If you are looking to trade crypto without giving up custody of your funds, you are in the right place. In 2026, the gap between centralized exchanges (like Binance or Coinbase) and best decentralized exchanges (DEXs) has almost vanished. DEXs now offer speed, low fees, and massive liquidity. But with hundreds of options, which one should you use?

Volume is the most important metric. High volume means better prices and faster trades.

We analyzed on-chain data to rank the top 8 DEXs by trading volume this year. Whether you want to trade meme coins on Solana, earn yield on Ethereum, or trade perpetual futures, this list has the best platform for you.

Top 8 Decentralized Exchanges (DEXs) at a Glance

| Rank | DEX Name | Best For… | Primary Chain(s) |

| 1 | Uniswap | The safest, most popular choice | Ethereum, L2s (Arbitrum, Base, etc.) |

| 2 | Hyperliquid | Trading perps (futures) | Hyperliquid L1 |

| 3 | Raydium | Solana tokens & memecoins | Solana |

| 4 | PancakeSwap | Gamified trading & low fees | BNB Chain |

| 5 | Aerodrome | Best liquidity on Base | Base |

| 6 | dYdX | Pro-level derivative trading | Cosmos (dYdX Chain) |

| 7 | Curve | Swapping stablecoins (USDC/USDT) | Multi-chain |

| 8 | 1inch | Getting the best price (Aggregator) | Multi-chain |

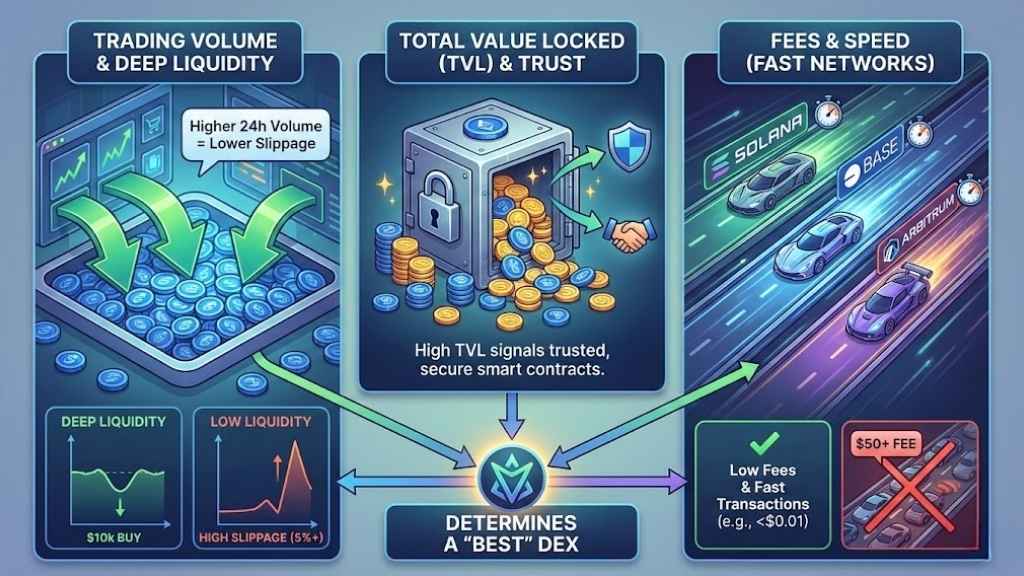

What Determines a “Best” DEX?

Before we dive into the reviews, you need to know how we picked these. We didn’t just look at a logo; we looked at the math.

- Trading Volume: This is the total money exchanged in 24 hours. Higher volume creates “deep liquidity.” This means you can buy $10,000 worth of a token without the price jumping up 5% instantly (that bad price jump is called “slippage”).

- Total Value Locked (TVL): This is how much money users have deposited into the smart contracts. High TVL usually signals that the platform is trusted and secure.

- Fees & Speed: In 2026, paying $50 for a transaction is unacceptable. We prioritized DEXs that work on fast networks like Solana, Base, and Arbitrum.

Top 8 Decentralized Exchanges Ranked

Finding the right place to trade can be overwhelming with so many protocols fighting for liquidity. To help you navigate the chaos, we have curated the ultimate list of the top Decentralized Exchanges operating today. These platforms were selected based on real trading volume, user security, and ecosystem dominance. From Ethereum giants to Solana speedsters, here are the market leaders defining DeFi in 2026.

1. Uniswap (The Market Leader)

Best For: Everyone. It is the standard for DeFi.

