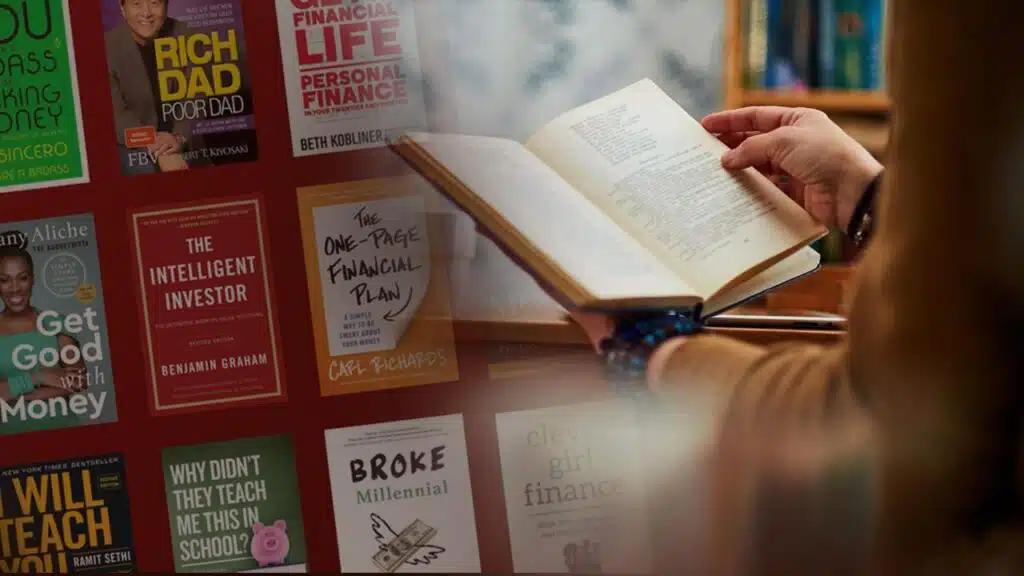

Money matters can be confusing. Reading finance books helps you learn how to manage your cash better. Good finance books teach you about saving, investing, and growing your wealth.

The best finance books give you practical tips you can use right away. You’ll find advice from experts who know how to build wealth.

These books can show you how to budget, pay off debt, and plan for the future. Reading them is a smart way to take control of your money.

1. Rich Dad Poor Dad

Robert Kiyosaki’s “Rich Dad Poor Dad” is a must-read finance book. It challenges traditional ideas about money and success. The book compares the financial advice of two father figures in Kiyosaki’s life.

You’ll learn why the rich don’t work for money, but make money work for them. Kiyosaki explains how to build wealth through smart investments and business ventures. He stresses the importance of financial education and thinking like an entrepreneur.

The book teaches you to focus on assets that generate income, not liabilities that drain your wallet. You’ll discover why your house isn’t always an asset and how to spot real money-making opportunities.

Kiyosaki’s simple writing style makes complex financial concepts easy to grasp. He uses stories and examples to illustrate his points. This approach helps you understand and apply the lessons to your own life.

“Rich Dad Poor Dad” encourages you to take control of your financial future. It pushes you to think differently about work, money, and success. The book has inspired millions to improve their financial literacy and pursue financial freedom.

By reading this book, you’ll gain valuable insights into building wealth and securing your financial future. It’s a great starting point for anyone looking to change their money mindset and take charge of their finances.

2. The Intelligent Investor

“The Intelligent Investor” by Benjamin Graham is a must-read for anyone interested in finance and investing. This book has stood the test of time since its first publication in 1949.

Graham’s approach focuses on value investing. He teaches you how to analyze stocks and make smart investment decisions. The book emphasizes long-term strategies over quick profits.

You’ll learn about the concept of “Mr. Market” – Graham’s personification of stock market behavior. This idea helps you understand market fluctuations and make level-headed choices.

Graham introduces the “margin of safety” principle. It encourages you to buy stocks at prices below their intrinsic value. This strategy aims to minimize risks and maximize potential returns.

The book also covers portfolio management techniques. You’ll discover how to balance your investments between stocks and bonds based on your risk tolerance.

