In a significant transformation of the American financial landscape, Capital One Financial Corporation has officially completed its $35.3 billion all-stock acquisition of Discover Financial Services, fifteen months after the deal was first announced. This merger not only marks one of the most impactful banking consolidations in recent years but also officially positions Capital One as the largest credit card issuer in the United States by loan volume.

The transaction was finalized on Sunday, May 18, 2025, following a series of critical regulatory approvals and internal shareholder agreements. With this merger, Capital One gains access to Discover’s extensive financial infrastructure and proprietary payment network — a development that could fundamentally shift the balance of power in the credit card industry.

Strategic Vision: Building a More Competitive Payments Network

Richard D. Fairbank, the Founder, Chairman, and CEO of Capital One, celebrated the merger in a formal news release. He expressed his gratitude to Discover’s interim CEO Michael Shepherd, the board, and all teams involved in successfully completing the transaction.

“This deal brings together two innovative, mission-driven companies that together are poised to deliver breakthrough products and experiences to consumers, businesses, and merchants,” Fairbank stated.

He emphasized that the two companies, united by a shared vision, are now better positioned to “change banking for good” and to build a more inclusive and competitive payments ecosystem.

By acquiring Discover, Capital One now controls the Discover®, PULSE®, and Diners Club International® networks. This strategic advantage gives Capital One full access to its own end-to-end payment infrastructure, which no other major U.S. credit card issuer except American Express currently possesses. With this added capability, Capital One is now equipped to compete more aggressively with Visa and Mastercard, which have historically dominated the U.S. and global payments sectors.

Timeline of the Deal: From Announcement to Regulatory Approval

The acquisition was first announced in February 2024, when Capital One disclosed its intention to purchase Discover through a stock-based agreement valued at $35.3 billion. The news sparked widespread industry debate and close scrutiny from federal regulatory bodies.

-

In December 2024, the Delaware State Bank Commissioner gave its initial approval.

-

On April 18, 2025, both the Federal Reserve Board and the Office of the Comptroller of the Currency (OCC) granted their final approvals.

-

Shareholders of both companies voted to approve the merger in early 2025, signaling strong institutional support.

These approvals cleared the final hurdles, allowing Capital One to formally complete the acquisition in mid-May.

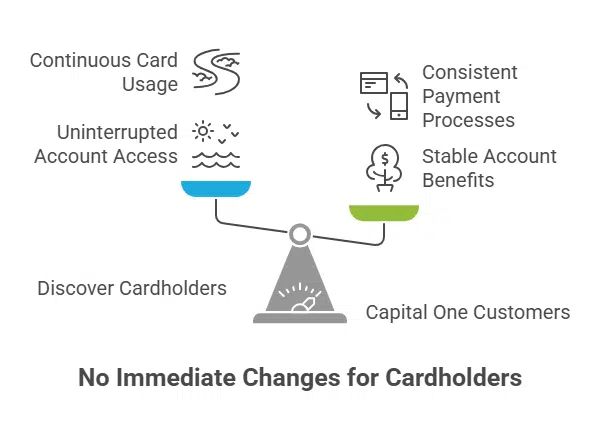

What This Means for Customers

For now, customers of both Capital One and Discover will continue to use their existing accounts without any immediate changes. This means:

-

Existing Discover cardholders can continue to use their cards, access their online banking services, and manage their accounts without interruption.

-

Capital One customers will not see any changes in their account access, card benefits, or payment processes.

However, the companies plan to integrate Discover’s payment networks into Capital One’s broader product ecosystem over time. This could lead to the development of new co-branded products, enhanced rewards programs, and a broader acceptance footprint in international markets, where Discover has been expanding its reach.

Political Pushback and Consumer Advocacy Concerns

While the deal passed the regulatory test, it was not without controversy.

A few weeks before the acquisition was finalized, Senator Elizabeth Warren (D-MA) and Representative Maxine Waters (D-CA) publicly urged the Federal Reserve to reconsider its approval. In a formal letter, they argued that greenlighting the merger without further scrutiny could:

-

Reduce competition in the already consolidated credit card market

-

Enable Capital One to dictate unfavorable terms to merchants

-

Limit consumer choice and raise the risk of higher fees and interest rates

“Merchants would have no choice but to accept the terms dictated by Capital One’s network, since they need to access the customers of the largest credit card issuer in the country,” the lawmakers warned.

Advocacy groups such as the American Economic Liberties Project and Public Citizen also opposed the merger, stating that such consolidation harms both consumers and small businesses by reducing competition and innovation. They demanded a more rigorous antitrust review process to prevent the emergence of what they called a “super-sized” financial conglomerate.

Despite these objections, the Federal Reserve and OCC justified their approvals by stating that the merger posed no substantial risk to U.S. financial stability and was unlikely to lessen competition significantly based on current market shares and dynamics.

Why This Merger Matters: Scale, Networks, and Economic Impact

This acquisition gives Capital One immediate access to a fully owned, global payments network, allowing the company to expand into new areas such as:

-

Cross-border commerce

-

Peer-to-peer payments

-

Real-time processing capabilities

Discover’s network is already accepted in over 200 countries, and its partnerships with global institutions can now be leveraged by Capital One to offer new services beyond U.S. borders.

For Capital One, which has long been an innovator in credit risk modeling, digital banking, and AI-driven personalization, this deal strengthens its ability to deliver fintech-style services at scale. For Discover, the merger provides a more powerful infrastructure to further its reach and relevance in a highly competitive market.

Additionally, PYMNTS and CNBC reported that the merger could benefit paycheck-to-paycheck consumers, giving them access to more inclusive credit products and flexible payment tools by combining Discover’s customer-centric model with Capital One’s technology-driven services.

Ongoing Legal Issues: $455 Million Settlement

Alongside the Discover acquisition, Capital One also made headlines recently for agreeing to a $455 million legal settlement with customers of its 360 Savings products.

The lawsuit alleged that Capital One misled depositors by advertising high interest rates for 360 Savings accounts but offering better rates under a similar but newer product, the 360 Performance Savings account. Plaintiffs accused the company of failing to inform existing customers that better interest rates were available, effectively discriminating against loyal users in favor of new ones.

As part of the settlement:

-

Around $300 million will be paid out for unrealized interest

-

$125 million will be provided to current account holders

-

Customers will also receive compensation in the form of interest adjustments and service credits

Although Capital One denied wrongdoing, the case highlighted the importance of transparency in financial product offerings, especially as the company moves toward even greater market dominance.

A New Era for Consumer Banking?

The Capital One–Discover merger is more than just a business transaction. It represents a significant realignment in the U.S. financial ecosystem — one that could impact consumers, merchants, and even competing fintech platforms.

Supporters argue that the consolidation will:

-

Enable more innovation and competition with Visa, Mastercard, and American Express

-

Expand payment processing capabilities across international borders

-

Deliver better services through combined technological strengths

Critics, however, continue to warn about the risks of mega-mergers in banking, calling for ongoing regulatory oversight to ensure fair practices and consumer protections.

Whether this merger turns out to be a watershed moment for banking innovation — or a step toward financial consolidation that harms consumers — will depend largely on how Capital One executes its post-merger integration strategy and how regulators respond to the shifting market dynamics in the months ahead.