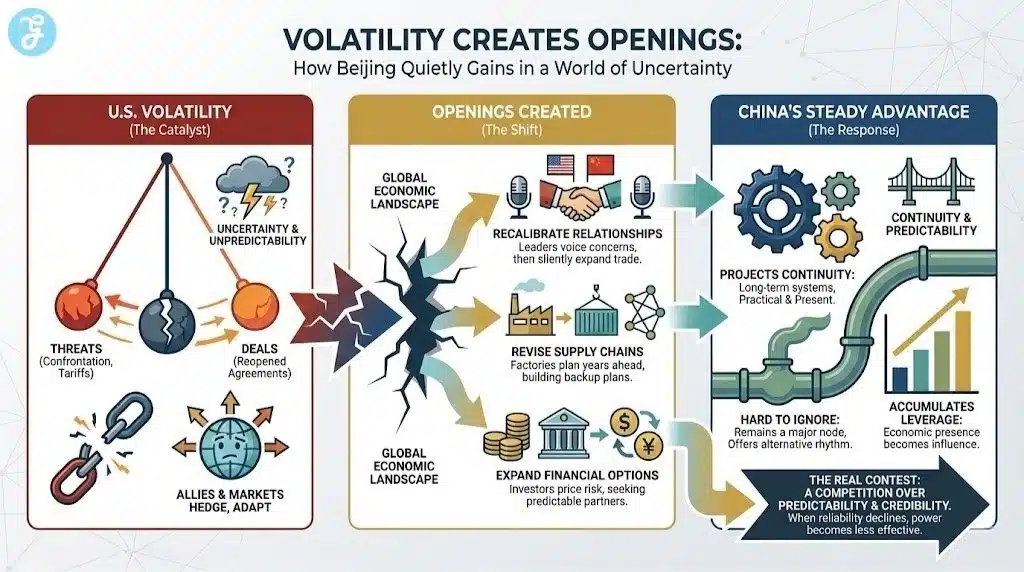

One year into Donald Trump’s presidency, the world is relearning an old lesson in a new way: uncertainty has a winner. When Washington lurches between threats and deals, allies and markets do not pause to admire the drama. They adjust. They hedge. They build backup plans. That is where Beijing has found its advantage. While the United States projects intensity, China projects continuity. While Washington turns trade and diplomacy into a rolling domestic campaign, Beijing treats them as long-term systems that must keep running.

That being said, let’s look into why China winning Global economic race is not about a sudden breakthrough or a single masterstroke. It is about a steady accumulation. Beijing is converting U.S. volatility into economic leverage, and that leverage is reshaping diplomacy as much as it is reshaping trade.

In practice, the shift looks quiet. It shows up in how countries recalibrate relationships, how businesses revise supply chains, and how financial institutions expand options. It is not a dramatic handover of power. It is a slow rewiring of incentives.

If the United States wants to compete, it has to understand the real contest. This is not simply a battle of tariffs versus counter-tariffs. It is a competition over predictability, credibility, and who becomes the default partner when leaders cannot afford surprises.

Volatility Creates Openings

“America First” can mean many things depending on who is translating it. To supporters, it signals toughness and a focus on domestic jobs. To many foreign capitals, it signals conditionality. It suggests that agreements can be reopened, alliances can be priced, and previously stable commitments can become bargaining chips.

That perception matters because global economies depend on routine. Factories plan years ahead. Shipping contracts are signed months in advance. Investors price risk based on expectations of stability. When a major power injects volatility, the system does not break overnight. It simply adapts around the volatility.

China benefits from that adaptation because it offers an alternative rhythm. Beijing’s message is not inspirational. It is practical. China will keep negotiating, keep buying, keep lending, and keep manufacturing. Even when others complain, China remains present.

This presence does not make China beloved. It makes China hard to ignore. In an era of volatility, “hard to ignore” becomes a form of influence.

You can see it in the way nations speak in public and act in private. Leaders will voice concerns about China’s security posture or human rights record, then quietly expand trade talks. They will announce new screenings of Chinese investment, then approve projects that are economically useful. They are not choosing China as a value system. They are choosing China as an economic reality.

That is the central challenge for Washington. When the U.S. becomes unpredictable, it not only frightens rivals. It also forces partners to build autonomy. That autonomy often requires deeper economic ties with the one actor that can deliver scale on demand.

Steady Beats Loud

The US still holds enormous advantages: innovation, capital depth, the dollar’s dominance, and an alliance network that remains unmatched. But advantages become less effective when they are used inconsistently.