Graham’s teachings have influenced many successful investors, including Warren Buffett. Buffett has called it “by far the best book on investing ever written.”

While some examples may feel dated, the core principles remain relevant today. You’ll gain timeless wisdom that can guide your investment decisions for years to come.

3. Think and Grow Rich

“Think and Grow Rich” by Napoleon Hill is a must-read finance book. Published in 1937, it has stood the test of time and continues to inspire readers today.

Hill interviewed over 500 successful people to uncover the secrets of their wealth. He distilled these insights into 13 principles that anyone can apply to achieve financial success.

The book emphasizes the power of your thoughts in shaping your reality. It teaches you how to harness your mind to create wealth and success in all areas of life.

You’ll learn about the importance of desire, faith, and persistence in reaching your goals. Hill also explains how to tap into the power of your subconscious mind to overcome obstacles.

One key concept is the “mastermind principle.” This involves surrounding yourself with like-minded individuals to accelerate your growth and success.

The book offers practical steps you can take to transform your mindset and achieve your financial dreams. It’s not just about making money, but about developing a success-oriented attitude.

Many successful people credit this book as a major influence in their lives. Its timeless wisdom can help you unlock your potential and create the life you desire.

4. The Millionaire Next Door

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko challenges common beliefs about wealth. It reveals surprising facts about America’s millionaires based on extensive research.

You might think millionaires live lavish lifestyles. But this book shows many live modestly and save a lot. They often have regular jobs and live in middle-class neighborhoods.

The authors found that most millionaires are self-made. They didn’t inherit their wealth. Instead, they worked hard, lived below their means, and invested wisely.

One key lesson is the importance of budgeting and saving. Many millionaires track their spending carefully. They avoid unnecessary luxury items and focus on building long-term wealth.

Another insight is that high income doesn’t always mean wealth. Some high-earners spend too much and save too little. True wealth comes from what you keep, not what you earn.

The book also stresses the value of financial education. Many millionaires take time to learn about money management and investing. This knowledge helps them make smart financial choices.

You’ll learn that becoming wealthy often means going against social pressure to spend. It requires discipline and a long-term outlook. But the rewards can be substantial.

5. Your Money or Your Life

“Your Money or Your Life” by Vicki Robin and Joe Dominguez is a game-changer in personal finance. This book helps you rethink your relationship with money.

The authors introduce the concept of “life energy.” They ask you to consider how much of your life you’re trading for the things you buy.

You’ll learn to track every penny you spend. This practice helps you become more aware of your spending habits.

The book teaches you to calculate your real hourly wage. This eye-opening exercise shows you the true cost of your purchases.

You’ll discover how to save money without feeling deprived. The authors share tips for living well on less.

The book also covers investing for financial independence. You’ll learn strategies to grow your wealth over time.

“Your Money or Your Life” isn’t just about money. It’s about aligning your spending with your values.

You’ll be encouraged to define what “enough” means to you. This helps you avoid the trap of always wanting more.

The book has inspired many readers to pursue financial independence. It’s a key text in the FIRE (Financial Independence, Retire Early) movement.

By following the steps in this book, you can transform your finances. More importantly, you can transform your life.

6. Principles: Life and Work

Ray Dalio’s “Principles: Life and Work” is a must-read finance book. It shares the wisdom Dalio gained as a successful investor and entrepreneur.

You’ll learn about Dalio’s unique approach to decision-making and problem-solving. He outlines principles that have guided his success in both business and life.

The book teaches you how to think critically and make better choices. Dalio emphasizes the importance of radical transparency and idea meritocracy in organizations.

You’ll discover strategies for personal growth and achieving your goals. Dalio explains how to learn from mistakes and turn challenges into opportunities.

The book offers practical advice on building strong teams and creating an effective company culture. You’ll gain insights on how to foster innovation and drive results.

Dalio’s principles can help you in your career and personal life. You’ll learn to approach problems systematically and make more informed decisions.

“Principles” has sold millions of copies worldwide. Its popularity stems from its actionable advice and unique perspective on success.

Reading this book can change how you think about work and life. You’ll gain tools to improve your decision-making and achieve better outcomes.

