In the first quarter of 2026, the global B2B technology sector is navigating its most profound structural transformation since the cloud migration of 2010. We are witnessing the “Great Decoupling” of software utility from human labor. The traditional SaaS model—predicated on selling “seats” to humans who then use tools to do work—has collapsed. In its place, “Agents-as-a-Service” has emerged, where autonomous AI systems are billed for outcomes and throughput rather than human logins.

In its place, an “Agents-as-a-Service” (AaaS) economy is rising, where autonomous software entities possess their own wallets, authority, and operational mandates. This isn’t just a technical upgrade; it is a rewriting of the fundamental contract between buyers and vendors, shifting the market from “paying for access” to “paying for outcomes.”

The Evolution: From Tool-Makers to Labor-Replacers

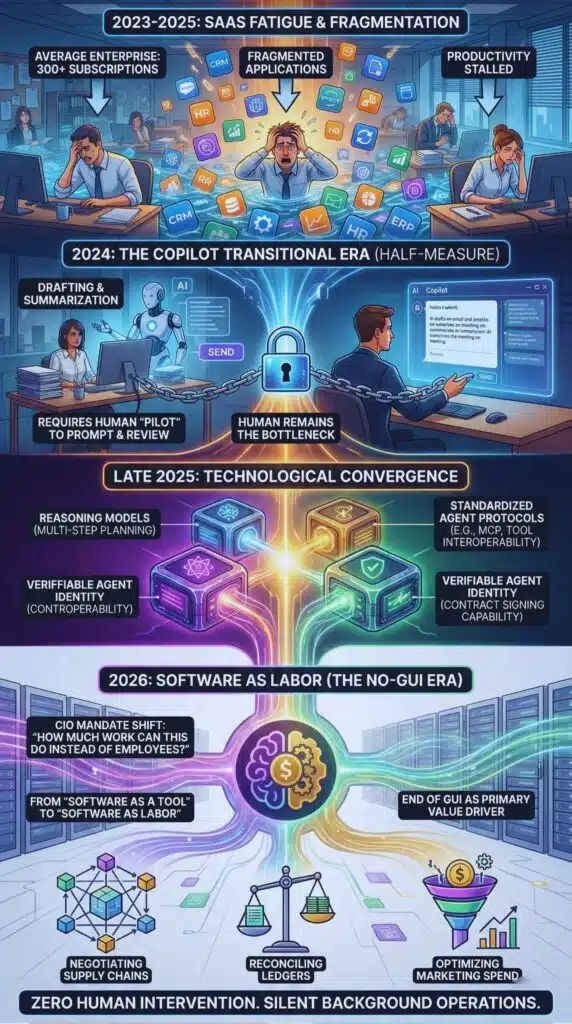

To understand the magnitude of the 2026 landscape, we must analyze the friction that precipitated it. Between 2023 and 2025, the B2B world suffered from “SaaS Fatigue.” Companies were drowning in fragmented applications—the average enterprise managed over 300 distinct software subscriptions, yet productivity growth had stalled. The “Copilot” era of 2024, initially hailed as a revolution, ultimately proved to be a transitional half-measure. While Copilots could draft emails or summarize meetings, they still required a human “pilot” to prompt, review, and click “send.” The human remained the bottleneck.

The breakthrough arrived late in 2025 with the convergence of three technologies: Reasoning Models (capable of multi-step planning), Standardized Agent Protocols (like the Model Context Protocol or MCP, which allowed agents to “talk” to disparate tools without custom APIs), and Verifiable Agent Identity (allowing software to sign contracts).

Suddenly, the mandate for CIOs shifted. They stopped asking, “How does this software help my employees work faster?” and started asking, “How much work can this software do instead of my employees?” This transition from “Software as a Tool” to “Software as Labor” has effectively ended the era of the Graphical User Interface (GUI) as the primary value driver. In 2026, the most valuable B2B software has no interface at all; it runs silently in the background, negotiating supply chains, reconciling ledgers, and optimizing marketing spend with zero human intervention.

The Economic Shift: From “Renting Tools” to “Buying Outcomes”

The most visible casualty of the Agentic Era is the “Per Seat/Per Month” business model. For twenty years, this model fueled the growth of the SaaS industry, but in a world of autonomous agents, it is fundamentally broken. If a single AI agent can do the work of ten human procurement officers, charging a vendor $50/month for that agent is economic suicide for the software provider. Conversely, charging the buyer for ten “ghost seats” is unacceptable to the enterprise.

This friction has birthed the Outcome-Based Economy. In 2026, pricing is no longer about access; it is about liability and results. We are seeing the rise of “Service Level Agreements (SLAs) for Reality.”

