Credit scores used to feel like a mystery—a number managed by people in suits behind closed doors. In 2026, they are managed by sophisticated algorithms. These models don’t just look at whether you paid; they analyze how you manage your debt capacity.

At the center of this mathematical evaluation is Credit Utilization.

Next to your payment history, utilization is the most influential factor in your credit score, accounting for roughly 30% of your FICO score. Yet, it remains one of the most misunderstood metrics in personal finance. In the algorithmic age, where data is trended and snapshots are analyzed instantly, understanding utilization is no longer just about “keeping it low.” It is about understanding the signal you are sending to the risk models.

This guide explores the mechanics, the math, and the strategy of credit utilization, designed to take you from a basic understanding to mastery of your credit profile.

What Credit Utilization Means

Credit utilization is the percentage of your available revolving credit limit that you are currently using. It acts as a real-time barometer of your financial bandwidth. Algorithms use this ratio to determine if you are managing credit responsibly or if you are overextended and relying too heavily on borrowed money to fund your lifestyle.

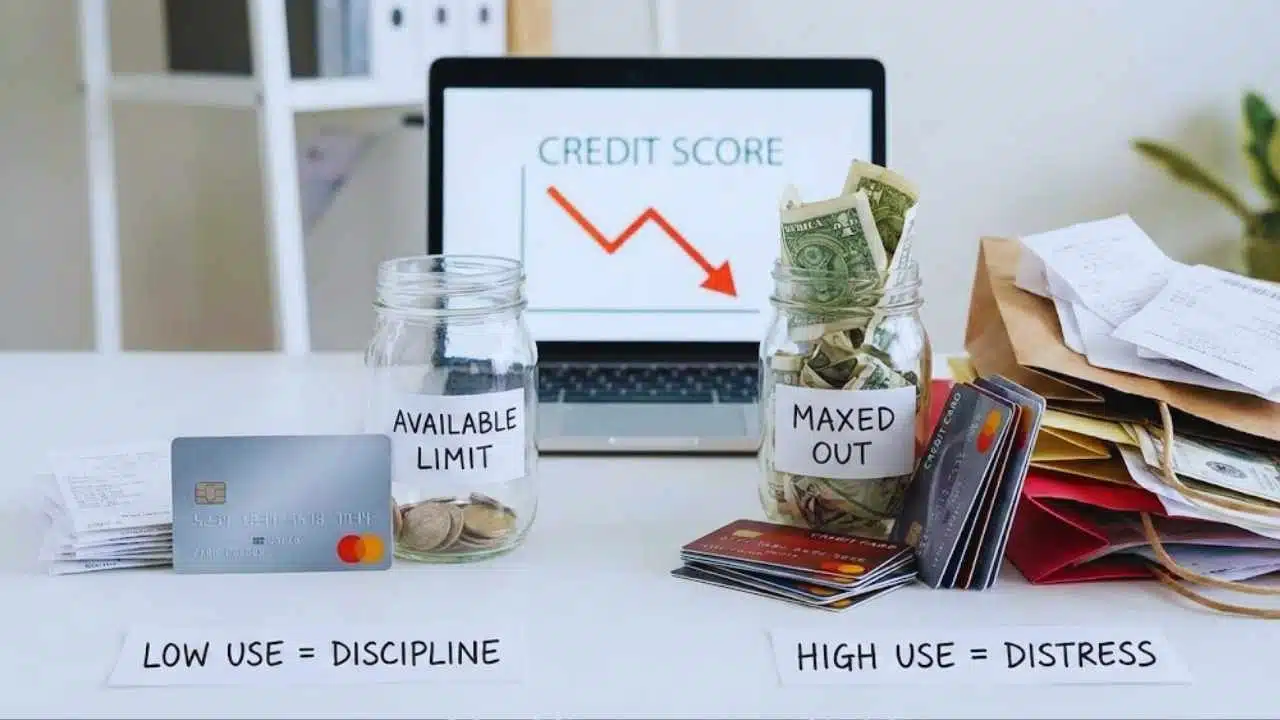

At its core, credit utilization is a measure of temptation versus discipline. Lenders extend you a line of credit—say, $10,000—not because they expect you to spend $10,000, but to see how you handle the potential to spend it.

If you have access to $10,000 but only use $500, you send a signal of high discipline and low financial stress. You have access to capital, but you don’t need it to survive. This makes you a low risk.