7. The Richest Man in Babylon

“The Richest Man in Babylon” is a classic book on money management. It uses tales set in ancient Babylon that George S. Clason wrote in 1926 to impart financial wisdom.

The book’s main character is Arkad, the richest man in Babylon. He shares his secrets to wealth with others. His advice is simple but powerful.

Arkad teaches seven key rules for managing money. These include saving at least 10% of your income and investing wisely. He also stresses living below your means and paying off debts.

The book uses parables to make its points easy to understand. This style helps readers remember the lessons. Many people find the stories more engaging than dry financial advice.

You’ll learn about the importance of financial education in this book. It shows how knowledge about money can change your life. The lessons apply just as much today as they did in ancient times.

“The Richest Man in Babylon” is short and easy to read. You can finish it quickly, but the ideas will stay with you. It’s a great starting point if you want to improve your finances.

8. You Are a Badass at Making Money

“You Are a Badass at Making Money” is a game-changing book by Jen Sincero. It aims to help you overcome financial roadblocks and achieve your money goals.

Sincero shares her personal journey from living in a garage to traveling in luxury. Her story shows that big changes are possible with the right mindset.

The book tackles common fears and obstacles that hold people back financially. It gives practical advice on how to push past these barriers and reach new levels of success.

Sincero’s writing style is direct and motivating. She encourages readers to take charge of their financial lives and make bold moves.

The book covers topics like identifying limiting beliefs about money and replacing them with more empowering thoughts. It also discusses how to align your actions with your financial goals.

You’ll learn strategies for increasing your income and managing your money more effectively. The book emphasizes the importance of mindset in achieving financial success.

Sincero challenges you to think bigger about your earning potential. She provides tools to help you overcome self-doubt and take decisive action towards your money goals.

This book is a mix of practical advice and motivational content. It’s designed to inspire you to take control of your financial future and pursue the wealth you desire.

9. The Total Money Makeover

The Total Money Makeover by Dave Ramsey is a game-changer for your finances. This book gives you a simple plan to take control of your money and build wealth.

Ramsey’s approach is based on real results, not wishful thinking. He lays out clear steps to help you get out of debt and start saving.

You’ll learn how to create a budget that works for you. The book teaches you to live below your means and save for the future.

Ramsey’s “Baby Steps” make financial planning easy to understand. You start with a small emergency fund, then tackle your debts one by one.

The book is full of success stories from real people. These tales show that anyone can turn their money troubles around with hard work and dedication.

You’ll get tools to help you stay on track. The Total Money Makeover Workbook lets you put what you’ve learned into action right away.

This book can help you change your family tree. By following Ramsey’s advice, you can leave a legacy of financial wisdom for future generations.

The Total Money Makeover is more than just a finance book. It’s a roadmap to peace of mind and a secure financial future.

10. Unshakeable

“Unshakeable” by Tony Robbins is a must-read finance book. It gives you clear steps to build wealth and reach financial freedom.

Robbins shares insights from top investors. He shows you how to make smart money choices, even when markets are shaky.

The book teaches you to avoid common mistakes. You’ll learn how to protect your savings and grow your wealth over time.

Robbins explains complex ideas in simple terms. He focuses on practical advice you can use right away.

You’ll discover how to create a strong financial plan. The book covers topics like saving, investing, and planning for retirement.

“Unshakeable” also talks about the mental side of money. It helps you build confidence in your financial decisions.

Robbins includes real-life examples to illustrate his points. These stories make the advice easier to understand and apply.

The book is a shorter version of Robbins’ earlier work. But it adds new content about the psychology of wealth.

You’ll find tips on how to stay calm during market ups and downs. This can help you make better choices with your money.

“Unshakeable” is a great guide for anyone looking to improve their finances. It offers clear, actionable steps to help you build a secure financial future.

11. The Little Book of Common Sense Investing

John C. Bogle’s “The Little Book of Common Sense Investing” is a must-read for anyone looking to build wealth through the stock market. This book reveals a simple yet powerful strategy: low-cost index funds.

Bogle, the founder of Vanguard Group, explains why trying to beat the market is a losing game. Instead, he recommends buying and holding low-cost index funds that track broad market indexes.

You’ll learn why active trading and stock picking often lead to poor results. Bogle shows how fees and taxes can eat away at your returns over time.