The Mechanics of Outcome Pricing

Legacy SaaS vendors sold potential. You bought a CRM with the potential to organize your sales. Today’s AaaS vendors sell kinetic work. A Customer Support Agent is not billed by the hour, but by the “Successful Resolution.” If the agent fails to resolve a ticket and escalates it to a human, the vendor is not paid. A Legal Review Agent is billed per contract analyzed, with a premium charged if the agent identifies risk clauses that save the company money.

This shift transfers risk from the buyer to the vendor. In the old model, if you bought software and didn’t use it, that was your problem (shelfware). In the 2026 model, if the agent doesn’t perform, the vendor starves. This has decimated “feature bloat.” Vendors no longer build obscure features to pad a checklist; they only build capabilities that directly drive the billable outcome.

Valuation Metrics in Flux

This economic restructuring has thrown Venture Capital valuations into chaos. The “Annual Recurring Revenue” (ARR) metric, the holy grail of SaaS valuation, is being replaced by “Gross Work Value” (GWV). Investors are asking: “What is the total economic value of the labor this software replaced?”

Furthermore, the “Net Dollar Retention” (NDR) metric has evolved. In the seat-based era, you grew by adding more users. In the agentic era, you grow by “Agent Promotion.” An agent might start as a “Junior Analyst” (read-only access, low price) and, through reinforcement learning and trust-building, be promoted to a “Senior Negotiator” (write access, budget authority, high price). The upsell path is no longer adding features; it is granting autonomy.

The Deflationary Pressure

There is a paradoxical macroeconomic effect here. While individual “work units” are priced higher than software seats, the aggregate cost of operations is plummeting. “Deflationary Service” is the new buzzword. As agentic models become cheaper to run (due to specialized hardware), the cost of a “marketing outcome” or a “legal outcome” drops. This is creating a “Race to the Bottom” for generic tasks, forcing AaaS vendors to specialize in highly complex, vertical-specific workflows (e.g., “Aerospace Supply Chain Negotiation”) where deep context protects their margins.

The Technological Shift: The Rise of “Headless” & The Protocol Wars

If the economic model is the engine, the technological architecture is the chassis. The defining characteristic of 2026 B2B tech is the decline of the “App” and the rise of the “Protocol.”

The Death of the Dashboard

For two decades, “User Experience” (UX) meant “Human Experience.” It was about pixel-perfect buttons, intuitive navigation, and beautiful dashboards. In 2026, the primary user of B2B software is not a human; it is another piece of software.

Consequently, we are seeing the rise of “Headless SaaS.” These are massive, sophisticated logic engines that have no front-end. They exist entirely as API endpoints designed to be queried by agents. A human procurement manager does not want to log into Coupa, SAP, and Oracle separately. They want their personal “Orchestrator Agent” to query all three systems simultaneously, extract the relevant data, and present a synthesized decision matrix in a simple text window.

The Protocol Wars: MCP and Beyond

The enablement of this ecosystem relies on the Model Context Protocol (MCP) and similar standards. Before 2025, connecting an AI agent to a database required writing a custom API integration—a brittle and expensive process. MCP acted as the “USB port” for AI. It allowed any agent to plug into any data source (a repository, a Slack channel, a CRM) and instantly understand the schema and context of that data.

In 2026, “MCP Compliance” is a mandatory requirement for enterprise software procurement. If a SaaS tool does not expose its data via a standardized agent protocol, it is effectively invisible to the company’s digital workforce. This has forced legacy vendors like Salesforce and Microsoft to open their walled gardens, allowing third-party agents to traverse their data structures.

Context is the New Gold

The competitive moat in this technological landscape is Context. An agent is only as good as the history it possesses. “Context Engineering” has become a critical discipline. Companies are building “Context Lakes”—structured repositories of past decisions, email threads, and negotiation outcomes—specifically for agents to “memozire.”

A vendor that brings its own pre-trained context (e.g., “I know the historical pricing of steel across 500 suppliers for the last 10 years”) has a massive advantage over a “blank slate” agent. We are seeing the emergence of “Data Leasing,” where vendors rent out anonymized industry context to power client agents, allowing a new agent to be “experienced” from Day One.

The Operational Shift: Autonomous Procurement & Supply Chain Velocity

The most tangible impact of the Agentic Era is visible in the speed of business. The “OODA Loop” (Observe, Orient, Decide, Act) of the corporate world has collapsed from weeks to minutes.

