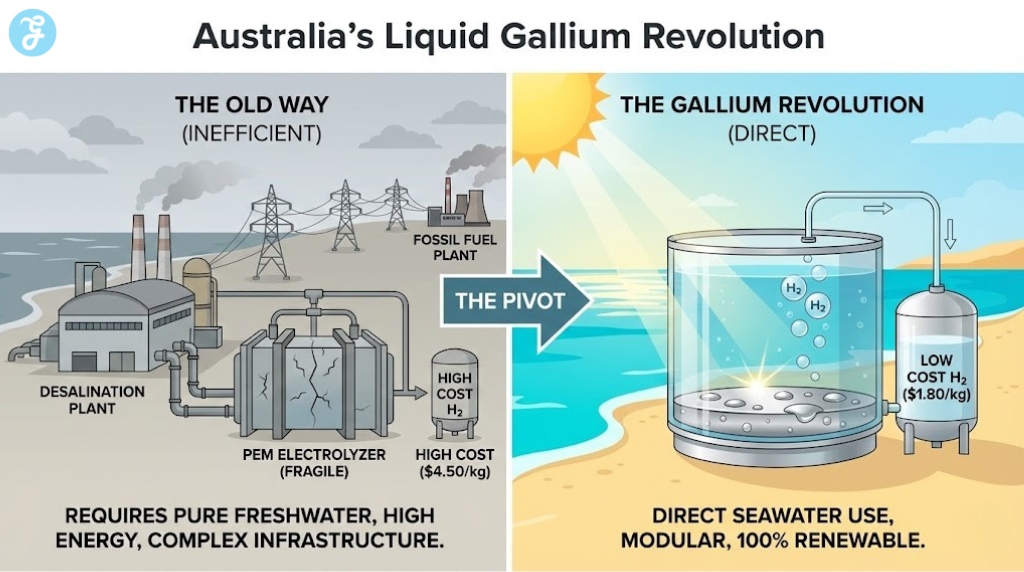

For decades, the “Green Hydrogen” dream has been anchored by a massive, salty anchor: the cost and complexity of turning seawater into something an electrolyzer won’t choke on. Conventional wisdom says you must desalinate first, then split. Australia’s newest breakthrough flips the script, using liquid metals to turn the ocean itself into a fuel tank.

Forget everything the “Hydrogen Evangelists” told you in 2024. They promised a world powered by green molecules, then quietly choked on the bill for massive desalination plants and crumbling membranes. Today, the game has changed. Australia’s Liquid Gallium Revolution isn’t just a laboratory curiosity; it is the final nail in the coffin for the fossil fuel status quo and the inefficient, fragile electrolysis systems that tried—and failed—to replace it. We are no longer just looking at a new way to make fuel; we are looking at the moment Australia stops being the world’s quarry and starts being its powerhouse.

The News Peg: Sydney’s Sunlight Breakthrough

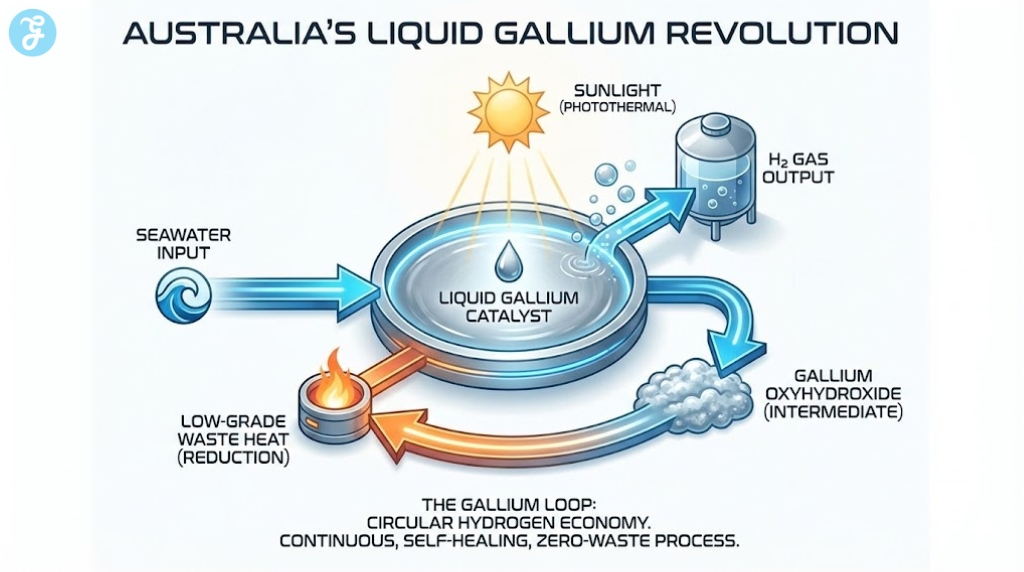

Yesterday, the University of Sydney dropped a scientific bomb that should have sent shockwaves through the boardrooms of every major energy company from Riyadh to Houston. Led by Professor Kourosh Kalantar-Zadeh, researchers successfully demonstrated a photothermal oxidation process that produces hydrogen directly from seawater using nothing but sunlight and liquid gallium.

