In a landmark acquisition that reshaped the creative software landscape earlier this year, design giant Canva purchased Affinity, the UK-based developer behind the industry’s most prominent Adobe alternative. The move ignited intense speculation and anxiety among Affinity’s 3 million-plus users, who feared their beloved perpetual license model would be forcibly converted to a subscription, mirroring Adobe’s controversial 2013 pivot.

This week, the conversation has been dominated by a persistent—and incorrect—rumor: that Canva makes Affinity design suite permanently free. The reality, confirmed by official company statements, is more complex and commercially significant. Rather than making the software free, Canva and Affinity have issued a public pledge to protect the existing pricing model, promising that perpetual licenses will remain a core part of the business, even as they explore deeper integrations.

Key Facts: The Acquisition & The Pledge

- The Deal: Canva officially acquired Serif (Affinity’s parent company) on March 26, 2024. The deal, valued at “several hundred million pounds,” united Canva’s 185 million monthly active users with Affinity’s 3 million-plus specialist users.

- The Backlash: The acquisition immediately triggered widespread “subscription fatigue” fears online, with users on platforms like Reddit and X (formerly Twitter) threatening to abandon the platform if it adopted a subscription-only model like Adobe Creative Cloud.

- The Pledge: In response, Affinity CEO Ashley Hewson published a “pledge” to users. The core promise is that Affinity will continue to sell perpetual licenses for its V2 suite and future V3, indefinitely.

- The ‘Free’ Misconception: The rumor of the suite becoming “free” is factually incorrect. The pledge confirms it will remain a paid product. Analysts suggest the “free” rumor may stem from a misunderstanding of Canva’s “freemium” model, which it applies to its core web product, not its new professional-grade acquisition.

- Market Context: This consolidation is the most significant challenge to Adobe’s market dominance in over a decade. Adobe’s Digital Media segment, which includes Creative Cloud, reported $11.66 billion in Annualized Recurring Revenue (ARR) as of Q3 2024.

The Anatomy of a Market Shock

The Anti-Adobe Niche

To understand the user backlash, one must first understand Affinity’s market position. Since its debut, the Affinity suite (Photo, Designer, and Publisher) was built as a direct challenge to Adobe’s Photoshop, Illustrator, and InDesign.

Its primary unique selling proposition (USP) was not just its features, but its business model: the perpetual license.

In a post-2013 world where Adobe locked its ubiquitous tools behind the $59.99/month Creative Cloud subscription, Affinity offered a one-time payment (often around $70 per app, or $170 for the universal license) for permanent ownership. This made it a sanctuary for freelancers, hobbyists, and small businesses suffering from “subscription fatigue”—the growing exhaustion and financial burden of endless monthly software fees.

“Affinity wasn’t just a tool; it was a statement,” explained a long-time user on the r/Affinity subreddit. It was a vote with your wallet against the subscription model. The fear was that Canva, itself a subscription-based giant, would absorb and destroy the very reason we chose Affinity.”

The Backlash ThatForced a Promise

Canva’s March 2024 acquisition was, therefore, seen by many as an existential threat. The Internet’s reaction was immediate and visceral.

