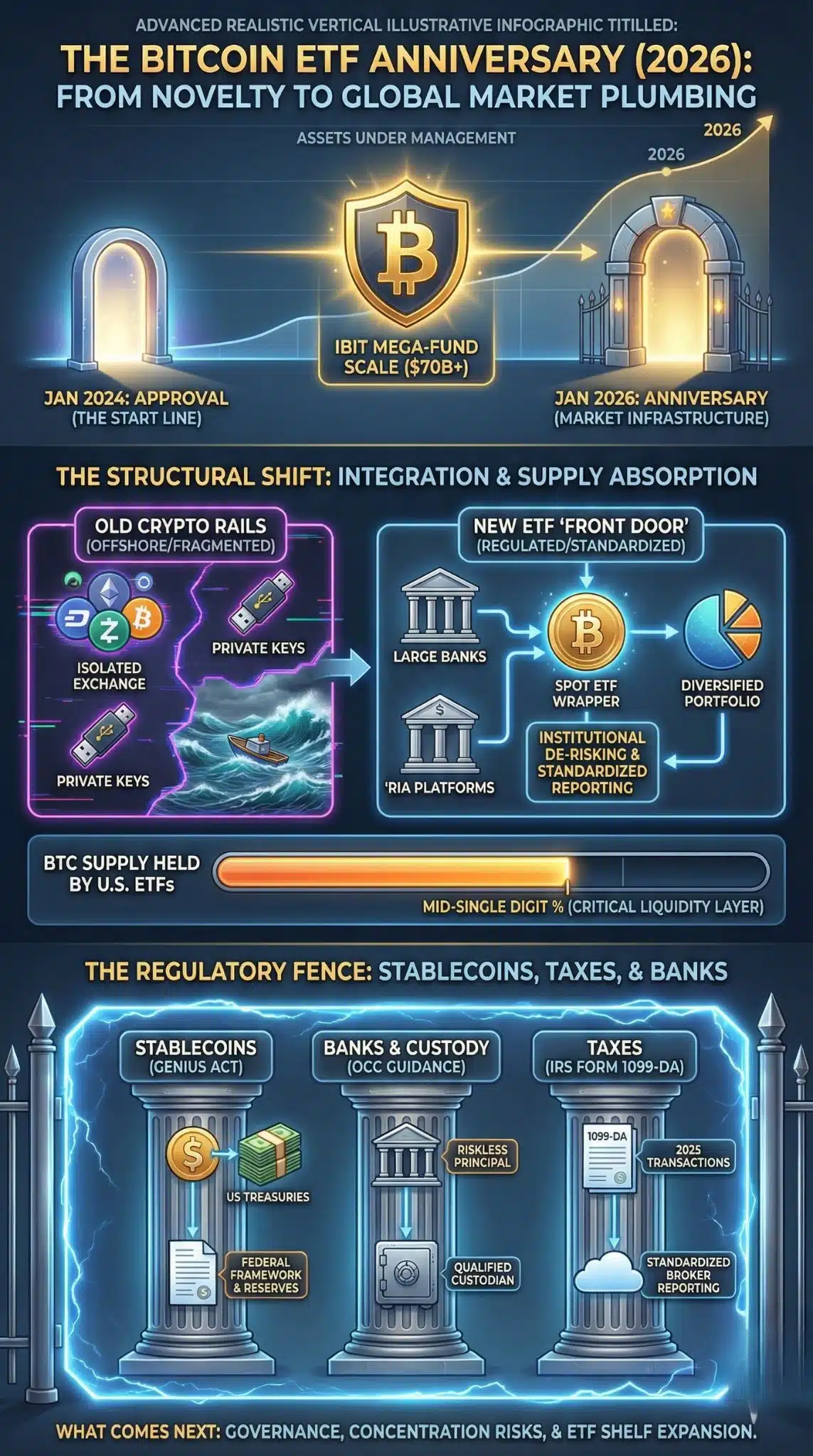

Spot Bitcoin ETFs are approaching a key Bitcoin Spot ETF Anniversary moment with Wall Street now treating them less like a novelty and more like market plumbing. BlackRock’s IBIT has scaled from “test case” to mega-fund, while regulators tighten the rules around stablecoins, taxes, and bank crypto activity.

Two years ago, the idea of a U.S. spot Bitcoin ETF still carried a whiff of “maybe someday.” Today, it is hard to argue the product is anything but consequential infrastructure. BlackRock’s iShares Bitcoin Trust (IBIT) has scaled into a mega-fund, and U.S. spot Bitcoin ETFs collectively hold a meaningful slice of total Bitcoin supply—large enough that flows into and out of these products increasingly influence day-to-day market narrative.

