The days of easy money and speculative frenzy defining the blockchain industry are largely behind us. The sector has matured, pivoting sharply away from ephemeral hype cycles toward building robust financial infrastructure, regulatory compliance, and real-world utility. For professionals looking to enter the space, this shift is excellent news. It means that a Crypto Career Roadmap is no longer a gamble on a volatile trend, but a calculated step into a sophisticated, evolving technological landscape.

Whether you are a veteran engineer or a marketing strategist, the industry is now hiring for longevity, seeking talent capable of bridging the gap between traditional systems and decentralized innovation.

This guide is designed to cut through the noise. It is not about day trading or “getting rich quick.” It is a comprehensive, actionable blueprint for building a sustainable career in the Web3 ecosystem. We will cover the specific technical stacks in demand, the rise of non-technical operational roles, and the unique “proof of work” hiring culture that separates successful candidates from the rest.

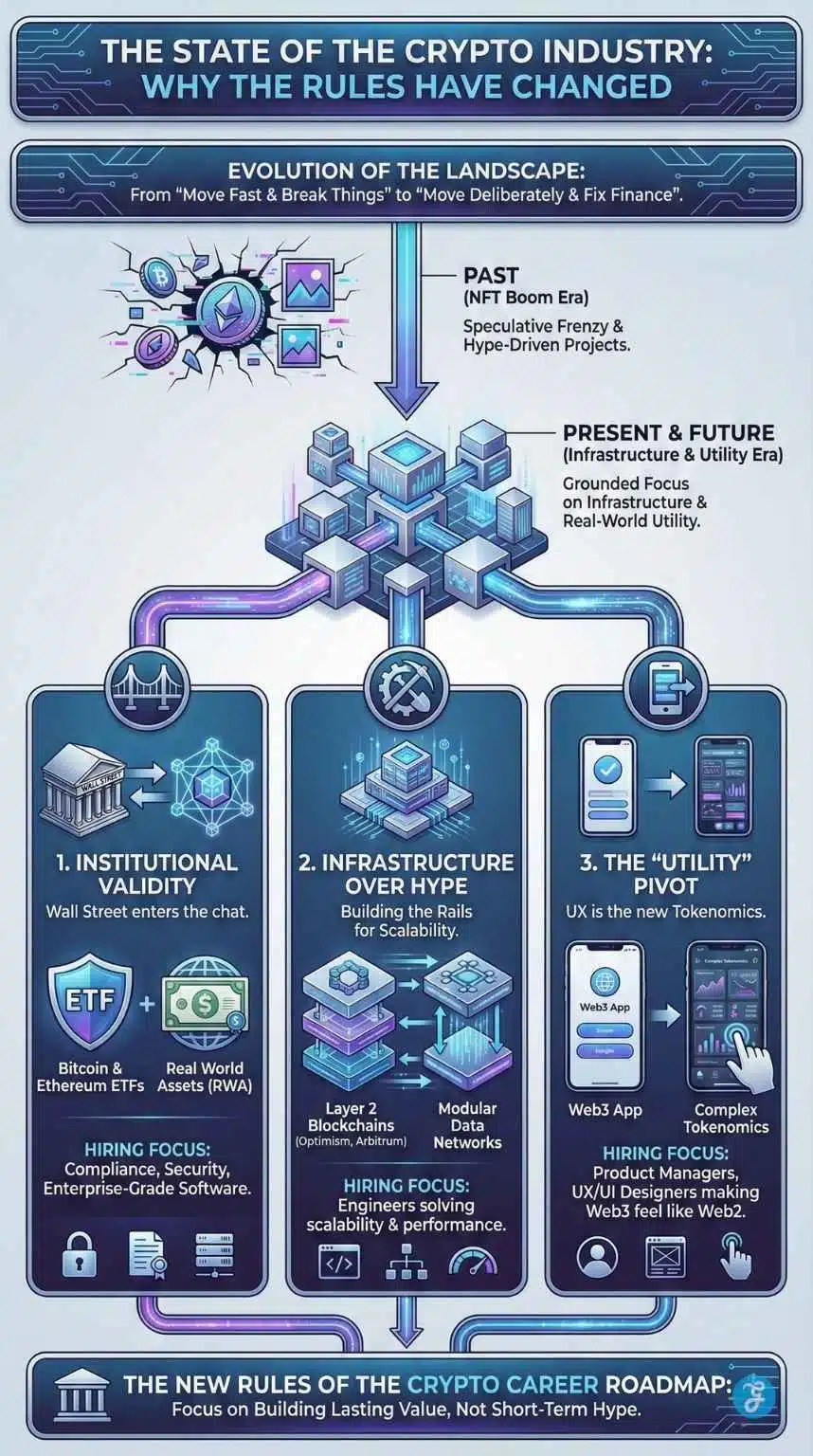

The State of the Industry: Why the Rules Have Changed

Before diving into the roadmap, it is critical to understand the ground you are standing on. If you last paid attention to crypto during the NFT boom, the landscape today will look unrecognizable. The industry has graduated from “move fast and break things” to “move deliberately and fix finance.”

Three major shifts define the current job market:

-

Institutional Validity: The arrival of Bitcoin and Ethereum ETFs, alongside the tokenization of Real World Assets (RWA) like US Treasuries, means Wall Street is now a major employer in the space. They don’t need “crypto enthusiasts”; they need professionals who understand compliance, security, and enterprise-grade software.

-

Infrastructure over Hype: The hiring frenzy has moved to the “picks and shovels” layer. Layer 2 blockchains (like Optimism or Arbitrum) and modular data networks are aggressively hiring engineers to solve scalability problems.

-

The “Utility” Pivot: Consumer apps are finally prioritizing user experience (UX) over complex tokenomics. This has triggered a massive demand for Product Managers and UX Designers who can make Web3 feel like Web2.

Phase 1: Understanding the New Landscape

Before updating your resume, it is crucial to understand who is hiring and why. The industry has moved into a phase of Institutional Adoption and Infrastructure.