The book breaks down complex investing concepts into easy-to-understand ideas. You’ll discover why diversification is crucial and how to achieve it efficiently through index funds.

Bogle emphasizes the importance of focusing on what you can control. This includes keeping costs low, staying disciplined, and thinking long-term.

You’ll find practical advice on how to build a simple, effective investment portfolio. The book guides you through different types of index funds and how to choose the right ones for your goals.

By following Bogle’s common-sense approach, you can capture your fair share of stock market returns. This book will change how you think about investing and help you make smarter financial decisions.

12. The Barefoot Investor

The Barefoot Investor by Scott Pape is a popular money guide for Australians. It offers simple steps to build wealth and achieve financial freedom.

Pape’s book gives practical advice on managing money. He covers topics like saving, investing, and paying off debt. The book uses easy-to-understand language and avoids complex terms.

One key idea is the “buckets” system for organizing finances. This helps readers split their income into different accounts for specific purposes. It makes budgeting and saving easier.

The book also talks about choosing the right bank accounts and credit cards. It explains how to get better deals and avoid unnecessary fees. Pape gives tips on negotiating with banks and service providers.

For investing, The Barefoot Investor suggests low-cost index funds. It explains why these can be better than trying to pick individual stocks. The book also covers superannuation (retirement savings) strategies.

Pape includes advice on insurance, buying a home, and teaching kids about money. He shares personal stories and examples to make the concepts more relatable.

Many readers find the book’s step-by-step approach helpful. It breaks down financial tasks into manageable chunks. This makes it less overwhelming for people new to personal finance.

The Barefoot Investor has become a bestseller in Australia. Its ideas can apply to readers in other countries too, with some adjustments for local laws and systems.

13. Money: Master the Game

“Money: Master the Game” by Tony Robbins is a popular finance book. It aims to help you take control of your money and achieve financial freedom.

Robbins shares insights from interviews with successful investors. He breaks down complex financial concepts into simple steps anyone can follow.

The book covers topics like saving, investing, and retirement planning. You’ll learn strategies for building wealth and protecting your assets.

Robbins emphasizes the importance of mindset in achieving financial success. He encourages you to think like wealthy individuals and make smart money decisions.

The book provides practical advice on creating a financial plan. You’ll discover how to set goals and take action to reach them.

Robbins also discusses common money mistakes to avoid. He offers tips for overcoming financial fears and building confidence.

The book includes a section on asset allocation and diversification. You’ll learn how to spread your investments to reduce risk.

Robbins explains different investment options and their pros and cons. He helps you understand which strategies might work best for your situation.

The book also covers ways to reduce fees and maximize returns. You’ll find out how small changes can make a big difference in your finances over time.

14. I Will Teach You to Be Rich

“I Will Teach You to Be Rich” by Ramit Sethi is a game-changer in personal finance. This book gives you a 6-week plan to take control of your money.

Sethi’s approach is refreshing. He doesn’t tell you to give up small pleasures like lattes. Instead, he focuses on big wins that really matter.

You’ll learn how to set up your accounts for automatic savings and investments. The book shows you how to choose the right bank and credit cards.

Sethi explains how to invest in a simple, low-cost way. He breaks down complex topics into easy steps you can follow.

The book covers how to tackle debt and boost your credit score. You’ll also get tips on how to negotiate a higher salary.

Sethi’s writing style is fun and engaging. He uses humor to make dry finance topics interesting.

This book is great for young adults just starting their financial journey. But it has valuable advice for people of all ages.

“I Will Teach You to Be Rich” gives you practical tools to build wealth. It’s not about getting rich quick, but about making smart choices with your money.

15. Financial Freedom

“Financial Freedom” by Grant Sabatier is a must-read for anyone looking to break free from money worries. This book offers practical advice on how to build wealth and achieve financial independence.

Sabatier shares his personal story of going from broke to millionaire in just five years. He provides actionable steps you can take to increase your income and grow your savings.

The book covers topics like side hustles, investing, and reducing expenses. You’ll learn strategies to earn more, spend less, and make your money work for you.

One key takeaway is the importance of tracking your net worth. Sabatier explains how this simple habit can motivate you to make better financial decisions.