China’s strategy, by contrast, is built around consistency. Industrial policy, export capacity, infrastructure financing, and trade diplomacy are treated as connected tools. Even when Beijing makes mistakes, it returns to the same core play: deepen interdependence, expand influence, and keep partners invested in China’s stability.

This is why China’s trade performance carries more significance than a headline number. The context you provided, including a record $1.2 trillion trade surplus in 2025, is less interesting as a brag and more interesting as a signal. It signals that China’s export engine is still capable of scaling and redirecting under pressure.

For countries watching from the outside, that signal is reassuring. It says China can keep supplying. It says China can keep buying. It says China will remain a major node in global commerce even when politics turn rough.

Meanwhile, Washington’s signal has been mixed. Some policies emphasize onshoring and strategic resilience. Others emphasize confrontation without a stable path for partners. The result is that allies can struggle to plan around American leadership.

Planning is where power hides. When people can plan around you, they build their future with you. When they cannot, they plan away from you.

Trade Becomes Diplomacy

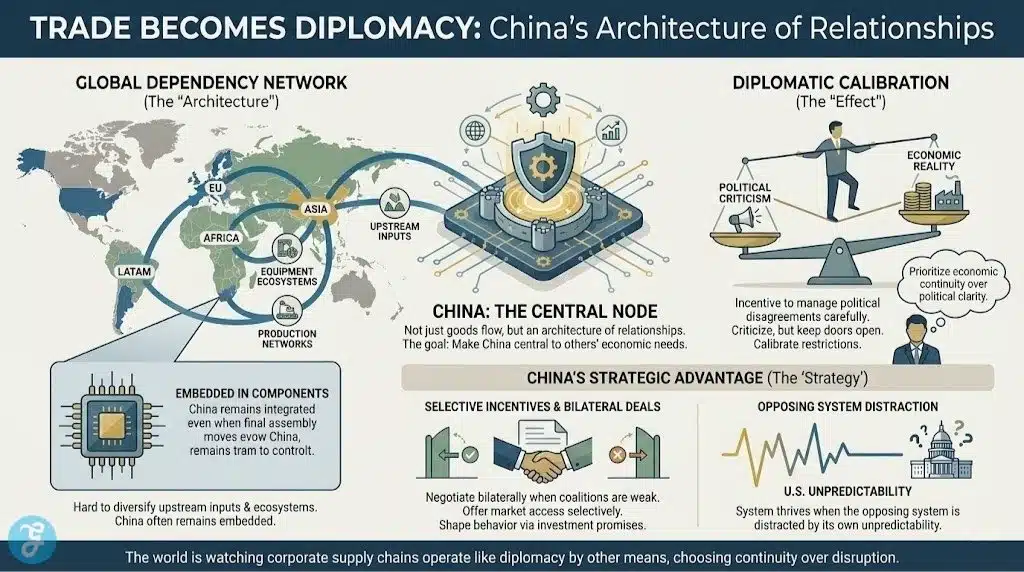

Trade is not just a flow of goods. It is an architecture of relationships. It creates winners and losers inside countries. It shapes which industries grow and which shrink. It determines who becomes dependent on whom for parts, capital, and markets.

China has treated this architecture as statecraft. The goal is not only to export. The goal is to make China central to how other countries meet their own economic needs.

This is where many discussions about “decoupling” miss the point. The world can diversify assembly lines, but it is much harder to diversify upstream inputs, equipment ecosystems, and production networks built over decades. Even when manufacturing moves, China often remains embedded in components, materials, and the industrial services that keep production efficient.

The diplomatic effect is predictable. If your growth depends on trade flows that run through China, you have incentives to manage political disagreements carefully. You can criticize Beijing, but you also have to keep doors open. You can impose restrictions, but you also have to calibrate them so your own industries do not suffer.

At around this point in the argument, it becomes clear why China winning global economic race feels plausible to so many policymakers. They are watching countries prioritize economic continuity over political clarity. They are watching corporate supply chains operate like diplomacy by other means.

This does not mean China faces no pushback. It does, and it will. But the pushback often comes in narrow lanes, not as a unified front. That fragmentation is an advantage for Beijing.

China can negotiate bilaterally when coalitions are weak. It can offer market access selectively. It can use investment promises and procurement decisions to shape political behavior without openly issuing ultimatums.

A system built on selective incentives tends to thrive when the opposing system is distracted by its own unpredictability.

