The Best Citizenship by Investment Programs 2026 are no longer just about travel freedom; they are about survival, asset sovereignty, and strategic arbitrage in a volatile world. Gone are the days when a second passport was merely a status symbol or a travel convenience for skipping visa queues. In today’s climate, holding a single citizenship is a critical point of failure in your personal and financial security architecture.

This guide is your definitive roadmap to navigating the complex, expensive, yet vital landscape of 2026 citizenship programs.

The Rise of the “Sovereign Citizen”

We have entered the era of the “Sovereign Citizen”, a time where relying on a single government for your rights is a risk you can no longer afford. As geopolitical instability rises in Eastern Europe and the Middle East, and as aggressive taxation policies take root in traditionally “safe” Western democracies, the “Plan B” passport has evolved from a luxury into a necessity. It is the ultimate insurance policy.

Whether you are a crypto-entrepreneur facing regulatory chokeholds, a family seeking protection from hyperinflation, or a business owner tired of being “unbankable” due to your passport’s reputation, Citizenship by Investment (CBI) is the exit valve. Unlike Residency by Investment (RBI), which grants you the right to live in a country but leaves you subject to renewal bureaucracy and potential revocation, CBI grants you irrevocable status. You are not a guest; you are a citizen. You have the right to vote, the right to consular protection, and, crucially, the right to a passport that no foreign government can cancel.

The 2026 Landscape: What Changed?

