Decentralized finance, popularly known as DeFi, has emerged as a revolutionary force in the Web3 era, redefining how we think about financial systems. With DeFi, users can access financial services like lending, borrowing, trading, and staking without relying on traditional banks or intermediaries.

This transformative technology is built on blockchain, ensuring transparency, security, and accessibility. If you’re looking for the best DeFi platforms in Web3, this guide will help you navigate through the most reliable and innovative options.

As the DeFi ecosystem continues to grow, finding the best platforms can be overwhelming. This guide simplifies the process, introducing you to the top 10 DeFi platforms worth exploring in 2025. Whether you are a seasoned investor or a curious beginner, these best DeFi platforms in Web3 offer something for everyone.

What is DeFi?

DeFi stands for Decentralized Finance, a blockchain-based financial system that removes the need for centralized entities like banks. Instead, DeFi leverages smart contracts, which are self-executing agreements coded on blockchain networks, to automate financial transactions securely and transparently.

Key Features of DeFi:

- Decentralization: No central authority governs the system.

- Accessibility: Anyone with an internet connection and a crypto wallet can participate.

- Transparency: All transactions are visible on the blockchain.

- Interoperability: Many DeFi platforms support multiple blockchain networks.

DeFi’s significance in the Web3 era lies in its ability to democratize finance, providing equal opportunities for individuals worldwide.

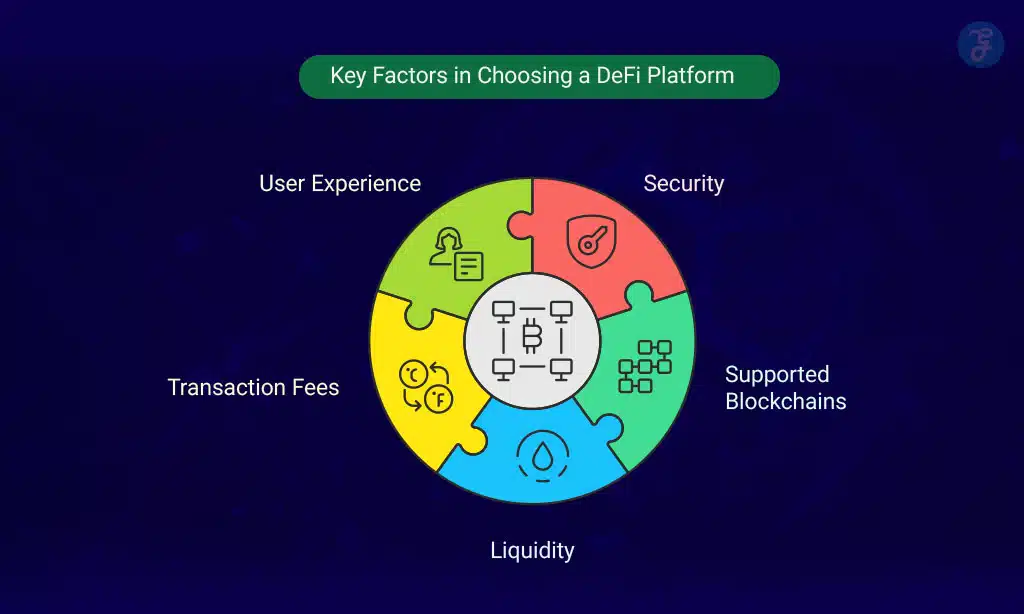

Key Factors to Consider When Choosing a DeFi Platform

When selecting the best DeFi platforms in Web3, consider the following factors:

| Factor | Description |

| Security | Ensure the platform undergoes regular audits to minimize vulnerabilities. |

| Supported Blockchains | Check for compatibility with major blockchains like Ethereum and Binance Smart Chain. |

| Liquidity | Higher liquidity ensures better trading opportunities and reduced slippage. |

| Transaction Fees | Compare fees to find a cost-effective option. |

| User Experience | Opt for platforms with intuitive interfaces and robust customer support. |

Choosing a secure, user-friendly, and feature-rich platform will enhance your DeFi experience.

The 10 Best DeFi Platforms in Web3

The DeFi ecosystem is vast and growing rapidly, but not all platforms are created equal. The following list highlights the best DeFi platforms in Web3 that stand out for their innovation, user experience, and reliability.

Each best DeFi platforms in Web3 offers unique features that cater to different user needs, from trading and lending to staking and liquidity farming.

1. Uniswap

Uniswap is a leading decentralized exchange (DEX) on the Ethereum blockchain. It pioneered automated market maker (AMM) technology, allowing users to trade tokens directly from their wallets.

| Feature | Details |

| Supported Blockchain | Ethereum |

| Unique Offering | AMM technology for seamless token swaps |

| Use Case | Trading and liquidity provision |

Good Side: High liquidity, widely supported tokens, and ease of use.

Bad Side: High gas fees on Ethereum network.

Additional Tips: Utilize Layer-2 solutions like Arbitrum to save on transaction costs.

2. Aave

Aave is a DeFi protocol focused on lending and borrowing. It’s known for its innovative features like flash loans and collateral swapping.

| Feature | Details |

| Supported Blockchain | Ethereum, Polygon, Avalanche |

| Unique Offering | Flash loans requiring no collateral |

| Use Case | Lending and borrowing |

Good Side: Offers multiple blockchain support and advanced lending features.

Bad Side: Complex for beginners and higher risks with flash loans.

Additional Tips: Start with small amounts to understand the platform’s functionality.