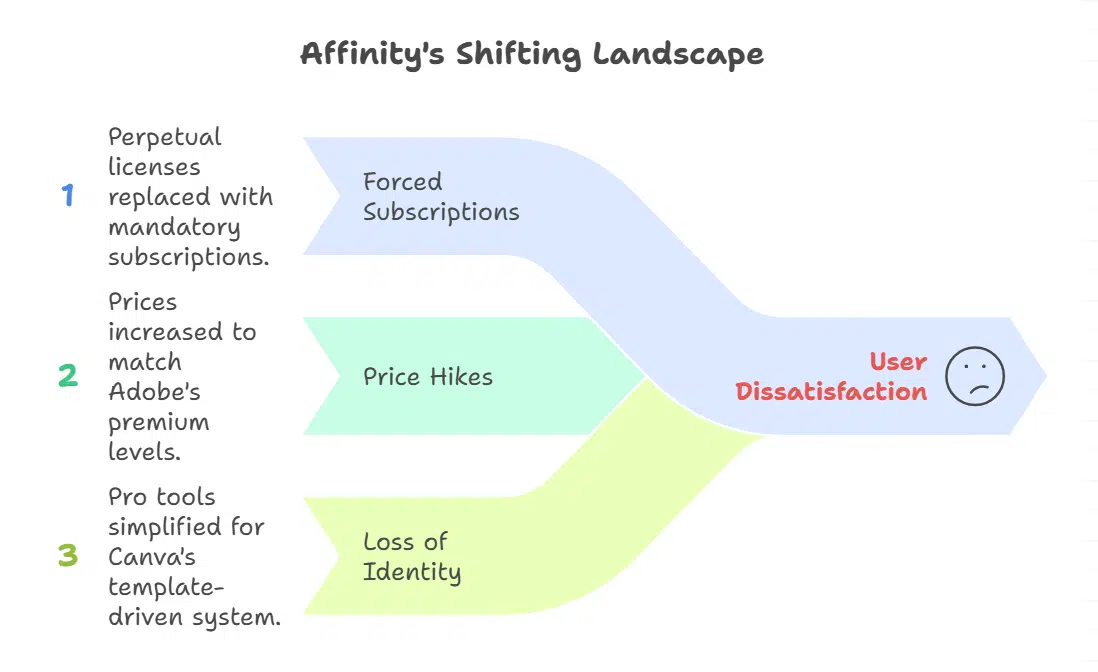

Canva, valued at $26 billion (down from its 2021 peak but still a colossus), operates on a “freemium” subscription model. Users feared the worst:

- Forced Subscriptions: The end of perpetual licenses.

- Price Hikes: A move toward Adobe’s premium pricing.

- Loss of Identity: The “dumbing down” of Affinity’s pro-grade tools to fit Canva’s simpler, template-driven ecosystem.

The backlash was so significant that it prompted an unprecedented response from the newly acquired company.

Dissecting the ‘Affinity Pledge’

On May 23, 2024, Affinity CEO Ashley Hewson published a blog post titled “Affinity and Canva: The Story So Far,” which serves as the definitive source on the company’s future.

This pledge, which directly refutes any notion of the software becoming free, is the actual news. It contains four main promises:

- Perpetual Licenses Will Continue: This is the headline. Hewson stated, “We are 100% committed to continuing to offer a perpetual model… This is not going to change.” This includes the current Version 2 and all future major versions.

- Pricing Will Remain “Fair and Affordable”: While not committing to a specific price point, the company pledged to avoid drastic hikes, keeping the software accessible.

- A Subscription Option May Appear: Acknowledging the needs of large teams and those who want cloud services, Hewson confirmed they are “exploring an optional subscription.” This would bundle Affinity with Canva’s Pro services, but—critically—it would exist alongside the perpetual license, not replace it.

- Integration Will Be Additive, Not Destructive: The short-term goal is to build integrations between Canva and Affinity but Affinity will remain a standalone, downloadable application suite.

Analysis: Why ‘Free’ Makes No Sense (And ‘Perpetual’ Does)

The rumor that “Canva makes Affinity design suite permanently free” is not just factually wrong; it’s strategically nonsensical.

Canva did not spend “several hundred million” pounds to acquire a 3-million-strong user base just to liquidate its primary revenue stream. The value of Affinity lies precisely in its status as a premium, paid product with a loyal following.

“Making Affinity free would be commercial malpractice,” noted Dr. Rebecca Hsing, a market analyst specializing in SaaS (Software as a Service). “The strategic play here is a classic ‘pincer movement’ against Adobe, which now faces a two-front war.”

This “pincer movement” strategy looks like this:

- Front 1 (The Low-End): Canva’s core product attacks Adobe Express, capturing the mass market of non-designers (social media managers, students, marketers).

- Front 2 (The High-End): The newly acquired Affinity suite attacks Adobe Creative Cloud (Photoshop, Illustrator), capturing the professional market (designers, illustrators, publishers) who are fleeing Adobe’s subscription wall.

By promising to keep Affinity’s perpetual license, Canva retains the suite’s single biggest competitive advantage. They aren’t just buying software; they are buying a community defined by its business model preference.

What to Watch Next

The acquisition is still in its early days. While the pledge has calmed immediate fears, industry watchers are now focused on three key developments:

- The Price of Version 3: “Fair and affordable” is subjective. The pricing of the next major Affinity release will be the first true test of Canva’s pledge.

- The Nature of Integration: How will the two products connect? Will Canva’s cloud-first, collaborative DNA enhance Affinity, or will it create a bloated, slow product?

- Adobe’s Response: Thus far, Adobe has remained publicly silent. However, this acquisition directly threatens its flagship product line. Analysts are watching for potential price adjustments to Creative Cloud or new features in Adobe Express to compete with Canva.

For now, the 3 million Affinity users can be assured of two things: their software is not becoming a mandatory subscription, and it is certainly not becoming free. The “soul” of Affinity, its perpetual license, has been publicly guaranteed—a guarantee bought by the passionate, vocal, and immediate backlash of its community.