Those numbers matter for a reason that goes beyond bragging rights. They suggest the spot ETF wrapper did something crypto had struggled to do for a decade: convert volatile, operationally tricky exposure into something that fits inside ordinary portfolio machinery, with familiar custody, compliance, and reporting processes.

But the anniversary arrives in a different political and regulatory climate than the one that birthed the first spot Bitcoin ETFs. In the U.S., stablecoins now have a federal framework through the GENIUS Act. Banks have fresh guidance from the OCC confirming certain crypto activities are permissible. And the IRS has finalized broker reporting rules that pull crypto deeper into the mainstream tax system, with reporting tied to Form 1099-DA and transactions beginning in 2025. In Europe, MiCA has moved the industry from “patchwork” oversight toward passportable licensing.

So the real question is not whether the ETFs “worked.” It is what their success is doing to Bitcoin’s market structure, to the crypto industry’s center of gravity, and to the next wave of regulation.

How We Got Here

The spot Bitcoin ETF story is a long detour through America’s regulatory philosophy: innovation is allowed, but only after it looks like everything else.

U.S. spot Bitcoin ETP proposals appeared more than a decade before approval. The SEC’s core objection was consistent: it was not convinced underlying spot markets were sufficiently resistant to manipulation. The logjam broke after courts and market evolution made “no” harder to justify. In August 2023, the D.C. Circuit ruled the SEC’s denial of Grayscale’s proposal was “arbitrary and capricious” because the agency failed to explain why futures-based products were acceptable but a spot product with comparable surveillance logic was not.

Then came the watershed: on January 10, 2024, the SEC approved 11 spot Bitcoin ETP rule-change applications. Even in approving them, SEC leadership stressed the decision did not constitute endorsement of Bitcoin itself and reiterated investor-risk concerns.

Trading began the next day for the new cohort, and the Bitcoin market effectively gained a “front door” embedded in the world’s most used investment channels: brokerage accounts, RIAs, model portfolios, and institutional platforms.

That’s the context for why “$40B” became such a symbolic milestone. It wasn’t just a number. It was a proof point that the ETF wrapper could scale quickly enough to change the market’s shape. And now that IBIT is far beyond that threshold, the question is less “can it grow?” and more “what does growth mean for everything else?”

From Speculative Bet To Standard Portfolio Sleeve

The most important shift the spot ETF era brought was psychological: Bitcoin moved from “something you buy on a crypto exchange” to “something your wealth platform can allocate to.”

That change is visible in three ways:

- Distribution power beat native crypto rails. ETF distribution is built on existing relationships: advisors, broker-dealers, retirement platforms, and institutional allocators. Those channels are slow to adopt new products, but once they do, they can be enormous.

- Compliance and reporting became easier to standardize. Tax forms, custodial statements, risk reporting, and audit trails are native to the ETF ecosystem, not native to self-custody or offshore exchanges.

- The product lowered the “operational courage” required to own Bitcoin. For many institutions, the barrier was never philosophical. It was the risk of being the person who mishandled keys, exchange exposure, or custody vendor selection.

This is why the ETF wrapper is not just an instrument, but a filter. It shifts demand toward what can be packaged, audited, and supervised.

That filter has a consequence that Bitcoin purists often dislike: Bitcoin exposure becomes more mediated by TradFi gatekeepers. The success of a spot ETF is not purely a victory for decentralization. It is also a victory for centralized distribution.

The Supply Absorption Story Is Now Too Big To Ignore

When ETFs hold a rounding error, their impact is mostly sentiment. When they hold a material percentage of a hard-capped asset, they become market structure.

A key reality of early 2026 is that U.S. spot Bitcoin ETFs collectively hold a substantial quantity of BTC. Depending on the measurement method and timing, that can equate to a mid–single-digit percentage of Bitcoin’s maximum supply—large enough to change how market participants interpret liquidity and price discovery.

Snapshot: Who Holds What (U.S. Spot Bitcoin ETFs)

| Fund | Ticker | What It Represents | Why It Matters |

| iShares Bitcoin Trust | IBIT | The dominant “core beta” product | Scale + liquidity can make it the default allocation |

| Fidelity’s spot Bitcoin ETF | FBTC | A major incumbent challenger | Strong distribution into traditional brokerage channels |

| Grayscale’s converted ETF | GBTC | The legacy giant with fee baggage | Redemptions created a pathway for mass rotation into cheaper ETFs |

| Smaller issuers | Various | Niche strategies and fee challengers | Competitive pressure, but harder to match distribution depth |

Why This Concentration Changes The Conversation

The biggest funds increasingly act like dominant marginal buyers and sellers. If inflows accelerate, authorized participants create new shares and the trust must acquire more bitcoin, pushing demand into spot markets. If outflows accelerate, the reverse is true.

