The digital asset market has matured into a sophisticated landscape for yield generation. Investors are seeking the best staking platforms in 2026 to secure their financial future. This transition reflects a move toward sustainable passive income rather than pure speculation.

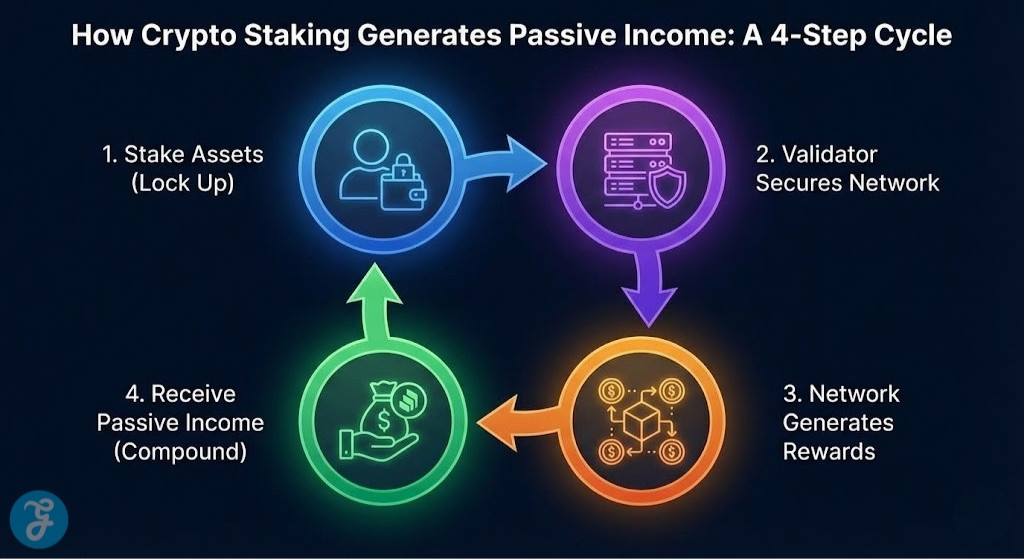

Staking allows you to earn rewards by locking your assets to support a blockchain network. It is a vital component of the modern decentralized economy. Choosing the right provider is essential for managing your risk profile effectively.

Analyzing The Best Staking Platforms 2026

Diversification is the key to managing risk in a volatile digital market. These platforms represent the most reliable options currently available for staking your digital assets. Each entry has been vetted for its performance and security standards in the current year.

1. Binance Earn

This platform is a massive hub for all types of yield generation across the crypto industry. It supports the widest variety of assets which makes it ideal for users with diverse portfolios. You can manage multiple positions from a single dashboard with ease.

The following features and considerations define the Binance experience for modern stakers.

Special Features:

-

Auto invest tools for compounding

-

Integration with new project launches

-

Flexible and locked term options

Things to Consider:

-

Centralized custody requires full trust in the exchange

-

Identity verification is mandatory for all users

-

Terms can change without notice based on market conditions

Best for: Investors who hold many different types of altcoins.

2. Lido Finance

Lido provides a way to stay liquid while your assets are actively staked on the chain. You receive a derivative token that tracks the value of your original deposit. This allows you to use your capital in other financial applications while earning rewards.

Users should weigh these specific benefits and risks before committing their capital to the protocol.

Special Features:

-

No minimum deposit requirements

-

Wide adoption in the decentralized finance space

-

Governance through the LDO token

Things to Consider:

-

Risk of smart contract bugs is always present

-

Derivative price can fluctuate against the underlying asset

-

Limited customer support options for retail users

Best for: Active participants in decentralized finance protocols.

3. Kraken

Security is the primary focus for this veteran exchange based in the United States. They provide clear evidence of their on chain reserves through regular independent audits. This transparency builds a high level of trust with their global user base.

The service is structured to provide the following advantages and challenges to its clients.

Special Features:

-

Transparent and flat fee structure for all assets

-

Fast and reliable reward payouts directly to wallets

-

Dedicated professional trading tools for advanced users

Things to Consider:

-

Regional restrictions apply to some staking products

-

Lower APY compared to most decentralized options

-

Account security remains the responsibility of the user

Best for: Safety conscious investors seeking reliable income streams.

