Crypto investing can be risky. Hacks, scams, and sudden market crashes leave many investors worried about their money.

That’s where DeFi insurance comes in. Using smart contracts on blockchain networks, it helps protect crypto assets from losses like theft or software bugs. It makes risk management faster and more fair.

This blog will explain how DeFi insurance works, what risks it covers, and its benefits for investors. Ready to learn how to protect your investments? Keep reading!

How DeFi Insurance Works

DeFi insurance uses blockchain to protect investments. It creates clear rules and quick payouts for covered losses.

Discretionary Insurance Model

The discretionary insurance model works through group decision-making. Members of decentralized autonomous organizations [DAOs] vote on claims. If approved, the pool pays for losses.

Insurance companies in this model rely on community trust rather than rigid rules.

This setup gives more freedom to insure risks like smart contract failures and flash loans. Coverage is flexible, but payouts depend on market sentiment and DAO choices. Nexus Mutual, a leading name here, uses blockchain technology to simplify decisions while reducing fraud risk.

Parametric Insurance Model

Parametric insurance uses pre-set rules and data to trigger payments. It relies on blockchain technology and smart contracts for speed. For instance, if a cyberattack causes losses over $10,000, the policy pays out automatically.

No need for claims adjusters or long reviews. This model suits crypto investors dealing with risks like smart contract failures or market crashes.

No detailed investigation is required in this process. Investors benefit from faster payouts and lower costs compared to standard insurance models. Protocols like Nexus Mutual use parametric coverage to protect decentralized finance [DeFi] activities such as yield farming and liquidity mining.

This keeps the DeFi ecosystem more stable during unexpected events.

Types of Risks Covered by DeFi Insurance

Crypto investing comes with risks, no bones about it. DeFi insurance steps in, offering a safety net where things can go wrong.

Smart Contract Vulnerabilities

Smart contract vulnerabilities can lead to big losses. Bugs in smart contract technology may allow hackers to steal funds or drain total value locked [TVL]. In 2023, over $1 billion was lost due to exploits in decentralized finance [DeFi] protocols.

Poor coding increases risks like phishing attacks and rug pulls. Insurance companies, such as Nexus Mutual and Cover Protocol, help crypto investors manage these threats by offering coverage for smart contract failures.

Developers often miss code errors during audits. These gaps open doors for attackers to manipulate systems on decentralized exchanges or automated market makers. DeFi insurance steps in by providing protection against such flaws.

Policyholders pay insurance premiums that cover potential losses from security vulnerabilities tied to smart contracts. This hedges risks while boosting trust within the DeFi ecosystem.

Market Volatility

Market swings can wipe out investments quickly. Price fluctuations in crypto are wild and unpredictable. DeFi insurance helps investors manage this risk. It offers coverage for losses caused by sudden price drops or extreme market movements.

Protocols like Nexus Mutual provide protection, allowing users to feel safer during volatile periods.

Without a safety net, investing in crypto is like walking a tightrope blindfolded.

DeFi insurance uses blockchain technology to handle claims fast and fairly. This protects against devaluation during shaky times. By leveraging smart contracts, insurers reduce delays and disputes common in the traditional insurance sector.

Cybersecurity Threats

Hackers target DeFi protocols every day. Phishing attacks, rug pulls, and smart contract exploits put investor funds at risk. In 2023 alone, billions of dollars were lost due to these threats.

One small error in a smart contract can cause massive losses.

Cybersecurity gaps are a big worry for crypto investors. Smart contract failures or poorly written code create vulnerabilities. Attackers quickly take advantage of such flaws within decentralized finance systems.

Insurance helps cover losses from these events, giving users peace of mind while investing through blockchain technology.

