People did not call it a bubble because buying in installments was new. They called it a bubble because the growth felt too easy. Checkout buttons multiplied. Approvals looked instant. Many shoppers carried several plans at once. And the product moved from “nice to have” to “how I afford it” for a share of users.

By early 2026, the story looks more complicated than the headlines. BNPL did not vanish. In many places, it became a normal payment choice. Yet the stress points that fueled “bubble” talk are real: loan stacking across providers, heavy repeat usage, and a sector that depends on stable funding and clear rules. A major CFPB dataset found that in 2022 most borrowers took out multiple BNPL loans at the same time, and a third did so across multiple firms.

This retrospective breaks the topic into measurable pieces. What did the data show about repayment health? Who was most exposed? How did business models change once interest rates rose? And what do new regulatory plans, especially the UK’s 2026 move to regulate BNPL, mean for the next phase?

What People Mean When They Say “BNPL Bubble”

“Bubble” is not a technical term in consumer credit. It is a label people use when they sense a pattern like this:

-

Fast adoption with light friction

-

Heavy marketing and easy availability

-

Risk that shows up later in missed payments, complaints, or losses

-

A business model that looks stable only while funding and growth remain cheap

That framing can be fair, but only if you test it with data. In the BNPL case, you also have to separate two ideas:

-

The product category, which is likely here to stay

-

Specific growth-era behaviors that can look bubble-like

A useful way to judge the label is to focus on indicators you can track.

| “Bubble” Claim | Measurable Indicator | Why It Matters |

|---|---|---|

| Approvals were too easy | Approval rates and underwriting changes | Easier approvals can raise defaults later |

| Users were “stacking” plans | Share of borrowers with multiple simultaneous loans | Stacking makes budgets fragile |

| BNPL hid true debt burden | BNPL not appearing in credit files | Lenders may miss risk signals |

| Growth was funding-driven | Rising funding costs and investor pressure | Tight funding forces tighter credit |

