Exchange-traded funds have quietly become the default toolkit for long-term ETF investing. Costs have fallen, choice has exploded, and it is now possible to build a globally diversified portfolio with just a handful of funds.

That choice creates a different problem. Instead of asking which single product looks exciting this month, investors need to ask a deeper question: what are the best ETF strategies for long-term growth? The answer lies less in clever trades and more in clear structure, repeatable rules, and a strong match with personal goals.

This guide looks at the ETF portfolio strategies that have proved robust over time and at the habits that help investors stay the course through market cycles.

Why ETF Strategies Matter for Long-Term Growth

A long-term portfolio does not grow by accident. It grows through structure, discipline, and thoughtful allocation. That is why strategy—not stock picking—shapes most real-world investment outcomes. Understanding how ETF strategies work helps investors build portfolios that stay resilient across cycles.

ETFs and the Case for Patient, Low-Cost Investing

At their core, most ETFs are simple. They track an index, hold the securities in that index, and pass the returns back to investors minus costs. That structure does two important things for anyone chasing long-term growth.

- It creates instant diversification of stress-free investing. A single broad equity ETF can hold hundreds or even thousands of companies spread across many sectors. That reduces the impact of any one stock blowing up.

- It makes costs visible. Expense ratios, trading spreads, and taxes quietly erode returns over time. Low-fee ETFs capture more of the market’s growth. Over long horizons, even small fee differences compound into meaningful gaps in wealth.

When investors look at the best ETF strategies for long-term growth, they are usually variations on one theme: own diversified assets, keep costs low, and let time do the heavy lifting.

Growth, Risk, and Time Horizon—What You Are Really Optimizing For

“Growth” sounds simple, but investors rarely want growth at any price. They care about drawdowns, volatility, and the chance of reaching specific goals such as retirement, education costs, or financial independence.

For a long horizon, equities tend to drive the return engine. They also bring bigger swings, including sharp market corrections. Bonds and cash dampen those swings. The right ETF strategy mixes these building blocks to match the investor’s time horizon and risk tolerance.

That is why the best ETF strategies for long-term growth rarely chase the story of the day. Instead, they set a clear asset mix, stick to it, and adjust only when life circumstances change.

The Core of Long-Term ETF Investing: Broad, Low-Cost Diversification

Strong portfolios rarely rely on a single winning bet. They grow on the back of diversification and low costs—two advantages ETFs deliver naturally. A well-built core becomes the engine that supports steady compounding over decades.

Building a Core With Broad Equity Index ETFs

Most robust ETF portfolio strategies start with a core of broad market equity ETFs. These funds track well-known benchmarks such as large-cap indices, total-market indices, or global stock markets.

Several features make them suitable as growth engines:

- Diversification: They spread risk across many companies, sectors, and often countries.

- Low fees: Highly competitive fee levels leave more of the return in the investor’s pocket.

- Liquidity: Heavy trading volume keeps bid-ask spreads tight, which reduces trading costs.

- Transparency: Holdings and index rules are clear and easy to follow.

Instead of searching for the single “best” fund, long-term ETF investing focuses on a handful of core funds that together cover domestic equities, global equities, and possibly small-cap stocks. This foundation does most of the work for compounding wealth.

Adding Bonds and Defensive ETFs for Smoother Compounding

Pure equity portfolios can deliver strong growth, but they can also test nerves. Big drawdowns tempt investors to sell at the worst possible time. Including bond ETFs and defensive assets can make a long-term plan easier to stick with.

Investment-grade government and corporate bond ETFs play several roles:

- They reduce overall portfolio volatility.

- They act as a source of funds for rebalancing when equities fall.

- They provide some income, which can be important for investors closer to retirement.

A simple way to think about the mix is to start from a broad equity core and then adjust the bond allocation based on time horizon and risk appetite. A younger investor might accept a high equity share with a small allocation to bonds. Someone who prioritizes capital preservation may choose a larger bond core and treat equities as a growth satellite.

Global Diversification With International and Emerging-Market ETFs

Home-country bias is powerful. Many investors place most of their money in domestic stocks, even when their home market represents a small part of the global market value. International and emerging-market ETFs offer a way to counter that bias.

Adding developed-market and emerging-market ETFs can:

- Broaden exposure to different economic cycles and policy regimes.

- Capture growth in regions that may expand faster than the home market.

- Reduce reliance on a single country’s political or regulatory environment.

The trade-offs are real. Currency risk, different accounting rules, and geopolitical tensions can all affect returns. Still, as part of a diversified plan, global ETFs support the aim of building resilient long-term growth rather than betting on one market. ETFs’ impact on the financial market is also significant.