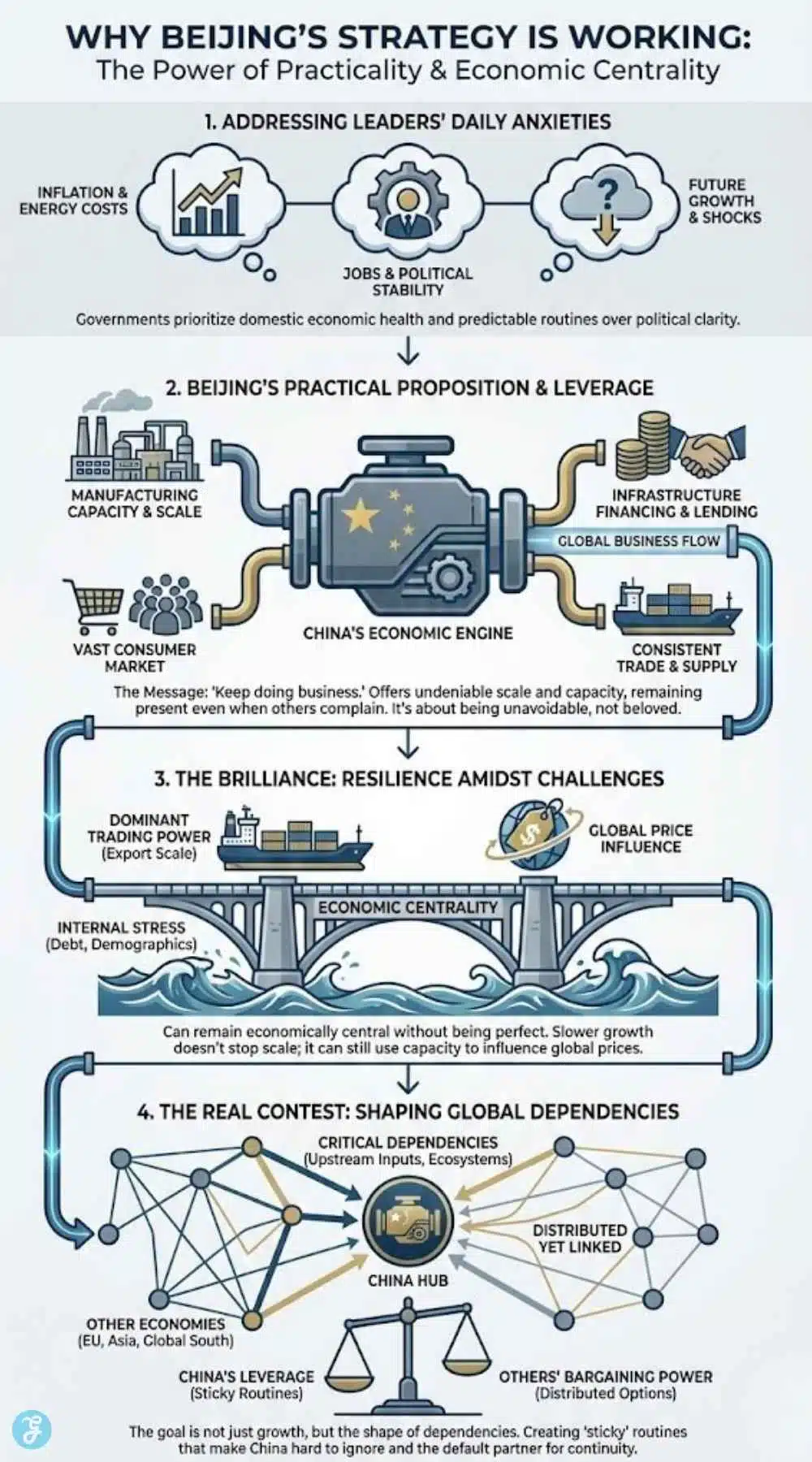

Why Beijing’s “Quiet” Strategy Works

China’s approach works because it speaks to the daily concerns of governments. Most leaders wake up thinking about inflation, jobs, and energy costs. They worry about political stability and fiscal pressure. They worry about whether next year’s growth projections can survive external shocks.

Beijing does not ask these leaders to love China. Beijing asks them to keep doing business.

It offers scale. It offers manufacturing capacity. It offers financing. It offers a vast consumer market, even if that market is uneven. It offers the promise that China’s system will remain oriented toward trade and industrial expansion.

The brilliance is that this promise can hold even when China’s internal challenges grow. A slower-growing China can still be a dominant trading power. A China with financial stress can still export at scale. A China facing demographic decline can still use industrial capacity to influence global prices.

In other words, China can remain economically central without being economically perfect.

This is also why the debate should move beyond simplistic measures of who grows faster in a given quarter. The race is about the shape of global dependencies.