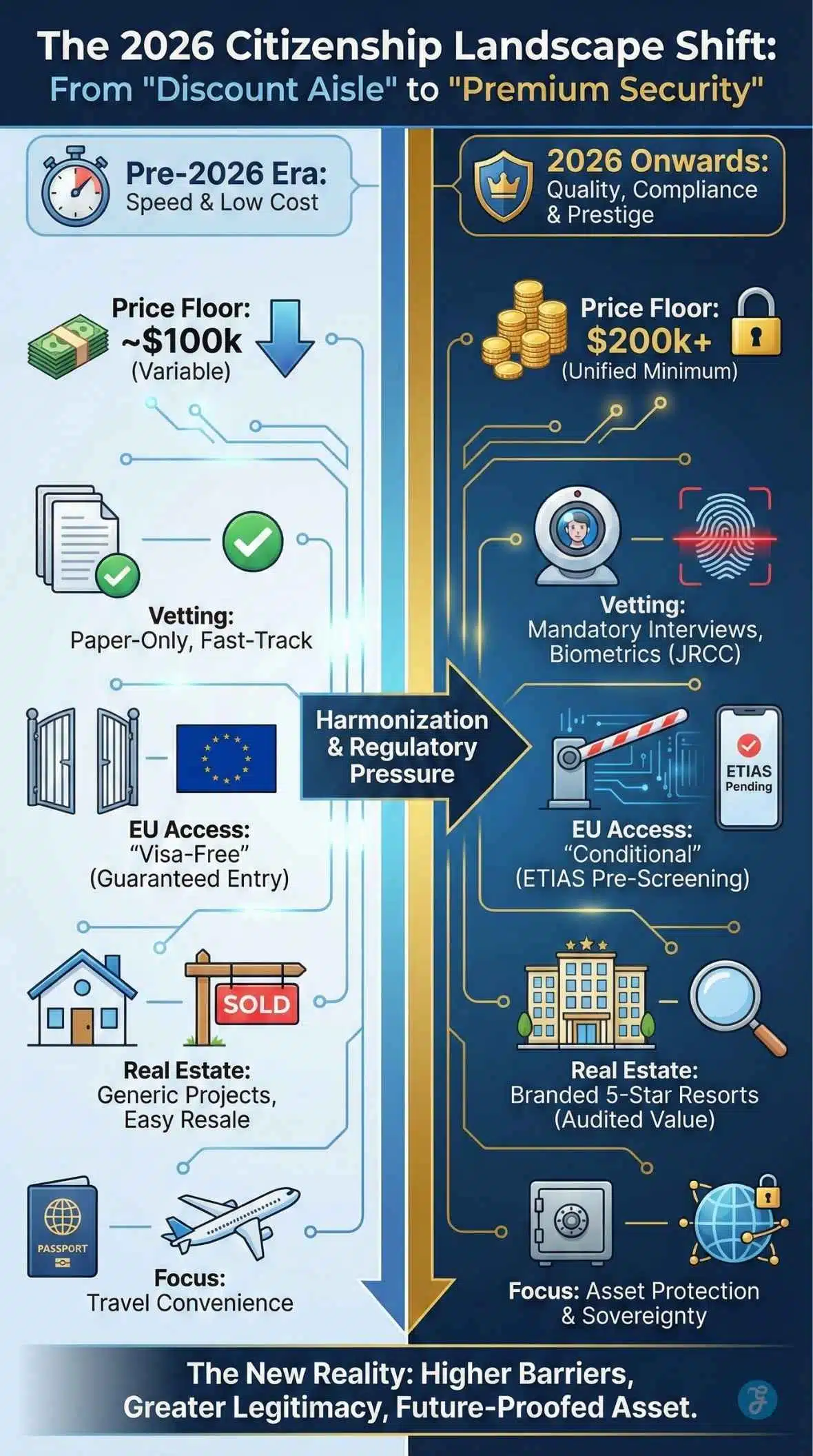

The citizenship market in 2026 bears little resemblance to the “discount aisle” environment of the early 2020s. A wave of regulatory pressure from the European Union (EU) and the United States has forced a “harmonization” of prices and standards, effectively raising the barrier to entry for everyone.

The End of “Cheap” Citizenship

The most significant shock to the system was the implementation of the $200,000 price floor across the Caribbean. Following the Memorandum of Agreement (MoA) signed by the “Big 5” Caribbean nations, the days of $100,000 donations are over. In 2026, if you see a program advertising significantly below this threshold, it is likely a scam or an unauthorized “financing” scheme that could lead to your citizenship being revoked later.

This price hike was not arbitrary; it was a concession to Western powers who demanded stricter due diligence (DD) in exchange for maintaining visa-free access to the UK and Schengen Area. The result? A safer, more prestigious product, but one that requires significantly more capital.

The “Visa” Trap

Many investors confuse long-term visas with citizenship. In 2026, this distinction is dangerous to ignore. A “Digital Nomad Visa” or a “Golden Visa” is a permission slip; it can be withdrawn if political winds change. We saw this with the cancellation of certain Russian investor visas in 2022 and the tightening of rules for Chinese applicants in 2025.

This brings us to a critical realization for the modern remote worker or global entrepreneur. You might think a simple remote work permit is sufficient, but when a crisis hits, be it a pandemic, a war, or a banking collapse, a visa holder is often the first to be deported or de-banked.

To understand why a temporary permit leaves you vulnerable, learn more about digital nomad vs citizen, why a visa is not enough, where we dissect why a visa is not enough for long-term safety.

The Caribbean “Big 5”: The Gold Standard

Despite the price hikes, the Caribbean remains the epicenter of the CBI world. St. Kitts and Nevis, Dominica, St. Lucia, Grenada, and Antigua and Barbuda offer the perfect blend of speed, cost-efficiency, and global mobility. However, in 2026, these programs have diverged in their target demographics.

St. Kitts vs. Grenada: The Titan Clash

For decades, St. Kitts and Nevis was the undisputed king, the “Rolls-Royce” of Caribbean passports. It still holds the title for the strongest travel document in the region and the most efficient acceleration process. However, Grenada has emerged as a fierce competitor for a specific type of investor: the business mogul eyeing the United States.

Grenada is the only Caribbean CBI nation with an E-2 Investor Visa treaty with the USA. This allows a Grenadian citizen to move to the US to run a business (with a substantial investment), bypassing the agonizing wait times of the EB-5 green card. Furthermore, Grenada offers superior family inclusion, allowing you to add siblings to your application, a massive advantage for large families.

Conversely, St. Kitts remains the choice for the ultra-wealthy who want pure “zero tax” status on worldwide income and the prestige of the oldest program in existence.

Deciding between these two giants depends entirely on your US ambitions. Check out the comparative guide about st kitts vs grenada citizenship for business to see which passport aligns with your corporate strategy.