3. PancakeSwap

Built on Binance Smart Chain, PancakeSwap is a popular DEX offering lower fees and faster transactions compared to Ethereum-based platforms.

| Feature | Details |

| Supported Blockchain | Binance Smart Chain |

| Unique Offering | High-speed, low-cost token swaps |

| Use Case | Trading, staking, and liquidity farming |

Good Side: Low transaction fees and fast processing.

Bad Side: Limited to Binance Smart Chain and lower decentralization.

Additional Tips: Use for quick token swaps and farming opportunities with high APYs.

4. MakerDAO

MakerDAO is the protocol behind DAI, a decentralized stablecoin. It allows users to generate DAI by collateralizing assets.

| Feature | Details |

| Supported Blockchain | Ethereum |

| Unique Offering | Decentralized stablecoin (DAI) |

| Use Case | Stablecoin generation and lending |

Good Side: Stability with DAI and proven track record.

Bad Side: Complex collateral requirements and high gas fees.

Additional Tips: Use for stablecoin needs and avoid over-collateralizing assets.

5. Compound

Compound is a lending protocol that enables users to earn interest on their crypto holdings or borrow assets by providing collateral.

| Feature | Details |

| Supported Blockchain | Ethereum |

| Unique Offering | Automated interest rates based on supply and demand |

| Use Case | Lending and borrowing |

Good Side: Easy-to-use interface and automated interest adjustments.

Bad Side: High gas fees and limited blockchain support.

Additional Tips: Diversify your lending portfolio to maximize returns.

6. Curve Finance

Curve Finance specializes in stablecoin trading with low slippage and efficient liquidity pools.

| Feature | Details |

| Supported Blockchain | Ethereum and multiple Layer-2 networks |

| Unique Offering | Low slippage trading for stablecoins |

| Use Case | Stablecoin trading and liquidity farming |

Good Side: Optimized for stablecoin trades with low slippage.

Bad Side: Limited use case beyond stablecoins.

Additional Tips: Pair stablecoins for better liquidity rewards.

7. SushiSwap

SushiSwap offers DEX functionality and additional features like yield farming and staking.

| Feature | Details |

| Supported Blockchain | Multi-chain (Ethereum, Binance Smart Chain, Polygon, etc.) |

| Unique Offering | Comprehensive DeFi ecosystem |

| Use Case | Trading, staking, and yield farming |

Good Side: Multi-chain support and wide range of features.

Bad Side: Slower development compared to competitors.

Additional Tips: Explore its staking features for steady rewards.

8. Balancer

Balancer is an automated portfolio manager and trading platform allowing customizable liquidity pools.

| Feature | Details |

| Supported Blockchain | Ethereum |

| Unique Offering | Customizable liquidity pools |

| Use Case | Portfolio management and liquidity provision |

Good Side: Flexibility in liquidity pool design.

Bad Side: High complexity for new users.

Additional Tips: Use pre-configured pools to start before creating custom ones.

9. Yearn Finance

Yearn Finance focuses on maximizing yields through automated strategies for liquidity provision.

| Feature | Details |

| Supported Blockchain | Ethereum |

| Unique Offering | Automated yield optimization |

| Use Case | Yield farming |

Good Side: Excellent for yield optimization.

Bad Side: Limited to Ethereum and complex for beginners.

Additional Tips: Stick to vaults with established strategies for lower risk.

10. Synthetix

Synthetix enables users to create and trade synthetic assets that track the value of real-world assets like commodities and stocks.

| Feature | Details |

| Supported Blockchain | Ethereum |

| Unique Offering | Synthetic asset trading |

| Use Case | Exposure to real-world asset value |

Good Side: Access to synthetic assets without owning the underlying assets.

Bad Side: High collateral requirements and potential regulatory challenges.

Additional Tips: Monitor market trends to make informed synthetic asset trades.

The Advantages of Using DeFi Platforms

- Accessibility: No restrictions based on geography or credit history.

- Transparency: Transactions are recorded on the blockchain for public verification.

- Higher Yields: Opportunities like yield farming offer attractive returns.

- Innovation: Constant development of new financial tools and applications.

Risks to Keep in Mind

While DeFi has significant advantages, there are risks:

- Smart Contract Vulnerabilities: Exploits can lead to loss of funds.

- Regulatory Uncertainty: Laws regarding DeFi vary across regions.

- Volatility: Prices of DeFi tokens can be highly unpredictable.

- Scams: Always verify the legitimacy of platforms.

Future Trends in DeFi and Web3

- Cross-Chain Solutions: Enhanced interoperability between blockchains.

- DAOs: Decentralized governance models for managing platforms.

- AI Integration: Automated and smarter financial tools.

- Mainstream Adoption: More user-friendly interfaces to attract non-tech-savvy users.

How to Get Started with DeFi

- Set Up a Crypto Wallet: Use wallets like MetaMask or Trust Wallet.

- Connect to a DeFi Platform: Choose a platform based on your goals.

- Learn Basic Features: Understand staking, liquidity provision, and yield farming.

- Start Small: Begin with small investments to minimize risk.

Takeaways

The DeFi space is unlocking unprecedented financial opportunities in the Web3 era. By exploring the best DeFi platforms in Web3, you can harness the power of decentralized finance to achieve your financial goals.

Whether you want to trade, lend, or stake, there is a platform designed to meet your needs. Start your journey today, but remember to conduct thorough research and stay informed about the risks.