In 2026, the landscape for Crypto Citizenship 2026 has fundamentally shifted from a luxury travel perk to a critical defensive strategy. The era of easily acquiring a “Plan B” passport with a simple wire transfer is effectively over, forcing investors to choose between two diverging paths: the crypto-native ecosystem of El Salvador or the newly regulated, physical-presence mandates of St. Kitts & Nevis.

This guide is not just a comparison of price tags. It is a strategic analysis of Crypto Citizenship 2026. We will dissect the $1 million El Salvadoran bet versus the reformatted St. Kitts option to determine which jurisdiction actually offers true sovereignty. Are you looking for a transactional travel document, or are you looking for a home that views your Bitcoin as money rather than a suspicious asset?

The Sovereign Shift: Why the Rules Changed

For years, high-net-worth investors viewed second passports primarily as travel tools, a way to skip visa lines at Heathrow or JFK. But in 2026, the priority has moved towards securing a geopolitical hedge. We are now witnessing the rise of the “sovereign individual” class, investors who realize that holding millions in digital assets while living under a jurisdiction that can freeze bank accounts or tax unrealized gains is a catastrophic risk.

The Caribbean, once the default “mail-order” solution, has changed. St. Kitts & Nevis has instituted the most aggressive overhaul in its history to appease international regulators, moving away from purely transactional citizenship. Meanwhile, El Salvador stands alone as a disruptive force, betting its national identity on Bitcoin. This divergence means your choice is no longer just about where you can travel, but about who controls your wealth.

Why “Crypto Citizenship” Matters in 2026

The term “Crypto Citizenship” is often thrown around loosely, but in 2026, it has a precise legal and financial definition. It refers to a jurisdiction that either:

- Accepts crypto directly for citizenship (removing the need for fiat off-ramps).

- Recognizes crypto as legal tender, eliminating capital gains taxes on appreciation.

- Provides a regulatory shield against the encroaching “financial surveillance” grid of the G7 nations.