Core-Satellite: ETF Strategies For Extra Growth Potential

Not every investor wants a one-size-fits-all plan. Core-satellite strategies offer a flexible way to pair broad-market stability with selective growth ideas, without letting speculation overtake long-term discipline.

How the Core Satellite Structure Works

Core-satellite investing has become a popular way to blend stability with targeted growth opportunities. The idea is straightforward.

- The core holds broad, low-cost ETFs that provide diversified exposure to major asset classes. It usually makes up the majority of the portfolio, often between sixty and eighty percent.

- The satellites are smaller positions in more focused ETFs that aim to boost returns or express specific views.

This structure keeps the bulk of the portfolio aligned with the market while still leaving room for higher-conviction ideas. By ring-fencing satellites, investors reduce the risk that a single bad theme derails their long-term ETF investing plan.

Choosing Growth-Oriented Satellite ETFs

Satellites can take many forms, but they should always have a clear role. Common examples include

- Factor ETFs: Funds that tilt toward characteristics like value, quality, momentum, or low volatility.

- Size tilts: Small-cap and mid-cap ETFs that seek higher growth potential, balanced against higher risk.

- Sector ETFs: Focused exposure to areas such as technology, healthcare, or industrials.

- Thematic ETFs: Targeting long-term trends like clean energy, digital infrastructure, or aging demographics.

The key is purpose, not excitement. Satellite ETFs should connect to a long-term thesis, not a short-lived story. They should also respect diversification. Satellites that all cluster around the same sector or group of stocks can create hidden concentration risk.

When Satellites Become a Risk, Not a Boost

Core-satellite strategies can fail when satellites grow too large, too complex, or too expensive. Warning signs include:

- High fees and trading costs that eat into any extra return.

- Illiquid funds with wide spreads and low daily volume.

- Narrow themes with only a handful of underlying holdings.

- Overlapping exposures that duplicate the core rather than complement it.

Many ultra-niche or highly engineered ETFs are designed for short-term trading, not for the best ETF strategies for long-term growth. Keeping satellites small and reviewing them regularly helps ensure they remain a disciplined complement to the core rather than an uncontrolled bet.

Time-Based ETF Strategies: Habits that Drive Long-Term Results

Markets move in cycles, but investor habits determine long-term outcomes. Consistent contributions, reinvesting dividends, and rebalancing create a rhythm that supports growth even during volatile periods.

Dollar-Cost Averaging into ETFs

Dollar-cost averaging is one of the simplest ETF portfolio strategies. Instead of trying to guess the best entry point, the investor commits to investing a fixed amount at regular intervals, such as monthly or quarterly, regardless of market moves.

This approach offers several practical benefits:

- It creates an automatic saving habit.

- It reduces the emotional strain of investing a large lump sum at what might feel like the wrong time.

- It results in buying more ETF units when prices are low and fewer when prices are high.

Dollar-cost averaging does not guarantee higher returns than investing a lump sum, especially in markets that tend to rise over time. However, it can make it easier for many people to stick with their plan. For the best ETF strategies for long-term growth, the psychological advantage of consistency often matters more than squeezing out every last theoretical basis point.

Reinvesting Dividends and Compounding Over Decades

Many ETFs distribute dividends or interest. Investors can either take that cash out or reinvest it to buy more ETF units. For long horizons, reinvesting usually plays a big role in compounding.

Each reinvested distribution increases the number of units held. Future distributions then apply to a larger base. Over decades, this snowball effect can be dramatic, especially in equity income and broad market ETFs.

Some investors also add a dividend-focused ETF as a satellite holding. The appeal is clear: income and potential exposure to established, profitable companies. The risk is over-concentration in a few sectors. As with any satellite, the dividend sleeve should fit into the broader strategy rather than dominate it.

Scheduled Rebalancing to Keep Risk in Check

Rebalancing is the quiet workhorse of disciplined ETF portfolio strategies. Over time, strong-performing assets grow faster than others and drift above their target weights. Rebalancing trims those winners and adds to laggards, nudging the portfolio back toward its original mix.

Most investors use one of two simple rules:

- Calendar rebalancing: Adjust once or twice a year.

- Threshold rebalancing: Adjust when an asset class drifts beyond a set band, such as five percentage points from target.

Rebalancing does not try to predict markets. It simply maintains the risk profile that the investor agreed to at the start. That helps the portfolio stay aligned with the goal of steady, long-term growth rather than becoming unintentionally aggressive after long bull runs.

Risk Management: Avoiding ETF “Traps.”