This “liquidity loop” has two second-order effects:

- Price discovery gets more tightly linked to ETF flows. Market commentary now treats ETF net flows as a key daily signal, often alongside macro catalysts like rates and risk sentiment.

- Bitcoin’s circulating supply becomes more “financialized.” ETFs are not built around a cultural commitment to holding forever. They are vehicles used by allocators who may rotate risk quickly. That can increase liquidity in calm periods while amplifying flow-driven volatility in stress periods.

Key Statistics (Early 2026)

- IBIT has grown into one of the largest spot Bitcoin ETFs by assets.

- U.S. spot Bitcoin ETFs collectively hold a meaningful share of Bitcoin’s maximum supply.

- Daily ETF flow data has become a mainstream market indicator, frequently cited alongside macro headlines.

A Fee War With Strategic Side Effects

One underappreciated reason spot Bitcoin ETFs scaled so fast is that they arrived already shaped by the modern ETF playbook: fees compress until only distribution and brand matter.

The market quickly sorted into “core allocation” winners and everyone else. In practice, many advisors prefer a small set of issuers with recognizable operational depth. That advantage compounds over time because liquidity begets liquidity, and spreads narrow where volume is thick.

The clearest structural “loser” of the transition was the old premium-priced wrapper: GBTC. The conversion of Grayscale’s trust into an ETF unlocked redemptions, making it easier for investors to exit and shop fees elsewhere. That did not just move assets between issuers. It changed how Bitcoin was held: from a quasi-closed-end trust structure into more conventional ETF plumbing.

Why it matters: In the ETF world, a product that becomes the default “beta” tends to stay the default until something breaks. That sets up a future where Bitcoin’s largest pools of ownership are not exchanges or retail wallets, but a few giant ETF complexes and their custodial partners.

That is not an argument that Bitcoin becomes “captured.” It is an argument that the political economy of Bitcoin changes: the most influential voices become those who represent large regulated pools, because they have the strongest incentives to lobby for clear rules that protect distribution.

Regulation Tightens Around The “Permissioned” Crypto Stack

A strange paradox defines 2026: crypto is being mainstreamed, but also fenced in.

The ETFs are a perfect example. They are a form of permissioned access to an otherwise permissionless asset. Regulators may still dislike some parts of crypto, but they can tolerate exposure through products that sit in familiar supervisory frameworks.

That same logic is now visible across the rest of the crypto stack.

Stablecoins: From Grey Zone To Federal Rulebook

In the U.S., the GENIUS Act created a federal framework for payment stablecoins, including reserve requirements and regular public disclosures of reserve composition.

This matters for Bitcoin ETFs because stablecoins are the liquidity grease of crypto markets. When stablecoins are regulated like payment instruments (and explicitly categorized in law), crypto liquidity becomes easier to integrate with banks and payment rails, but also easier to supervise and restrict.

Banks And Custody: “Yes, But Under Our Terms”

The OCC has issued interpretive guidance clarifying that national banks may engage in certain crypto-asset activities, including custody and some stablecoin-related functions, subject to safety and soundness expectations.

The signal is not “banks love crypto.” It is “banks can participate, but within bank-style risk controls.” Over time, that pulls the market toward regulated custodians, regulated reserves, and regulated product wrappers.

Taxes: Crypto’s Informal Era Is Ending

Treasury and the IRS have finalized broker reporting rules designed to expand standardized information reporting in digital assets, tied to Form 1099-DA and phased implementation dates.

This is not merely administrative. It changes user behavior by increasing the friction of “casual” trading and making off-platform transfers easier to flag.

Europe: MiCA’s Licensing Reality Check

MiCA has reshaped how exchanges, brokers, and issuers operate in Europe by establishing a standardized regulatory regime and clearer licensing pathways. Supervisors have also published guidance to manage transitional timelines and enforcement expectations.