Uniswap is the “Google” of decentralized trading. If a token exists, it is probably on Uniswap. In early 2026, Uniswap launched Uniswap V4, a massive upgrade that allows for custom trading features like limit orders and dynamic fees.

- Why it’s #1: It has the most liquidity and the highest trust score. It operates on almost every major blockchain, including Ethereum, Arbitrum, Optimism, Polygon, and Base.

- Our Experience: The interface is incredibly simple. We tested a swap on the Arbitrum network, and it cost less than $0.05 in gas fees.

Pros:

- Massive liquidity (easy to trade millions without slippage).

- Trusted security (battle-tested for years).

- Available on almost all major Layer 2 networks.

Cons:

- Using it on Ethereum Mainnet is still expensive (gas fees can be high).

- The V4 features can be slightly confusing for total beginners.

2. Hyperliquid (The New King of Perps)

Best For: Traders who want leverage (futures) and high speed.

Hyperliquid has taken the crypto world by storm. It is not just a DEX; it is its own high-performance blockchain. It recently flipped dYdX to become the #1 place to trade perpetual futures (betting on if a price will go up or down with leverage).

- Why it’s widely used: It feels exactly like a centralized exchange (like Binance). It uses an “order book” (buyers and sellers matched instantly) rather than an automated pool. It is famously fast and has very low fees.

- The “Hype”: The platform gained massive loyalty through its airdrop program and community ownership.

Pros:

- Instant trades with zero gas fees for placing orders.

- Supports trading widely popular assets like pre-launch tokens.

- Deep liquidity for large trades.

Cons:

- You must bridge funds to the Hyperliquid L1 chain to use it.

- Focused on leverage trading, not simple token swaps.

3. Raydium (The Engine of Solana)

Best For: Speed, low fees, and Solana memecoins.

If you trade on Solana, you are likely using Raydium (even if you don’t know it). It is the primary liquidity source for the entire Solana ecosystem. When you see a new memecoin launch, it almost always starts on Raydium.

- Why it ranks high: Solana is booming in 2026. Because Solana is cheap and fast, Raydium processes millions of transactions a day.

- User Tip: While Raydium is great, many users access its liquidity through Jupiter (an aggregator) for a slightly smoother interface. However, Raydium is where the actual volume lives.

Pros:

- Extremely fast (transactions settle in seconds).

- Fees are a fraction of a penny.

- The best place to find new, small-cap Solana tokens.

Cons:

- The interface can be buggy during times of extreme network congestion.

- High risk of “rug pulls” (fake tokens) because it is so easy to list a new coin.

4. PancakeSwap (The BNB Giant)

Best For: Beginners and BNB Chain users.

PancakeSwap is colorful, fun, and easy to use. Originally built on the Binance Smart Chain (BNB Chain), it has expanded to Ethereum and Aptos. It is famous for its “Cake” token and gamified features like lottery drawings and trading competitions.

- Why it’s popular: It has a massive user base globally because fees on BNB Chain are low. It is very beginner-friendly.

- Our Experience: The “Smart Router” feature works well, automatically finding the cheapest path for your trade.

Pros:

- Very low fees.

- Fun interface that isn’t intimidating.

- Earn high interest (yield) by depositing tokens.

Cons:

- Mostly dependent on the BNB ecosystem.

- Many listed tokens are low-quality projects.

5. Aerodrome (The Liquidity Hub of Base)

Best For: Trading on the Base network (Coinbase’s Layer 2).

Aerodrome is the rising star of 2025-2026. Built on Base (the blockchain created by Coinbase), it captures over 50% of all trading volume on that network.

- How it works: It uses a clever voting system (called ve(3,3)) where holders of the AERO token vote on which pools get rewards. This attracts massive liquidity.

- Why use it: If you are in the Coinbase ecosystem, this is the most liquid and efficient place to trade.

Pros:

- Incredible liquidity for Base ecosystem tokens.

- Low trading fees.

- Generous rewards for liquidity providers.

Cons:

- Only available on the Base network.

- Tokenomics (the AERO token structure) is complex to understand.

6. dYdX (The Pro Trading Platform)

Best For: Institutional traders and algorithmic trading.

dYdX was the original king of decentralized futures. While Hyperliquid has challenged it, dYdX remains a powerhouse with billions in daily volume. It now runs on its own standalone blockchain (dYdX Chain) in the Cosmos ecosystem.

