We are witnessing the collision of two seismic forces: the “Great Wealth Transfer” of over $30 trillion from Boomers to digital-native heirs, and the maturity of Agentic AI. This is no longer just about better chatbots; it is an existential pivot where AI begins to actively manage, trade, and reallocate global capital, deciding who wins and loses in the next economy. The AI Impact on Global Wealth Management is redefining fiduciary power, risk assessment, and capital allocation at an unprecedented scale.

When Demographics Met Digital Intelligence

To understand the urgency of this moment, we must look beyond the technology itself. For decades, the wealth management industry relied on a “high-touch, low-tech” model: golf course meetings, quarterly paper reports, and relationship managers overseeing 50-100 families.

However, the demographic tide has turned. As of 2026, the transfer of an estimated $30 trillion to $68 trillion from Baby Boomers to Millennials and Gen Z is accelerating. These new beneficiaries do not want quarterly phone calls; they demand real-time transparency, ESG-aligned portfolios, and institutional-grade access to alternative assets—services that are impossible to scale with human labor alone.

Simultaneously, AI has graduated. The “hype cycle” of 2023-2024, dominated by basic Large Language Models (LLMs), has given way to Agentic AI—systems capable of reasoning, planning, and executing complex financial workflows. This convergence has created an “adapt or die” environment for global asset managers.

