Electric cars are on the rise, and with them come new questions. One big concern for drivers is motor insurance. Are policies changing? Will premiums skyrocket? Many EV owners feel unsure about what lies ahead in 2025.

By 2025, electric vehicles could make up 25% of all car sales. This shift means insurance companies must evolve too. Repair costs for EVs are higher due to expensive batteries and parts, but advanced safety tech might balance things out.

This blog will break it all down for you—costs, trends, tips to save money, and what insurers are doing to keep up. Keep reading to stay ahead of the curve!

Key Takeaways

- By 2025, electric cars may account for 25% of all car sales. This increase will alter insurance policies and raise costs for drivers due to expensive EV repairs and batteries.

- EV batteries can cost $5,000 to $16,000 to replace. Policies should offer coverage for battery damage resulting from accidents or wear.

- Telematics can provide up to 30% discounts for safe driving habits. Using apps that track speed and braking can help lower premiums for careful drivers.

- Home charging stations reduce risks during public charging and could lead to policy discounts. Some plans now cover installation costs or charger repairs.

- Insurers are developing new rules for EVs and training workers on handling high-cost parts like batteries while offering roadside assistance customized for EV needs such as mobile charging services.

Key Factors Affecting EV Insurance Costs in 2025

EV repairs can break the bank due to costly parts and skilled labor needs. Plus, their price tags often make them more expensive to insure than gas-powered cars.

Higher purchase prices of EVs

Electric vehicles are more expensive to purchase than gas-powered cars. Their higher market value increases the insured declared value (IDV). For instance, a Tesla Model Y or Ford Mustang Mach-E may have a significantly higher price compared to similar traditional models.

This rise is connected to costly components like battery packs. A replacement can cost up to Rs.7 lakh, which contributes significantly to the car’s overall price. These aspects also result in higher EV insurance premiums.

Expensive battery replacements

Battery replacements make up 50-70% of an EV’s cost. Floods often damage batteries, causing high insurance claims. Repairs can cost thousands of dollars due to the advanced traction battery and tools needed.

Specialized work makes fixing these batteries costly. Auto insurers may raise premiums because expensive repairs drive up claims. Many Tesla models and hybrids are pricey to fix, adding more weight to your wallet woes.

Specialized parts and repair expertise

EVs need special parts and tools for repairs. These parts, like EV batteries, cost more than those used in gas-powered vehicles. Skilled technicians are also needed to handle electric car systems safely.

The repair infrastructure for EVs is still growing. Not every repair shop can fix them yet. This lack of service centers adds to higher repair costs for policyholders. As demand grows by 2025, insurance companies may face added challenges covering these expenses.

Trends in EV Insurance Premiums

Insurance costs for electric cars are shifting gears. Expect rates to reflect repair expenses and advanced tech use in vehicles.

Increase in collision coverage costs

Special parts and repairs for electric vehicles (EVs) drive up costs. EV batteries make repair bills higher after crashes. These batteries can cost $5,000 to $16,000 to replace. Higher market values, like those found in a Tesla or Lexus EV, also raise collision coverage.

Repair shops need trained workers for EV fixes. This adds time and money to the process. Insurance companies see these risks and charge more for auto insurance plans covering collisions.

Discounts for telematics and safe driving

Telematics can lower insurance costs for careful drivers. This technology tracks speed, braking, and mileage through a device or app. Usage-based insurance (UBI) uses this data to adjust premiums based on risk.

Drivers who avoid hard stops, rapid acceleration, and high speeds often pay less.

Safe driving earns perks with many companies like State Farm. Some offer up to 30% discounts for good habits. These programs also help electric vehicle owners save money while promoting safer roads.

Features to Look for in EV Insurance Policies

Look for policies that give extra protection for your EV’s key parts. Some plans even cover things you might not think about, like special gear or roadside help.

Comprehensive coverage for batteries

Battery replacements cost a fortune, sometimes reaching Rs.7 lakh. Insurance policies should include coverage for this, as accidents or wear can damage batteries. Without it, you may face steep repair bills.

Policies must also protect against electrical and mechanical issues linked to batteries. EV owners need this extra layer of safety since fixing advanced EV tech isn’t cheap. This feature helps cover risks tied to your car’s power source directly.

Inclusion of charging equipment coverage

EV policies should cover charging equipment. This includes home charging stations and portable chargers. These tools are costly to replace or fix. Damage from theft, accidents, or power surges can leave EV owners with hefty bills without this coverage.

Insurance companies may also help with installation costs for home chargers. Some plans support upgrades to meet charging infrastructure standards like the North American Charging Standard (NACS).

Check if your policy has these benefits to avoid extra expenses later.

Roadside assistance for EV-specific needs

Electric cars need special roadside help. Towing requires equipment that won’t harm the battery. A regular tow truck might damage an electric vehicle’s systems, leading to costly repairs.

Some insurance policies now offer EV-specific towing options.

Mobile charging services are also a must-have feature. Running out of charge in remote areas happens more often than running out of gas with traditional cars. Insurance companies like State Farm could cover on-the-spot charging to get you back on the road quickly.

These additions save time, money, and stress for drivers switching to EVs.

How EV Owners Can Reduce Insurance Costs

Cutting the cost of insurance for your EV isn’t rocket science—small steps like smart choices can save big bucks; read on to find out how.