Another valuable lesson is the concept of “money multipliers.” These are actions that can significantly boost your wealth over time.

“Financial Freedom” also discusses mindset shifts needed to achieve your goals. You’ll discover how to overcome limiting beliefs about money and develop a more abundant outlook.

The book provides tools and calculators to help you plan your path to financial independence. You can use these resources to set realistic targets and measure your progress.

16. The Wealthy Gardener

The Wealthy Gardener is a unique personal finance book. It tells the story of a father teaching his son about money and success. The book uses parables to explain important financial ideas.

You’ll learn lessons on prosperity from the conversations between father and son. These weekly talks cover topics like budgeting, saving, and investing. The book aims to help you grow your wealth over time.

Many readers say The Wealthy Gardener changed their lives. Some even compare it to classic finance books like Think and Grow Rich. The lessons are easy to understand and apply to your own finances.

The book teaches that an ambitious life can be satisfying. It encourages you to work hard and make smart money choices. You’ll learn how to balance enjoying life now with planning for the future.

The Wealthy Gardener offers timeless wisdom about money. It’s a good choice if you want to improve your financial knowledge. The story format makes the lessons more engaging and memorable.

17. The Simple Path to Wealth

“The Simple Path to Wealth” by J.L. Collins is a must-read for anyone looking to build financial independence. This book offers clear, easy-to-follow advice on investing and money management.

Collins explains how to invest in low-cost index funds. He argues this approach is the best way for most people to grow their wealth over time.

The book covers important topics like how to save money, pay off debt, and plan for retirement. Collins uses simple language to break down complex financial concepts.

You’ll learn about the power of compound interest and why starting to invest early is so important. The book also teaches you how to avoid common investing mistakes.

Collins shares his personal experiences and lessons learned. This makes the advice more relatable and easier to understand.

One key message is to keep your investing strategy simple. Collins believes you don’t need fancy techniques or expensive financial advisors to build wealth.

The book provides practical tips on how to create a portfolio that matches your goals and risk tolerance. It also explains how to rebalance your investments over time.

You’ll find advice on how to handle market ups and downs without panicking. Collins emphasizes the importance of staying the course during tough times.

The Simple Path to Wealth” is a great resource for both beginners and experienced investors. It offers timeless wisdom that can help you achieve financial freedom.

18. The Bogleheads’ Guide to Investing

The Bogleheads’ Guide to Investing is a must-read for anyone looking to build long-term wealth. This book offers practical advice on creating a smart investment strategy.

You’ll learn about the power of index funds and why they often outperform actively managed funds. The authors explain how to build a simple, low-cost portfolio that can weather market ups and downs.

The book covers key topics like asset allocation, diversification, and rebalancing. You’ll gain insights on how to minimize taxes and fees that can eat into your returns.

One of the book’s strengths is its focus on emotional discipline. You’ll discover techniques to stay calm during market volatility and avoid common investing mistakes.

The authors also discuss important aspects of financial planning beyond just investing. This includes advice on insurance, estate planning, and saving for retirement and college.

By following the principles in this book, you can take control of your financial future. The Bogleheads’ approach emphasizes simplicity and long-term thinking over fancy strategies or market timing.

Whether you’re new to investing or looking to refine your approach, this book offers valuable guidance. It’s a roadmap to help you achieve your financial goals with less stress and complexity.

19. The Automatic Millionaire

“The Automatic Millionaire” by David Bach is a must-read for anyone looking to build wealth. This book offers a simple, one-step plan to achieve financial success.

Bach’s main idea is to make your finances automatic. He suggests setting up automatic payments for savings, investments, and bills.

The book teaches you how to pay yourself first. This means putting money into savings before spending on anything else. Bach recommends saving at least 10% of your income.

You’ll learn about the “Latte Factor” – how small daily expenses can add up over time. By cutting these costs, you can save more money for your future.

Bach explains the power of compound interest. He shows how even small amounts saved regularly can grow into large sums over time.

The book covers important topics like buying a home and paying off debt. It gives practical advice on how to handle these financial challenges.

You’ll find tips on choosing the right retirement accounts. Bach explains different options like 401(k)s and IRAs in easy-to-understand terms.