4. Rocket Pool

This is the most decentralized option for those who support the Ethereum network. It allows you to contribute to the health of the blockchain without using a middleman. The protocol is designed to be trustless and community driven at every level.

The protocol offers a unique set of decentralized features along with important operational factors.

Special Features:

-

Non custodial wallet connections for maximum privacy

-

Support for independent node operators with lower collateral

-

Privacy focused staking experience for individual users

Things to Consider:

-

Requires some technical knowledge to set up properly

-

Transaction fees on the main network can be expensive

-

No insurance coverage for lost or stolen private keys

Best for: Privacy advocates and Ethereum decentralization supporters.

5. Coinbase

Coinbase is a publicly traded company that follows strict financial regulations in multiple jurisdictions. It is the most accessible platform for new users who want a familiar interface. The platform handles all the complex technical aspects of staking for you.

You can expect the following regulatory protections and service limitations when using this platform.

Special Features:

-

Insured protection for staked assets against certain risks

-

Automatic tax reporting for users in supported countries

-

Highly regulated financial status providing peace of mind

Things to Consider:

-

Commissions are generally higher than other competitors

-

Centralized account management means less user control

-

Limited selection of staking assets compared to Binance

Best for: Users who prioritize regulatory compliance and simplicity.

6. Jito

Jito is the premier choice for anyone holding assets within the Solana ecosystem. It offers a unique yield structure that includes rewards from transaction tips. This maximizes the total return for every token you stake on the network.

Solana enthusiasts should note these specific performance metrics and ecosystem limitations.

Special Features:

-

MEV boosted reward structures for higher efficiency

-

High-performance network speeds for instant transactions

-

Liquid derivative for Solana tokens that remains active

Things to Consider:

-

Focused strictly on one specific blockchain network

-

Younger platform than its established industry rivals

-

Higher volatility in reward rates compared to Ethereum

Best for: Solana holders looking for the highest real yield.

How We Chose Our Top 6 List?

Our evaluation process is rigorous and relies on public data from the current year. We prioritize the long-term safety of user funds above any short-term gains. This ensures that the platforms we recommend are stable for the foreseeable future.

| Criteria | Weighting | Focus Area |

| Security History | 40% | Record of zero major hacks |

| Actual Yield | 30% | Net returns after service fees |

| User Interface | 30% | Ease of navigation and tools |

Selecting a provider requires understanding your own technical skills and liquidity needs. This section highlights our top recommendations for different user categories based on current market trends.

Quick overview:

| User Goal | Recommended Platform | Primary Advantage |

| Maximum Asset Variety | Binance Earn | Over 300 supported tokens |

| Institutional Security | Kraken | Proof of Reserves transparency |

| Decentralized Liquid Staking | Lido Finance | High secondary market liquidity |

| Ethereum Network Health | Rocket Pool | Community governed protocol |

| Ease of Use | Coinbase | Simple one click interface |

| Solana Optimization | Jito | MEV boosted staking rewards |

How to Select the Best Option for You

You must weigh the pros and cons of custody against your own comfort level. Decentralized options give you more control but carry the responsibility of managing your own keys. Centralized exchanges offer convenience but require you to trust their internal security systems.

-

Assess your current technical knowledge level carefully

-

Determine how quickly you might need to access your funds

-

Compare the net yields after all service fees are deducted

-

Check if the platform is legal in your specific geographic area

It is helpful to see which platform wins in specific categories of service. This table breaks down the leaders based on their primary market strengths. Use this to align your choice with your personal investment strategy for the year.

| Strength Category | Winning Platform | Primary Reason |

| Portfolio Diversity | Binance | Support for 350+ coins |

| Transparency | Kraken | Regular proof of reserves |

| High Performance | Jito | Maximum extractable value yield |

| Network Health | Rocket Pool | Fully decentralized node system |

The Verdict?

The search for the best staking platforms 2026 ends with choosing a strategy that fits your daily life. Proper research will ensure your passive income remains steady throughout the year. Always stay informed about changes in the crypto regulatory landscape to protect your assets.

Passive income through staking is a reliable way to grow your holdings over time. Whether you choose a centralized exchange or a decentralized protocol, you are building long-term wealth. Start with a small amount to test the platform before committing significant capital to any single provider.