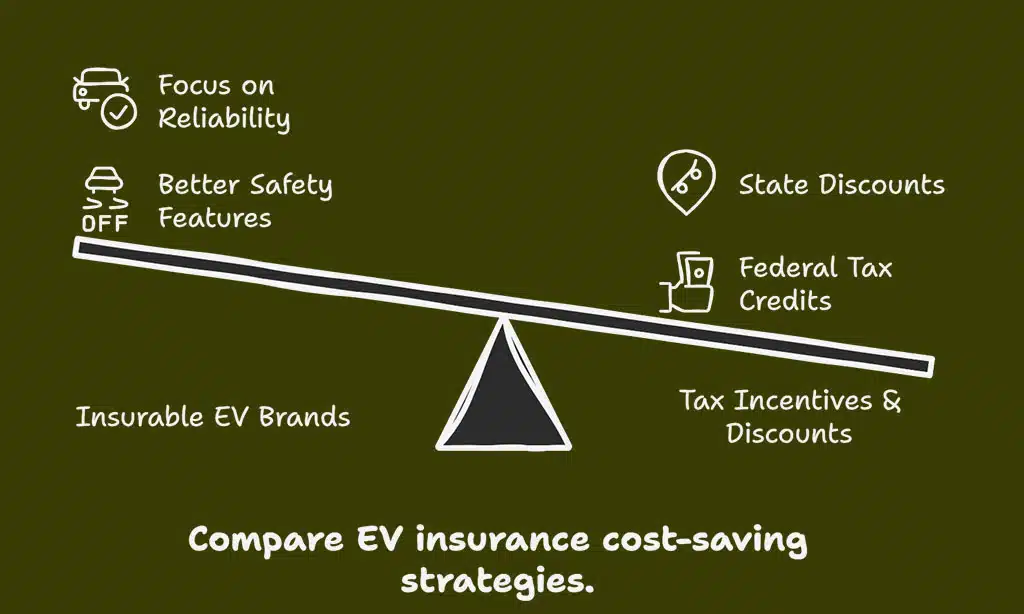

Choosing more insurable EV brands

Some EV brands come with better safety features. These can lead to lower insurance premiums. Tesla vehicles, for example, often offer advanced driver-assist systems like Enhanced Autopilot.

Such technology reduces accident risks and repair costs.

Collaboration between EV makers and insurers also helps. Companies like State Farm work with manufacturers to offer special deals on electric car insurance. Choosing brands that focus on reliability lowers long-term expenses in repairs and coverage costs.

Taking advantage of tax incentives and discounts

Federal tax credits can lower EV costs. The Inflation Reduction Act offers up to $7,500 for new electric cars. Plug-in hybrids may also qualify. Check if your EV or hybrid meets the rules of clean air standards.

State discounts might include reduced registration fees or road taxes. Some insurance companies like State Farm give cheaper rates for safe driving tech in EVs. Shop smart, and keep more money in your pocket!

Installing home charging stations

Home charging stations can lower your electric car insurance. Some policies give discounts for having one at home. Insurance companies see this as reducing risks, like damage or theft during public charging.

A charging station also boosts convenience and saves money on fuel. It ensures quick access to clean energy right in your driveway. Many homeowners insurance plans now include coverage for chargers, offering extra peace of mind if something goes wrong.

The Role of Insurers in Adapting to EV Growth

Insurance companies must adjust fast as electric cars transform the market. They need fresh policies and better-trained teams to handle EV claims.

Development of EV-specific policies

Insurers must offer policies that cover EV batteries. Battery replacements are costly, often exceeding $15,000 for some models. Comprehensive insurance should handle these expenses and provide zero depreciation coverage to shield owners from high repair bills.

Roadside assistance for charging issues is key too. Policies need to address unique EV needs like towing to charging stations or fixing onboard chargers. Insurers also adjust as EV adoption grows under laws like the Inflation Reduction Act and Bipartisan Infrastructure Law, boosting clean energy investment nationwide.

Training for EV repair and claims handling

Repairing EVs takes special skills. Staff need to learn about high-voltage batteries, EV chargers, and unique parts. Without proper training, repair times drag on longer, frustrating car owners.

Claims handling also changes with electric cars. Insurance agents must understand new risks like battery damage or fire hazards. Companies invest time and money into teaching workers these details to stay ahead in a growing EV market.

Takeaways

Electric cars are changing how insurance works. By 2025, expect new rules, plans, and costs for these vehicles. Owners can find ways to save with safe driving and smart choices. Insurance companies will also adjust to keep up with EV growth.

The road ahead looks exciting for drivers and insurers alike!

FAQs

1. What changes can we expect in EV insurance by 2025?

Insurance companies are likely to adjust policies as the U.S. auto market shifts toward electric vehicles. Expect more options for EV insurance discounts, new risk management strategies, and better coverage tailored for fully electric cars.

2. Will repair costs for electric vehicles impact premiums?

Yes, repair costs often affect premiums. Since EV technology and battery charging systems can be expensive to fix, some insurers may charge higher rates compared to gas-powered vehicles.

3. Are federal tax credits still available for buying an EV?

Yes, federal tax credits are part of the Inflation Reduction Act and other climate legislation like the Clean Air Act. These incentives aim to make owning hybrid or fully electric cars more affordable.

4. How does charging infrastructure affect car ownership and insurance?

Improved charging infrastructure under programs like the Bipartisan Infrastructure Law helps reduce range anxiety but could also influence how insurers calculate risks tied to long trips or frequent use of Tesla’s Supercharger network.

5. Can I get lower premiums with an EV compared to a gas-powered vehicle?

Some providers offer loyalty programs or discounts on clean energy-friendly cars due to their fuel savings and reduced emissions under EPA standards—but it depends on your insurer’s policy.

6. What role do government incentives play in transitioning from gas-powered vehicles?

Government incentives like EV tax credits, emission standards, and support for Plug In America encourage drivers to switch while helping utility companies expand energy-efficient solutions across states.