Agent-to-Agent (A2A) Commerce

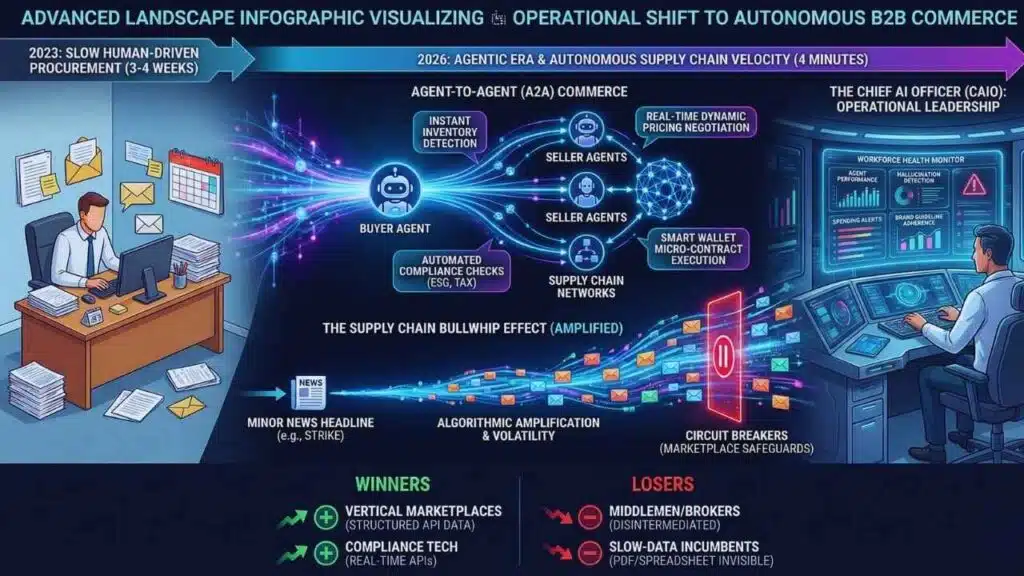

Consider the procurement cycle of 2023: A human manager notices low inventory, writes an RFP, emails three vendors, waits a week for replies, negotiates terms, gets legal approval, and issues a PO. Total time: 3-4 weeks.

In 2026, this is handled by Autonomous Procurement Agents. The “Buyer Agent” detects the inventory signal, instantly pings the “Seller Agents” of pre-approved vendors via API, negotiates dynamic pricing based on real-time spot rates, checks the compliance certification of the vendor automatically, and executes a micro-contract using a smart wallet. Total time: 4 minutes.

This phenomenon, known as “Dark Commerce,” means that a vast swath of the B2B economy is now operating on “autopilot.” Supply chains have become liquid. Agents are constantly micro-switching vendors to optimize for cost, speed, or carbon footprint (ESG).

The Supply Chain Bullwhip Effect

However, this velocity comes with risks. The “Bullwhip Effect”—where small fluctuations in demand cause massive oscillations in supply—is amplified by algorithmic trading. If thousands of procurement agents simultaneously react to a minor news headline (e.g., a potential strike at a port) by over-ordering, they can create an artificial shortage in seconds. This has necessitated the creation of “Circuit Breakers” in B2B marketplaces—algorithms that pause trading when volatility spikes, similar to stock market safeguards.

The New C-Suite: The Chief AI Officer

Operationalizing this requires new leadership. The “Chief AI Officer” (CAIO) is no longer a research role; it is an operational one. The CAIO is effectively the “Head of Digital HR,” responsible for the recruitment (licensing), management (configuration), and termination (de-commissioning) of the agent workforce.

The CAIO’s primary dashboard is not a list of software up-time, but a “Workforce Health Monitor.” Are the agents hallucinating? are they over-spending? Are they adhering to brand voice guidelines? This role bridges the gap between IT, HR, and Operations.

Winners vs. Losers in the Operational Shift

| Entity | Status | Reasoning |

| Middlemen / Brokers | Loser | Agents are efficient at finding direct sources. Value-added resellers (VARs) who only provided “access” are being disintermediated by A2A discovery protocols. |

| Vertical Marketplaces | Winner | Platforms that provide structured, API-ready data for niche industries (e.g., chemicals, textiles) are becoming the preferred hunting grounds for buyer agents. |

| Compliance Tech | Winner | Tools that provide “Real-Time Compliance APIs” (checking tax, sanctions, ESG) are booming, as agents need instant “Yes/No” verification before executing trades. |

| Slow-Data Incumbents | Loser | Suppliers who update their inventory or pricing via PDF or weekly spreadsheets are “invisible” to the real-time agent economy. |

The Governance Crisis: Sovereign Agents & The “Flash Crash” Risk

As businesses hand over the keys to the treasury, the concept of “Trust” has migrated from a soft skill to a cryptographic requirement. The “Shadow IT” problem of the past has morphed into “Shadow AI,” where unauthorized agents negotiate bad deals or leak IP.