By suspending tiny droplets of gallium in a saltwater bath, the team achieved a solar-to-hydrogen efficiency of 12.9%. To the uninitiated, that sounds like a small number. To those of us watching the 2026 energy markets, it’s a revolution. For context, the first silicon solar cells struggled to hit 6% efficiency for decades. This proof-of-concept isn’t just “competitive”—it’s a predator. It bypasses the need for multi-billion dollar desalination infrastructure, meaning we can finally produce fuel exactly where the resources are: the sun-drenched, salt-crusted coastlines of Western Australia.

Why Your Current Energy Portfolio is Obsolete

The “So What?” is simple: the traditional hydrogen economy was built on a lie of abundance that was actually a reality of scarcity. You cannot have a global hydrogen economy if you need ultrapure “Grade A” freshwater to make it. In a world facing 2026’s severe water stress, using drinking water to power trucks is a moral and economic failure.

Australia’s Liquid Gallium Revolution solves the three “Unsolvables” of the 2020s:

-

The Water Trap: We no longer need to build $200 million desalination plants before we even start producing a single kilogram of H2.

-

The Membrane Crisis: Standard PEM electrolyzers are notoriously finicky, with membranes that degrade the moment a salt ion looks at them sideways. Gallium doesn’t care about salt.

-

The Infrastructure Lag: This tech is modular. We don’t need “Mega-Hubs” connected to massive grids; we need sunlight and a tank of seawater.

Winners vs. Losers: The 2026 Power Shift

To understand the gravity of this shift, look at who stands to gain and who is currently clinging to a sinking ship.

| Stakeholder | The Old Way (Electrolysis + Desal) | The Gallium Era | Strategic Impact |

| Regional Australia | Dependent on massive capital inflow and grid expansion. | Localized production at ports; direct sea-to-ship fueling. | High Win: Revitalizes coastal ghost towns into energy hubs. |

| Middle East Oil | Attempting to pivot using massive, expensive Blue Hydrogen. | Threatened by low-CAPEX solar-thermal competition. | Loss: UAE and Saudi lose their desalination infrastructure advantage. |

| Global Tech Giants | Struggling with ESG targets due to water-heavy energy. | Direct, water-neutral green energy for data centers. | Win: Pure-green compliance without “water-washing.” |

| China (Refining) | Dominates the supply of electrolyzer membranes (PEM). | Gallium processing is the new bottleneck (which Australia owns). | Strategic Reset: Australia moves from “supplier” to “manufacturer.” |

The Economic Cost of Inaction

If we continue to play it safe, funneling taxpayer dollars into “Hydrogen Headstart” programs that rely on 2010-era electrolysis, we aren’t investing in the future—we’re subsidizing obsolescence. The 2026 market data is clear: the cost per kilogram of green hydrogen must hit $2.00 to kill diesel. Conventional methods are still hovering at $4.50 when you factor in the “Desalination Tax.”

The logic of Australia’s Liquid Gallium Revolution projects a path to $1.80/kg by 2028 because it eliminates the two most expensive parts of the value chain: water purification and electricity conversion losses. Every month we spend “studying” this instead of scaling it is a month we lose to competitors who aren’t afraid to break things.

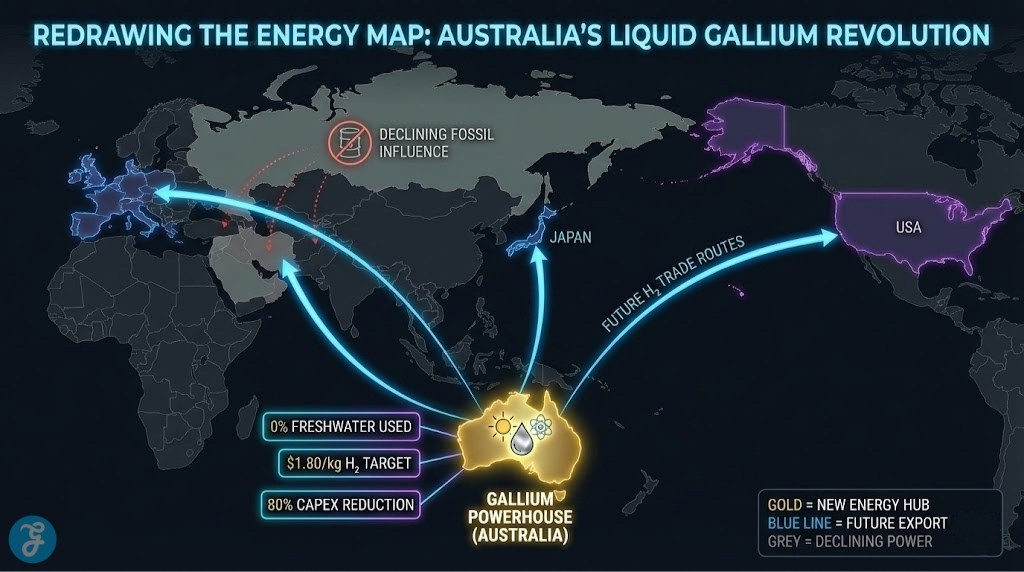

The Geopolitical Spine: Who Owns the Metal?