Conversely, if you max out that limit, using $9,900 of the $10,000, you send a distress signal. To a lender (and the algorithm), this looks like a borrower who is living on the edge, potentially using credit to cover basic expenses. Statistically, people who max out their credit cards are significantly more likely to default on future payments than those who do not. Therefore, as your utilization goes up, your credit score goes down.

Revolving Credit vs. Installment Credit (What Counts, What Doesn’t)

It is crucial to understand that credit utilization applies specifically to revolving credit.

- Revolving Credit (Counts toward utilization): This primarily includes credit cards and lines of credit (like a HELOC in some scoring models, though primarily credit cards). “Revolving” means the balance goes up and down, and the credit renews as you pay it off. You control the balance.

- Installment Credit (Does NOT count toward utilization): This includes mortgages, auto loans, and student loans. These loans have a fixed balance that you pay down over a set schedule. While the amount of debt matters for your Debt-to-Income (DTI) ratio, the remaining balance percentage on a mortgage does not impact your credit utilization ratio in the same direct, volatile way that credit cards do.

The algorithms are hyper-focused on revolving credit because it is behavioral. You can’t easily change your mortgage payment overnight, but you can run up a credit card bill in an hour. That volatility makes utilization the best immediate predictor of credit risk.

How Credit Utilization Is Calculated (With Real Examples)

The math behind credit utilization is straightforward, but the way it is applied involves two distinct calculations. overall utilization and per-card utilization. Understanding both is the key to preventing surprise score drops.