The Truth About Processing Speeds

Marketing brochures will tell you “60 days,” but the reality of 2026 due diligence is different. With US and EU intelligence agencies now assisting in background checks, the average Caribbean file takes 4 to 6 months.

However, outliers exist. Vanuatu, in the Pacific, still processes applications with lightning speed, often under 60 days. But this speed comes with a “caveat emptor”—Vanuatu has lost visa-free access to the EU and UK due to this very laxness. Dominica, on the other hand, has strengthened its vetting to protect its visa-free treaties, resulting in slightly longer wait times but a much more valuable passport.

Don’t be fooled by outdated marketing. We tracked the actual approval timestamps for this year. Check out dominica vs vanuatu citizenship processing time to see the real “Fast-Track” myth debunked.

The “Active Citizen” Pivot: The 30-Day Rule

For years, the selling point of Caribbean citizenship was “Zero Residency.” You could become a citizen of a country you couldn’t find on a map. In 2026, under pressure from the OECS (Organization of Eastern Caribbean States) and Western partners, this is ending.

The “Genuine Link” Requirement

New harmonization laws are introducing a Physical Presence Standard.

- The Expectation: Applicants may soon be required to spend a minimum of 30 days in the country over a 5-year period to renew their passports.

- Why it Matters: This shifts the asset from a “commodity” to a “lifestyle.” You need to ask yourself: “Do I actually want to vacation in Dominica?” If the answer is no, you might find yourself unable to renew your passport in 2031.

St. Vincent: The New Contender

Keep a close watch on St. Vincent and the Grenadines. They are slated to launch a CBI program in 2026. Unlike the older programs, this one is being built from scratch with these new strict standards (interviews, residency) baked in, potentially making it the most “future-proof” (albeit stricter) option on the market.

The “Paper Shield” is Gone: Mandatory Interviews and Biometrics

One of the most jarring changes for applicants in 2026 is the end of the “paper-only” application. In previous years, you could buy a passport without ever speaking to a government official. That era is dead.

The Interview Mandate

As of 2026, mandatory interviews are the standard across all five Caribbean CBI nations. This is a direct result of US pressure to ensure that “bad actors” are not buying anonymity.

- Who is interviewed: The main applicant and all dependents over the age of 16.

- The Format: These are conducted virtually (via secure video link). You do not need to fly to the island, but you do need to show your face.

- The Content: It is not an interrogation, but a verification. They will ask about your source of funds, your business background, and why you want citizenship.

- The Implication: If you cannot speak English or if your story contradicts your paperwork, you will be rejected. This “human element” adds a layer of security that protects the reputation of the passport you are buying.

Biometric Data Collection

Alongside the interview, you must now submit full biometrics (fingerprints and facial scans) before approval. This data is shared with the JRCC (Joint Regional Communications Centre) in Barbados, which cross-references it against Interpol, FBI, and UK databases.

Why You Will Be Rejected [The “Kill List”]

Rejection rates have skyrocketed in 2026. It is no longer just about having a clean criminal record; it is about financial hygiene.

The Top 3 Rejection Triggers in 2026:

- Sanctions Exposure: It’s not just about whether you are sanctioned. If you own a business that traded with a sanctioned entity (even unknowingly), or if your source of funds touched a “grey-listed” crypto exchange, you are out. Automated AI vetting now catches connections 3 degrees of separation away.

- The “Cryptic” Wealth: If you cannot trace your Bitcoin back to the mining block or the fiat on-ramp from 2016, your application will die in compliance. “I bought it years ago” is no longer an acceptable explanation without wallet audits.

- Visa Denials: This is the Golden Rule. If you have ever been denied a visa to the UK, USA, Canada, or EU and have not successfully resolved it, you are automatically disqualified from all Caribbean programs. They share a common database.

Actionable Advice: Before applying, run a personal “Adverse Media Check” on yourself. If there is a negative news article about you from 10 years ago, fix your reputation before you apply.

Donation vs. Real Estate: The Financial Truth

When applying for citizenship, you generally have two choices: a one-time non-refundable donation to the government (The Sunk Cost) or an investment in government-approved real estate (The Asset).

The “Sunk Cost” Fallacy

Most agents push the donation route because it is easier. You pay $200,000 (plus fees), and the money is gone. It is simple, clean, and fast. However, for a savvy investor, throwing away a quarter of a million dollars is painful.

