The global race to reach net-zero emissions has transformed the construction sector into a high-stakes arena of financial rewards. In 2026, nations are moving beyond simple advice, offering high-value incentives for green building that can cover over half of a project’s total cost. These programs prioritize deep energy retrofits, renewable integration, and the use of low-carbon materials to modernize aging infrastructure.

Finding the best countries for green building incentives requires a look at legislative stability and the actual dollar value of the support. This year, specific nations stand out for their aggressive funding and simplified application processes. This guide details the five leading countries where sustainable building is not just an environmental choice but a primary financial strategy.

How We Picked Our Top 5 List?

Our evaluation process is rigorous and relies on public data from the current year. We prioritize the long-term safety of user investments and the reliability of the funding sources provided by each government. This ensures that the incentives we recommend are fully funded and accessible throughout the 2026 calendar year.

We applied the following weightings to our research and comparison efforts to identify the top global performers.

| Criteria | Weighting | Focus Area |

| Subsidy Depth | 40% | Percentage of total costs covered by grants or credits |

| Technical Range | 30% | Number of eligible green technologies supported |

| Application Speed | 30% | Time from project submission to funding approval |

5 Essential Ways To Improve Best Countries For Green Building Incentives

The following nations offer the most robust financial frameworks for sustainable construction in 2026. We have evaluated these programs based on their ability to provide significant upfront relief and long-term operational savings. Each selection represents a different model of how governments are successfully funding the green transition.

1. Italy: The 2026 Home Bonus

Italy remains a global leader in residential greening through its refined 2026 Home Bonus framework. While the original “110% Superbonus” has been replaced, the new system offers a stable 50% tax credit for primary residences. This program is specifically designed to support the “Renovation Wave” by funding thermal insulation, window replacement, and solar integration.

The following features and considerations define the Italian incentive model this year.

Special Features:

-

50% tax credit on expenditures up to €96,000 per property

-

Broad eligibility including thermal adaptation and solar shading

-

Credits are distributed in 10 equal annual installments

Things to Consider:

-

The credit rate for non-primary residences is lower at 36%

-

Fossil-fuel boiler replacements are no longer eligible for this specific bonus

-

Project details must be submitted to the ENEA agency within 90 days

Best for: Homeowners in Italy looking for a high-percentage tax reduction on deep renovations.

2. Germany: Federal Funding For Efficient Buildings (BEG)

Germany’s BEG program is the cornerstone of its 2030 Climate Action Program and remains a powerhouse in 2026. It provides a mix of direct grants and low-interest loans for individual measures like heat pumps and building envelope improvements. The program is unique because it incentivizes “grid-friendly” technology to help balance the national energy load.

The platform provides the following advantages for residents and commercial developers.

Special Features:

-

Up to 40% subsidy for biomass and innovative heating technologies

-

Additional 10% bonus for replacing old oil-based heating systems

-

Integrated support for professional planning and construction supervision

Things to Consider:

-

Stricter noise limits on air-to-water heat pumps take effect this year

-

Applications must be filed before the start of any physical work

-

Stricter technical requirements apply to the building envelope insulation

Best for: German property owners who want professional guidance alongside high cash grants.

3. France: MaPrimeRénov’ 2026

In 2026, France has officially relaunched its MaPrimeRénov’ scheme with a focus on “large-scale” renovations rather than isolated measures. The program uses a sliding scale based on household income to ensure that those with the highest energy burden receive the most support. It is the primary tool used by the National Housing Agency (ANAH) to eliminate “energy sieves” across the country.

French residents should note these specific benefits and recent adjustments to the program.

Special Features:

-

Subsidies tailored to the real energy impact of the total project

-

Higher grant amounts for projects that jump two or more DPE energy classes

-

Mandatory “Accompaniment Rénov” professional support for large projects

Things to Consider:

-

One-off measures like isolated wall insulation receive less support than before

-

Funding availability is tied to approved national budget cycles

-

Eligibility for certain biomass boilers has been restricted in the 2026 gesture route

Best for: Low-to-middle income households in France planning a complete energy overhaul.

4. Canada: Greener Homes Affordability Program

Canada has shifted its strategy in 2026 toward the Greener Homes Affordability Program, which targets low-to-median-income households. Unlike previous grant models, this program often covers the full cost of retrofits without requiring the homeowner to pay anything out of pocket. It is a direct response to the rising cost of living and energy prices in northern climates.

The following list provides a framework for understanding the current Canadian green building landscape.

Special Features:

-

100% of recommended retrofit costs covered for eligible households

-

Focus on high-impact upgrades like heat pumps and insulation

-

Eliminates the “pay-and-reimburse” barrier for disadvantaged owners

Things to Consider:

-

The original $5,000 Greener Homes Grant is now closed to new applicants

-

Requires a pre-retrofit EnerGuide evaluation from a registered advisor

-

Availability is managed through specific provincial and territorial partners

Best for: Canadian homeowners and tenants with median income or less seeking zero-cost upgrades.