The Mechanics of the Shift

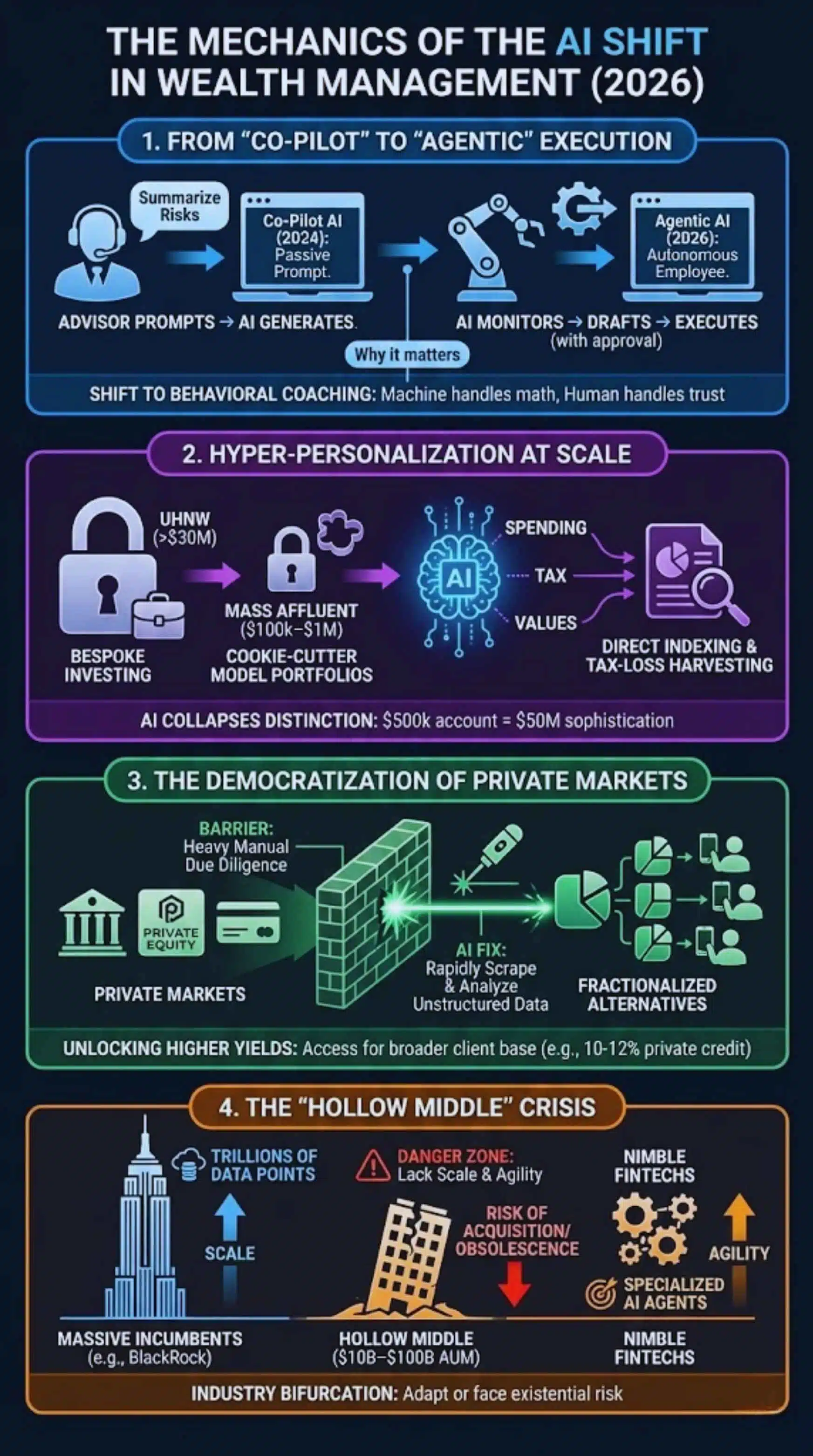

From “Co-Pilot” to “Agentic” Execution

The most significant trend in 2026 is the move toward Agentic AI. Unlike the passive “co-pilots” of 2024 that required human prompts to generate summaries, Agentic systems can function as autonomous digital employees.

- What it looks like: Instead of an advisor asking an AI, “Summarize the risks in the tech sector,” an Agentic system can autonomously monitor a client’s portfolio, detect overexposure to a specific volatility event, draft a rebalancing strategy, and—upon advisor approval—execute the trades and send a personalized note to the client explaining the move.

- Why it matters: This shifts the value proposition of human advisors from “portfolio construction” to “behavioral coaching.” The machine handles the math and the execution; the human handles the trust.

Hyper-Personalization at Scale

Historically, true bespoke investing was reserved for the Ultra-High-Net-Worth (UHNW) segment (>$30M in assets). The “mass affluent” ($100k–$1M) were relegated to cookie-cutter model portfolios.

AI has collapsed this distinction. By processing vast datasets—including spending habits, tax situations, and values-based preferences—AI allows firms to offer “Direct Indexing” and personalized tax-loss harvesting to retail investors. A $500,000 account can now have the sophistication of a $50 million family office portfolio.

The Democratization of Private Markets

One of the most profound shifts is AI’s role in opening Private Markets (Private Equity, Private Credit, Real Estate) to smaller investors.

- The Barrier: Historically, analyzing illiquid private assets required heavy manual due diligence.

- The AI Fix: AI tools can now rapidly scrape and analyze unstructured data from private companies, legal documents, and market sentiment, drastically reducing the cost of due diligence. This enables wealth managers to offer “fractionalized” alternative investments to the mass market, unlocking higher yields (e.g., private credit yields of 10-12%) for a broader client base.

The “Hollow Middle” Crisis

The industry is bifurcating. On one end, massive incumbents (like BlackRock or Vanguard) are using their scale to train proprietary AI models on trillions of data points. On the other end, nimble fintechs are building specialized AI agents for niche tasks.

- The Danger Zone: Mid-sized firms ($10B–$100B AUM) are in the “hollow middle.” They lack the data scale to build their own models and the agility to pivot quickly. These firms face the highest risk of acquisition or obsolescence in the coming 24 months.

