Freelancing in Portugal comes with flexibility and independence, but it also means handling your own taxes. Understanding common tax deductions for freelancers in Portugal can help you legally minimize tax liability while maximizing savings.

Many expenses related to your freelance work can be deducted, reducing the amount of taxable income and ultimately lowering your tax bill.

In this guide, we will explore 10 common tax deductions for freelancers in Portugal, eligibility criteria, and practical steps to claim them efficiently.

Understanding Freelancer Taxation in Portugal

Freelancers in Portugal operate under the Regime Simplificado (Simplified Regime) or Regime de Contabilidade Organizada (Organized Accounting Regime). The simplified regime applies to freelancers earning up to €200,000 annually and taxes only a portion of their income (typically 75%). The organized accounting regime is mandatory for higher earnings and allows for more tax deductions.

Importance of Tax Deductions for Freelancers

Claiming common tax deductions for freelancers in Portugal reduces taxable income, helping you save money and reinvest in your business. Proper expense tracking and documentation ensure that you maximize your deductions while staying compliant with Portuguese tax laws.

Eligibility Criteria for Tax Deductions

Freelancers registered with Autoridade Tributária e Aduaneira (AT) and issuing Recibos Verdes (Green Receipts) can claim deductions. However, only expenses directly related to business activities are eligible.

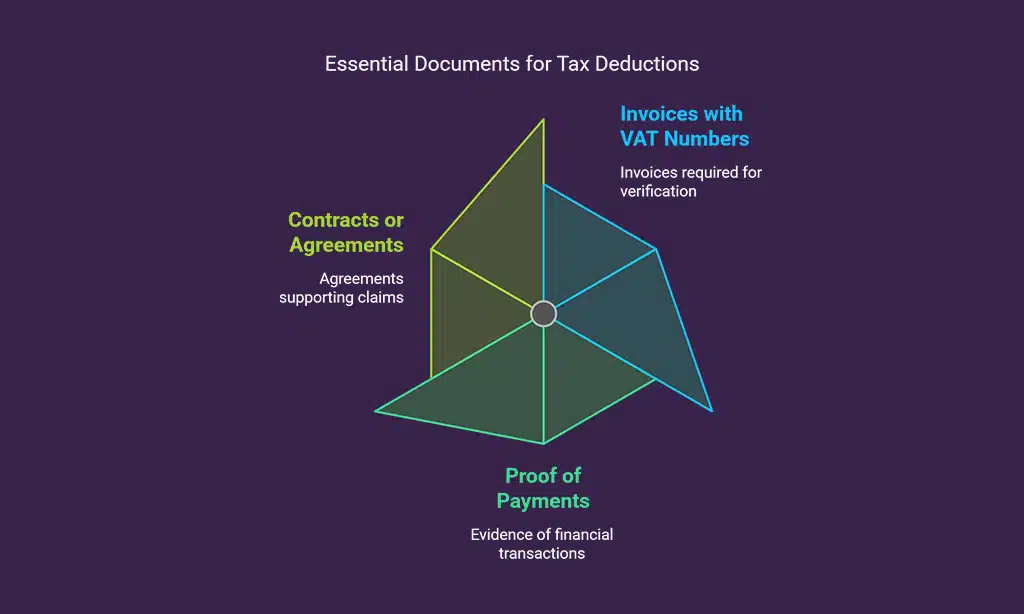

Essential Documents Needed for Claiming Deductions

- Invoices with VAT numbers (NIF)

- Proof of payments (bank statements, receipts)

- Contracts or agreements (if applicable)

- Tax return records (IRS filings)

10 Common Tax Deductions for Freelancers in Portugal

Freelancers often require a well-equipped workspace to stay productive and efficient. The cost of office supplies and work-related tools can add up, but fortunately, these expenses can be deducted from your taxable income.

