost that also feeds the manufacturing industry and the it sector.

Development of eco-tourism and cultural tourism

The Recovery and Resilience Plan funds roads and rails in protected natural areas. An inter-ministerial committee now guides eco-tourism projects. Romania boasts forests, hills, and castles, all prime draws.

EU funding will channel cash into waste management and circular economy ideas. Communities see fewer unemployed, with new guides and rangers hired.

Cultural hubs in old towns host folk fairs and art tours. Visitors learn local crafts, and they taste regional foods. Group tours now visit machine tools factories. Tours boost manufacturing industry and pensions for dancers.

Romania’s economy gains as tourists spend on culture spots. Agencies will track impact with green metrics and energy sector audits. Local it sector teams build apps that guide eco-travelers.

Takeaways

Romania’s growth wave shows in ten hot fields. Software hubs hum with code and cloud platforms. Private clinics open labs and serve more patients. Farms ship fresh goods fast, using drip irrigation and sorting robots.

Wind generators spin power, and solar modules soak sun. Car factories build EV parts with CNC machines. Builders raise new malls and city roads. Banks and shops fuel the services boom.

Tourists roam castles and nature trails. It feels like a relay race, each sector passing growth baton. Future gains seem bright on this launchpad.

FAQs on Fast-Growing Industries in Romania

1. What is driving Romania’s booming economy?

The manufacturing industry roars ahead with new factories. The energy sector pumps power to homes and firms. Together, they lift Romania’s economy fast.

2. Why is the it sector growing so fast, and how does it stand next to the automotive industry and machine tools?

The it sector snaps up young talent like fish in a barrel, it hires coders by the thousands. The automotive industry still gears up, and machine tools keep parts rolling. Each area fills a niche.

3. How did past events shape today’s fast-growing industries?

When Romania united with the kingdom of romania, it opened wider markets. The euro crisis stalled growth, and firms had to tighten belts like during the great depression. Paris club deals gave a fresh start and let new sectors sprout.

4. How do environmental rules like the common fisheries policy affect local growth?

Overfishing near the Black Sea drained fish stocks in no time. The common fisheries policy caps catches, and that helps fish populations heal. Then coastal towns can plan for a steady catch, even add tourism.

5. Do regional ties and interest rates play a big part in Romania’s boom?

Trade with moldova and hungary flows smoothly, they share roads and trains. Low interest rates keep loans cheap, and firms can expand with less red tape. That combo makes growth feel like a breeze.