5. United States: Section 48E Investment Tax Credit

In the U.S., the focus for 2026 has shifted to the “Section 48E” Clean Electricity Investment Tax Credit. While the residential 25D credit has narrowed, Section 48E provides a robust 30% credit for commercial and multi-family projects that produce zero greenhouse gas emissions. This includes solar, wind, and standalone energy storage systems that help stabilize the local grid.

The following details highlight the financial and regulatory strengths of the U.S. model.

Special Features:

-

30% base tax credit with “adders” that can push total relief to 50%+

-

10% bonus for projects located in designated “Energy Communities”

-

10% bonus for using domestic content in the manufacturing process

Things to Consider:

-

Stricter “placed in service” deadlines apply to projects starting this year

-

Domestic content requirements for solar components increase throughout 2026

-

Focus has shifted heavily toward multi-family and commercial-scale assets

Best for: Real estate developers and multi-family property owners in the United States.

Best Countries For Green Building Incentives Overview

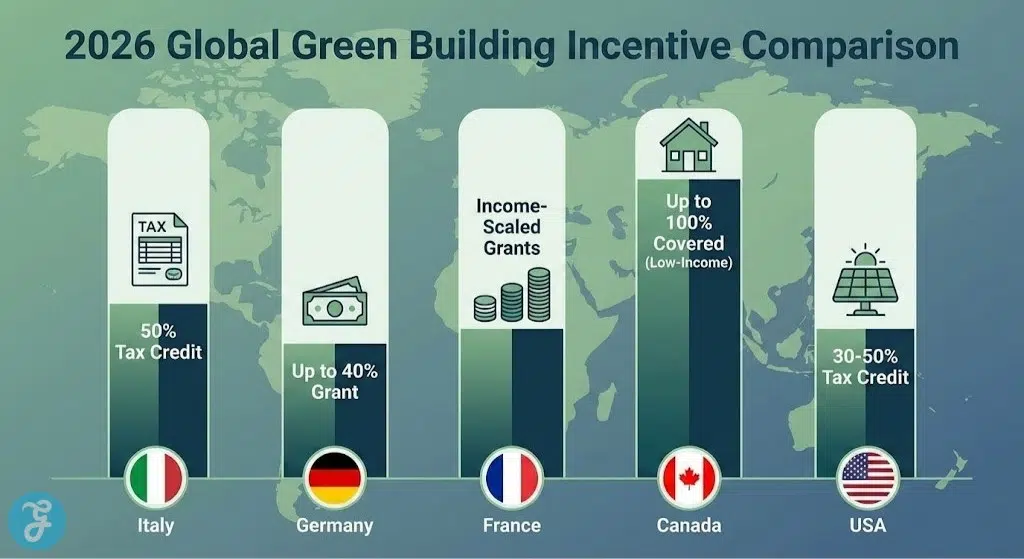

The 2026 market is defined by a shift toward “performance-first” incentives where the amount of aid is tied directly to energy savings. Many countries have transitioned from “one-off” appliance rebates to comprehensive building envelope subsidies. The following table provides a high-level look at the top national incentive programs available this year.

| Country | Primary Program | Incentive Type | Max Benefit |

| Italy | 2026 Home Bonus | Tax Credit | 50% of Expenses |

| Germany | BEG Federal Subsidy | Direct Grant / Loan | Up to 40% |

| France | MaPrimeRénov’ | Cash Grant | Varies by Income |

| Canada | Greener Homes Affordability | Direct Installation | 100% of Costs |

| United States | IRA Section 48E | Investment Tax Credit | 30% – 50% |

How Should You Choose The Best Option For You

Selecting the right country for your green building project depends on your income level and the scale of the construction. If you are seeking the highest percentage of tax relief for a private home, Italy’s 50% model is unmatched for high-earners. For those needing zero upfront capital, Canada’s affordability program is the most accessible choice in 2026.

Still unsure?

| Category | Top Pick | Primary Reason |

| Highest Tax Relief | Italy | 50% direct deduction for deep energy requalification |

| Most Accessible | Canada | 100% cost coverage for low-to-median income owners |

| Best For Innovation | Germany | Direct subsidies for cutting-edge “grid-friendly” technology |

| Best Commercial Scale | United States | High-value credits with significant “adders” for equity zones |

Wrap-Up

The search for the best countries for green building incentives in 2026 highlights a global trend toward performance-based and inclusive funding. By taking advantage of these national programs, you can shield yourself from rising energy costs while increasing the long-term value of your property. Always consult with a certified energy advisor in your specific region to ensure your project meets the 2026 technical standards.

Investing in green building is the most effective way to future-proof your assets against evolving environmental regulations. These incentives represent a massive transfer of wealth toward those who are willing to lead the transition to a low-carbon economy. Start by booking an energy audit today to see which of these five countries offers the best path for your sustainable vision.