The ETF universe has expanded rapidly, and not all funds suit long-term investors. Solid research and careful screening protect your portfolio from products that look appealing but carry hidden risks.

Screening for Cost, Liquidity, and Tracking Error

The ETF market now spans thousands of products. Not all of them deserve a place in a long-term plan. A short checklist can filter out many weak candidates:

- Cost: Compare expense ratios with peers tracking similar indices. Persistent tracking error beyond fees is a red flag.

- Liquidity: Look at average trading volume and bid-ask spreads. Thinner trading often means higher costs to enter and exit.

- Size and longevity: Very small funds with little history may be more likely to shut down or merge.

- Index quality: Understand how the index selects and weights securities. Complex or opaque rules can create unwanted exposures.

The best ETF strategies for long-term growth Treat this due diligence as routine. It happens before money goes in, not after problems appear.

Beware of Ultra-Niche, Leveraged, or Complex ETF Strategies

Some ETFs promise amplified returns or protection from every market downturn. These products often rely on derivatives, leverage, or short positions. They can behave very differently from broad index ETFs, especially over longer holding periods.

Leveraged and inverse ETFs, for example, are usually designed for short-term trading around specific events. Daily rebalancing and compounding effects can make their long-term performance diverge sharply from the advertised multiple of the index.

Other products concentrate on very narrow slices of the market or complex strategies that are difficult to evaluate. For investors focused on long-term ETF investing, these tools often add complexity without improving the odds of success. A cautious default is to assume that if an ETF needs a multi-page explainer to describe how it works, it probably does not belong at the core of a retirement portfolio.

Tax Awareness and Account Placement

ETFs are often praised for tax efficiency, especially index funds with low turnover. Even so, tax rules differ by country, account type, and asset class. Distributions, capital gains, and cross-border withholding taxes can all affect net returns.

Practical steps include:

- Understanding how different accounts treat dividends and gains.

- Checking whether certain ETF exposures are better held in tax-advantaged accounts.

- Being mindful of turnover and distribution policies when choosing between similar funds.

Tax is highly jurisdiction-specific, so broad principles only go so far. Still, acknowledging tax effects is part of serious ETF portfolio design, especially for investors building sizeable long-term positions.

Putting It Together: Choosing the Best ETF Strategies For Your Goals

Every investor’s path looks different, but the principles of long-term ETF investing remain the same. The right blend of core holdings, satellites, and disciplined habits can align your portfolio with your future goals.

