If you’re holding Bitcoin in early 2026, you’re likely asking one question: “Where is the $210,000 peak we were promised?” Back in 2024, the popular “Bitcoin Power Law” theory—championed by physicist Giovanni Santostasi and widely tracked by long-term investors—forecasted a cycle top of roughly $210,000 by January 2026. Yet, here we are. The calendar has turned, and Bitcoin is trading near $96,000, well below the model’s projected “Fair Value” of ~$142,000.

After a surprisingly flat 2025 that defied “supercycle” expectations, critics are calling the Power Law dead. They argue that institutional ETFs have dampened volatility so much that the old mathematical models no longer apply. But are we really witnessing the death of the Power Law, or are we simply in the longest, most aggressive “compression phase” in Bitcoin’s history?

Key Takeaways

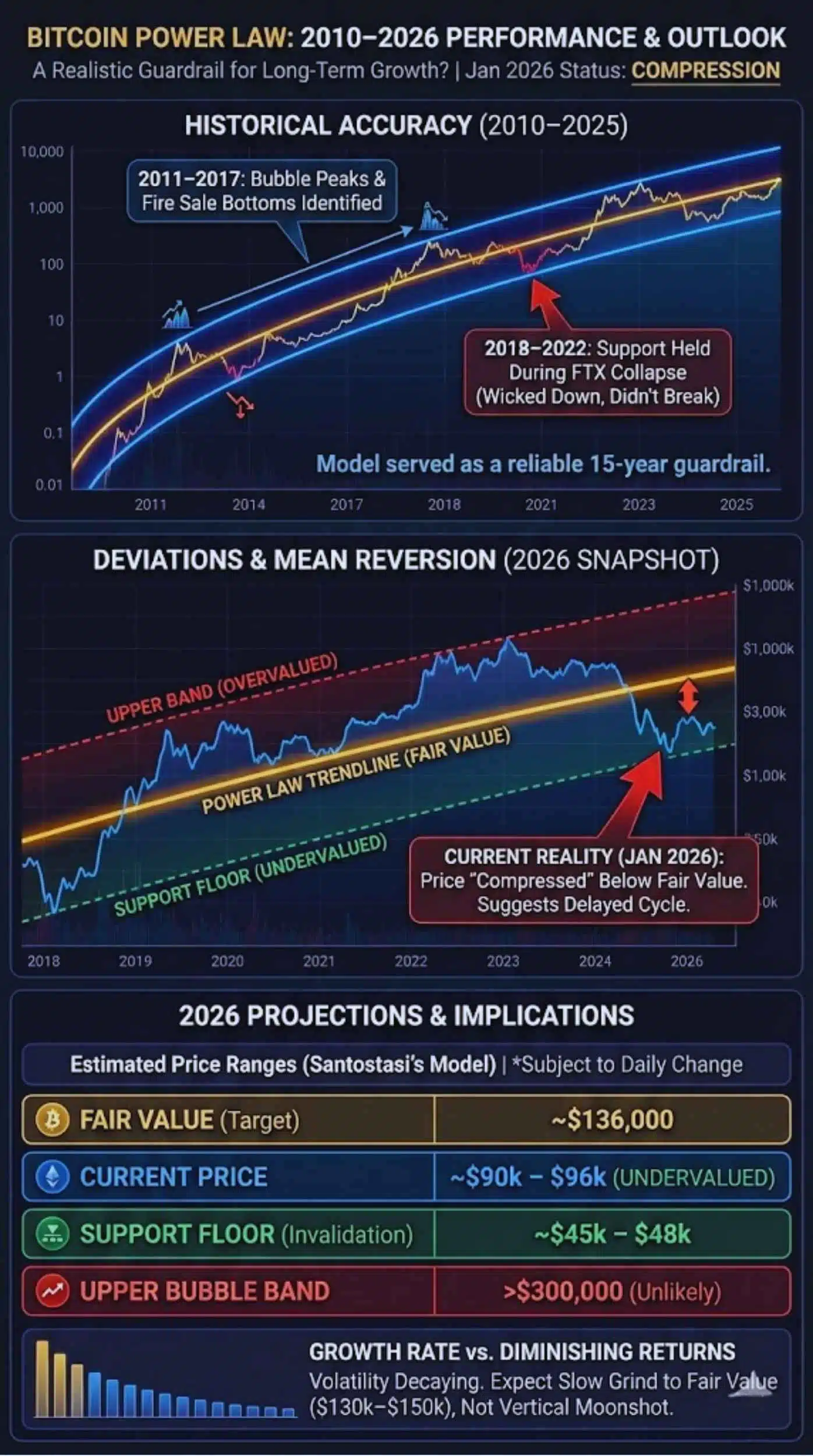

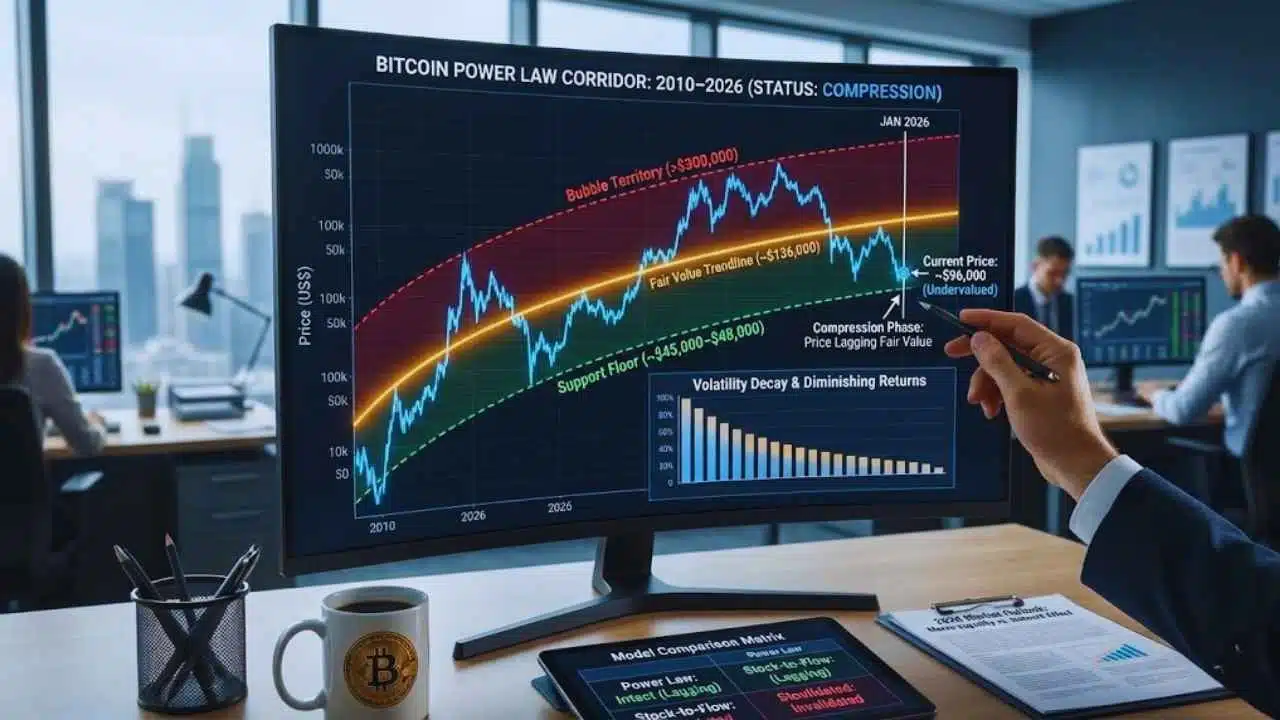

- Current Status (Jan 2026): Bitcoin is trading around $90,000–$96,000, which is below the Power Law’s projected “Fair Value” of ~$136,000.

- The 2026 Test: With 2025 finishing in the red (contrary to some “bull run” expectations), the model is currently testing whether this is a “coiling” phase or a model failure.

- Support Levels: The critical Power Law support floor currently sits near $45,000–$48,000. As long as price stays above this, the model remains technically intact.

What Is the Bitcoin Power Law Theory?

The Bitcoin Power Law theory is a long-term valuation model that attempts to mathematically chart Bitcoin’s growth from its inception. Unlike short-term technical analysis, it claims that Bitcoin’s price evolution is not random but follows a scale-invariant power law—a relationship often found in nature (like the size of cities, earthquakes, or metabolic rates of animals).

Origins of the Power Law in Bitcoin

