You got a denied claim from your health insurer, and you feel stuck. Your insurer must send a denial letter that explains why. This post shows you how to start the appeal process, gather supporting documentation, and request an external review if needed.

Ready to fight back?

Key Takeaways

- Read your denial letter. It lists the exact reason (coding error, lack of medical necessity, out‑of‑network care, or coverage max) and states your appeal deadline under HIPAA.

- Call your insurer and ask for claim details, required forms, and deadlines. Call your doctor’s office for a medical‑necessity letter. Write down names, dates, and case numbers.

- Gather all records: denial letter, original bills, EOB, Electronic Health Record notes, doctor’s notes, and test results. Redact private data per HIPAA before you send.

- Submit an internal appeal by the deadline (30 days for future care, 60 days for care already given, 72 hours for urgent claims). Fill out insurer forms, cite your plan sections, and attach new evidence.

- If you still get a denial, request an external review with your state insurance department or Medicare for federal claims. Track response times and keep all logs and call notes.

Understand Why Your Insurance Claim Was Denied

Your denial letter lists the exact reason for a denied claim. A health insurer might flag a coding error or say a service lacked medical necessity under your health insurance plan.

It could also note you saw an out-of-network provider or point out a coverage maximum you reached. The note also spells out your appeal process deadline and details on an external review right under the Health Insurance Portability and Accountability Act.

Study your Electronic Health Record and billing details line by line. Find any filing errors and gather supporting documentation like a doctor’s note or test report. Keep your health info off public feeds on a social network or microblogging site.

Lock down privacy settings before you click. Choose secure channels, not digital advertising links, when you submit your appeal.

Steps to Appeal a Denied Insurance Claim

Claim denials can feel like hitting a brick wall. You can fight back.

- Step 1: Understand the reason for denial. Review the denial letter and spot specific reasons like filing errors, service not covered, service deemed not medically necessary, out‑of‑network care, or a coverage maximum reached. Note the time allowed for an appeal and the appeal process details on the letter.

- Step 2: Call your health insurer. Speak with a claims representative and ask for a clear explanation of the claim denial. Gather appeal process info, required forms, deadlines, and jot down names, dates, and case numbers.

- Step 3: Consult your doctor’s office. Tell the billing team if info is missing or coding is wrong. Request a letter supporting medical necessity and any other documents. Ask the office to delay billing until the appeal process ends.

- Step 4: Gather supporting documentation. Collect the denial letter, original bills, service records, doctor notes, policy documents, dates from phone calls, and even social media posts from facebook or twitter groups on appeal tips.

- Step 5: Submit an internal appeal. Fill out the insurance forms, include the denial letter and claim number, and write a clear appeal letter. State the denied service, cite policy sections, outline your health condition, and attach new evidence.

- Step 6: Await a response. Expect 30 days for treatment not yet received, 60 days for care already rendered, and 72 hours for urgent claims. Track each timeline and set reminders.

- Step 7: File an external review. If the internal appeal is denied, request an independent external review as shown in your EOB or Explanation of Benefits. Contact your state insurance department or a review board to start the appeal process.

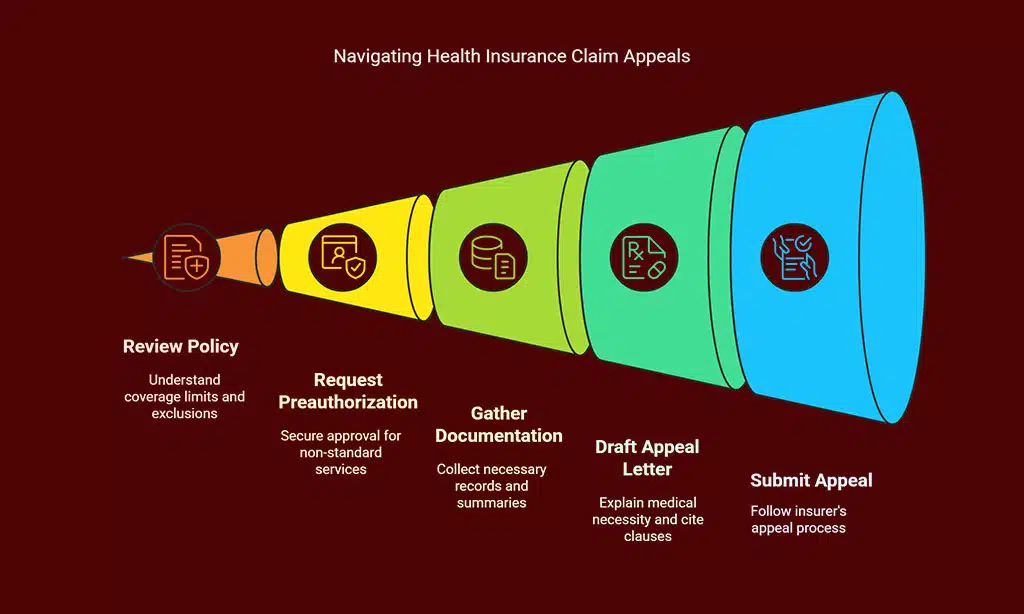

Tips for Strengthening Your Insurance Appeal

Good appeal tips boost your odds of winning a denied claim. You need clear proof and fast action.

- Review your health insurance policy for coverage limits and note any excluded services.

- Request preauthorization for services that may fall outside standard benefits.

- Gather your benefit summary, payment summary, and any other payer notifications.

- Draft a clear reconsideration letter that explains why your care met medical necessity and cite plan clauses.

- Add doctor notes, test results, and supporting documentation, redacting sensitive data under HIPAA rules.

- Track deadlines: 30 days for care not yet received, 60 days for past treatment, 72 hours for urgent claims.

- Contact CareFirst for tips on low‑cost care options or plan guidance.

- Follow the health insurer’s appeal process step by step in your policy guide.

- Log every call, email, and letter and note any claim denial, partial payments, or delays.

- Seek an external review or ask your state insurance commissioner’s office for help, or tap Medicare resources for federal claims.

Takeaways

You can fight a denied care request with clear proof. Gather your refusal letter, bill copies, and care notes. Show medical necessity with strong supporting documentation. Call your payer, file the appeal forms, and ask for an external review.

Keep your chin up and watch your case move ahead.

FAQs

1. What is a denied claim?

A denied claim is when your health insurer turns down your bill. You get a notice that states the claim denial. It may feel like hitting a wall, but it is just step one.

2. How do I start the appeal process?

Read the notice. It lists reasons for claim denial. Next, call your insurance carrier, ask about appeal process steps. Gather bills, records, doctor’s notes. Submit them by certified mail or by fax.

3. What is an external review?

An external review is an outside check by a third party. You can ask for it if the initial appeal fails. A fresh look can swing the decision your way.

4. How long does the appeal process take?

Your carrier must reply in about 30 days after you file the appeal process. An external review can add up to 60 more days. It may drag, so keep track, make calls.