Here is the “tightening” story in one view:

| Regulatory Layer | U.S. Direction | EU Direction | Practical Effect On Markets |

| ETF product access | More standardized pathways for listed crypto ETPs | ETPs exist under stricter market rules | More exposure happens via listed products |

| Stablecoins | Federal framework for payment stablecoins | MiCA stablecoin regime active | Stablecoin rails become more regulated |

| Banking participation | Clarified bank permissions with controls | National + EU supervisory convergence | Custody and settlement shift to regulated entities |

| Tax compliance | Broker reporting ramps through 2026+ | Country-by-country but tightening | Less informal trading, more compliance tooling |

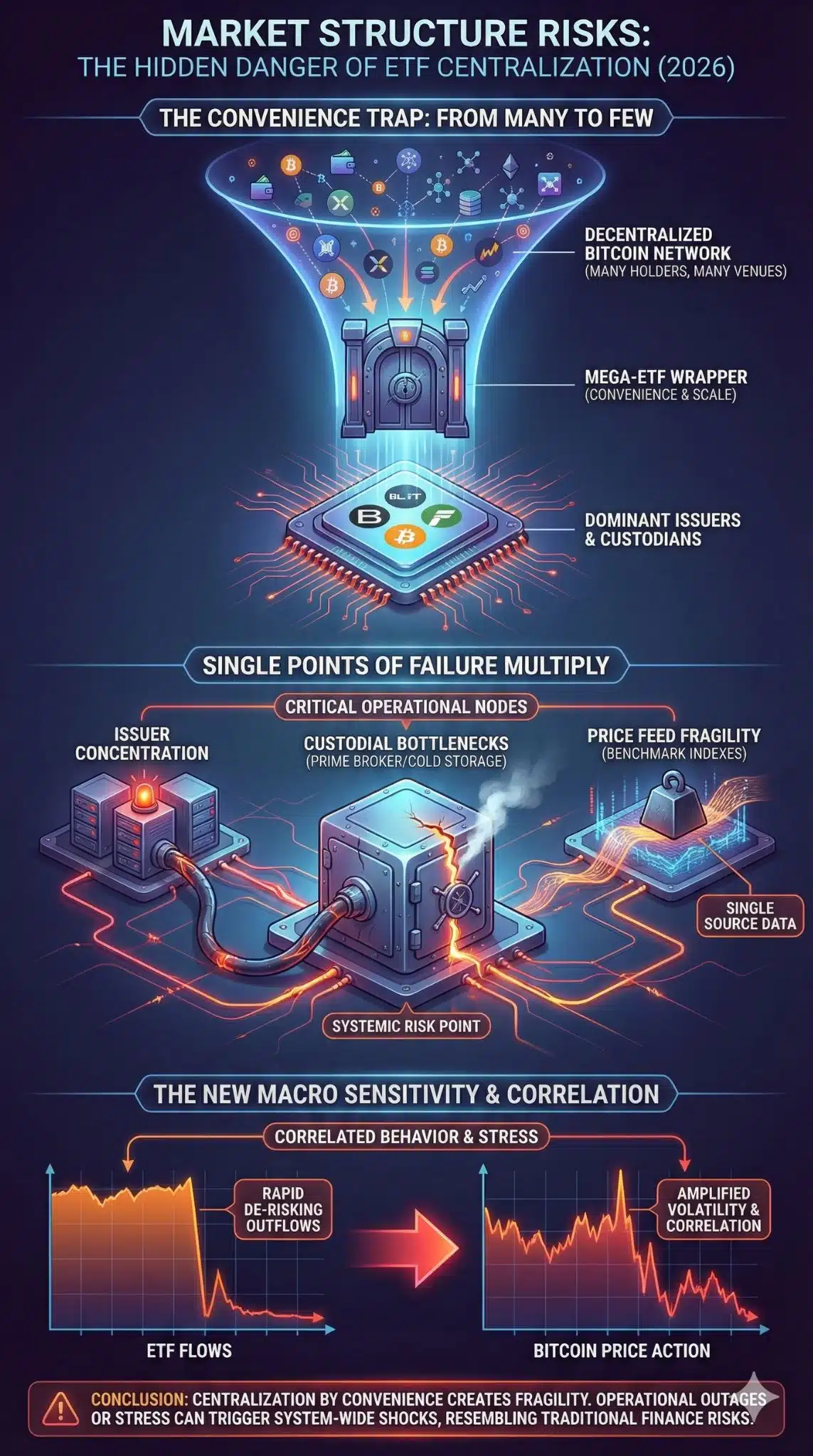

Market Structure Risks: Centralization By Convenience

Spot Bitcoin ETFs solved a user problem, but they also created new concentration risks.

Single Points Of Failure Multiply

Bitcoin’s original risk model is distributed: many holders, many venues, many wallets. ETF ownership consolidates risk into a small number of operational nodes:

- a handful of dominant issuers

- a small set of authorized participants

- prime broker and custody relationships

- benchmark indexes and pricing feeds

None of this implies fragility is guaranteed. But it does imply the “crypto risk” conversation starts to resemble classic finance: operational outages, prime broker concentration, collateral and settlement plumbing, and correlated behavior during stress.