In previous cycles, the job market was dominated by experimental DeFi protocols and NFT projects with short lifespans. Today, the biggest drivers of employment are:

-

Infrastructure Layers: The “roads and bridges” of crypto (Layer 1 and Layer 2 blockchains) that need to be faster, cheaper, and more secure.

-

Real World Assets (RWA): Tokenizing stocks, bonds, and real estate requires a blend of legal, financial, and technical expertise.

-

Institutional Finance: With major asset managers launching ETFs and stablecoins, there is a massive demand for professionals who speak the language of both Wall Street and the blockchain.

This maturity means companies are prioritizing security and compliance over raw speed. They aren’t just looking for “crypto bros”; they need adults in the room—auditors, compliance officers, and product managers who understand user safety.

Phase 2: Choose Your Track

The first step in your roadmap is identifying where your existing skills fit. The industry is broadly divided into two tracks: the Builders (Technical) and the Operators (Non-Technical).

Track A: The Technical Path (Builders)

If you have a background in computer science or software engineering, your transition will be direct, but the learning curve is steep. You are not just writing code; you are writing financial software that is often immutable—meaning bugs cannot be easily patched once deployed.

1. The Smart Contract Engineer

This is the bedrock role of the industry. You build the logic that runs on the blockchain.

-

The EVM Standard (Ethereum): Most of the industry still revolves around the Ethereum Virtual Machine (EVM). Proficiency in Solidity is the baseline requirement.

-

The High-Performance Alternative (Solana/Sui): As apps demand higher speed, blockchains based on Rust are surging. There is currently a significant talent shortage here, often commanding higher salaries than Solidity roles.

2. The Security Auditor

With billions lost to hacks, security is recession-proof. Auditors review smart contracts to find vulnerabilities before malicious actors do. This requires an obsessive attention to detail and a deep understanding of how blockchains process transactions.

3. The Zero-Knowledge (ZK) Developer

This is the frontier of crypto privacy and scaling. It involves complex mathematics and cryptography to prove something is true without revealing the underlying data. It has the highest barrier to entry but offers the highest compensation.