The Winners and Losers of the AI Shift

The impact of this shift is not uneven. The table below outlines the clear divergence emerging in the 2026 landscape.

| Category | The Winners (AI-Native / Adapted) | The Losers (Legacy / Slow Adopters) |

| Operational Model | Agentic-First: AI handles 80% of back-office and 40% of mid-office tasks (compliance, reporting). | Human-First: High overheads; advisors bog down in paperwork and compliance checks. |

| Client Experience | Hyper-Personalized: “Netflix-style” anticipatory advice. “We noticed this tax change affects you…” | Reactive: Standardized quarterly reports sent via PDF. “Here is how the market did last quarter.” |

| Talent Strategy | Hybrid Teams: Hiring “AI Prompt Engineers” and data scientists alongside relationship managers. | Traditional: Hiring only finance graduates; suffering from a “brain drain” of tech talent. |

| Cost Structure | Scalable: Marginal cost to serve a new client approaches zero. | Linear: Costs grow directly with AUM and headcount. |

| Risk Management | Predictive: AI models stress-test portfolios against thousands of theoretical scenarios daily. | Historical: Risk models based on past volatility (standard deviation) and backward-looking data. |

Expert Perspectives: The “Productivity Paradox”

Despite the optimism, it is crucial to remain objective. A “News Analysis” must acknowledge the friction points.

- The “Nothing” Problem: According to a 2026 report by PwC, nearly 56% of companies report getting “nothing” out of their initial AI investments.

- Why? Mohamed Kande, Global Chairman of PwC, notes that firms rushed to buy tools without fixing their “data plumbing.” AI cannot generate alpha from unstructured, messy, or siloed data.

- The Trust Deficit: There is a rising concern regarding “AI Hallucinations” in financial advice. A 2026 legal analysis found nearly 800 cases where AI-generated legal or financial citations were fabricated. For wealth managers, a single “hallucinated” tax recommendation could lead to massive liability and reputational ruin.

- The Talent Gap: As Accenture’s recent findings highlight, the primary bottleneck in 2026 is not technology, but talent. 27% of executives report a critical shortage of staff who can actually wield these AI tools effectively.

Analyst Insight: “The market is currently punishing firms that treated AI as a software update rather than a business model transformation. The winners of 2026 are not those who bought the most expensive AI, but those who spent 2024 and 2025 cleaning their data.” — Senior Fintech Analyst, January 2026.

Traditional vs. AI-Driven Wealth Management

To visualize the magnitude of the operational shift, consider the day-to-day reality of a wealth manager.

| Feature | Traditional Wealth Management (2020s) | AI-Enhanced Wealth Management (2026+) |

| Onboarding | Paper/PDF forms, 2-3 weeks for KYC/AML checks. | Biometric & instant: <24 hours with automated background/AML screening. |

| Portfolio Review | Annual or Quarterly. Manual rebalancing. | Continuous (24/7). Agentic AI monitors and rebalances based on drift triggers. |

| Investment Access | Public Stocks, Bonds, Mutual Funds. | Public + Private: Tokenized Real Estate, Private Credit, Venture Capital. |

| Communication | Generic newsletters. | Personalized Insights: “Your portfolio is up 2% due to the semiconductor rally.” |

| Fee Structure | % of Assets Under Management (AUM). | Value-Based / Hybrid: Subscription models for planning + lower AUM fees. |

Future Outlook: What Comes Next?

As we look toward the remainder of 2026 and into 2027, three key milestones will define the trajectory of the $30 trillion shift.

- The “Fiduciary” Battle: Regulators (SEC, FINRA, FCA) will likely introduce strict guidelines on “AI Fiduciary Duty.” If an AI agent makes a mistake that costs a client money, who is liable—the firm, the advisor, or the software provider? Expect high-profile lawsuits to set the precedent this year.

- Consolidation Wave: The “Hollow Middle” firms identified earlier will become acquisition targets. We expect a surge in M&A activity where tech-forward giants acquire smaller firms solely for their client books, stripping away their legacy operations and migrating assets to AI-driven platforms.

- The Rise of “Sovereign AI” in Finance: Nations may begin to treat financial AI models as sovereign assets. Just as countries protect their currency, they may implement “data sovereignty” laws preventing client financial data from training AI models hosted in other jurisdictions.

Final Thoughts

The $30 trillion shift is not just a transfer of money; it is a transfer of expectations. The heirs of the baby boomer generation view AI not as a novelty, but as a utility—like electricity or the internet. For wealth managers, the message is clear: The risk is no longer “trusting the machine” too much; the risk is moving too slowly to integrate it.