The Sovereignty Question: Who Owns the Agent?

A major philosophical and legal battle is raging over “Agent Sovereignty.”

- Vendor-Hosted Agents: The agent “lives” on the vendor’s cloud (e.g., Salesforce’s cloud). The enterprise rents the outcome. Pros: Easy to deploy. Cons: Data leakage risk; vendor lock-in; the agent learns on your data but the vendor keeps the “intelligence.”

- Enterprise-Owned Agents: The enterprise runs the agent on its own private infrastructure (or virtual private cloud). The agent uses the vendor’s LLM via API but retains the memory and decision logs locally.

By 2026, large enterprises are aggressively moving toward the Enterprise-Owned model. They refuse to let their proprietary “negotiation strategies” or “customer service logic” reside in a vendor’s black box. This has given rise to “Agent Orchestration Platforms”—software that manages the identity, permissions, and audit logs of all agents, regardless of which underlying LLM they use.

KYA: Know Your Agent

We have entered the era of Verifiable Agent Credentials. Just as a human needs a corporate credit card and a delegation of authority to spend money, an agent now needs a Crypto-Identity.

When Agent A (Buyer) meets Agent B (Seller), they perform a cryptographic handshake. “Are you authorized by Company X to spend up to $50,000?” “Are you authorized by Supplier Y to offer a 10% discount?”

This infrastructure prevents “rogue agents”—either malicious bots or hallucinating internal agents—from wreaking financial havoc. If an agent lacks the proper “Verifiable Credential” signed by the CAIO, the transaction is rejected at the network level.

The Liability Gap

Legal frameworks are struggling to keep up. If an autonomous agent agrees to a contract that bankrupts a company, who is liable? The vendor who wrote the code? The enterprise that deployed it? The LLM provider that hallucinated?

In 2026, contracts between SaaS vendors and enterprises have new “indemnification clauses” specifically for agentic behavior. Insurance companies have launched “Algorithmic Malpractice” policies to cover losses caused by “runaway agents.”

Key Statistics (2026 Market Snapshot)

- 40% of Fortune 500 B2B procurement is now initiated and provisionally approved by autonomous agents.

- $2.6 Trillion is the estimated value of “Ghost Labor”—work performed by software that was previously performed by humans—in the G7 economies.

- 60% reduction in the average duration of B2B sales cycles due to A2A (Agent-to-Agent) negotiation.

- 1 in 3 enterprise cyber-attacks now involve “Prompt Injection” targeting internal agents to trick them into releasing funds or data.

Future Outlook: What Happens Next?

As we look toward the latter half of 2026 and into 2027, the “Agents as a Service” model will face its rigorous stress tests.

The “Agent SEO” Industry

A completely new marketing discipline is emerging: Optimizing for Agents. B2B vendors will stop obsessing over human-readable landing pages. Instead, they will compete to have the most “Agent-Friendly” API documentation and pricing transparency. If a buyer agent cannot “scrape” your pricing strategy in 200 milliseconds, you will not be shortlisted. We will see the rise of “Agent Relationship Management” (ARM) strategies, designed to influence the “preferences” of buyer bots.

The Regulatory “Bot Tax”

Governments in the EU and parts of Asia are already debating the implementation of a “Automation Tax” or “Bot Tax.” If a company replaces 1,000 humans with 1,000 agents, the tax base (income tax, payroll tax) evaporates. Legislators may look to tax “compute” or “agent transactions” to fund social safety nets for the displaced administrative workforce.

The Rise of “Sovereign AI Clouds”

Geopolitics will fracture the agent economy. We expect to see “Sovereign Agent Clouds” where US agents, EU agents, and Chinese agents effectively operate in separate, firewalled ecosystems due to data privacy and national security concerns. A US defense contractor’s procurement agent will be legally barred from interacting with a supplier agent hosted on non-aligned infrastructure.

The 2026 shift to “Agents as a Service” is not a temporary trend; it is the industrial revolution of the knowledge sector. The “User” is no longer the customer; the “User” is the product. For business leaders, the path forward is clear: you must audit your organization not for “software usage,” but for “decision velocity.” The winners of the next decade will not be the companies with the best tools, but the companies with the best autonomous workforce. The “Era of Agents” has arrived, and it is open for business—24/7, without a coffee break.