Family health insurance is a single plan that covers the medical expenses of all insured family members under one umbrella policy. Unlike individual plans where each person needs a separate policy, a family health insurance policy offers a shared sum insured among all members, providing both convenience and financial security. For instance, if you purchase a ₹12 lakh plan and ₹4 lakhs are used for one member’s surgery, the remaining ₹8 lakhs can still cover the rest of the family for other medical emergencies within the same policy year.

This shared pool of funds ensures comprehensive protection, allowing you to address multiple medical needs without buying separate plans for each member. It’s an efficient, flexible, and cost-effective option for families.

Why Family Health Insurance is Vital in Today’s World

Medical inflation in India has been rising sharply over the years, making healthcare costs unaffordable for many households. Treatments like cardiac surgeries can cost ₹2-5 lakhs, cancer therapies can exceed ₹10 lakhs, and even common illnesses like dengue or typhoid can cost ₹50,000-1 lakh. Without insurance, a single medical emergency can wipe out years of savings or force families into debt. A family health insurance policy provides a crucial safeguard, covering hospital stays, surgeries, medications, and post-hospitalization expenses, so families don’t have to compromise on quality healthcare due to financial constraints.

By sharing the financial burden, insurance enables timely and necessary treatments without sacrificing other family priorities, ensuring your loved ones always receive the care they need.

Importance of Buying a Family Health Insurance Policy

A family health insurance policy isn’t just an administrative requirement—it’s an essential investment in your family’s well-being. Rising healthcare costs mean it’s increasingly difficult to afford quality treatment without insurance. With a comprehensive policy, your family has access to the best doctors, hospitals, and treatments without worrying about bills.

Preventive care benefits included in many policies, like annual health check-ups, help detect diseases early, improving outcomes and reducing long-term treatment costs. Additionally, premiums paid for a family health insurance policy are eligible for tax deductions under Section 80D, reducing your annual tax burden by up to ₹50,000. Most importantly, knowing that your family is protected from unexpected medical costs gives you peace of mind.

Key Features and Benefits of a Family Health Insurance Policy

- Cashless Treatment: Family health plans allow cashless hospitalization at thousands of network hospitals across India. Whether it’s an emergency or planned surgery, you can focus on recovery while the insurer settles the bills directly with the hospital.

- Restoration Benefit: If your policy sum insured is used up during a year, some plans automatically restore 100% of the original coverage amount, ensuring your family stays protected for future medical emergencies.

- Guaranteed Bonuses: Many insurers offer a cumulative bonus on your sum insured for every year without claims, increasing your coverage without raising your premium.

- Wellness Programs: Modern family health insurance policies often include wellness programs, offering rewards like discounts on medicines, free consultations, or vouchers for regular health check-ups.

- Global Coverage: Selected plans offer treatment coverage outside India, so you and your family can access quality healthcare even during international trips.

- Lifetime Renewability: Family policies come with lifelong renewability, ensuring uninterrupted protection for your loved ones no matter how their healthcare needs evolve.

- Tax Benefits: Premiums paid for a family health insurance policy are eligible for tax deductions, helping you save money while securing your family’s future.

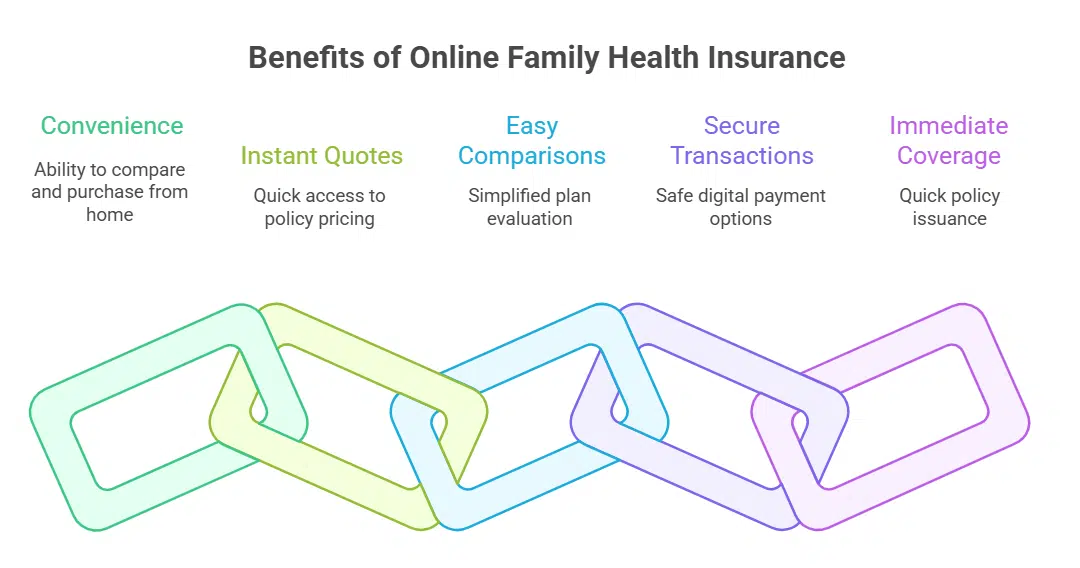

Why Buy a Family Health Insurance Policy Online?

Purchasing family health insurance online offers unmatched convenience. You can compare plans, read expert advice, and buy a suitable policy—all from the comfort of your home. Online platforms provide instant quotes and easy plan comparisons, making it simple to choose the best policy for your needs and budget.

Digital payment gateways ensure secure transactions, whether you use debit or credit cards, net banking, or e-wallets. Plus, online purchase processes are streamlined so you receive your policy document within hours, ensuring immediate health coverage.

What is Covered Under a Family Health Insurance Plan?

Family health insurance covers an extensive list of medical expenses, including hospitalization costs for illnesses or injuries that require over 24-hour hospital stays. Coverage extends to daycare procedures like cataract surgery or chemotherapy, where treatment doesn’t require long hospital stays. Ambulance charges incurred while transporting a patient during emergencies are also reimbursed, ensuring you don’t face out-of-pocket expenses.

Pre- and post-hospitalization expenses, such as diagnostic tests, consultations, and follow-up medications, are covered, providing financial relief before and after hospital stays. Maternity cover offers protection for pregnancy-related expenses, including delivery charges and newborn healthcare needs, supporting your growing family. Organ donor expenses, domiciliary treatment (home care on a doctor’s advice), and OPD consultations for minor health concerns are included in many policies, offering comprehensive protection.

Benefits also extend to alternative treatments like Ayurveda, Yoga, Siddha, Unani, and Homeopathy, so you can choose holistic healthcare options. Mental health treatments for conditions like depression or anxiety are often included, recognizing the importance of mental well-being. Daily cash allowances cover non-medical incidental expenses like meals or transportation during hospitalization, and consumables like gloves, syringes, and other essential medical supplies are reimbursed, reducing hidden costs.

Final Thoughts on Family Health Insurance and Health Coverage

Investing in a family health insurance policy isn’t just about managing medical bills—it’s about providing your loved ones with the security and access to quality healthcare they deserve. With rising medical inflation, a comprehensive plan ensures you won’t have to compromise on treatments or worry about the financial strain of unforeseen health issues. Family health insurance provides holistic health coverage, offering peace of mind, tax savings, preventive care, and financial stability, making it an essential part of every household’s financial planning.