Technical Role Breakdown

| Role | Primary Languages | Key Tools & Frameworks | Difficulty Level |

| EVM Engineer | Solidity, Vyper | Foundry, Hardhat, Ethers.js | Medium |

| SVM Engineer | Rust | Anchor Framework, Seahorse | High |

| Frontend Web3 | TypeScript, React | Wagmi, Viem, Web3.js | Low/Medium |

| ZK Engineer | Circom, Cairo, Rust | SnarkJS, StarkNet | Very High |

Track B: The Non-Technical Path (Operators)

You do not need to write code to work in crypto. In fact, as the technology stabilizes, the need for “Operators”—people who can sell, manage, and regulate the tech—is exploding.

1. Compliance & Legal

This is arguably the fastest-growing non-tech vertical. As governments impose stricter regulations on stablecoins and exchanges, firms are desperate for Crypto Compliance Officers. These roles involve navigating KYC (Know Your Customer) and AML (Anti-Money Laundering) laws while understanding on-chain data.

2. Product Manager

Crypto products are notoriously difficult to use. Product Managers today are tasked with “abstraction”—hiding the complex crypto mechanics (like gas fees and seed phrases) behind a smooth, familiar user interface.

3. Growth & Business Development

The era of “Discord Community Managers” is fading. Companies now need Business Development professionals who can forge partnerships with other protocols and Key Opinion Leader (KOL) Managers who can execute sophisticated marketing campaigns.

Non-Technical Role Breakdown

| Role | Core Competency | Key Responsibilities |

| Compliance Officer | Legal & Regulatory Knowledge | Managing KYC/AML, licensing, and regulatory reporting. |

| DeFi Analyst | Data Science & Finance | Designing tokenomics, analyzing yield strategies, monitoring protocol health. |

| Product Manager | UX/UI & Strategy | simplifying user journeys, managing developer sprints, roadmap planning. |

| Technical Writer | Communication | Writing documentation, whitepapers, and developer guides. |

Phase 3: The Learning Curve (Skills & Tools)