Originally popularized by physicist Giovanni Santostasi (and later adopted by various analysts like those at Bitbo and rational investors), the theory posits that Bitcoin’s adoption is growing exponentially, but that growth slows down logarithmically over time. The model was created by plotting Bitcoin’s price on a log-log scale (logarithm of price vs. logarithm of time), which reveals a surprisingly straight linear regression line.

How Power Law Applies to Bitcoin Price

In plain English, the Power Law suggests that Bitcoin’s price ($P$) is a function of time ($t$) raised to a specific power ($n$), usually expressed as:

$$P \propto t^{5.8}$$

This formula creates a “corridor” or channel:

- The Trendline (Fair Value): Where the price “should” be based on network growth.

- The Support Line (Floor): A lower band that Bitcoin has historically never broken (currently ~$45k).

- The Resistance Line (Ceiling): The “bubble” territory where price historically peaks before correcting.

Power Law vs. Linear & Exponential Models

The key distinction is diminishing returns. An exponential model (like the tech stock bubbles of the 90s) assumes growth speeds up or stays constant. The Power Law assumes growth is explosive early on but naturally decelerates as the asset matures. This explains why a 100x return was easy in 2011 but virtually impossible in 2026.

Why 2026 Is a Critical Test for the Power Law

As of January 2026, the Power Law is facing its most significant stress test since the 2022 bear market.

Post-Halving Maturity & The “Red 2025”

The 2024 halving was expected to trigger a massive supply shock. However, 2025 ended as a consolidation year (finishing in the red or flat for many), defying the aggressive “supercycle” calls. This deviation has critics asking if the model’s time-based projections are too rigid.