The New Macro Sensitivity

Bitcoin’s ETF era also raises a more subtle question: does Bitcoin become more correlated with traditional risk cycles?

The ETF wrapper makes it easier for allocators to treat Bitcoin like a tactical sleeve. That can increase correlation with broader portfolio de-risking events, even if Bitcoin’s narrative remains distinct.

Second-Order Effects: The Next ETF Wave And The Tokenization Debate

Once a regulator approves a product category, the next fight is about scope. That fight is already underway.

Rule changes and exchange standards adopted in 2025 have made it easier to list certain spot crypto ETPs under more generic frameworks. Major financial institutions continue to file for new crypto-linked ETFs, reflecting the role ETFs now play as the compliant bridge into digital assets.

Why Bitcoin’s ETF Success Makes Expansion More Likely

Bitcoin ETFs did two things regulators care about:

- shifted demand into supervised market venues

- used disclosure and surveillance practices that are legible to regulators

That gives policymakers a template: allow access through a product wrapper, then tighten rules on the underlying rails (stablecoins, custody, tax reporting, market integrity).

Tokenization: Promise, Hype, And New Risk

Global financial institutions and standard-setters argue tokenization could improve settlement and efficiency, but they also emphasize that stablecoins and tokenized claims raise governance and legal clarity issues. In practice, that sets up a world where tokenization is encouraged in “approved” environments while riskier constructs face heavier scrutiny.

Expert Perspectives And The Key Counterarguments

A credible analysis has to hold two truths at once: spot Bitcoin ETFs have been a market success, and they may still create systemic and philosophical tensions.

The Bull Case

- ETFs reduce operational risk and expand access through liquid, familiar products.

- The scale of adoption signals durable institutional demand.

- Regulated wrappers can reduce fraud and opaque leverage by migrating activity into supervised markets.

The Bear Case

- Concentration risk grows as ownership consolidates into a small set of giant funds.

- ETF-driven structure can make Bitcoin more flow-sensitive and potentially more correlated with risk-off cycles.

- The ETF “front door” could weaken native crypto venues, reducing competition and pushing more activity into permissioned lanes.

The Regulator’s Middle Position

Even regulators who allowed the products have continued emphasizing caution and investor-risk warnings, underscoring that approval of an ETP is not the same as endorsement of the underlying asset.

What Comes Next

If the first phase of spot Bitcoin ETFs was about access, the next phase is about governance.

Here are the milestones that matter most over the next 6–18 months:

1) A Broader Spot ETF Shelf

More standardized listing pathways increase the probability of additional spot crypto ETP approvals. Markets will test how far regulators extend the “ETF wrapper” approach into other tokens and baskets.

2) Stablecoin Compliance Becomes Real Operations

Stablecoin reserve and disclosure rules create ongoing compliance burdens that can reshape liquidity patterns, platform choices, and the economics of market-making.

3) Tax Reporting Starts Showing Up In Behavior

As standardized tax reporting becomes routine, some retail trading patterns may fade, while larger compliant venues gain share.

4) The Concentration Question Becomes Political

As ETFs hold a larger slice of BTC supply, scrutiny tends to follow: market power, custodial concentration, and whether a few intermediaries become the “systemically important layer” of a supposedly decentralized asset.

5) Macro Regime Still Rules The Short Run

Even with structural tailwinds, Bitcoin remains sensitive to rates, liquidity, and risk sentiment. ETFs can amplify this: they may accelerate rallies and deepen drawdowns.

A Clear Forecast (Labeled)

- Base case: ETF growth continues but normalizes, shifting from “new position building” to routine rebalancing.

- Bull case (analysts suggest): broader approvals plus regulated stablecoin rails pull more institutional capital into compliant channels.

- Bear case (risk indicators imply): a major market-structure or custody incident triggers outflows and intensifies concentration critiques.

Final Thoughts:

Spot Bitcoin ETFs have shifted Bitcoin from a niche trade into a portfolio instrument, and that shift is now feeding back into how the market behaves. BlackRock’s IBIT scale signals that “crypto exposure” is increasingly being intermediated by regulated funds, advisors, and custodians rather than exchanges and self-custody. The upside is cleaner access, stronger governance expectations, and broader institutional participation.

The risk is concentration: flows, liquidity, and even political influence may cluster around a few mega-issuers. What comes next is less about approval headlines and more about rules—stablecoins, taxes, custody, and the expanding ETF shelf.