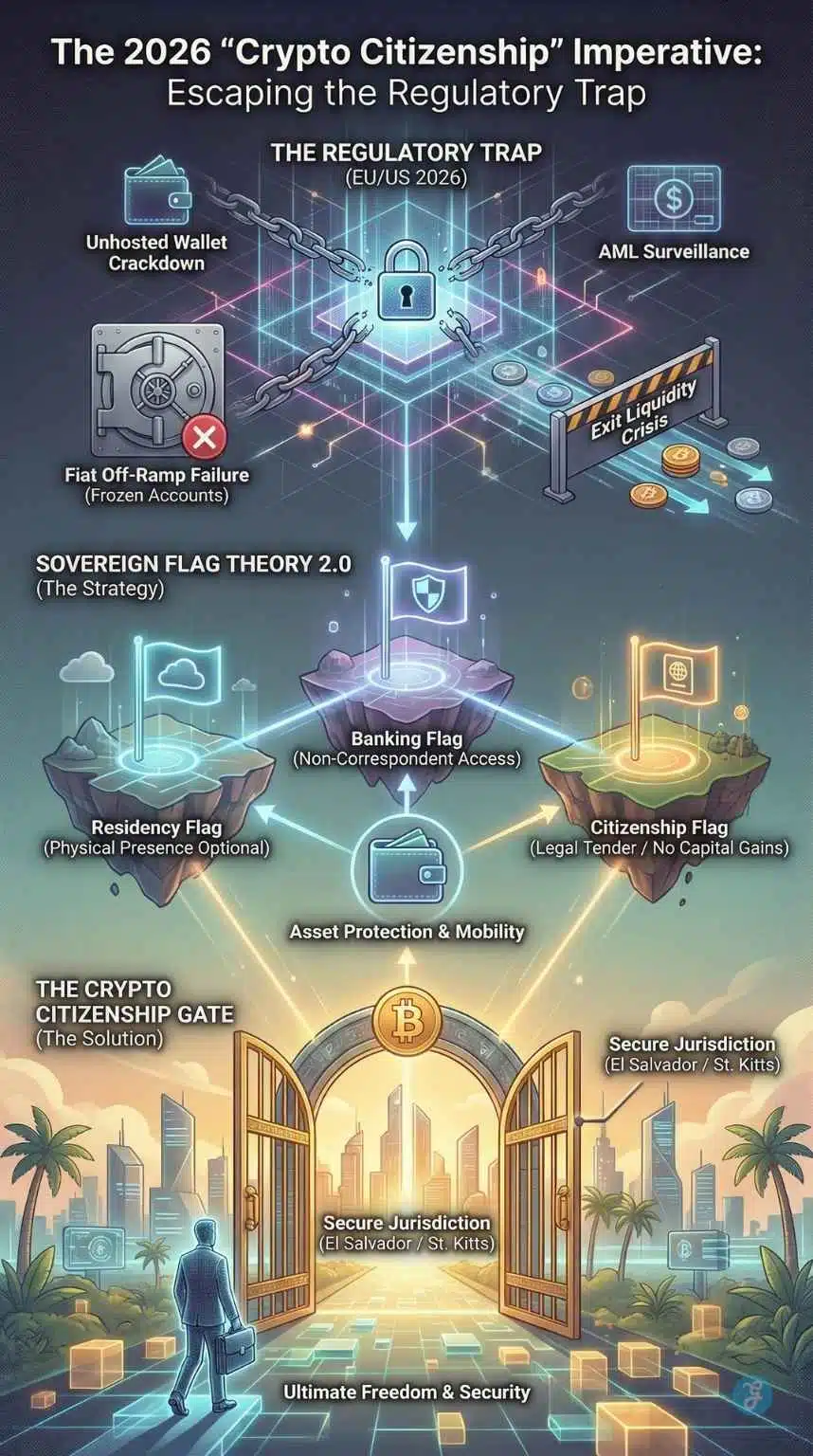

The “Exit Liquidity” Crisis

The primary driver for seeking a second passport this year is the global “Exit Liquidity” crisis. In 2024 and 2025, we saw the European Union and the United States tighten Anti-Money Laundering (AML) regulations specifically targeting “unhosted wallets.”

For a Bitcoin “whale” holding $10 million in self-custody, the problem isn’t poverty; it’s access. Trying to off-ramp that amount into a traditional bank in France, Canada, or the UK now triggers immediate freezing of funds and “Source of Wealth” inquisitions that can last for months.

“Crypto Citizenship” solves this by giving you a legal identity in a jurisdiction that understands the provenance of digital assets. It is the ultimate insurance policy. If your home country decides to tax unrealized gains or ban self-custody, your second passport is the key to exiting that system legally and instantly.

Flag Theory: The 2026 Edition

The old “Flag Theory”, the idea of planting flags in different countries for banking, residency, and citizenship, has been updated.

- Banking Flag: Must be in a jurisdiction that doesn’t rely on US correspondent banking for crypto.

- Residency Flag: Must be in a place where “physical presence” is either enjoyable or non-existent.

- Citizenship Flag: Must offer visa-free travel but, more importantly, immunity from extraterritorial tax overreach.

This brings us to our two contenders. One is a state that has bet its entire national treasury on Bitcoin (El Salvador). The other is the oldest Citizenship by Investment (CBI) program in the world (St. Kitts & Nevis), fighting to stay relevant amidst crushing pressure from the EU.

Deep Dive: El Salvador’s “Freedom Visa” [2026 Status]

El Salvador is the only country in the world offering a program specifically designed by Bitcoiners for Bitcoiners. It is not a “CBI program” in the traditional sense; it is an invitation to join a nation-building experiment.

The Pitch: “The First Bitcoin Country”

The Adopting El Salvador Freedom Visa program is unapologetically elitist. Capped at just 1,000 participants per year, it targets the high-net-worth individual who views Bitcoin not as a trade, but as a philosophy.

The Cost: The $1 Million Premium

- Price Tag: $1,000,000 USD.

- Payment Method: Bitcoin (BTC) or Tether (USDT).

- The Mechanism: This is a direct transfer to the Salvadoran government. There is no middleman converting your BTC to Eastern Caribbean Dollars. You send BTC; they receive BTC.

Critics argue that $1 million is overpriced compared to the Caribbean. However, this misses the point of the “Whale Calculation.” If you are sitting on $10 million of gains:

- In the US/Europe: You might pay 20-30% capital gains tax upon cashing out ($2M – $3M loss).

- In El Salvador: You pay $1M for the passport, but you pay 0% Capital Gains on the remaining $9M because Bitcoin is legal tender, not an asset. The passport effectively pays for itself.