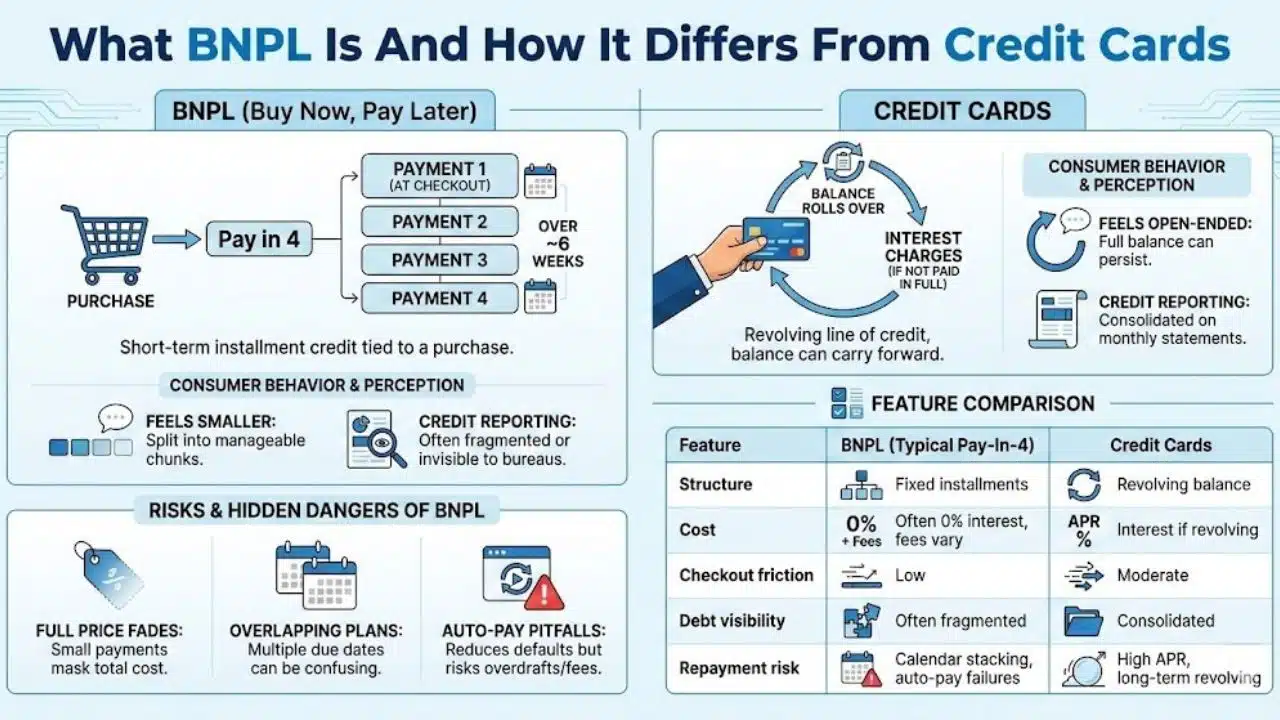

What BNPL Is And How It Differs From Credit Cards

BNPL usually refers to short-term installment credit at checkout. The classic version is “pay in four,” often repaid over about six weeks. The borrower pays the first installment at purchase, then the rest on scheduled dates.

Credit cards are revolving credit. BNPL is usually fixed-term credit tied to a purchase. That creates different consumer behavior:

-

BNPL feels smaller because it is split into small payments

-

Credit cards feel open-ended because the full balance can roll over

BNPL also differs in how it shows up in credit reporting. The CFPB has noted that many BNPL loans have not appeared in credit bureau records, which makes it harder to see total exposure across providers.

How BNPL can look “safer” than it is:

-

The payment is small, so the full price fades into the background

-

Multiple plans can overlap, each with separate due dates

-

Auto-pay reduces defaults but can also trigger overdrafts or late fees if funds are not there

| Feature | BNPL (Typical Pay-In-4) | Credit Cards |

|---|---|---|

| Structure | Fixed installments tied to purchase | Revolving balance |

| Cost | Often 0% interest, fees vary | Interest if revolving |

| Checkout friction | Low | Moderate |

| Debt visibility | Often fragmented across providers | Consolidated on statement |

| Repayment risk | Calendar stacking, auto-pay failures | High APR, long-term revolving |

The Rise That Fueled Bubble Talk (2019–2024)

BNPL expanded quickly in the years around the pandemic and the e-commerce surge. It was not only a consumer trend. Merchants pushed it, too, because it can lift conversions.

Global context matters here. Worldpay’s 2025 Global Payments Report estimated BNPL was about 5% of global e-commerce value in 2024, roughly $342 billion, and forecast online BNPL value rising toward about $580 billion by 2030. That does not prove a bubble. It shows scale.

In the US, the CFPB found several growth signals that explain why critics raised alarms:

-

The average number of annual BNPL originations per borrower rose from 8.5 in 2021 to 9.5 in 2022

-

About 63% of borrowers originated multiple simultaneous loans at some point in 2022

-

About 33% did so across multiple BNPL firms

Those numbers point to a category moving beyond occasional use.

| Driver | What Changed | Why It Boosted Growth |

|---|---|---|

| Merchant demand | BNPL added at checkout | Better conversion and basket size |

| Consumer demand | Budget pressure and convenience | Smaller installments feel manageable |

| Funding conditions | Cheap capital era | Growth-first expansion |

| Product design | Fast approvals and smooth UX | Less friction than many credit options |

The Core Question: Did Growth Match Repayment Health?

This is where the “bubble” label either holds up or falls apart.

One of the most cited data points comes from the CFPB’s matched sample covering 2019–2022. It found BNPL borrowers defaulted on about 2% of their BNPL loans on average, while defaulting on about 10% of their credit cards over the same period.