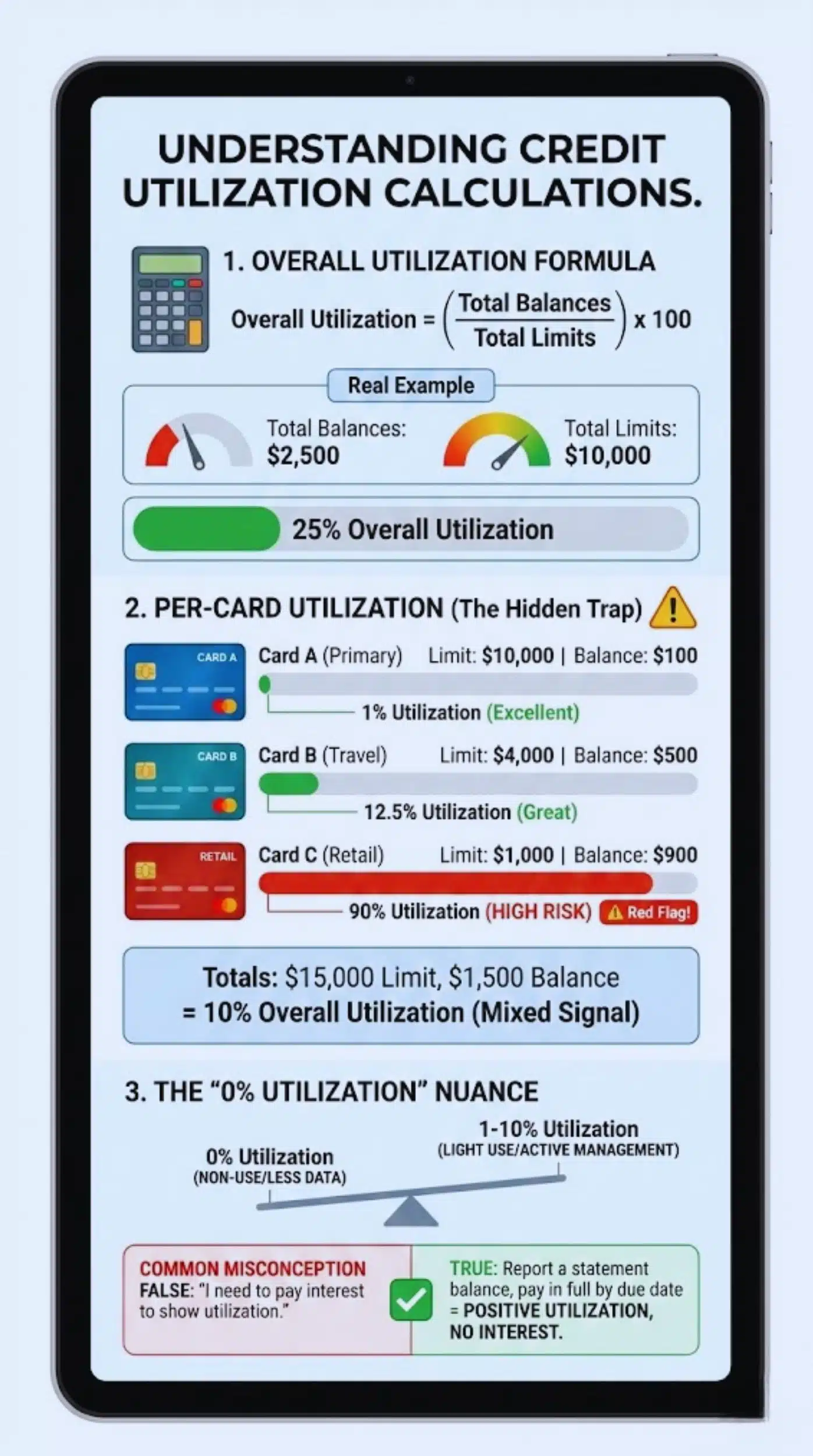

Overall Utilization Formula (Total Balances ÷ Total Limits)

The most commonly cited number is your aggregate or overall utilization. This looks at your entire credit profile as a single bucket.

The Formula:

$$\text{Overall Utilization} = \frac{\text{Sum of All Credit Card Balances}}{\text{Sum of All Credit Limits}} \times 100$$

If you have five credit cards, the scoring model adds up every single penny you owe on them and divides that by the total credit limits of those five cards. This provides a macro view of your leverage.

Example:

- Total Balances: $2,500

- Total Limits: $10,000

- Calculation: $2,500 / $10,000 = 0.25

- Result: 25% Overall Utilization.

Per-Card Utilization (Why One High Card Can Hurt)

This is the hidden trap. You might have excellent overall utilization, but if a single card is maxed out, your score can still suffer.

Scoring models like FICO and VantageScore look at individual line utilization. This assesses the risk of a specific account. If you have a credit card with a $1,000 limit and a $900 balance, that card is at 90% utilization.

Even if you have another card with a $20,000 limit and a $0 balance (bringing your overall utilization down to a very healthy 4%), that single maxed-out card is a red flag. It suggests you might be struggling to manage that specific payment, or that you are “robbing Peter to pay Paul.”

Example Table (3 Cards, Different Balances, Same Total)

To visualize how this works, let’s look at a borrower named Alex. Alex has a total credit limit of $15,000 and total debt of $4,500. His Overall Utilization is 30%.

However, the distribution of that debt matters.

| Card Name | Credit Limit | Current Balance | Per-Card Utilization | Status |

| Card A (Primary) | $10,000 | $500 | 5% | Excellent |

| Card B (Travel) | $4,000 | $1,000 | 25% | Good |

| Card C (Retail) | $1,000 | $3,000 | 300% (Over Limit) | CRITICAL FAILURE |

Wait, let’s correct the math for a realistic scenario:

| Card Name | Credit Limit | Current Balance | Per-Card Utilization | Risk Signal |

| Card A | $10,000 | $100 | 1% | Excellent |

| Card B | $4,000 | $500 | 12.5% | Great |

| Card C | $1,000 | $900 | 90% | High Risk |

| Totals | $15,000 | $1,500 | 10% Overall | Mixed Signal |

In this corrected scenario, Alex has a beautiful 10% overall utilization. However, Card C is at 90% utilization.

- The Algorithm’s View: “Alex is managing his overall load well, BUT he is nearly maxed out on the Retail card. Penalize slightly for the maxed-out account.”

What “0% Utilization” Signals (And Why It’s Nuanced)

Is 0% the perfect score? Surprisingly, no.

While 0% utilization is better than 50% utilization, having $0 reported balances on all your credit cards can actually result in a slightly lower score than having a very small balance (like 1%).

This is because the algorithm is trying to predict risk based on usage. If all balances are zero, the system has no recent data on your repayment behavior. It looks like “non-use.” A “non-user” is slightly riskier than a “light user” who demonstrates active management by spending and paying off the balance every month.

Common Misconception: “I need to pay interest to show utilization.”

FALSE. You never need to pay a penny of interest to have good utilization. Utilization is calculated based on the statement balance. If you pay that balance in full by the due date, you pay no interest, but the balance was still reported to the bureaus, counting as positive utilization.