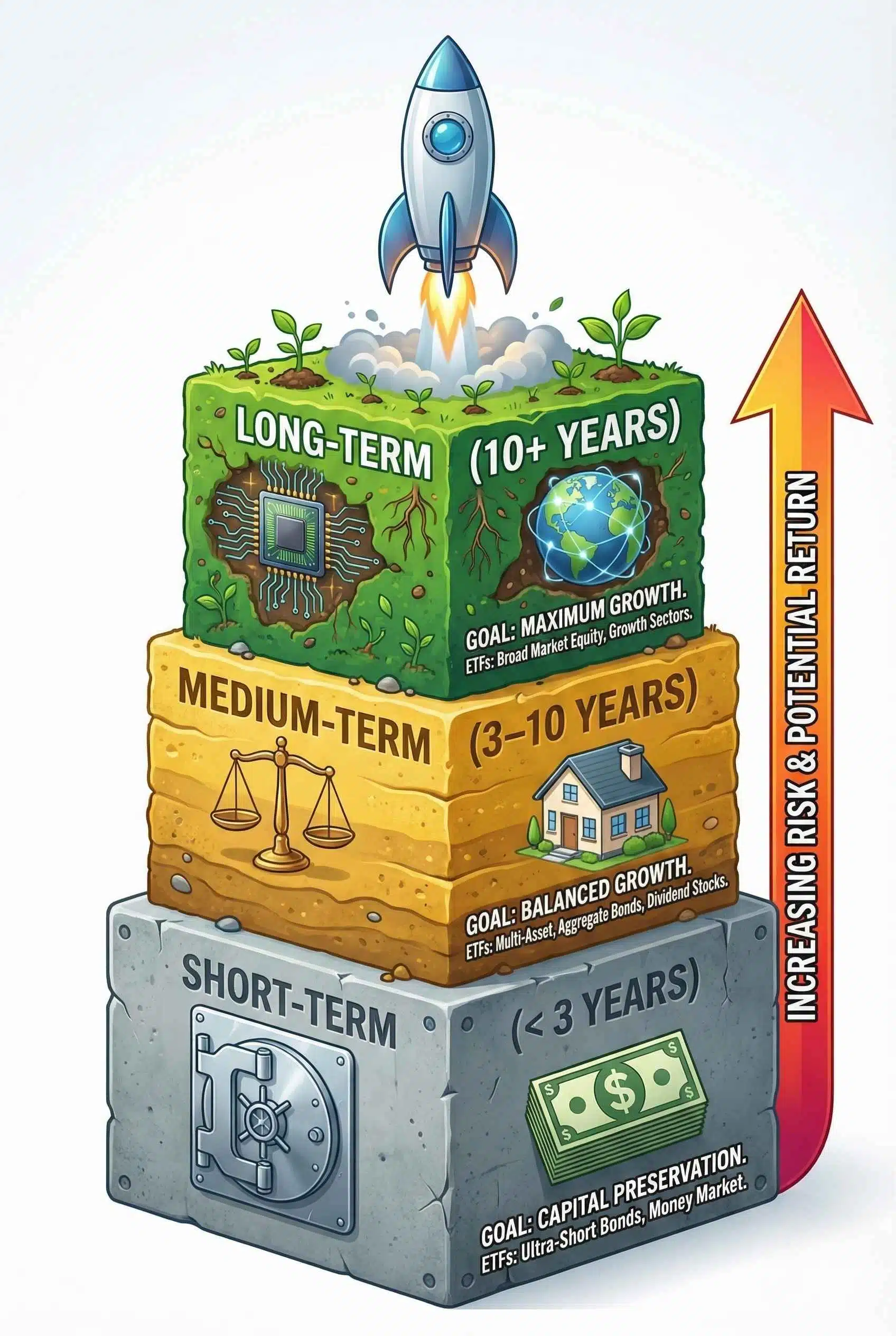

Matching Strategies to Your Time Horizon and Risk Tolerance

No single recipe fits everyone, even when the ingredients are similar. Two investors can both use broad equity and bond ETFs, yet end up with very different portfolios.

A few guiding ideas help:

- Longer horizons support higher equity shares. Investors who will not touch the money for many years can usually accept more volatility in pursuit of growth.

- Shorter horizons or low risk tolerance call for more balance. Here, bond ETFs and cash-like holdings can play a larger role.

- Behavior matters as much as allocation. A “perfect” strategy that an investor abandons during a downturn is worse than a simple, slightly less aggressive one they can follow through on.

Instead of asking for the one universal best ETF strategy for long-term growth, it is more useful to ask: which strategy can I understand, believe in, and stick with across different market conditions?

Sample ETF Strategy Combinations

Without naming specific products, it is still possible to sketch how different investors might use these principles.

Growth-oriented long-term saver

- Core: broad domestic and global equity ETFs.

- Bonds: a modest allocation to high-quality bond ETFs for stability.

- Satellites: small tilts to factors like quality or small caps, and perhaps a limited thematic allocation.

- Habits: regular contributions via dollar-cost averaging, automatic dividend reinvestment, and annual rebalancing.

Balanced investor with a medium horizon

- Core: a mix of equity and bond ETFs, perhaps close to a fifty-fifty split.

- Satellites: one or two sector or factor ETFs aligned with long-term views.

- Habits: contributions that vary with income, focus on keeping risk levels comfortable, and disciplined rebalancing.

Conservative investor prioritizing capital preservation

- Core: a larger allocation to short- and intermediate-term bond ETFs, with a reduced equity share.

- Satellites: very limited equity tilts, if any, and perhaps an inflation-linked bond ETF.

- Habits: close attention to withdrawal needs, limited trading, and a strong emphasis on avoiding unnecessary risk.

In each case, the building blocks are similar. The differences lie in proportions, satellites, and behavior. That is the heart of the best ETF strategies for long-term growth: a clear framework tailored to the person who owns it.

Final Words

The ETF revolution has made investing more accessible than ever. Yet the abundance of choice means that strategy now matters as much as selection.

The most reliable and best ETF strategies for long-term growth share a few traits:

- They start with a diversified, low-cost core of broad index ETFs.

- They use satellites sparingly and purposefully to express long-term views.

- They rely on habits like dollar-cost averaging, dividend reinvestment, and systematic rebalancing.

- They pay attention to fees, liquidity, tax, and concentration risks.

- They match risk levels to real-world goals and personal tolerance, not to short-term noise.

None of this requires predicting markets or outsmarting every other investor. It does require clarity, patience, and a willingness to let a well-designed plan run over time.

This article is for information and education only. It is not personal financial advice. Every investor should consider their own circumstances and regulations in their country and, where needed, seek professional guidance before implementing any ETF strategy.