- Key Feature: It offers a truly professional interface that looks just like Wall Street trading software. It is fully decentralized but highly compliant and secure.

- Trust Signal: It has been running for years with a strong security track record.

Pros:

- Pro-level charts and tools.

- Self-custody (you control your funds).

- Mobile app is available (for iOS).

Cons:

- Requires bridging funds to their specific chain.

- US residents face strict restrictions on accessing many features.

7. Curve Finance (The Stablecoin Specialist)

Best For: Swapping cash-equivalents (like USDC to USDT).

Curve is unique. It doesn’t try to be cool; it tries to be efficient. It uses a special mathematical formula designed specifically for “stable” assets.

- The Use Case: If you want to swap $100,000 of USDC for DAI, Uniswap might charge you $50 in slippage. Curve might charge you $1.

- Volume Source: Whales and other DeFi protocols use Curve constantly to move massive amounts of stablecoins.

Pros:

- Lowest slippage in the industry for stablecoins.

- Very deep liquidity.

- Safe and battle-tested code.

Cons:

- The user interface looks like Windows 95 (very retro/confusing).

- Not good for trading volatile tokens (like ETH or SOL).

8. 1inch (The Best Aggregator)

Best For: Getting the absolute best price across all DEXs.

1inch is not a standard exchange; it is a “search engine” for trades. When you want to buy Ethereum, 1inch scans Uniswap, Curve, Balancer, and 50+ other sources to find you the best deal.

- Why it’s on the list: It drives massive volume by splitting your trade. It might buy 60% of your tokens from Uniswap and 40% from Curve to save you money.

- Safety Feature: Their “Fusion” mode allows you to swap tokens without paying gas fees (the market makers pay it for you).

Pros:

- Always ensures the best market price.

- Zero gas fee options (Fusion mode).

- Huge selection of tokens.

Cons:

- Can be overwhelming for new users.

- Sometimes the gas cost to route through multiple exchanges is higher than the savings.

DEX vs CEX: Which Should You Use?

Still not sure if you should leave Binance or Coinbase? Here is the breakdown.

| Feature | DEX (e.g., Uniswap) | CEX (e.g., Coinbase) |

| Custody | You hold the keys (Self-custody). | They hold the keys (Exchange wallet). |

| Privacy | High. No ID required (No KYC). | Low. Requires Passport/ID verification. |

| Variety | Lists everything (even risky new coins). | Lists only vetted coins. |

| Ease of Use | Moderate (Need a wallet like MetaMask). | Easy (Login with email/password). |

| Customer Support | None. You are on your own. | Yes, they have support teams. |

Verdict: Use a CEX to buy your first crypto with a bank card. Use a DEX to trade freely, access new coins, and keep full control of your money.

How to Trade on a DEX Safely

Decentralized trading is powerful, but there is no “undo” button. Follow these three rules to stay safe.

1. Verify the URL

Hackers buy ads on Google that look exactly like Uniswap or Raydium.

- Always bookmark the official site.

- Never click on “Sponsored” links in search results for a DEX.

2. Check the Token Contract

Anyone can create a fake token called “Bitcoin.”

- Before you buy, copy the token’s contract address from a trusted site like CoinGecko or CoinMarketCap.

- Paste that address into the DEX to ensure you are buying the real thing.

3. Revoke Permissions

When you trade, you give the DEX permission to spend your tokens. If that DEX ever gets hacked, your wallet could be drained.

- Use a tool like Revoke.cash regularly to cancel old permissions you don’t need anymore.

Final Thoughts

Choosing the right decentralized exchange isn’t just about chasing the highest volume numbers—it’s about matching the platform to your specific trading strategy. In 2026, the ecosystem has matured enough that you no longer have to sacrifice speed or low fees to maintain self-custody of your assets.

If you are a high-frequency trader looking for the next breakout token on Solana, Raydium is your undisputed home. For those prioritizing institutional-grade security and deep liquidity for major assets like ETH and WBTC, Uniswap remains the gold standard. Meanwhile, sophisticated traders seeking leverage without the risk of a centralized exchange collapse have found a robust haven in Hyperliquid.

Remember, decentralized finance (DeFi) offers incredible freedom, but it demands responsibility. You are your own bank now. Always double-check URLs, verify token contract addresses, and start with smaller amounts until you are comfortable with the interface. The tools listed here represent the pinnacle of open finance—choose the one that fits your goals, stay safe, and trade with confidence.