The Real Estate Reality

The real estate option usually requires a minimum of $300,000 to $400,000. On paper, this looks attractive: “I buy a villa, I get a passport, I sell the villa in 5 years, and the passport is free.”

- The Catch: In 2026, the ROI on CBI real estate is complex. “CBI Approved” properties are often marked up 30-50% above local market value, and you are often buying a “share” in a hotel rather than a physical deed.

- The Strategy: Invest only in branded 5-star resorts (like Park Hyatt or InterContinental in St. Kitts or Dominica). These assets hold value better than generic developments. The goal isn’t high profit; it’s capital preservation. If you can sell the asset for what you paid in 5 years, your citizenship effectively costs you zero (minus government fees).

Financial Sovereignty: Banking and Crypto

For many clients in 2026, a passport is not about travel; it is about banking. If you hold a passport from a “high-risk” jurisdiction (e.g., Iran, Russia, Pakistan, or even certain scrutinized emerging markets), you are likely “unbankable.” Tier-1 banks in Switzerland, Singapore, and the UK often auto-reject applicants based on nationality alone.

The “Unbankable” Problem

A second citizenship acts as a new “KYC (Know Your Customer) Identity.” When you approach a bank as a citizen of St. Kitts or Antigua, you are viewed through the lens of a Commonwealth citizen. This opens doors to global brokerage accounts, merchant processors like Stripe, and international wealth management platforms that were previously closed off.

If your business is suffering because you can’t access global payment rails, read the Caribbean citizenship banking solutions guide.

The Crypto Frontier

2026 has also seen the crystallization of “Crypto Citizenship.” While El Salvador made headlines with its Bitcoin legal tender law, its “Freedom Visa” citizenship program comes with a staggering $1 million price tag, payable in BTC or USDT. This is a vanity product for the “Bitcoin whales.”

Smart crypto investors are looking elsewhere. St. Kitts and Nevis, for example, has passed virtual asset laws that make it a haven for crypto-wealth preservation, even if they don’t accept Bitcoin directly for the passport donation (though many agents facilitate the fiat conversion).

Are you holding significant digital assets? You need to weigh the $1M El Salvador “flex” against the $250k St. Kitts utility. Read the crypto citizenship guide el salvador vs st kitts before you liquidate your portfolio.

Wealth Protection and Inflation

The silent killer of wealth in the 2020s has been inflation and currency devaluation. Holding all your assets in a single currency or jurisdiction is financial suicide.

Your Passport as an Inflation Hedge

A second citizenship allows you to practice “Geographic Arbitrage.” You can earn in a strong currency (USD, EUR, CHF) while legally residing in a jurisdiction with a lower cost of living and a territorial tax system. More importantly, it allows you to legally exit a tax residency that demands a percentage of your worldwide income.

For Americans, the “Plan B” passport is the necessary precursor to renunciation (should tax policy become confiscatory), but for citizens of volatile economies (Turkey, Argentina, Nigeria), it is a literal hedge against the collapse of their home currency. By obtaining a passport that grants access to stable banking jurisdictions, you insulate your net worth from domestic shocks.

Wealth preservation is about options. Learn why the Plan B passport inflation hedge is the most effective investment you can make against currency debasement.

The American Dilemma: The “Exit Tax” and Renunciation

A unique and accelerating trend in 2026 is the surge of Americans seeking second citizenships, not for travel, but for renunciation. The United States remains one of only two countries in the world (the other being Eritrea) that taxes its citizens on worldwide income, regardless of where they live.

For High-Net-Worth Individuals (HNWIs), the “Plan B” passport has shifted from a lifestyle asset to a financial necessity. However, exiting the US tax net is not as simple as handing back your passport. It is a minefield of “Exit Taxes” and inheritance traps that can wipe out 40% of your wealth if navigated incorrectly.

1. The “Covered Expatriate” Trap

Before you can renounce, you must determine if you are a “Covered Expatriate.” If you fall into this category, the IRS treats you as if you “sold” all your assets the day before you renounced.

In 2026, you are a “Covered Expatriate” if you meet ANY of these three tests:

- The Net Worth Test: Your global net worth is $2,000,000 or more (this threshold is not inflation-adjusted and captures more Americans every year).

