The cryptocurrency market is once again making headlines as major digital assets rebound with impressive strength. Among them, Dogecoin (DOGE) is leading a surprising charge, posting its highest price in over two months. As the entire sector experiences renewed investor enthusiasm, Bitcoin is inching closer to reclaiming its all-time high, while Ethereum soars on the back of a key network upgrade. Here’s a detailed breakdown of what’s happening across the crypto landscape.

Dogecoin Hits Multi-Month High, Nears $0.23

Dogecoin, the internet’s favorite meme coin, surged early Saturday, briefly approaching $0.23, according to data from CoinGecko. This marked its highest price since March 2, demonstrating a solid recovery from recent lows where it dipped below $0.17.

Over the past week alone, DOGE gained nearly 27%, including a 9% surge in just 24 hours. The rally comes amid a broader market uplift, where even smaller and more speculative tokens are enjoying renewed attention.

Despite the recent bump, Dogecoin remains well below its 2021 peak of $0.73, when Elon Musk’s tweets and SNL appearance propelled the token to historic highs. Since then, it’s struggled to maintain momentum, only climbing back to a high of around $0.48 in December 2024 before slipping again in early 2025.

Open Interest in Dogecoin Futures Hits 3-Month High

Accompanying Dogecoin’s price surge is a dramatic increase in open interest, which refers to the total value of futures contracts that have not yet been settled. According to CoinGlass, DOGE open interest now sits at $2.52 billion—its highest since mid-February.

This growth in open interest typically indicates rising speculation and trader confidence. For comparison, DOGE’s open interest had dropped as low as $1.3 billion just weeks ago, signaling low market participation at the time. However, it’s still below the $5.5 billion peak recorded in January 2025, right after the excitement surrounding the U.S. presidential inauguration of Donald Trump.

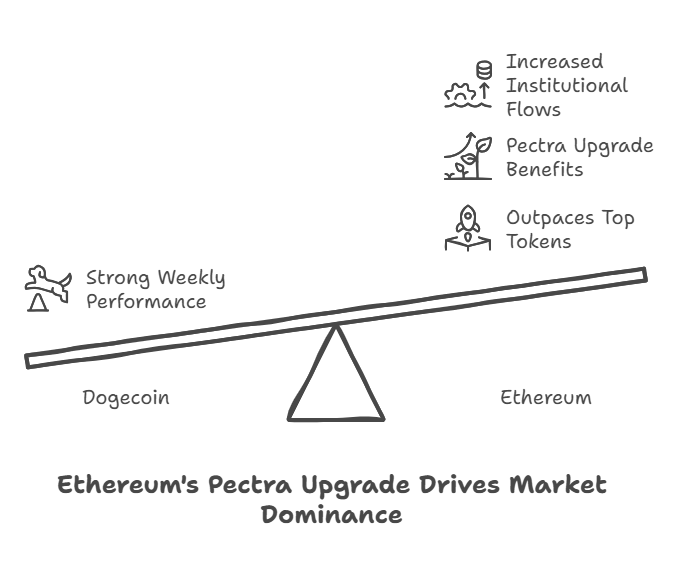

Ethereum Soars 32% Thanks to Pectra Upgrade

While Dogecoin is having a strong week, Ethereum (ETH) has outpaced nearly every other top token. ETH is up 32% over the last seven days, now trading at $2,409.

The rally is largely attributed to the successful rollout of Ethereum’s Pectra upgrade, which introduced enhancements to scalability, lower transaction costs, and smart contract efficiency. The upgrade, which includes several Ethereum Improvement Proposals (EIPs), is designed to strengthen Ethereum’s competitiveness as layer-2 solutions continue to thrive.

Additionally, institutional flows into Ethereum have reportedly increased, with asset managers positioning ETH as a hedge against traditional equities volatility and a key player in future Web3 infrastructure.

Meme Coins Are Exploding: MOODENG and PNUT Rally Hard

Meme coins beyond Dogecoin are also experiencing significant momentum. Two standout performers this week are Moo Deng (MOODENG) and Peanut the Squirrel (PNUT), which have seen exponential growth.

-

MOODENG has reportedly tripled in value, with its price jumping over 200% in just five days. This rapid gain was driven by viral memes on X (formerly Twitter) and a TikTok challenge tied to Moo Deng merchandise giveaways. Daily trading volume crossed $1.2 billion, surprising analysts who expected meme coin interest to fade in 2025.

-

Peanut the Squirrel (PNUT) climbed 165% over the week, with market capitalization now exceeding $438 million. Community-driven campaigns and speculative bets have helped fuel the surge.

Though these meme coins lack strong fundamentals, they continue to attract speculative interest, reflecting the high-risk appetite still present in the crypto space.

Bitcoin Nears All-Time High: Price Touches $103,700

Meanwhile, the world’s largest cryptocurrency, Bitcoin (BTC), remains at the center of investor attention. The digital asset surged past $100,000 earlier this week and now trades at approximately $103,700, just 5% shy of its all-time high of $108,786, which was set in January 2025 during Trump’s inauguration.

The upward move has been fueled by several key factors:

-

Macroeconomic optimism, including easing inflation concerns in the U.S. and interest rate stability.

-

A tentative trade agreement between the U.S. and U.K., which boosted global investor sentiment.

-

Strong inflows into Bitcoin ETFs and increasing institutional adoption.

-

A shift in trader sentiment as altcoins outperform tech stocks in traditional markets.

As the flagship cryptocurrency, Bitcoin’s surge often sets the tone for the rest of the market. Its current trajectory suggests bullish momentum heading into the second half of the year.

$1.1 Billion in Liquidations as Market Volatility Spikes

With price spikes across the board, the crypto market also saw a wave of liquidations, especially among traders using leveraged positions.

According to Coinglass, over $1.1 billion in positions were liquidated on Friday alone. Ethereum led the way, as many short positions were closed out in losses following ETH’s sharp rebound.

Dogecoin, Solana, and other popular tokens also contributed to this total, highlighting the risks traders face in such a volatile environment.

Short traders—those betting on prices falling—were hit the hardest, with some exchanges showing funding rate spikes indicating a sudden swing in bullish sentiment.

What This Rally Tells Us About the Crypto Market

The current crypto market rebound showcases several key themes:

-

Meme coin resilience: Despite being dismissed as speculative, tokens like DOGE, MOODENG, and PNUT continue to attract liquidity and community support.

-

Bitcoin’s role as an anchor: BTC still leads sentiment and acts as a bellwether for overall market health.

-

Ethereum’s evolving role: Network upgrades like Pectra reinforce ETH’s position as a foundational layer for decentralized applications.

-

Retail investor re-entry: The price movements suggest that retail interest, especially among younger investors, is reigniting after months of relative dormancy.

Is Crypto Heating Up Again?

The past week marks a turning point for crypto in 2025. With Dogecoin’s price surging 27%, Ethereum jumping 32%, and Bitcoin nearing its record high, it’s clear that the market is entering a more optimistic phase. However, traders should remain cautious. Despite the rally, the volatility remains intense, and liquidations are a sharp reminder of how quickly tides can turn.

For long-term investors, the current momentum could offer entry points, while for short-term traders, the strategy must balance risk with opportunity.