What The Algorithms “See” In 2026 (The Algorithmic Age Angle)

We are moving past the era of simple snapshots. The credit scoring industry has evolved significantly with the introduction of advanced models and “Trended Data.”

Credit Scores Are Statistical Risk Models (Not Moral Judgments)

It is vital to detach your ego from your score. Algorithms do not judge your character; they calculate probability. When FICO or VantageScore lowers your score because of high utilization, they are not saying you are a “bad person.” They are outputting a statistical probability that says: “People with this utilization profile are X% more likely to be 90 days late on a payment in the next 24 months.”

In the algorithmic age, this calculation happens faster and with more precision.

Snapshot vs. Trend: Why Patterns Matter

For decades, credit scores were purely a “snapshot.” If you maxed out your card in January but paid it off in February, the February score would look as if the debt never happened. The memory was short.

Enter Trended Data (used prominently in FICO® Score 10 T and VantageScore 4.0).

Trended data allows the algorithm to look back at your balance history over the last 24 months. It distinguishes between:

- The Transactor: Someone who runs up a balance but pays it in full every month.

- The Revolver: Someone who runs up a balance and pays only the minimum, carrying the debt forward.

In the past, if both people had a $2,000 balance on the day the data was pulled, they looked identical. In 2026, the algorithms can see the trend. The Transactor is rewarded; the Revolver is viewed as higher risk. This means consistently managing utilization is now more important than just “fixing it” right before a loan application.

Per-Card Spikes, High-Water Marks, and Volatility

Algorithms are also becoming sensitive to volatility. If your balances swing wildly—$500 one month, $9,000 the next, then $200—you represent a volatile borrower.

Stability is the new gold standard. A borrower who maintains a consistent, low utilization rate (e.g., 2% to 5% every month) is statistically safer than one who spikes near their limit frequently, even if they always pay it off. This “High-Water Mark” (the highest balance you’ve ever had on a card) is a data point lenders can review to see your potential for spending shocks.

FICO vs. VantageScore (High-Level Differences)

While the principles are similar, the two main scoring entities treat utilization slightly differently:

- FICO (Used by 90% of lenders): Very sensitive to utilization. It generally creates a score based on the data present at the exact moment the credit report is pulled. Newer versions (FICO 10 T) incorporate the trended data mentioned above.

- VantageScore (Common on free credit apps like Credit Karma): Also highly sensitive but tends to be more volatile. VantageScore 4.0 was an early adopter of trended data. It looks heavily at the trajectory of your debt—is it going up or down over time?

The takeaway: Do not panic if your free VantageScore moves differently than your FICO score. Lenders primarily use FICO, so prioritize FICO-friendly behaviors (low snapshots), but understand that trended data is becoming the industry standard.

What Is A “Good” Credit Utilization Ratio?

You will often hear specific percentages thrown around. Let’s separate the “rules of thumb” from the data-driven reality.