By leveraging these deductions, you can ensure that your workspace remains optimized without taking a financial toll. Whether you work from home or a co-working space, investing in the right equipment and tools will help improve workflow and overall productivity.

1. Home Office Expenses

Freelancers working from home can deduct a portion of home-related costs, including:

- Rent and utilities: Proportional to workspace usage

- Internet and phone bills: If used for business

- Maintenance costs: Repairs and improvements necessary for your workspace

- Furniture and office setup: Chairs, desks, and shelves used for work

- Property insurance: If covering a dedicated home office space

| Deductible Expense | Description | Eligibility Criteria |

| Rent & Utilities | A portion based on workspace size | Must have a designated work area |

| Internet & Phone | If used for business purposes | Proportionally claimed |

| Maintenance Costs | Repairs and improvements | Directly related to workspace |

| Furniture & Office Setup | Work-related items | Used for business activities |

| Property Insurance | Coverage for home office | Must be business-related |

2. Professional Equipment and Software

Investing in essential tools for work is deductible:

- Laptops, desktops, and accessories

- Software subscriptions (Adobe, Microsoft, etc.)

- Cloud storage and cybersecurity tools

- Printers and scanners

- External hard drives and backup solutions

| Deductible Equipment | Description | Eligibility Criteria |

| Laptops & Desktops | Essential for digital work | Must be business-related |

| Software Licenses | Subscriptions to tools | Used for freelance projects |

| Cloud Storage | Backup and security | Business-related data storage |

| Printers & Scanners | Office setup essentials | If needed for business use |

| Backup Solutions | External hard drives, cloud backups | Data protection for business files |

3. Business Travel and Transportation

Freelancers who travel for work can claim several expenses as deductions. If you attend meetings, conferences, or client visits outside your primary work location, these costs can be deducted. Travel-related deductions can significantly reduce overall business expenses and include:

- Public transport costs (bus, metro, train)

- Vehicle expenses (fuel, insurance, maintenance) if used for business

- Hotel and accommodation (if travel is work-related)

- Meals during business trips

- Conference and seminar travel fees

| Deductible Expense | Description | Eligibility Criteria |

| Public Transport | Bus, metro, or train used for business purposes | Must provide receipts |

| Vehicle Expenses | Fuel, insurance, and maintenance costs | Must be primarily for business |

| Hotel & Accommodation | Lodging during work-related travel | Must show proof of travel purpose |

| Business Meals | Meals during work-related trips | Reasonable and documented expenses |

| Conference Fees | Fees for attending professional events | Must relate to business activities |

4. Education and Skill Development

Continuous learning helps freelancers stay competitive in their field. Whether you’re upgrading your skills or learning a new trade, educational expenses related to your profession can be deducted. This includes:

- Online courses and certifications

- Workshops, webinars, and seminars

- Books and study materials

- Professional training and coaching

| Deductible Expense | Description | Eligibility Criteria |

| Online Courses | Skill-enhancing digital courses | Must be related to business |

| Certifications | Industry-specific professional certifications | Required for business growth |

| Workshops & Seminars | In-person or online training events | Directly relevant to work |

| Books & Study Materials | Professional literature and guides | Business-related learning materials |

5. Marketing and Advertising Costs

Marketing is essential for freelancers looking to grow their client base. Investing in promotional efforts can be deducted as business expenses. These include:

- Website hosting and domain fees

- Paid social media ads (Facebook, Google Ads, LinkedIn)

- SEO services and content marketing

- Brand design and logo development

- Email marketing services and automation tools

| Deductible Expense | Description | Eligibility Criteria |

| Website Costs | Hosting, domain fees | Used for business promotion |

| Social Media Ads | Paid ads on platforms like Facebook, Google | Direct marketing efforts |

| SEO Services | Hiring an expert or using SEO tools | Must enhance business visibility |

| Branding | Logo and brand design services | Business identity development |

| Email Marketing | Subscription to email marketing tools | Directly promoting services |