Key Benefit: Bitcoin as Legal Tender

This is the “Killer App” of the El Salvador passport. In every other jurisdiction, using Bitcoin to buy a house or a car is a taxable event (barter or asset sale). In El Salvador, it is a currency transaction.

- Banking Safety: Salvadoran banks are mandated to service Bitcoin businesses. You will never receive a letter closing your account for “suspicious crypto activity” because the activity is state-sanctioned.

- No “Foreign” Income: For tax purposes, Bitcoin appreciation is not taxed.

Residency Requirement: Zero

El Salvador understands its audience. The Freedom Visa requires no physical residency to maintain citizenship. You do not need to live there, although President Bukele’s government aggressively incentivizes you to move with “Bitcoin City” infrastructure and coastal developments.

The 2026 Pros & Cons

| Pros | Cons |

| Instant Citizenship: 4-6 weeks processing (fastest globally). | Cost: $1M is 4x the price of St. Kitts. |

| Direct Crypto Payment: No fiat conversion friction. | Passport Power: Weaker than St. Kitts. Access to Schengen is valid, but lacks visa-free access to the UK (requires a visa). |

| Ideological Alignment: You are a “founder” of the country. | Volatility: The economy is pegged to Bitcoin’s success. |

Deep Dive: St. Kitts & Nevis CBI in 2026 [The Overhaul]

St. Kitts & Nevis has historically been the “Gold Standard” of buying a passport. However, 2026 marks the end of the “paper passport” era. Under immense pressure from the European Union (which threatened to revoke visa-free access for CBI nations), St. Kitts has introduced the “Genuine Link” reforms.

The 2026 Game Changer: Mandatory Physical Presence

This is the most critical update for any investor to understand. As of January 2026, you can no longer simply wire money and receive a passport.

- The New Rule: Applicants must demonstrate a “Substantive Connection” to the Federation.

- Implementation: While the exact day count is fluid based on investment type, the new protocols require applicants to visit the island to complete the process or collect documents. The days of “fully remote” citizenship are over for St. Kitts.

- Why? The EU demanded that citizenship cannot be purely transactional. It must involve a genuine link to the nation.

The Cost: A Structured Discount?

- Donation (SISC): ~$250,000 USD (plus fees).

- Real Estate: Minimum ~$400,000 (must be held for 7 years).

- Family Structure: In 2026, the pricing structure for families remains attractive compared to El Salvador. A family of four can obtain citizenship for roughly $250,000 – $300,000 total, whereas El Salvador would charge significantly more or require the full $1M single donation to cover the primary applicant (with additional smaller fees for dependents).

The “Fiat Bridge” Problem for Crypto

St. Kitts is “crypto-friendly,” but it is not crypto-native.

- Payment: The government Treasury does not accept Bitcoin.

- The Agent Model: You must hire a licensed agent who accepts your crypto, converts it to USD (incurring exchange fees and spread), and then wires the USD to the government.

- The Risk: This conversion is a taxable event in your home country. If you are American or European, selling $250k of BTC to pay for the passport triggers a capital gains tax bill, adding to the true cost of the citizenship.

Passport Strength: The ETIAS Factor

St. Kitts still holds a stronger travel document than El Salvador.

- Visa-Free Access: ~153 countries, including the UK, Schengen Area (EU), Singapore, and Hong Kong.

- The 2026 ETIAS Warning: Starting late 2026, St. Kitts citizens traveling to Europe must apply for ETIAS (European Travel Information and Authorisation System). It is not a visa, but a pre-authorization. While still easier than a visa, it removes the “grab and go” spontaneity of the past.

Head-to-Head Comparison: The 2026 Matrix

The following table breaks down the critical differences. Note the “True Cost” row, which includes the hidden costs of taxes and conversion fees.

| Feature | El Salvador 🇸🇻 (Freedom Visa) | St. Kitts & Nevis 🇰🇳 (2026 Rules) |

| Primary Philosophy | “Bitcoin is Money.” | “Citizenship is a Privilege.” |

| Investment Cost | $1,000,000 USD | ~$250,000 USD |

| Payment Method | BTC / USDT Direct | Fiat Only (Agent converts Crypto) |

| Residency Requirement | None (Zero days) | Mandatory Physical Presence (Genuine Link) |

| Processing Time | 4 – 6 Weeks (Ultra Fast) | 6 – 8 Months (Strict Due Diligence) |

| Tax Status | 0% Capital Gains (Legal Tender) | 0% Foreign Income (Crypto is an asset) |

| Passport Access | ~136 Countries (Schengen, no UK) | ~153 Countries (Schengen + UK) |

| Anonymity | High (Blockchain transparency) | Moderate (CRS/FATCA reporting active) |

| Dependents | Spouse + Children included | Age limit raised to 30 (New 2026 Rule) |

The “Sovereignty Score”: Who Actually Owns You?