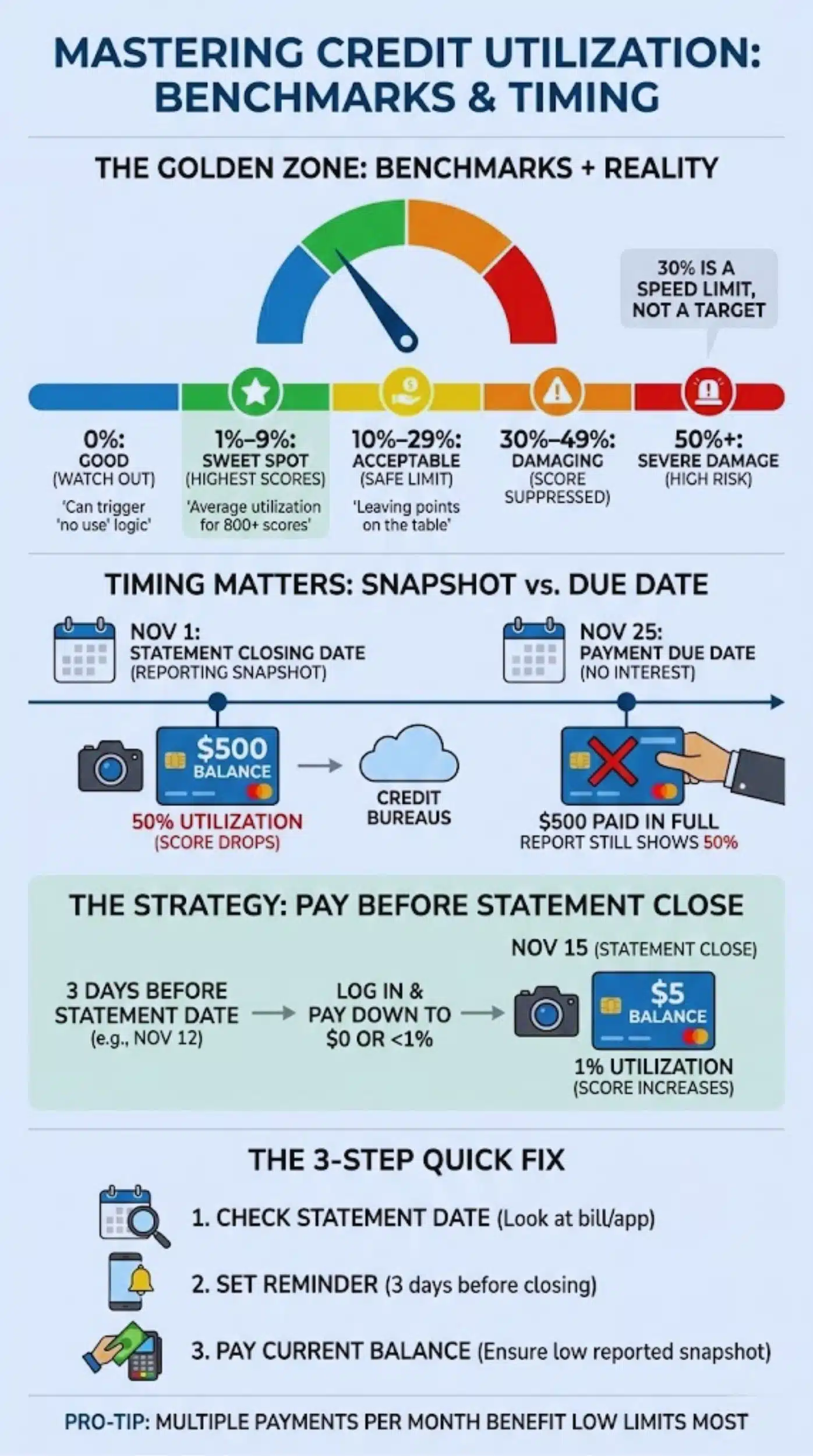

The 30% Guideline (Why It’s Popular, Why It’s Not The Finish Line)

If you Google “good credit utilization,” you will see 30% everywhere.

- Why? It is a safe upper boundary. If you stay under 30%, you are generally avoiding the severe penalties associated with high risk.

- The Reality: 30% is not a target; it is a limit. Think of 30% as the speed limit in a school zone. You won’t get a ticket (a massive score drop) if you do 29mph, but you aren’t exactly being the safest driver (getting the best score) either.

If you are currently at 70% utilization, getting to 30% is a massive victory. But if you want an 800+ credit score, 30% is still too high.

Why Single Digits Often Correlate With Top Scores

Data released by FICO and Experian consistently shows that “High Achievers” (those with scores above 800) have an average utilization ratio of roughly 7%.

The algorithm rewards “low, non-zero” usage the most. The difference between 29% utilization and 9% utilization can be as much as 20 to 40 points on your credit score.

The Golden Zone:

- 0%: Good, but sometimes triggers “no recent usage” logic.

- 1% – 9%: The Sweet Spot. This is where the highest scores live.

- 10% – 29%: Acceptable. You are creditworthy, but leaving points on the table.

- 30% – 49%: Damaging. Your score is being actively suppressed.

- 50% – 74%: Severe Damage. You look financially distressed.

- 75% – 100%: Maxed Out. Massive negative impact.

Low Utilization Without “No Use” (Avoiding Extremes)

To maximize your score, you want to avoid the extremes. You don’t want to be maxed out, but you also don’t want your credit report to look like a ghost town.

The strategy is “AZEO” (All Zero Except One). This is a strategy used by credit enthusiasts where they pay off all cards to $0 before the reporting date, except for one major bank card which they leave with a tiny balance (e.g., $10 or 1% of the limit). This proves activity to the algorithm without adding risk.

Timing Matters: Statement Date vs. Due Date

This is the technical “secret sauce” of credit utilization. Most people believe that if they pay their bill in full by the Due Date, their credit report will show a $0 balance. This is usually incorrect.