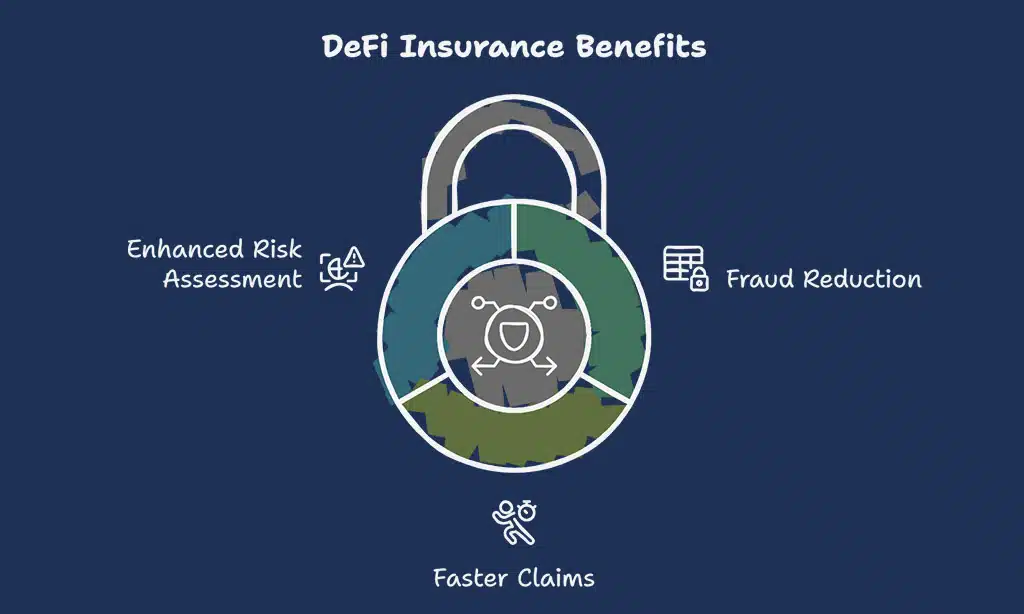

Key Benefits of DeFi Insurance

DeFi insurance helps cut risks in the crypto world. It offers smarter tools for faster, smoother claims processes.

Fraud Reduction

Smart contracts cut out middlemen, reducing fraud risks. These contracts execute automatically on blockchain technology. This transparency makes cheating much harder.

Insurance claims become tamper-proof with blockchain records. Every detail is public and secure. This system prevents fake claims or altered data, boosting trust in decentralized finance protocols.

Faster Claims and Automation

DeFi insurance uses smart contracts to handle claims automatically. These self-executing programs work fast and don’t need human adjusters. They cut delays by removing paperwork, making the claims process simple.

Automation lowers errors and boosts fairness. Blockchain technology ensures transparency at every step. Claims get processed faster, letting investors recover losses quickly after risks like hacking or exploits in DeFi protocols.

This speed gives users peace of mind while saving time and effort.

Enhanced Risk Assessment

Smart contracts and data analytics strengthen risk checks. These tools scan for flaws in blockchain technology, like smart contract failures or exploits. They help stop problems before they hurt investors.

Insurance protocols also track trends in crypto markets. By studying risks, such as phishing attacks or rug pulls, they set fair insurance premiums. This creates a safer decentralized finance ecosystem for users and platforms alike.

Challenges in DeFi Insurance Adoption

DeFi insurance faces hurdles like unclear rules and low user knowledge; stick around to explore the details.

Regulatory Uncertainty

Regulations on decentralized finance [DeFi] differ across countries. Some have strict rules, while others leave gaps, causing confusion. This lack of clarity affects DeFi insurance providers and investors alike.

For example, certain jurisdictions do not address smart contract technology or crypto-specific risks properly. Non-compliance can lead to penalties or restrictions for platforms.

Insurance companies in the blockchain space face questions about licensing and tax laws. Rules like GDPR add complexity when protecting user data in a decentralized ecosystem. These unclear policies slow growth and make it harder to gain trust from traditional markets.

Investors may hesitate due to fears of legal issues or changing guidelines over time.

Limited User Awareness

Many crypto investors still don’t know about DeFi insurance. This lack of awareness leaves their investments unprotected against smart contract failures, hacking risks, and phishing attacks.

Tools like Nexus Mutual or Cover Protocol offer solutions but remain underutilized due to limited knowledge. Misunderstandings about blockchain technology also make users hesitant to explore these options.

Education gaps in decentralized finance [DeFi] widen the problem. New users often see the system as too complex or risky without proper guidance. Decentralized insurance can safeguard assets from events like rug pulls, yet few understand how it works.

Clear explanations on parametric insurance models and premium payments could help attract more users into this ecosystem.

Takeaways

DeFi insurance is changing crypto investing. It makes risks smaller and safety bigger. Smart contracts bring speed, fairness, and less hassle. Investors now have better tools to handle hacks or losses.

With these steps, the future of decentralized finance looks much safer!

FAQs on How DeFi Insurance Is Reducing Risk for Crypto Investors

1. What is DeFi insurance, and how does it work?

DeFi insurance protects crypto investors from risks like smart contract failures, phishing attacks, and rug pulls. It uses blockchain technology and smart contracts to automate the claims process in decentralized finance [DeFi] ecosystems.

2. How does DeFi insurance reduce risk for investors?

It helps with risk mitigation by covering losses from vulnerabilities like smart contract exploits or parametric risks in DeFi protocols. This gives investors more confidence while participating in token sales or using lending platforms.

3. What types of risks can DeFi insurance cover?

DeFi insurance covers issues such as smart contract vulnerabilities, total value locked [TVL] losses, and cyber threats like phishing scams. Some providers also offer coverage for initial coin offerings [ICOs], sidechains, and non-fungible tokens [NFTs].

4. Who are some key players offering DeFi insurance?

Platforms like Nexus Mutual and Cover Protocol are popular names in the space. They use advanced tools like artificial intelligence to assess risks across the decentralized finance ecosystem.

5. How do premiums get priced in DeFi insurance?

Insurance premiums depend on factors such as protocol sustainability, past claims data, and perceived vulnerability of systems being insured.