Choosing the right finance graduate program can define your career path for years to come. Many students today find themselves comparing Corporate Finance and Financial Engineering programs to determine which aligns with their career goals.

If your interest leans toward understanding company valuations, mergers, investments, and financial strategies, a corporate finance master is often the most suitable option. But if your passion is in quantitative modeling, risk analysis, and algorithm-driven financial solutions, Financial Engineering might be the better fit.

Program Focus and Learning Outcomes

Corporate Finance Master

- Focuses on strategic financial decision-making within organizations.

- Key learning areas include:

- Corporate valuation and capital structure

- Mergers & acquisitions and investment banking

- Financial risk management and strategic planning

- Combines business insight with analytical and problem-solving skills for leadership roles.

Financial Engineering Master

- Highly quantitative and math-driven, merging finance, programming, and statistics.

- Curriculum includes:

- Derivatives pricing and risk modeling

- Algorithmic trading and portfolio optimization

- Financial data analysis and stochastic processes

- Ideal for students targeting quantitative finance, hedge funds, and fintech roles.

Career Opportunities

| Field | Corporate Finance Master | Financial Engineering Master |

| Investment Banking | M&A, IPOs, and strategic advisory | Limited unless in quant roles |

| Corporate Finance | FP&A, Treasury, CFO track | Minimal focus |

| Asset Management | Portfolio strategy, equity research | Quant trading and risk analytics |

| Hedge Funds & FinTech | Rare | High demand for quant specialists |

A corporate finance master prepares graduates for leadership and decision-making roles in corporations and consulting, while financial engineering graduates often enter quant‑driven roles in trading, risk, and fintech analytics.

Current Trends in Finance Education & Hiring

- AI & FinTech Integration: Business schools are embedding AI, machine learning, and blockchain into their curriculum—especially within Financial Engineering programs—to prepare students for automated trading, ESG analytics, and crypto/DeFi innovations .

- Dealmaking Revival: Driven by softer interest rates and favorable regulation, global M&A activity is surging, boosting demand for graduates of Corporate Finance-focused degrees .

- Quant Demand Spikes: Firms increasingly seek quant talent for desk roles, risk units, and fintech innovation—spurring growth in Financial Engineering and related quantitative degrees

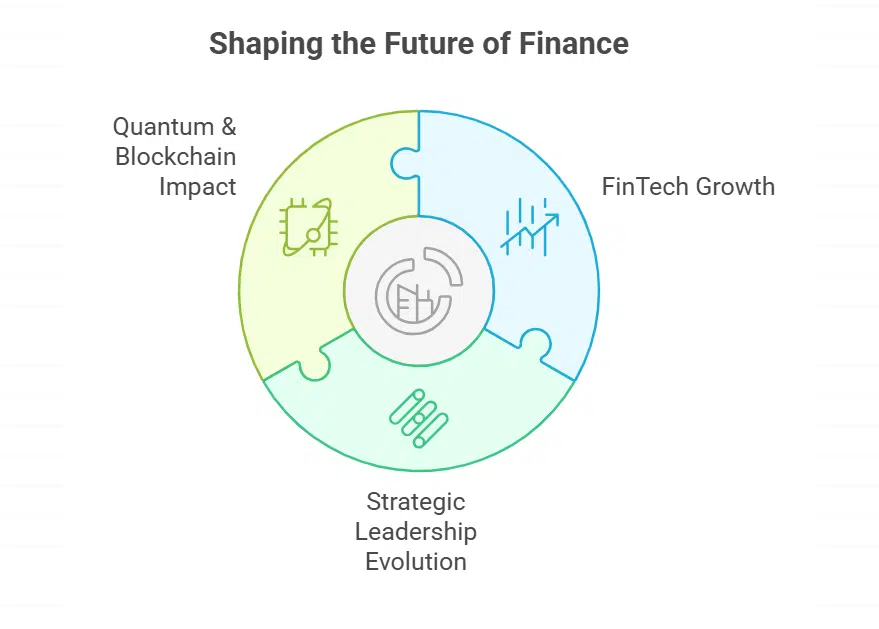

Future Outlook: Where Finance is Heading

- FinTech Accelerates: The global fintech sector is forecasted to grow ~21 % in 2025, outpacing traditional banking, with profitability rising and market impact expanding rapidly—this trend favors Financial Engineering graduates .

- Strategic Leadership Evolves: CFO and corporate finance roles are now expected to include AI integration, sustainability reporting, and macro-risk navigation—perfect for Corporate Finance-trained professionals .

- Quantum & Blockchain Impact: Research shows quantum computing and blockchain may reshape derivative pricing, optimization, and capital markets, influencing both Finance and Engineering curriculums

Skills Required for Each Program

- Corporate Finance Master

- Business acumen and strategic thinking

- Analytical skills for valuation and deal structuring

- Strong communication for financial presentations and negotiations

- Financial Engineering Master

- Advanced mathematics and statistical modeling

- Programming skills (Python, R, MATLAB, or C++)

- Comfort with financial algorithms and complex data sets

Which Master’s Should You Choose?

- Choose Corporate Finance if you want to work in corporate decision-making, investment banking, or financial consulting, with a mix of strategy and applied finance.

- Choose Financial Engineering if you are math‑driven, tech‑oriented, and aiming for quant roles like algorithmic trading, risk analytics, or fintech innovation.

FAQs

1. Which is easier?

Corporate Finance is easier for business backgrounds; Financial Engineering is math-heavy.

2. Which has better jobs?

Both are strong: Corporate Finance for strategy roles, Financial Engineering for quant roles.

3. Do I need coding for Corporate Finance?

No, but Excel and financial modeling are essential.

Final Thoughts

Choose Corporate Finance if you want strategic and leadership roles; choose Financial Engineering if you enjoy math, coding, and analytics. The right program depends on your strengths and long‑term career goals.

By evaluating your skills and aspirations carefully, you can select the program that aligns best with your long-term ambitions in the ever-evolving world of finance.