When Utilization Typically Gets Reported (Statement Balance Snapshot)

Credit card issuers generally report your balance to the bureaus (Equifax, Experian, TransUnion) once a month. This reporting date usually coincides with your Statement Closing Date, not your Payment Due Date.

- Statement Closing Date: The day your billing cycle ends and the bill is printed.

- Payment Due Date: Usually 21–25 days after the Statement Closing Date.

The Problem:

Imagine your limit is $1,000. You spend $500 during the month.

- Nov 1st (Statement Closes): The bank generates a bill for $500. They report this $500 balance to the credit bureaus immediately.

- Nov 1st: Your credit score updates. It sees 50% utilization. Your score drops.

- Nov 25th (Due Date): You pay the $500 in full. You pay no interest.

- Result: You were responsible and paid in full, but the credit report still shows 50% utilization for that entire month because the snapshot was taken on the 1st.

The “Pay Before Statement Close” Strategy (Ethical Optimization)

To manipulate this timing in your favor, you must pay the debt before the snapshot is taken.

If you log in to your banking app three days before the Statement Closing Date and pay your current balance down to $0 (or a very small amount), the statement will close with that low number.

When the bank reports to the bureau, they report the low number.

- Algorithm View: “This person has 1% utilization.”

- Result: Score increase.

This is not “tricking” the system; it is proactively managing your reported data. It is completely ethical and allowed.

Multiple Payments Per Month: Who Benefits Most?

This strategy benefits people with low credit limits the most.

If you have a $500 limit and spend $400 on groceries, you are at 80% utilization. By paying that $400 off immediately (perhaps weekly or bi-weekly) rather than waiting for the bill, you ensure your average daily balance and your reported balance remain low.

The 3-Step Quick Fix:

- Check your Statement Date: Look at your last bill or app. It is usually the same day every month (e.g., the 15th).

- Set a Reminder: Set a calendar alert for 3 days before that date (e.g., the 12th).

- Pay Current Balance: Log in on the 12th and pay the entire “Current Balance.” When the statement closes on the 15th, it will show $0 due.

Fast, Practical Ways To Lower Utilization (Without Games)

If your utilization is high, your score is suffering. Here is how to lower it effectively.

Pay Down Balances (Highest Utilization Card First)

Mathematically, paying off the card with the highest interest rate saves you the most money (the Avalanche Method). However, for credit scoring purposes, paying down the card with the highest utilization percentage helps your score the fastest.

If Card A is at 90% utilization and Card B is at 40%, pay Card A down first. Bringing a maxed-out card away from the limit provides immediate relief to your risk profile.

Spread Spending Across Cards (Per-Card Utilization Control)

If you have a large expense coming up (e.g., $2,000 for car repairs) and you have two cards with $3,000 limits, do not put the whole charge on one card.

- Option A: $2,000 on Card A. Utilization: 66%. (Risk Spike).

- Option B: $1,000 on Card A, $1,000 on Card B. Utilization on both: 33%.

Option B is better for your score because it avoids the “maxed out” flag on a single account.

Request A Credit Limit Increase

This is the denominator trick. Remember the formula: $\text{Balance} / \text{Limit}$. You can lower the ratio by lowering the balance OR by increasing the limit.

If you have a $5,000 limit and owe $2,500 (50%), and you get a limit increase to $10,000, your utilization instantly drops to 25% without you paying a dollar.

- When to do it: When your income has increased or you have a history of on-time payments.

- The Caution: Some banks do a “Hard Pull” (check your credit) for this. Ask them, “Is this a soft inquiry or a hard inquiry?” before proceeding. A hard inquiry might drop your score 5 points temporarily, but the utilization drop will likely raise it more.

Don’t Close Old Cards If Avoidable

When you close a credit card, you lose that credit limit.

If you close a card with a $10,000 limit, your Total Available Credit shrinks by $10,000. If you still have balances on other cards, your utilization percentage will spike mathematically.

- Strategy: Keep old cards open with no annual fee. Put a small subscription (like Netflix or iCloud) on them and set up autopay to keep them active. This preserves your credit age and your total limit buffer.

If Your Limit Is Low: Micro-Utilization Approach

For students or rebuilders with $300 or $500 limits, traditional advice fails. Buying one tank of gas can ruin your utilization.

- The Fix: Treat your credit card like a debit card. Do not wait for the bill. If you buy a $50 coffee, open your banking app in the parking lot and pay it off. This “Micro-Utilization” ensures you never get caught with a high balance snapshot.