That sounds reassuring, but it needs context:

-

BNPL often requires auto-pay, which reduces missed payments

-

BNPL loans are shorter, so problems surface quickly

-

BNPL defaults can still hurt, even if the default rate is lower than cards

The same CFPB report highlights why concerns persisted even with low default rates:

-

Many borrowers used multiple BNPL loans at the same time

-

Heavy users originated more than one BNPL loan per month on average in 2022

-

Borrowers with deep subprime credit scores accounted for 45% of BNPL originations in 2021–2022

Company-reported performance can look better than broader consumer strain. For example, Klarna announced improving repayment performance and lower delinquency in mid-2025. That may be true for its portfolio. It does not erase the structural risks of stacking and fragmented visibility across providers.

| Metric | What It Tells You | What To Watch |

|---|---|---|

| BNPL default rate | How often loans go seriously delinquent | Definition used (e.g., 120+ days) |

| Loan stacking | Budget strain risk | Multiple providers at once |

| Heavy usage | Dependence risk | Loans per month rising |

| Credit score mix | Underwriting posture | Deep subprime share |

| Company delinquency reports | Portfolio health | Mix shifts and tighter approvals |

Who Was Most Exposed And Why

BNPL is used by many income and age groups, but evidence shows higher usage among financially vulnerable consumers.

A Federal Reserve Bank of Boston paper in 2024 reported BNPL use was higher among financially vulnerable consumers and that usage had increased notably over a short period. The CFPB data adds a sharper risk picture:

-

In 2022, among BNPL borrowers aged 18–24, BNPL purchases were 28% of their total unsecured consumer debt during months they borrowed, compared with 17% across all age groups

-

Defaults were higher among younger borrowers in the CFPB sample

Exposure is not only about who uses BNPL. It is also about how they use it.

Patterns linked to trouble:

-

Multiple simultaneous plans

-

High credit card utilization before first BNPL use, which the CFPB suggests may indicate reduced credit card liquidity pushing consumers toward BNPL

| Borrower Pattern | Why It Raises Risk | Simple Self-Check |

|---|---|---|

| Multiple overlapping plans | Due dates collide | “How many payments hit this month?” |

| Cross-provider use | Harder to track total exposure | “Do I know the total I owe across apps?” |

| Heavy use (monthly) | BNPL becomes a habit | “Am I using BNPL for basics?” |

| High card utilization | Lower liquidity buffer | “Would a surprise bill break my budget?” |

The Buy Now Pay Later Bubble And The Business Model Behind It

If you want to understand why bubble talk spread, follow the money.

BNPL providers earn revenue through a mix that often includes:

-

Merchant fees (the merchant pays to offer BNPL at checkout)

-

Consumer fees (late fees in some models, interest on longer-term plans)

-

Interchange and partnerships (when BNPL is routed through cards)

-

Funding spreads (the difference between funding cost and what the provider earns)

The pressure point is funding. BNPL is not a simple “payments” product when it involves lending. It is credit. That means providers must fund receivables, manage losses, and satisfy investors.

In a higher-rate environment, this gets harder. Risky portfolios have to tighten approval rates, reduce losses, or raise pricing. The CFPB reported approval rates increased from 67% in 2020 to 79% in 2022 in its matched lender sample, including counteroffers. That is a sign of broad availability during the expansion phase.

Global transaction value also signals why merchants stayed interested. Worldpay’s report places BNPL at meaningful share of global e-commerce and expects continued growth.

| Business Lever | Helps Growth | Creates Risk |

|---|---|---|

| Merchant-paid fees | Keeps consumer price low | Merchants may drop BNPL if costs rise |

| Low-friction approvals | More users and conversions | Higher losses later |

| Auto-pay | Lower defaults | Overdrafts, consumer complaints |

| Funding access | Scales lending fast | Vulnerable when credit markets tighten |

Regulation And Enforcement Shifted Mid-Story

BNPL grew fastest in a gray zone. It looked like a checkout tool, but it also acted like credit. That tension pulled regulators in.

In the US, the CFPB issued an interpretive rule in May 2024 focused on how certain digital user accounts used to access BNPL credit can trigger protections under Regulation Z, similar to some credit card rules. The point was not to ban BNPL. It was to extend consumer protections, such as dispute handling and clear statements, to products that looked like credit cards in function.