“The Automatic Millionaire” is written in a clear, simple style. It avoids complex financial jargon, making it easy for anyone to follow.

By following Bach’s advice, you can set up a system that builds wealth without much effort. This book shows that becoming rich doesn’t have to be complicated or time-consuming.

20. The Book on Rental Property Investing

“The Book on Rental Property Investing” by Brandon Turner is a must-read for anyone interested in real estate investing. Turner, a successful investor and entrepreneur, shares his expertise on building wealth through rental properties.

You’ll learn practical strategies for finding great deals, financing your investments, and managing properties effectively. The book covers everything from setting achievable goals to analyzing potential investments.

Turner’s writing style is easy to understand, making complex concepts accessible to beginners. He provides real-world examples and actionable advice you can apply right away.

One of the book’s strengths is its focus on creating a long-term investment plan. You’ll discover how to build a sustainable portfolio of rental properties that generates passive income.

The author also addresses common challenges faced by landlords and offers solutions to overcome them. You’ll gain insights into tenant screening, property maintenance, and maximizing your returns.

Whether you’re just starting out or looking to expand your real estate portfolio, this book offers valuable guidance. It’s packed with practical tips and proven techniques to help you succeed in rental property investing.

21. The Psychology of Money

The Psychology of Money by Morgan Housel is a must-read for anyone looking to improve their financial decisions. This book digs into how our minds work when it comes to money.

Housel shows you that being good with money isn’t just about math. It’s about understanding your own behavior and emotions. He shares stories and lessons that make complex ideas easy to grasp.

You’ll learn why people make poor financial choices, even when they know better. The book explains how your past experiences shape your money habits. It also reveals why some folks stay rich while others lose it all.

One key idea is that doing well with money has more to do with how you act than what you know. Housel teaches you to think long-term and stay calm when markets get crazy.

The book is full of practical advice. You’ll find tips on saving, investing, and building wealth that lasts. It’s not about getting rich quickly, but about making smart choices over time.

Reading this book can change how you think about money. It gives you tools to make better financial decisions. Whether you’re just starting out or already have some savings, you’ll find valuable insights here.

22. One Up On Wall Street

Peter Lynch’s “One Up On Wall Street” is a must-read for anyone interested in investing. Lynch ran the Magellan Fund at Fidelity and beat the market consistently for years.

The book’s main idea is that regular people can use their everyday knowledge to find great stocks. Lynch believes you have an edge over Wall Street pros because you see products and trends in your daily life.

He encourages you to “invest in what you know.” This means looking for investment ideas in your job, hobbies, and shopping habits. Lynch thinks you can spot good companies before the experts do.

The book teaches you how to research stocks and analyze financial statements. You’ll learn about different types of companies and how to value them. Lynch also shares his tips for building a diversified portfolio.

One key lesson is to look for “tenbaggers” – stocks that can grow ten times in value. Lynch explains how to find these potential winners and when to buy or sell them.

He also warns about common investing mistakes to avoid. These include following the crowd, trying to time the market, and not doing enough research.

“One Up On Wall Street” is written in a clear, simple style. It makes complex investing ideas easy to understand. You’ll gain confidence in your ability to pick stocks and manage your own investments.

23. A Random Walk Down Wall Street

“A Random Walk Down Wall Street” is a must-read for anyone interested in investing. Written by Burton G. Malkiel, this book has been a go-to guide for investors since its first publication in 1973.

The book explains the concept of efficient markets. It argues that stock prices reflect all available information, making it difficult to consistently outperform the market.

Malkiel challenges the idea that expert analysts can pick winning stocks. He suggests that a blindfolded monkey throwing darts at stock listings could perform just as well as professional money managers.

The author recommends a simple investment strategy: buy and hold low-cost index funds. This approach aims to capture market returns over the long term without trying to beat the market.

You’ll learn about different investment options like stocks, bonds, and real estate. The book also covers newer topics like exchange-traded funds and cryptocurrency.

Malkiel updates the book regularly to keep it relevant. Recent editions discuss smart beta funds, tax-loss harvesting, and automated investment advisers.

The book’s clear language makes complex financial concepts easy to understand. You don’t need a finance degree to benefit from its wisdom.