ETF-Driven Demand vs. Organic Adoption

The approval of Spot ETFs introduced a new variable: institutional dampening. While ETFs brought trillions in potential volume, they also brought “smoothness” to the price action. The volatility needed to reach the Power Law’s upper “bubble” bands (predicted by some to be >$200k by now) has been suppressed by institutional rebalancing.

Bitcoin Power Law Performance So Far (2010–2025)

Historical Accuracy Across Market Cycles

For 15 years, the Power Law served as a remarkably reliable “guardrail.”

- 2011-2017: It correctly identified the bubble peaks (prices touching the upper band) and the “fire sale” bottoms (touching the lower support line).

- 2018-2022: Even during the FTX collapse, price wicked down to the Power Law support line but did not violate it for any significant duration.

Deviations and Mean Reversion

The model relies on mean reversion. Whenever Bitcoin price deviates too far above the trendline (as it did in 2021), gravity pulls it back. Currently, in early 2026, we are witnessing the opposite: price is “compressed” below the trendline.

- Model Prediction: Price oscillates around the “Fair Value.”

- Current Reality: Price has lingered below Fair Value for an extended period, suggesting either a delayed cycle or a fundamental shift in market structure.

What the Power Law Suggests for Bitcoin in 2026

If the model holds, 2026 should be a year of “catching up” to the trendline.

Estimated Price Ranges (2026 projections)

Based on the regression formula (specifically Santostasi’s version):

- Fair Value: ~$136,000

- Current Price: ~$90,000 – $96,000 (Undervalued)

- Support Floor: ~$45,000 – $48,000

- Upper Bubble Band: >$300,000 (Currently unlikely)

Note: These numbers change daily as ‘time’ progresses in the formula.

Growth Rate vs. Diminishing Returns

The model suggests that volatility is decaying. The days of 20x gains in a single year are likely over. For 2026, the Power Law implies that even a “bull run” might look more like a slow grind upward to the $130k–$150k fair value range, rather than a vertical shot to the moon.

Where the Power Law May Be Weakening

Market Saturation & Capital Constraints

Bitcoin is now a mature asset class. Moving the needle from a $1.8 trillion market cap to $3 trillion requires exponentially more capital than moving from $100 billion to $200 billion. The Power Law assumes “network effect” (Metcalfe’s Law) drives price, but in 2026, macro-liquidity (Fed rates, global money supply) seems to be overpowering organic network growth.

External Variables the Model Doesn’t Capture

The Power Law is a univariate model (Time is the only input). It fails to account for:

- Regulatory Shocks: Global crypto policies affecting on-ramps.

- Macroeconomics: The 2025 economic slowdown or rate decisions.

- Competition: The rise of other L1s or liquidity fragmentation.

Power Law vs. Other Bitcoin Valuation Models

| Model | Premise | Status in 2026 |

| Power Law | Growth scales with time (logarithmically). | Intact (Technically) – Price is within bands, though lagging. |

| Stock-to-Flow (S2F) | Scarcity (halvings) drives price. | Invalidated – Failed to predict the 2022 bear or the 2025 consolidation. |

| Metcalfe’s Law | Value = Users². | Strong – Closely correlates with Power Law but focuses on active addresses/wallets. |

Why No Single Model Is Sufficient

In 2026, smart money has moved to a multi-model convergence approach. They use the Power Law to set the “floor” (risk management) but look to on-chain metrics (MVRV, Realized Cap) to spot the “top.”

Is the Bitcoin Power Law Still Relevant in 2026?

The Power Law is currently the last standing long-term model that hasn’t been completely invalidated. However, the current price lag ($90k vs. predicted fair value of $136k) indicates that the market is “behind schedule.”

- The Bull Case: We are in a “coiling” phase (similar to mid-2016 or late-2020) and a reversion to the mean is imminent, targeting $130k+.

- The Bear Case: If Bitcoin breaks below the $45,000 support line in 2026, the Power Law theory is officially dead, signaling a regime change in how Bitcoin is valued.

What Long-Term Bitcoin Investors Should Take From This

For the strategist or investor in 2026, the Power Law offers actionable data without the hype:

- Buy the Compression: Historically, buying when Bitcoin is below the Power Law “Fair Value” line (as it is now) has offered the best risk-adjusted returns.

- Watch the $45k Floor: This is your invalidation point. If this breaks, the thesis changes.

- Ignore the “Date” Predictions: The model is great at price levels but poor at specific timing. Santostasi’s prediction of $210k by Jan 2026 missed, but the trajectory remains upward.

- Expect Lower Volatility: Adjust your portfolio for slower, steadier gains rather than lottery-ticket explosions.

Final Thoughts

As we navigate 2026, the verdict on the Bitcoin Power Law is nuanced: The map is accurate, but the schedule was wrong.

The failure of Bitcoin to hit the predicted $210,000 peak by January 2026 is a stark reminder that time-based models are guides, not guarantees. The Power Law has successfully identified the “corridor” in which Bitcoin moves, but it cannot account for the “institutional dampening” effect we witnessed throughout 2025. ETFs brought stability, but they also suffocated the explosive, retail-driven volatility that fueled previous parabolic runs.