When dependencies tilt toward China, China gains leverage. When dependencies tilt toward the U.S. and its allies, Washington gains leverage. When dependencies are distributed, smaller and mid-sized powers gain bargaining power.

Right now, the world is distributing dependencies, but in many sectors, that still means relying on China.

Currency Influence Without A Revolution

The most misunderstood arena in this competition is currency. Many people hear “yuan internationalization” and assume Beijing is trying to replace the U.S. dollar quickly. That is not necessary, and it is not realistic in the short term.

What Beijing needs is something subtler: more options for itself and for its partners. If a larger share of China-linked trade can be settled in yuan, if more firms can access yuan liquidity, and if more banks can route payments without relying entirely on dollar infrastructure, then China gains resilience.

Resilience is power. It reduces vulnerability to pressure. It makes sanctions less decisive. It gives China and its partners the ability to keep commerce running during political friction.

This is why yuan traction matters even if it remains modest relative to the dollar. What counts is not only the global share, but the network effect inside China-centered trade.

Once companies start invoicing in yuan for certain commodities or manufactured goods, they build routines around it. Treasury departments build risk models around it. Banks build compliance systems around it. Over time, those routines become sticky.

Sticky routines create influence without grand announcements. That is the kind of influence Beijing prefers.

Of course, there are limits. Capital controls, legal transparency, and trust all constrain the yuan’s appeal. But Beijing does not need universal trust. It needs enough trust among enough partners to keep trade moving.

This is how China turns economic volume into financial presence. It does it steadily, one corridor at a time.

Markets, Standards, And The New Gravity

There is another quiet form of power that gets less attention than tariffs or speeches. It is the power to shape global markets simply by being too large to exclude.

When China expands production in a sector, global prices respond. When China subsidizes industrial capacity, competitors either complain, copy, or protect. When China sets standards for manufacturing, logistics, and increasingly technology ecosystems, other countries must decide whether to align or build costly alternatives.

This is not only about exports. It is also about becoming a price-setter. If your domestic industry cannot compete with China’s scale, you face a political dilemma. Do you protect domestic producers and raise prices, or do you accept cheaper imports and risk industrial decline?

That dilemma is playing out across industries, especially those tied to energy transition, advanced manufacturing, and consumer electronics. It is a dilemma that forces governments to make choices that look economic but feel political.

China benefits from this because it can create facts on the ground. Capacity becomes leverage. Standards become leverage. Market gravity becomes leverage.

Meanwhile, U.S. policy can sometimes appear to swing between two instincts: protect domestic industry and punish rivals. Both instincts can be justified. But without predictable coordination with allies, they can also backfire.

If allies are not fully aligned, pressure leaks. Businesses re-route. Countries negotiate exceptions. Beijing then gains room to present itself as the stable anchor.

This is where the “quiet winning” narrative grows. It grows not because China is admired, but because China is structurally embedded.

Allies Are Not Defecting, They Are Hedging

It is tempting to frame this era as a binary contest where countries must choose sides. That frame is outdated. Most nations are not switching flags. They are building options.

Hedging takes many forms. It can mean signing new trade agreements that reduce reliance on a single market. It can mean creating strategic stockpiles. It can mean adjusting supply chains to reduce exposure to tariffs. It can mean expanding currency settlement options. It can mean strengthening regional ties.

This is the crucial point: hedging often increases China’s leverage even when countries distrust China.

Why? Because China is frequently the most practical hedge. China is large enough to matter and integrated enough to absorb shifts. Even when governments try to diversify away, they often do so slowly, and China remains upstream in many inputs.

At roughly this stage of the argument, the phrase China winning global economic race stops sounding like a headline and starts sounding like a description of behavior. Nations are recalibrating alliances in response to volatility. Many of those recalibrations require deeper economic routines that pass through China.

In that sense, Beijing’s gain is less about converting countries into loyal partners and more about becoming unavoidable in their economic planning.

This is also why strained U.S. ties with allies matter so much. Alliances are not only military arrangements. They are coordination platforms for trade rules, technology standards, investment screening, and shared resilience strategies.

When alliance coordination weakens, China’s bilateral approach becomes more effective. Beijing can negotiate country by country. It can exploit differences in economic exposure and political priorities. It can reward those who cooperate and punish those who resist, while keeping the broader system moving.

Coalitions reduce that advantage. Volatility increases it.

The U.S. Can Still Change The Trajectory

None of this is destiny. The United States can still compete effectively. But it must compete in the right dimension.

- First, Washington needs to make predictability a strategic asset again. That does not mean never changing policy. It means making changes coherent, gradual, and coordinated with partners whenever possible.