6. Professional Services and Consultancy Fees

Many freelancers hire professional services to manage legal, accounting, and business tasks. These services help ensure smooth business operations and compliance with tax laws. Deductible professional services include:

- Accountant and legal consultant fees

- Business consulting and tax advisory

- IT and cybersecurity services

- HR and recruitment services for hiring freelancers

| Deductible Expense | Description | Eligibility Criteria |

| Accounting Fees | Hiring a tax professional | Must be related to business finances |

| Business Consulting | Strategic guidance services | Direct business-related support |

| Cybersecurity | Software or consulting fees for IT security | Business security-related services |

| HR & Recruitment | Hiring freelancers or virtual assistants | Directly linked to business growth |

7. Health and Social Security Contributions

Freelancers in Portugal must contribute to social security (Segurança Social). These payments are mandatory but deductible. Additionally, other health-related expenses can be deducted, such as:

- Private health insurance premiums

- Mandatory social security contributions

- Occupational health assessments

- Wellness programs or gym memberships (if medically necessary)

| Deductible Expense | Description | Eligibility Criteria |

| Health Insurance | Private medical insurance costs | Business-related coverage |

| Social Security | Required government payments | Mandatory contributions |

| Health Assessments | Occupational health exams | Needed for work fitness |

| Wellness Programs | Gym memberships (if prescribed) | Requires medical documentation |

By understanding and utilizing these deductions, freelancers in Portugal can effectively reduce their taxable income while investing in their professional growth and well-being.

8. Office Supplies and Equipment

Office supplies and work-related tools are essential for running a freelance business efficiently. These costs can be deducted if they are directly related to your business. Examples include:

- Printers, paper, and notebooks

- Ergonomic office chairs and desks

- Software and digital tools for productivity

- Subscriptions to co-working spaces

| Deductible Expense | Description | Eligibility Criteria |

| Office Supplies | Items like paper, notebooks, and pens | Must be used for work purposes |

| Ergonomic Equipment | Chairs, desks, and footrests | Must enhance productivity |

| Software | Project management, accounting, and design tools | Business-related software |

| Co-working Spaces | Monthly rental costs | If primarily used for work |

9. Client Entertainment and Networking

Networking and business relationships are crucial for freelancers looking to expand their client base. Expenses related to entertaining clients or attending networking events can be deducted, such as:

- Business meals and coffee meetings

- Conference and networking event fees

- Professional membership fees

- Client gifts (within reasonable limits)

| Deductible Expense | Description | Eligibility Criteria |

| Business Meals | Lunches or dinners with clients | Must be business-related and documented |

| Networking Events | Tickets to industry conferences | Directly tied to business growth |

| Membership Fees | Annual fees for professional organizations | Must be related to industry |

| Client Gifts | Small tokens of appreciation | Must be reasonable and documented |

10. Bank and Transaction Fees

Freelancers often incur banking fees while managing their business finances. These fees are tax-deductible if they relate to business transactions. Examples include:

- Business bank account fees

- Payment processing charges (PayPal, Stripe, etc.)

- Foreign currency exchange fees

- ATM withdrawal charges for business accounts

| Deductible Expense | Description | Eligibility Criteria |

| Bank Fees | Monthly business account charges | Must be for business accounts |

| Transaction Charges | PayPal, Stripe, or credit card processing fees | Directly linked to client payments |

| Currency Exchange Fees | Costs incurred when dealing with foreign clients | Must be documented and related to business |

| ATM Fees | Withdrawal fees from business accounts | Must be work-related withdrawals |

Takeaways

Understanding common tax deductions for freelancers in Portugal helps you reduce tax burdens legally. By keeping track of expenses, maintaining proper documentation, and leveraging deductions effectively, freelancers can optimize their tax filings.

If you’re unsure, seeking professional help ensures compliance and maximization of benefits. Start organizing your deductible expenses today to keep more of your hard-earned money!