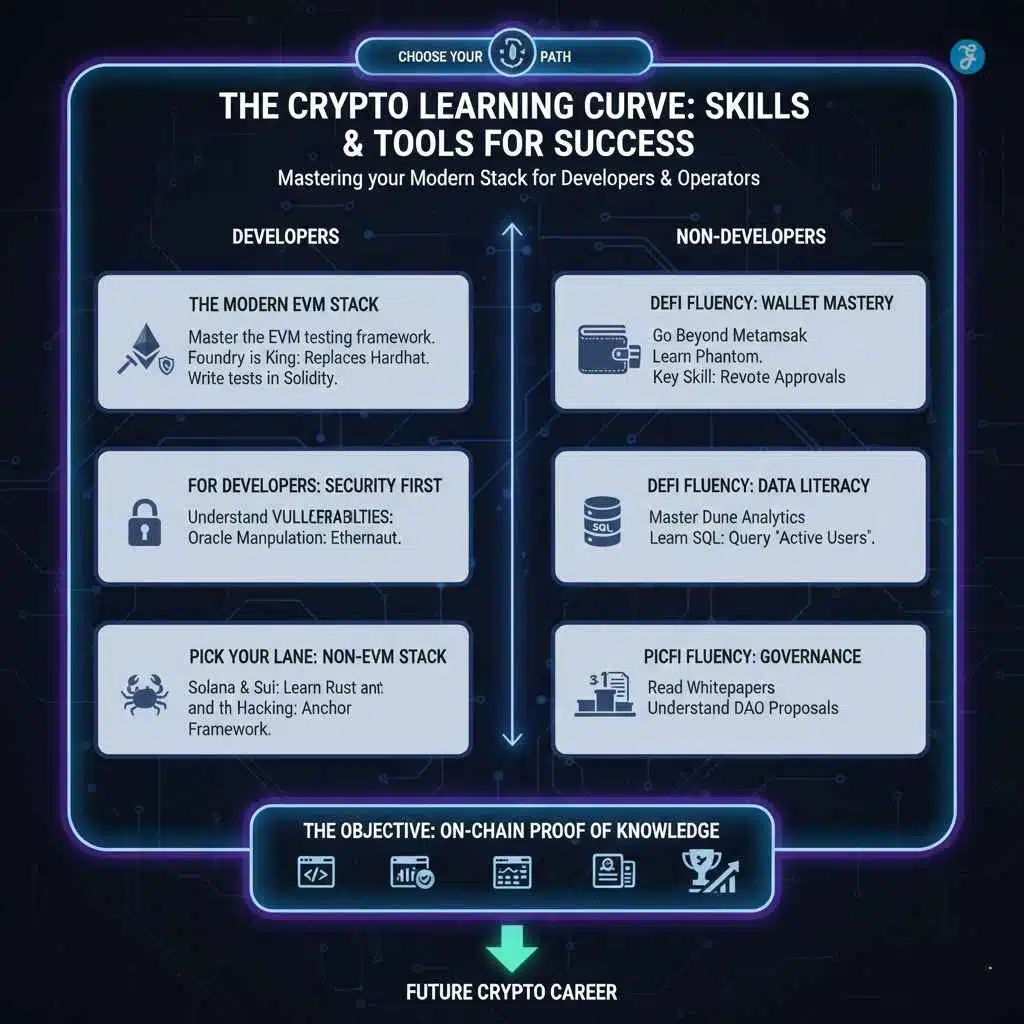

Once you have picked a lane, you need to master the tools of the trade. The tools in crypto evolve rapidly; using a tutorial from two years ago might lead you to deprecated software.

For Developers: The Modern Stack

If you are entering the Ethereum ecosystem, Foundry has largely replaced older testing frameworks like Hardhat or Truffle. It is faster and allows you to write tests in Solidity itself.

-

Actionable Step: Stop learning generic “blockchain theory.” Start building. Learn how to write a basic ERC-20 token contract.

-

Security focus: Even if you aren’t an auditor, you must understand common attack vectors like Reentrancy and Oracle Manipulation.

For Non-Developers: “DeFi Literacy”

You cannot work in this industry if you have never used the product. A resume that lists “Blockchain Enthusiast” but is paired with a candidate who has never swapped a token on a Decentralized Exchange (DEX) will be rejected.

-

Wallet Proficiency: Master non-custodial wallets (e.g., MetaMask, Phantom, or Rabbit). Learn what “gas” is and how to manage it.

-

On-Chain Analytics: Learn to read data. Tools like Dune Analytics and Token Terminal allow you to query blockchain data to see how many users a project actually has, versus what they claim in their marketing.

Phase 4: Building “Proof of Work” (Your Portfolio)

In the traditional corporate world, a degree from a prestigious university is your signal of competence. In crypto, the signal is your Proof of Work.

Because the industry is open-source, hiring managers expect to see what you have done. An anonymous GitHub repository with high-quality code or a Substack blog with deep analytical insights often holds more weight than a generic MBA.

The “Permissionless” Advantage

You do not need to wait to be hired to start working. The code is open. The data is open. You can start adding value to a company today without their permission.

-

For Developers: Do not just follow tutorials. contribute to existing open-source projects. Find a “Good First Issue” on a protocol’s GitHub and fix it. Participate in competitive audits on platforms like Code4rena.

-

For Marketers: Write a “breakdown” thread on X (formerly Twitter) analyzing a protocol’s Go-To-Market strategy. Point out what they did right and where they failed.

-

For Analysts: Build a dashboard on Dune Analytics that tracks a specific metric, such as “Daily Active Users on Protocol X,” and share it with the community.

Portfolio Ideas by Role

| If you want to be a… | Build this Portfolio Item |

| Smart Contract Dev | A fully tested DeFi primitive (like a staking contract) deployed on a Testnet. |

| Frontend Dev | A dashboard that reads blockchain data and displays it in a clean UI. |

| Writer / Marketer | A case study on a recent crypto crisis or success, published on Medium or Mirror.xyz. |

| Community Manager | A proposal for a DAO (Decentralized Autonomous Organization) to improve its governance. |

Phase 5: The Job Hunt Strategy

The best jobs in crypto are rarely posted on LinkedIn. The industry operates on different platforms and social graphs.

Where the Jobs Are

-

Crypto-Native Job Boards: Sites like Web3.Career, CryptoJobsList, and UseWeb3.xyz are the industry standards.

-

Telegram & Discord: Many high-level technical roles are filled through private channels like LobsterDAO.

-

Governance Forums: If you want to work for a specific DAO (like Uniswap or Aave), hang out in their governance forums. Jobs are often posted there as “proposals” for funding.