- The Tax Liability Test: Your average annual US income tax bill over the last 5 years was more than $211,000 (2026 inflation-adjusted figure).

- The Compliance Test: You fail to certify that you have been fully tax-compliant for the 5 years preceding renunciation.

Note: Even if you are poor, missing a single form can trigger this.

2. Calculating the “Exit Tax” [2026 Rates]

If you are “Covered,” you pay an Exit Tax on the unrealized gains of your worldwide assets (mark-to-market).

- The Exemption: For 2026, the first $910,000 of gain is tax-free.

- The Hit: Anything above this exclusion is taxed at capital gains rates (up to 23.8%).

- The Danger Zone: Deferred compensation (pensions, stock options) and specific tax-deferred accounts (IRAs) are often taxed immediately as a lump sum distribution at ordinary income rates (up to 37%).

3. The “Death Tax” Surprise [The $60k Rule]

Most “Plan B” articles miss this critical point. As a US citizen, your estate enjoys a massive $15 million exemption (2026) before federal estate taxes kick in.

- The Trap: The moment you renounce, you become a Non-Resident Alien (NRA) for tax purposes. Your exemption for US-situs assets (US stocks, real estate) drops from $15 million to just $60,000.

- The Result: If you renounce but keep your portfolio in US ETFs or own a Miami condo, your heirs could face a 40% tax bill on those assets upon your death.

Strategy: You must liquidate or “wrap” US assets into foreign corporate blockers before you renounce.

4. The “Reed Amendment” and Future Travel

Can you ever go back? The “Reed Amendment” (1996) theoretically bars entry to anyone who renounces for tax avoidance.

- Reality Check: In practice, this is rarely enforced because the DHS cannot easily prove “tax avoidance” intent. However, you will no longer enter as a citizen; you will need a visa or ESTA, and you can be denied entry at the whim of a border agent.

- The “Name & Shame”: Your name will eventually be published in the Federal Register in the “Quarterly Publication of Individuals Who Have Chosen to Expatriate.” This is a public record.

5. The “Bridge” Strategy: Timing is Everything

You cannot renounce until you have a second citizenship in hand (otherwise, you become stateless, leaving you with no travel document and no consular protection).

The 2026 Renunciation Timeline:

- Acquire Second Citizenship (3-6 months): Secure a Caribbean or European passport.

- Asset Restructuring (1-3 months): Move assets out of your personal name into trusts or foreign entities to mitigate Estate Tax risks.

- The “Exit” Interview: Schedule an appointment at a US consulate (current fee: $2,350). Wait times in London or Bern can exceed 6-9 months.

- File Form 8854: The final “Expatriation Statement” filed with your last US tax return.

Critical Warning: Do not “Just Leave.” If you stop filing taxes without formally renouncing, you accrue penalties forever, and your passport can be revoked/denied renewal if you have “seriously delinquent tax debt” (over ~$62,000). You must exit formally.

The European Union: Is the Door Closing?

The “Golden Visa” era in Europe is in its twilight. 2026 has seen the closure or severe restriction of programs that were once wide open. Portugal has removed its real estate option (leaving only fund investments), Spain has axed its Golden Visa entirely, and the Netherlands has tightened its investor routes.

Golden Visa Status Report 2026

However, opportunities remain for the astute investor. Hungary has relaunched its “Guest Investor” program, which is currently the most attractive option in Europe, offering a 10-year residency for a real estate fund investment, with a path to settlement. Greece raised its minimums to €800,000 in prime areas (Athens, Mykonos, Santorini) but left a €250,000 “loophole” for the conversion of commercial properties to residential use.

Malta remains the only true “Citizenship by Investment” in the EU (the MEIN policy), but it requires a contribution of approx €690,000+ and a year of residency. It is an elite product for those who need a Tier-1 EU passport and have the liquidity to pay for it.

The window is closing fast. Check out the “Death Watch” list to see eu golden visa programs 2026 status and find out which doors are still slightly ajar.

The “Soft Block”: ETIAS & The End of Impulse Travel

In 2026, “Visa-Free” no longer means “Guaranteed Entry.” A massive shift has occurred in how Caribbean citizens enter Europe and the UK, moving from a passive system to an active pre-clearance model.