“A Random Walk Down Wall Street” has sold over 2 million copies. It’s widely regarded as one of the best investment books ever written.

24. Common Stocks and Uncommon Profits

“Common Stocks and Uncommon Profits” by Philip Fisher is a must-read for investors. This book offers valuable insights into picking winning stocks for long-term growth.

Fisher introduces his famous “15 Points to Look for in a Common Stock” in this work. These points help you evaluate companies based on factors like management quality, growth potential, and competitive advantages.

The book stresses the importance of thorough research. Fisher suggests talking to customers, competitors, and former employees to truly understand a company’s prospects.

You’ll learn about Fisher’s “scuttlebutt” method for gathering information. This approach involves networking and digging deep to uncover hidden gems in the stock market.

Fisher also shares wisdom on when to buy and sell stocks. He advises holding onto great companies for the long term, even through market fluctuations.

The book covers key concepts like profit margins and dividends. You’ll gain tools to analyze these factors and make smarter investment choices.

Fisher’s ideas have influenced many successful investors, including Warren Buffett. By reading this book, you’ll tap into timeless wisdom that can improve your investing skills.

25. Security Analysis

Security Analysis is a must-read for anyone serious about investing. Written by Benjamin Graham and David Dodd, this book is considered the bible of value investing.

First published in 1934, Security Analysis teaches you how to analyze stocks and bonds. It shows you how to find undervalued companies that others have overlooked.

The book’s core idea is simple: buy stocks when they’re priced below their true value. This approach can help protect you from big losses and set you up for long-term gains.

Graham and Dodd’s methods have stood the test of time. Many successful investors, including Warren Buffett, credit this book for shaping their strategies.

You’ll learn how to read financial statements and spot red flags. The authors explain how to assess a company’s management and competitive position.

While some parts may seem dated, the key principles still apply today. You’ll gain insights into market psychology and how to avoid common investing mistakes.

Be prepared – this is not a light read. It’s dense and technical at times. But if you stick with it, you’ll gain valuable tools for evaluating investments.

For serious investors looking to build their skills, Security Analysis is an essential addition to your bookshelf. Its lessons can help you become a more disciplined and successful investor.

The Importance of Financial Literacy

Financial literacy helps you make smart money choices and reach your goals. It gives you the tools to build wealth and avoid costly mistakes.

Understanding Basic Financial Concepts

Financial literacy starts with grasping key ideas. You need to know about budgeting, saving, and investing. Budgeting helps you track spending and live within your means. Saving builds an emergency fund for unexpected costs. Investing grows your money over time.

Learning about credit and debt is crucial. Your credit score affects loan rates and job prospects. Knowing how to use credit wisely prevents overwhelming debt. You should also understand taxes and insurance to protect your money.

Basic math skills are important too. You need to calculate interest, compare prices, and figure out loan payments. These skills help you spot good deals and avoid ripoffs.

The Impact of Financial Education on Life Choices

Financial knowledge shapes your big life decisions. It helps you pick the right career path. You can weigh salary, benefits, and growth potential. This leads to better job satisfaction and earning power.

Buying a home becomes easier with financial smarts. You can figure out how much house you can afford. Understanding mortgages helps you get the best deal. You’ll know if renting or buying makes more sense for your situation.

Planning for retirement is easier with financial skills. You can estimate how much you’ll need to save. Knowing about different retirement accounts helps you choose wisely. This sets you up for a comfortable future.

Good money habits reduce stress in your daily life. You worry less about bills and unexpected costs. This leads to better health and relationships. Financial literacy gives you control over your money and your future.

How to Choose the Right Finance Books for Your Needs?

Picking the best finance books for you depends on your goals and background. The right books can teach you valuable money skills and help you reach your financial targets.

Identifying Your Financial Goals

Think about what you want to learn. Are you trying to save more money? Do you want to start investing? Maybe you need help with budgeting or getting out of debt.

Make a list of your top money goals. This will help you find books that match what you need.

Look for books that focus on your specific goals. If you want to invest, pick books about the stock market. For saving money, look for titles on frugal living or cutting expenses.

Assessing the Author’s Expertise and Background

Check the author’s credentials. Look for writers with real-world finance experience.