The Power of “X” (Twitter)

X is the town square of the crypto industry. It is where news breaks, where founders hang out, and where deals are made.

-

Optimize your Bio: Make it clear what you do (e.g., “Solidity Engineer” or “DeFi Analyst”).

-

Value-Add Networking: Do not DM founders asking for a job. DM them with value. “Hey, I noticed a typo in your documentation here,” or “I saw your user count dropped last week, here is a chart I made showing why.” This approach gets replies.

Hackathons: The Ultimate Recruitment Funnel

Hackathons like ETHGlobal or Solana Colosseum are not just coding competitions; they are job fairs in disguise. Sponsors (the hiring companies) send their engineers to mentor participants. If you build something using their tech stack and impress them, you will often be fast-tracked to an interview.

Phase 6: Ace the Interview

Crypto companies move faster than traditional tech. They value specific cultural traits.

The “Culture Fit”

-

Autonomy: Most crypto jobs are remote and asynchronous. You need to demonstrate that you can work without a manager hovering over your shoulder.

-

Skepticism & Curiosity: The ethos of crypto is “Don’t Trust, Verify.” Show that you research things deeply. Ask hard questions about their treasury management, their burn rate, and their decentralization roadmap.

-

Adaptability: The tech changes weekly. Show them you are a fast learner. If they ask, “Do you know X tool?” and you don’t, the correct answer is, “No, but I can learn it by Monday.”

Red Flags to Watch For

-

Anonymity: While some founders are anonymous, a fully anonymous team with no track record asking for access to funds is a major risk.

-

Unclear Revenue: If the project’s only source of revenue is selling its own token, run. Look for projects with sustainable revenue models (fees, service charges).

Frequently Asked Questions

1. Do I need to be a developer to get a high-paying job in crypto?

No. While engineers are highly paid, the 2026 market has seen a massive surge in demand for “Operators.” Roles in Compliance, Legal, and Product Management often command salaries comparable to senior developers ($120k–$200k+) because there is a shortage of talent that understands both regulation and Web3 mechanics. If you can navigate a whitepaper and a legal briefing, you are in the top 1% of candidates.

2. Is it safe to join a crypto startup, or will I get laid off in a bear market?

Job security in crypto depends on where you work.

-

High Risk: Small, anonymous teams launching “meme coins” or speculative NFT projects. These jobs often disappear when the market dips.

-

Lower Risk: Infrastructure companies (L1/L2 blockchains), regulated exchanges, and institutional custodians (like Fireblocks or Coinbase). These companies have deep war chests and build through bear markets. Always ask about a company’s “runway” (how many months of cash they have left) during the interview.

3. Do I need a university degree to work in Web3?

Rarely. In 90% of cases, your “Proof of Work” (Portfolio) matters more than your credentials. A GitHub repository with active contributions or a Substack with deep analytical research is often valued higher than an MBA. However, for specialized roles like General Counsel (Legal) or Quant Research, advanced degrees are still standard requirements.

4. Will I get paid in Crypto (Tokens) or Fiat (Cash)?

It is usually a mix, known as the “Split.”

-

Base Salary: Typically paid in Stablecoins (USDC/USDT) or Fiat currency to cover your living expenses.

-

Bonus/Equity: Often paid in the project’s native Tokens. This is your “upside”—if the project succeeds, these tokens can become valuable, similar to stock options in traditional tech.

-

Tip: Be wary of companies that want to pay 100% of your salary in their own volatile token.

5. I have zero experience. How do I get my first break?

The “Side Door” strategy is the most effective method in 2026:

-

Don’t apply cold. Pick a project you love.

-

Do the work first. finding a typo in their docs, translating their whitepaper, or fixing a small bug.

-

Send it to the founder. DM them: “Hey, I fixed X for you. Here is the link. No charge.” This demonstrates value immediately and often leads to a freelance contract or full-time offer faster than a LinkedIn application.

Final Thought: Crypto Career Roadmap

Building a career in crypto requires a shift in mindset. It demands that you become an active participant rather than a passive observer. The barrier to entry is high because the knowledge is specialized, but the ceiling is nonexistent.

The most successful people in this space are those who remain curious. They are the ones reading whitepapers on weekends, experimenting with new protocols on testnets, and engaging with the community.