When we analyze Crypto Citizenship 2026 through the lens of sovereignty, we must ask: Who controls the issuer?

El Salvador acts as a sovereign entity that has actively antagonized the IMF and World Bank to protect its Bitcoin standard. By choosing El Salvador, you are betting on a government that has proven it will withstand international pressure to maintain its crypto policies. Your passport is less likely to be revoked because the EU doesn’t like your financial habits.

St. Kitts & Nevis, conversely, is a small island nation heavily dependent on tourism and international banking relationships. The 2026 reforms (physical presence, strict due diligence) were not organic; they were implemented to appease the EU and the US. This represents a “Sovereignty Risk.” If the EU demands that St. Kitts revoke the passports of “high-risk crypto investors” in 2027, St. Kitts may have no choice but to comply to save its visa-free travel waivers.

The Application Process: A Walkthrough

Moving from strategy to execution requires understanding the logistical reality of your choice. In 2026, the application experience varies drastically depending on your target jurisdiction: one offers a streamlined, digital-first sprint for the crypto-native, while the other demands a rigorous, compliance-heavy marathon. Here is the step-by-step breakdown of how to secure your new citizenship in both jurisdictions.

Pathway A: The El Salvador “Whale” Route

This process is streamlined for speed and digital natives.

- Wallet Verification: You submit proof of funds via a wallet screenshot and blockchain link. No need to print six months of bank statements.

- KYC/AML: A standard background check (Interpol/criminal record).

- The Transfer: Once approved, you make the $1M transfer on-chain. The transaction is final.

- Citizenship: You travel to San Salvador (or the nearest consulate) solely to pick up your passport and biometrics. Total time: ~45 days.

Pathway B: The St. Kitts “Reform” Route

This process is now more involved due to the 2026 changes.

- Agent Selection: You must choose a government-authorized agent.

- Crypto Escrow: You send your crypto to the agent’s escrow service. They sell it for USD.

- Enhanced Due Diligence: The government performs a “Level 3” deep dive. They will verify your crypto source of wealth (e.g., mining records, early trade logs). This is where many disorganized crypto investors fail.

- The “Genuine Link” Visit: You schedule your mandatory visit to St. Kitts. You might open a local bank account or have an interview during this trip.

- Certificate of Registration: Issued after the visit and final vetting.

- Passport Issuance: Mailed or collected. Total time: ~7 months.

Strategic Verdict: The “Whale” vs. The “Nomad”

To make the right choice, you must identify which avatar you fit into.

Scenario 1: The Bitcoin Whale (Net Worth > $5M)

Recommendation: El Salvador.

If you hold significant Bitcoin wealth, the tax advantages of El Salvador far outweigh the $1 million entry price. The ability to live, spend, and bank in Bitcoin without triggering taxable events is worth millions over a lifetime. Furthermore, the lack of residency requirements suits the high-mobility lifestyle of a whale. You are paying for regulatory safety.

Scenario 2: The Crypto Nomad (Net Worth < $2M)

Recommendation: St. Kitts & Nevis.

If you cannot afford to drop $1M on a passport, St. Kitts remains the superior travel document. While the new “physical presence” rule is annoying, it can be viewed as a vacation. The $250k price point leaves you with $750k of liquidity compared to the El Salvador option. However, you must be prepared to document your source of funds meticulously. St. Kitts is no longer the “easy” option for anonymous crypto wealth.

Final Thought: The Death of the Paper Passport

The year 2026 will be remembered as the year the “Paper Passport” died. The era of buying a citizenship online and receiving it in the mail without a connection to the country is over. St. Kitts has adapted by forcing you to show up. El Salvador has adapted by forcing you to pay up (and buy into the ideology).

Your decision comes down to a simple question: Do you want a travel document that helps you move through the existing fiat world (St. Kitts), or do you want a membership card to the new digital economy (El Salvador)?

For the true believer, there is only one destination. For the pragmatist, the Caribbean sun still shines bright, but you’ll have to go there to feel it.