- Second, the U.S. needs to offer positive economic leadership, not only pressure. Many countries want an alternative to Chinese financing and Chinese supply chains, but they cannot adopt an alternative that does not exist at scale. If the U.S. and its allies want to reduce dependence on China, they must build credible substitutes in infrastructure, clean energy supply chains, and industrial capacity.

- Third, Washington should treat trade partnerships as strategic. Trade is not a distraction from security. It is part of security. Countries that feel economically secure within U.S.-aligned networks will take more risks in political alignment.

- Fourth, the U.S. needs to recognize that credibility is cumulative. If partners expect U.S. policy to swing sharply after each election, they will keep hedging even when they prefer the U.S. strategically.

Beijing’s steady approach is not magic. It is simply consistent. The U.S. can be consistent, too, but it requires discipline. It requires a willingness to build systems that last beyond news cycles.

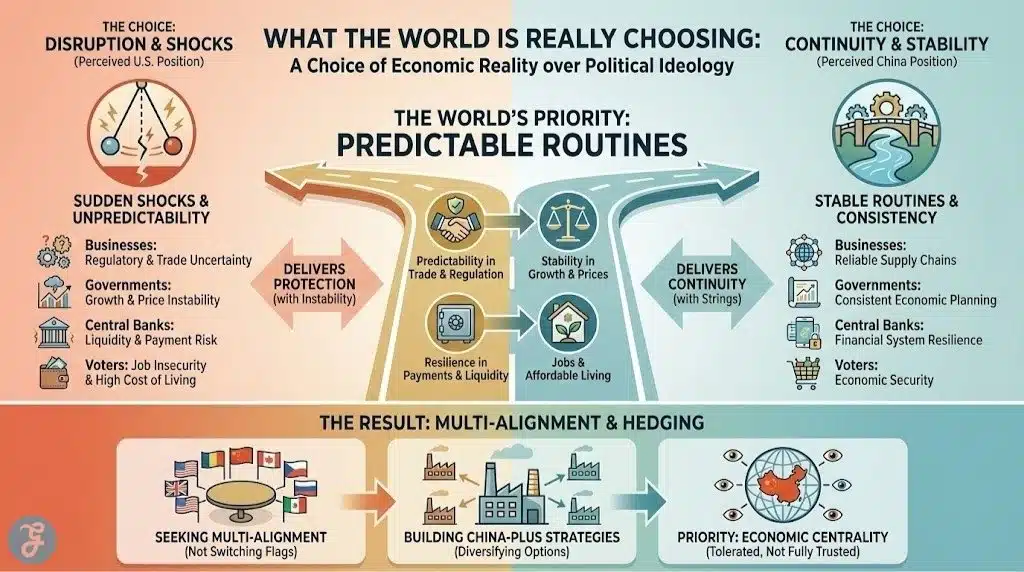

What The World Is Really Choosing

The world is not choosing between American values and Chinese values in most cases. It is choosing between disruption and continuity, between sudden shocks and stable routines.

For businesses, the priority is predictability in trade flows and regulation. For governments, it is stability in growth and prices. For central banks, it is resilience in payments and liquidity. For voters, it is jobs and the cost of living.

China is positioning itself to be the partner that can deliver continuity, even if that continuity comes with strings. The U.S. is sometimes positioning itself as the partner that can deliver protection, even if that protection comes with instability.

This is why narratives about U.S. dominance are being challenged. Dominance is not only about strength. It is about reliability. When reliability declines, power becomes less effective.

In the near term, we should expect more hedging, not less. More countries will seek multi-alignment. More firms will build China-plus strategies. More governments will talk about resilience while maintaining trade with China.

That combination is precisely what Beijing wants. It wants a world where China is economically central and politically tolerated, even if it is not fully trusted.

The Quiet Reality Of This Moment

The global economic race is not being won in a single arena. It is being won in how trade routes are structured, how payment systems evolve, and how alliances coordinate under stress.

Beijing is winning ground because it is steady. Washington is losing ground when it becomes unpredictable. In a world that craves stability, the steady player accumulates an advantage.

The uncomfortable truth is that the contest is not only between the U.S. and China. It is also within the U.S. itself: between short-term political gratification and long-term strategic credibility.

If the U.S. chooses volatility as a governing style, it will encourage hedging that strengthens China’s position. If it chooses predictable leadership and coalition-building, it can slow or reverse Beijing’s gains.

For now, the trajectory is clear. China winning the global economic race is becoming a plausible storyline not because Beijing is flawless, but because steadiness compounds while uncertainty spreads.