The ETIAS Trap [EU]

Starting late 2026, the European Travel Information and Authorization System (ETIAS) will go live. While not a full visa, it is a mandatory digital pre-screening.

- The Risk: Industry insiders fear ETIAS will be used as a “Soft Block.” While the EU may not formally revoke visa-free access for St. Kitts or Dominica (to avoid diplomatic fallout), they can simply “flag” CBI passports for “additional manual review” in the ETIAS algorithm.

- The Result: Instead of an instant approval, a CBI holder might face a 30-day “pending” status. The days of booking a flight to Paris on Friday for a weekend trip are over; you must now plan weeks in advance.

The UK ETA [Electronic Travel Authorisation]

As of February 25, 2026, the UK fully enforces its ETA scheme.

- The Impact: Even for transit, you need this digital permission. If you are a dual citizen (e.g., Nigerian + Grenadian), you must travel on your Grenadian passport and have the ETA linked to it. If you try to switch passports at the border to hide your original nationality, you risk a 10-year ban for deception.

Lifestyle and Future Proofing

Beyond money and travel, citizenship is about the quality of life for your family and the future safety of your lineage.

Education Arbitrage for Families

One of the most overlooked ROI factors of a second passport is education. International tuition fees in the UK, US, and Europe are astronomical, often 3x to 4x the rate paid by “domestic” students.

For example, a student with a Caribbean passport (which falls under the Commonwealth) may be eligible for certain scholarships in the UK or easier access to student visas. More directly, holding an EU passport (via Malta or a converted Golden Visa) grants access to university education in Europe that is often free or heavily subsidized. The savings on two children attending medical school in Europe vs. the US as “international” students can effectively pay for the entire citizenship cost.

Stop paying the “foreigner tax” on education. Discover how to leverage cheaper international tuition with a second passport.

The “Climate Exit” Strategy

In 2026, “Climate Migration” is no longer a buzzword; it is a real estate trend. Wealthy individuals are actively moving away from the “Global South” and equatorial zones where wet-bulb temperatures are becoming dangerous.

They are seeking “Climate Havens”, countries with water security, moderate temperatures, and resilient agriculture. New Zealand, parts of Canada, and Northern Europe are high on this list, but so are unexpected dual-citizenship-friendly nations like Austria or the cooler mountainous regions of Panama. Your second citizenship should be in a geography that complements, not replicates, the climate risks of your home country.

Is your “Plan B” location climate-resilient? Read the climate exit best countries to escape extreme heat to ensure you aren’t jumping from the frying pan into the fire.

Future-Proofing: Passing It Down [Jus Sanguinis]

You aren’t just buying a passport for yourself; you are buying it for your grandchildren. However, not all programs are equal when it comes to Citizenship by Descent.

- Restricted Descent: Some countries allow you to pass citizenship to your children, but their children (your grandchildren) might not get it automatically if they are born abroad.

- Unrestricted Descent: St. Kitts & Nevis and Grenada generally have stronger laws allowing citizenship to pass down multiple generations, effectively creating a permanent “safety net” for your family line.

Sibling Inclusion

If you want to protect your extended family today, Antigua & Barbuda and Grenada are the leaders. They allow you to include unmarried siblings (brothers and sisters) in your application. Most other programs (like St. Lucia) have stricter age limits or exclude siblings entirely.

Don’t leave your family behind. Check the specific rules on family inclusion and citizenship limits to see which countries allow you to bring siblings and parents.

Final Thoughts: The Architecture of Freedom

If there is one lesson for 2026, it is this: The window of opportunity is not closing, but the price of entry is rising.

We have moved past the era of “vanity passports.” Today, a second citizenship is a critical infrastructure. The walls are going up, from ETIAS digital borders to the $200,000 Caribbean price floor. In the world of global mobility, inaction is a decision to remain vulnerable.

Your goal isn’t just to “buy a passport.” It is to build a diversified portfolio where your banking, residency, and safety are not held hostage by a single government. The best time to secure your Plan B was five years ago. The second-best time is now, before the rules tighten further.

Don’t let your geography dictate your destiny.