Common Myths (And What The Data-Driven Models Actually Reward)

Myth: “Carry A Balance To Build Credit”

This is the most persistent and damaging myth in personal finance.

- The Myth: “You need to leave a balance of $100 on your card and pay interest on it so the bank sees you are using it.”

- The Truth: Absolutely false. You do not need to carry a balance over to the next month. You do not need to pay interest. You only need the balance to report on the statement date (as discussed above), and then you should pay it off in full. Paying interest does not increase your credit score; it only decreases your bank account.

Myth: “Overall Utilization Is All That Matters”

As detailed earlier, ignoring per-card utilization is risky. You can have a great aggregate score and still be denied credit because one specific card is maxed out. Lenders look for “localized distress” on specific accounts.

Myth: “Once You Fix It, Your Score Is Permanently Fixed”

Utilization is (mostly) a “memory-less” factor in older scoring models, but it is highly dynamic.

If you pay off all your debt today, your score will skyrocket next month. However, if you run the debt back up the following month, the score crashes again immediately. It is not a “fix it and forget it” metric; it is a maintenance metric.

Note on Trended Data: With newer models (FICO 10 T), running debt back up is even worse because the model now remembers that you have a history of volatility.

Use-Case Playbooks (Choose Your Scenario)

Different life stages require different utilization strategies. Find the one that matches your current goal.

Scenario A: Before A Mortgage Or Auto Loan (60–90 Day Plan)

If you are applying for a major loan, every point counts. Lowering your interest rate by 0.5% can save you tens of thousands of dollars.

- Goal: Maximum score boost.

- Strategy: The “AZEO” Method (All Zero Except One).

- Action: Two months before applying, pay all cards to $0 before their statement dates. Leave one card with a balance of roughly $20.

- Why: This maximizes the utilization points. Do not apply for new credit cards during this time (no hard inquiries).

Scenario B: After A Big Purchase (How To Recover Quickly)

You just put a $4,000 vacation on your card. Your score dropped 40 points.

- Goal: Rapid recovery.

- Strategy: Aggressive Paydown + Cycle Management.

- Action: Do not panic. The score drop is temporary. Pay the balance down as fast as possible. If you cannot pay it all at once, try to cross “thresholds.” Getting under 70%, then under 50%, then under 30%. Each threshold you cross will return some points to your score.

Scenario C: Rebuilding Credit (Small Limits, High Sensitivity)

You are rebuilding with a secured card ($300 limit).

- Goal: Trust building.

- Strategy: The “Netflix Only” Method.

- Action: Do not use this card for daily spending. Put one small recurring bill on it. Set the card to Autopay in Full. Cut up the physical card or lock it in a drawer.

- Why: This ensures you never accidentally go over 30% utilization (which is only $90 on a $300 limit) and guarantees 100% on-time payments.

Tools, Tracking, And What To Monitor Monthly

You cannot manage what you do not measure. In 2026, you have access to free tools that give you X-ray vision into your credit.

What Numbers To Track

- Statement Balance vs. Current Balance: Know the difference.

- Report Date: Know when your bank talks to the bureau.

- Peak Utilization: The highest percentage you hit during the month.

Alerts + Autopay + Budget Guardrails

Most banking apps allow you to set “Balance Alerts.”

- Setup: Go to your credit card app settings. Set an alert for “Balance exceeds $X.”

- The Number: Set $X to be 30% of your limit. If you get that text message, stop spending on that card immediately and make a payment.

The One Graph To Include (Utilization Trend Line)

Many credit monitoring apps (Credit Karma, Experian, banking apps) show a line graph of your utilization over 6 months or a year.

- What you want to see: A flat line near the bottom (consistent low usage).

- What you don’t want: A jagged mountain range (volatility).

- Pro Tip: Check this graph once a month. If the trend is creeping upward, it is an early warning sign of “lifestyle creep” before it becomes a debt problem.

Wrap-Up

Credit utilization is the lever you have the most control over. Unlike payment history (which takes 7 years to heal), utilization can often be fixed in 30 days. Credit utilization is the heartbeat of your credit score. It fluctuates, it reacts to your choices, and it is the fastest way to manipulate your creditworthiness.

In the Algorithmic Age, you are not just a number; you are a data pattern. By keeping your utilization low, stable, and predictable, you signal to the machines that you are a safe bet.