Then came policy uncertainty. Public reporting in 2025 described CFPB plans to withdraw the May 2024 BNPL interpretive rule amid broader rollbacks and litigation pressure. Separately, a May 12, 2025 Federal Register notice shows the CFPB withdrew many guidance documents issued since 2011 as part of a wider withdrawal process.

In the UK, the direction is clearer. The FCA states it will start regulating Deferred Payment Credit, commonly known as BNPL, in 2026. Media coverage and consultation details have pointed to a start date of 15 July 2026 under proposed plans, with a short authorization window for firms.

Regulation matters for the bubble debate because rules change incentives:

-

Stronger affordability checks can slow growth but reduce harm

-

Clear dispute and refund rights can improve outcomes

-

Reporting and data requirements can reveal hidden stacking

| Region | 2024–2026 Direction | What It Means For BNPL |

|---|---|---|

| United States | Interpretive rule in May 2024, followed by reported withdrawal plans in 2025 | Uncertain compliance baseline for providers |

| United Kingdom | FCA to regulate BNPL in 2026 | Higher compliance, stronger consumer protections |

| Market effect | Rules tighten visibility and affordability | Growth may shift toward higher-quality borrowers |

A 2026 Retrospective: What “Popped,” What Matured, What Grew

By early 2026, calling BNPL a bubble is both right and wrong, depending on what you mean.

What looks bubble-like:

-

Rapid expansion paired with fragmented oversight

-

Heavy usage and stacking becoming common

-

A reliance on a steady funding environment

-

BNPL moving into essentials, which can signal income strain

Federal Reserve research helps explain why BNPL became more than a convenience product. A 2024 Fed note focused on BNPL users reported that many consumers cite affordability constraints, using BNPL because it is the only way they can afford purchases. A St. Louis Fed “Page One Economics” piece published in January 2026 repeats a similar signal, reporting 58% of respondents said BNPL was the only way they could afford a purchase.

What looks like maturity:

-

Large providers reporting improved delinquency and repayment performance in 2025

-

More use of counteroffers, down payments, and tighter underwriting tools, as noted in CFPB findings

-

Regulation catching up, at least in the UK, where a 2026 regime is planned

A balanced conclusion fits the evidence: parts of the sector had bubble-like behavior, but the product category became durable.

| “Bubble” Signal | “Maturity” Signal | What It Suggests |

|---|---|---|

| Stacking across providers | Underwriting tools and counteroffers | Risk moved from hidden to managed |

| Affordability-driven use | Improved company delinquency | Health varies by user segment |

| Regulatory gaps | 2026 UK regulation | Rules may reshape growth |

Consumer Impact: Convenience, Costs, And Hidden Tradeoffs

For consumers, BNPL can be genuinely useful:

-

Predictable installments

-

Often no interest on short plans

-

Fast checkout with less friction than many credit products

But the risks can also be real:

-

You can stack plans without feeling the full cost

-

Auto-pay can fail and trigger fees or overdrafts

-

Returns and refunds can be confusing when a plan is already in motion

-

Your total exposure may be hard to track across multiple apps

If you want a practical way to use BNPL without getting trapped, focus on three habits.

-

Treat every BNPL plan like a bill, not a “payment option.”

-

Avoid overlapping due dates across providers.

-

Never use BNPL to cover routine essentials if your budget is already tight.

The research picture supports this caution. The CFPB found heavy BNPL users had higher balances across other unsecured credit products compared with non-BNPL users, which may reflect broader debt burden and vulnerability.

| Consumer Benefit | Consumer Risk | Simple Safeguard |

|---|---|---|

| Spreads payments | Stacking creates budget shocks | One BNPL plan at a time |

| Often 0% interest | Fees and overdrafts can still happen | Keep a cash buffer before due dates |

| Fast approval | Too easy to overbuy | Wait 24 hours on non-essential items |

| Helpful for cash flow | Can hide total debt burden | Track total BNPL obligations weekly |

Merchant And Retail Impact: Conversion Wins, Return Headaches

Merchants supported BNPL because it can reduce cart abandonment and raise average order value. That is the sales logic.