Here is where it gets provocative. Gallium is not a common mineral. For years, China controlled 90% of the world’s supply. But as of the 2026 Critical Minerals Strategy update, Australia has successfully retrofitted two major alumina refineries in Western Australia to extract gallium as a byproduct. We aren’t just the people with the “Sunlight and Seawater”; we are now the people with the “Secret Sauce.”

We are holding the cards for the first time in a century. By integrating this technology into our export strategy, we move from being a “hewer of wood and drawer of water” to the architects of the global energy interface. We aren’t just selling the gas; we are selling the catalysts.

The Cost of Inaction: 2026 vs. 2030 Projections

What happens if the Australian Government ignores this “liquid metal” path and stays married to traditional electrolysis?

| Metric | 2026 Status Quo (Inefficient PEM) | 2030 Projection (If We Fail to Pivot) | 2030 Projection (Liquid Gallium Integrated) |

| Production Cost (per kg) | $4.50 AUD | $3.20 AUD | $1.75 AUD |

| Freshwater Consumption | 15 Liters / kg H2 | 12 Liters / kg H2 | 0 Liters (Direct Seawater) |

| Global Market Share | 8% | 12% | 35% (Energy Superpower) |

| Carbon Intensity | 2.1kg CO2e (Grid-mix dependent) | 1.5kg CO2e | ~0kg (Solar Thermal Direct) |

The Counter-Punch: Addressing the “Efficiency” Skeptics

Critics—mostly those with vested interests in the multi-billion dollar electrolyzer manufacturing industry—will point to the 12.9% efficiency and sneer. They will say, “My PEM electrolyzer is 80% efficient!”

They are lying by omission.

They are measuring electricity-to-hydrogen efficiency. They aren’t counting the energy lost in generating that electricity, the energy lost in the transmission lines, or the energy spent desalinating the water first. When you look at the Sun-to-Hydrogen “Full Stack” efficiency, Australia’s Liquid Gallium Revolution is already outperforming the entire integrated value chain of its competitors.

Furthermore, 2026 research from the MERLin Group at UNSW has shown that liquid gallium isn’t just a reactant; it’s a circular catalyst. The gallium oxyhydroxide produced in the reaction is easily reduced back to liquid metal using low-grade waste heat—something Australia has in abundance. This isn’t a “consumable” process; it’s a hardware loop.

The Moral/Practical Solution: A Roadmap to 2030

We need to stop treating this as a “science project” and start treating it as a “State Secret.” Here is the roadmap:

-

National Gallium Reserve: Immediately declare gallium a strategic asset and restrict raw exports to favor domestic hydrogen reactor manufacturing.

-

The “Salt-Water Special Economic Zone”: Create a deregulated zone in the Pilbara where liquid gallium reactors can be deployed at scale without the 24-month environmental assessment lag.

-

Direct-to-Ship Integration: Mandate that all new “Green Iron” projects in the North West must utilize seawater-direct production to protect local aquifers.

2026 Fact Sheet: The Liquid Metal Landscape

This is what the liquid metal landscape looks like as of now in 2026:

-

Global Gallium Spot Price (Feb 2026): $650/kg (Up 40% YOY).

-

Aussie Production Target: 2,000 tonnes per annum by end of 2026.

-

Efficiency Milestone: 12.9% (Peak), with a 20% target by H2 2027.

-

Water Usage: 0.0% freshwater required.

-

Current Investment: $4.2 Billion allocated via the National Reconstruction Fund.

Global Benchmark: Comparing the Leaders

Who is actually winning the race to commercialize liquid metal splitting?

| Country | Technical Focus | Resource Status | Deployment Phase |

| Australia | Photothermal Liquid Gallium | Largest potential refined supply | Leader: Pilot site in Karratha. |

| China | Mass-market PEM Electrolyzers | High existing refinery capacity | Challenger: Shifting to gallium-doping. |

| Germany | High-pressure Storage Systems | Import dependent | Follower: Relying on AU/North Africa. |

| USA | Solid-state Hydrogen Storage | High R&D funding (DARPA) | Challenger: Researching gallium alloys. |

The Takeaway From Australia’s Liquid Gallium Revolution

The “Hydrogen Economy” was a beautiful idea that nearly died of its own complexity. Australia’s Liquid Gallium Revolution is the defibrillator it needed. We have the sun, we have the sea, and we finally have the metal. The only question left is: are we bold enough to own the technology, or will we wait for someone else to sell it back to us?

What Happens Next: Expect the first pilot “Sea-Tank” reactors to appear in the Pilbara by Q4 2026. If the efficiency hits 15%, the “Electrolyzer Era” is officially over.

Are you ready to bet against the ocean?