Health emergencies are stressful enough without the added confusion of how insurance claims work. Your team typically deals with cashless or reimbursement claims in a group insurance policy. Cashless means no out-of-pocket payments at hospitals, while reimbursement gives them more choice on where to go. Both have their pros—so what is the smarter call for your workforce?

Let us break down both methods to help you make an informed choice that keeps your employees covered and stress-free.

Cashless Claims in Group Insurance Policy

Cashless claims let employees receive medical treatment without upfront payments in a group health insurance policy. When treated at authorised hospitals, the insurer directly settles the bills, simplifying the process and curbing financial strain in times of health emergencies.

Cashless Group Insurance Claim Procedure

With insurers such as TATA AIG, policyholders can access treatment at any hospital of their choice, thanks to their “Cashless Everywhere” feature.

- Inform the insurer or TPA [Third Party Administrator] regarding the hospitalisation. Update 48 hours before hospitalisation for pre-planned treatments and for emergencies, inform them within 48 hours.

- Present the health card offered by the recruiter/TPA at the selected medical facility.

- Complete the group health claim form the hospital gave you to add all the details concerning the treatment and yourself.

- Present the health card offered by the recruiter/TPA at the selected medical facility.

- Once it is done, the medical facility will share the claim application form with the insurer for insurance claim approval.

- The insurance provider will then examine the details to reject or approve the claim.

- Upon claim approval, treatment proceeds as planned, and the corresponding medical bills are submitted to the insurer for settlement.

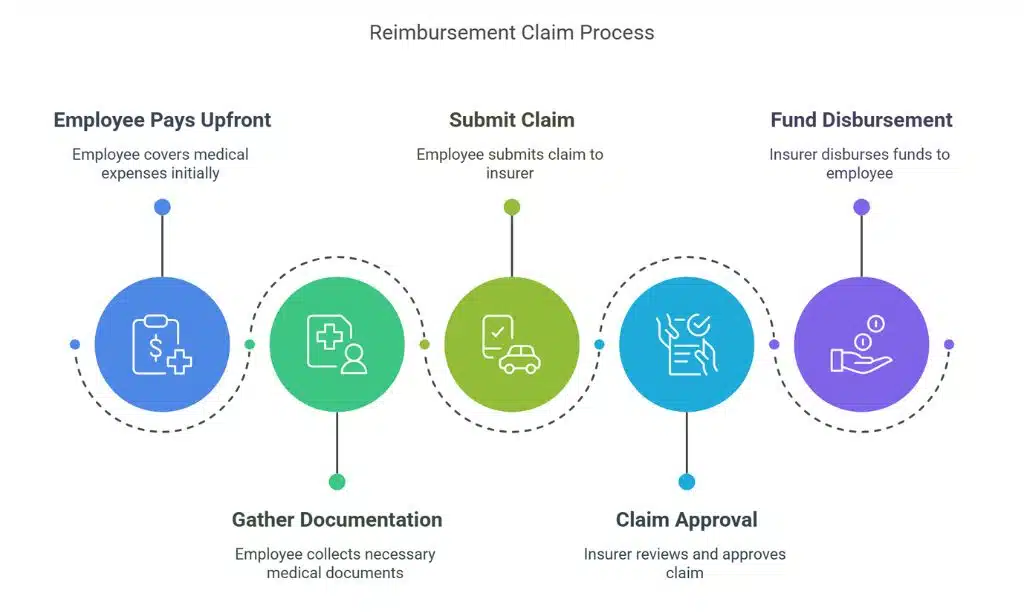

Reimbursement Claims in Group Insurance Policy

Reimbursement claims require employees to pay for medical expenses upfront and later seek repayment from the insurer. This process offers flexibility in choosing healthcare providers but necessitates careful documentation and may involve a waiting period for claim approval and fund disbursement.

Reimbursement Group Insurance Claim Procedure

- Inform the insurance provider or Third Party Administrator about the treatment within 24 to 48 hours of hospitalisation.

- Raise an insurance claim and fetch the claim number for claim status tracking and reference.

- Visit any hospital of your choice and complete the treatment. You should also complete the group health claim form the medical facility offers.

- Gather every treatment bill and other vital invoices or receipts.

- Present the group health form and the important papers to the Third Party Administrator or insurer.

- After that, they will examine every claim detail and bill and request any extra documentation, if required, before accepting the claim reimbursement sum.

- After the sum is accepted, the amount will be directly reimbursed to your personal bank account.

Major Differences Between Cashless and Reimbursement Claims in Group Health Insurance

Knowing the difference between cashless and reimbursement claims in group health insurance can save your team a lot of stress when it matters most. Here is a quick breakdown of four key ways they differ—so you can choose what works best for your people:

1. Payment Responsibility

In cashless claims, the insurance company pays the healthcare bills for the covered worker. In reimbursement claims, the covered worker pays from their pocket, and the insurance provider compensates.

2. Hospitality Eligibility

Cashless claims are permitted at any approved medical facility in the nation. It goes the same with reimbursement claims, too. Your insured employees can get treatment at any hospital of their choice.

3. Insured Expenses

Limited expenditures in case of diagnosis and treatments that are excluded from the insurance plan terms. In reimbursement claims, the insured employee needs to pay initially for the treatment, and then the same amount is compensated after the claim is accepted.

4. Claim Settlement Duration

With cashless, think of faster claim resolutions as it requires limited involvement of the insured employee and no need for approvals. With reimbursement, claim approval time depends, elevating the claim settlement period for the insured employee.

5. Documentation Complexity

Streamlined documentation process, primarily utilising forms completed at the hospital for Cashless Claims. The process for Reimbursement Claims is more intricate, necessitating the collection and submission of several documents following treatments.

6. Waiting Period

You do not have to wait for claim settlement, and the treatment expenses are resolved right away in Cashless Claims. However, the document verification before the reimbursement processing in the Reimbursement Claims may take some time.

Confident Coverage Begins with TATA AIG

Choosing between cashless and reimbursement claims is not just a technical decision—it affects how supported your employees feel during medical emergencies. TATA AIG makes it simple with Cashless Everywhere, giving your workforce access to any hospital nationwide without being limited to a few hospitals. Convenience and care, exactly when it is needed.

TATA AIG offers a streamlined claims process supported by expert assistance and transparent communication for those who prefer reimbursement.

Whether it is a medical emergency or planned treatment, TATA AIG ensures your workforce stays protected, empowered and worry-free. Because when your people are covered, productivity follows.