But merchant impact is not only positive. BNPL can introduce friction in areas retailers already struggle with:

-

Returns, especially partial returns

-

Chargeback disputes and customer confusion

-

Fraud risk, depending on how the provider allocates liability

Merchants also face dependency risk. If a provider tightens approvals or pulls back from certain customers, conversion lifts can shrink quickly.

The global scale of BNPL in e-commerce is one reason merchants keep testing it. Worldpay’s reporting shows BNPL is now a meaningful slice of global e-commerce value.

| Merchant Upside | Merchant Downside | Contract Clause To Check |

|---|---|---|

| Higher conversion | Refund complexity | Refund timeline and process |

| Bigger baskets | Customer support burden | Dispute responsibility and SLA |

| New customer reach | Provider pullback risk | Notice period for changes |

| Marketing boost | Fees can be high | Merchant fee tiers and triggers |

Risk Scenarios And Stress Tests

A bubble story usually ends with a trigger. In BNPL, the likely triggers are not dramatic crashes. They are slow squeezes.

Macro Stress

If unemployment rises and incomes fall, missed payments rise. BNPL is short-term, so stress appears quickly.

Regulatory Stress

If rules require stronger affordability checks and clearer disclosures, approval rates may drop. That can reduce growth and shift the product toward higher-income borrowers.

Funding Stress

BNPL depends on funding to carry receivables. Higher rates raise funding costs and force providers to either tighten credit or raise revenue per loan.

These stress tests are not predictions. They are planning tools.

| Stress Scenario | Likely Impact | Practical Mitigation |

|---|---|---|

| Recession | Higher delinquencies, more losses | Tighten underwriting, expand hardship support |

| New affordability rules | Slower approvals, lower volume | Improve income verification and transparency |

| Funding tightens | Fewer loans, more pricing pressure | Diversify funding sources, adjust product mix |

| Consumer backlash | More complaints, reputational risk | Clear terms, better dispute handling |

What Happens Next After 2026

By 2026, BNPL is moving toward a more “standard” consumer credit shape in many markets. That does not mean it becomes a credit card. It means it starts facing similar expectations: affordability checks, dispute rights, and clearer reporting.

Three shifts are worth watching:

-

Regulation tightening in the UK as FCA oversight begins in 2026

-

More data collection, including product sales data and consumer outcomes, as regulators demand clearer evidence

-

Providers adjusting product mix, including more longer-term financing, which can introduce interest rates and higher credit risk

Global growth is also likely to continue. Worldpay forecasts BNPL online value rising over the rest of the decade, which suggests the category remains strong even as rules tighten.

| Watch Item | Why It Matters | What Readers Should Look For |

|---|---|---|

| UK 2026 regulation | Stronger protections and checks | Final rules, authorization deadlines |

| US policy clarity | Sets baseline protections | Court outcomes, rulemaking signals |

| Credit reporting changes | Visibility into stacking | Bureau partnerships and reporting standards |

| Delinquency trend | Real consumer stress signal | Portfolio performance disclosures |

Final Thoughts

The buy now pay later bubble story did not end with a single pop. It reshaped itself. The data shows why: defaults on BNPL loans were relatively low in the CFPB sample, but stacking and heavy usage were common, especially among younger borrowers and those with weaker credit profiles.

In 2026, the better question is not “Is BNPL over?” The better question is “Which version of BNPL survives?” The likely winner is the version that looks more like responsible credit: clearer disclosures, realistic affordability checks, and better visibility into total obligations. The UK’s move to regulate BNPL in 2026 pushes in that direction.

If you want a simple takeaway, treat BNPL like credit every time you use it. If you do that, the buy now pay later bubble becomes less of a warning and more of a lesson.