Good authors often have:

- Work history in banking, investing, or financial planning

- Advanced degrees in economics or finance

- A track record of managing money successfully

Read reviews from other readers. See what they say about the author’s advice and writing style.

Avoid books by authors who make unrealistic promises. No one can guarantee you’ll get rich quick.

Types of Finance Books: Personal Finance, Investing, Economics

Personal finance books cover topics like:

- Budgeting

- Saving money

- Paying off debt

- Planning for retirement

Investing books teach you about:

- Stocks and bonds

- Real estate investing

- Building a portfolio

Economics books explain:

- How markets work

- Government policies that affect money

- Big-picture financial trends

Pick books that match your interests and knowledge level. Start with basic books if you’re new to finance. Choose more advanced titles as you learn more.

Incorporating Theories From Finance Books Into Real Life

Reading finance books can give you valuable knowledge. But the real magic happens when you use what you learn. Let’s look at how to put financial theories into practice.

Practical Applications of Financial Advice

Start small with your new financial know-how. Try tracking your spending for a month. This can show you where your money goes. You might be surprised by what you find.

Next, look at your debts. Many finance books talk about the snowball method. This means paying off your smallest debt first. As you pay off each debt, you gain momentum.

You can also apply investment ideas from finance books. Maybe you want to try index fund investing. Start by putting a small amount into a low-cost index fund each month. This lets you test the waters without risking too much.

Creating a Personal Financial Plan

Your financial plan is like a roadmap for your money. Start by writing down your goals. Do you want to buy a house? Save for retirement? Pay for your kids’ college?

Next, look at your current finances. How much do you earn? What are your expenses? This gives you a starting point.

Now, make a budget. This is where you decide how to use your money. Try the 50/30/20 rule. This means:

- 50% for needs (rent, food, bills)

- 30% for wants (fun stuff)

- 20% for savings and debt payoff

Don’t forget to plan for emergencies. Try to save 3-6 months of expenses in an emergency fund.

Overcoming Common Financial Obstacles

Many people struggle with debt. If this is you, don’t panic. Make a list of all your debts. Then choose a method to pay them off. The snowball method we talked about earlier can work well.

Another common problem is not saving enough. Start small if you need to. Even $10 a week adds up over time. As you earn more, try to save more.

Fear can also hold people back from investing. Education can help with this. Learn about different types of investments. Start with safer options like savings accounts or CDs. As you learn more, you can try other investments if you want to.

Remember, it’s okay to make mistakes. The key is to learn from them and keep moving forward with your financial goals.

The Evolution of Financial Literature

Finance books have changed a lot over time. They’ve gone from basic ideas to complex topics that reflect how money and markets work today.

Historical Perspectives on Finance

Early finance books focused on simple money management. In the 1800s, authors wrote about saving and budgeting. These books taught people how to handle their money wisely.

As markets grew, so did finance literature. The 1920s saw books like “Reminiscences of a Stock Operator” by Edwin Lefèvre. This book is still popular today. It tells stories about trading and market psychology.

After the Great Depression, more books looked at economic theories. They tried to explain why markets crash and how to avoid it.

Modern Trends and Emerging Topics

Today’s finance books cover new ground. They talk about things like:

- Behavioral finance

- Sustainable investing

- Fintech and digital currencies

Books now mix finance with psychology and technology. They help you understand how your mind affects money choices.

Some popular modern finance books are:

- “The Intelligent Investor” by Benjamin Graham

- “A Random Walk Down Wall Street” by Burton Malkiel

These books blend old wisdom with new ideas. They show how financial thinking has grown over time.

Finance books now also focus on personal stories and easy-to-follow advice. They aim to make complex ideas simple for everyone to understand.

Final Thoughts

Building financial literacy is a crucial step toward achieving financial success and security. The 25 books highlighted in this guide offer a wealth of knowledge, from basic money management to advanced investing strategies.

Whether you’re just starting your financial journey or looking to refine your skills, these books provide the insights and tools needed to make informed decisions, grow your wealth, and secure your financial future.

By incorporating the lessons from these essential reads, you can take control of your finances, overcome common obstacles, and build a solid foundation for long-term prosperity.