You may dread vet exam fees that punch a hole in your wallet when your dog needs care. The cheapest insurers for dog insurance include Pets Best, Embrace, and this fast claims processing plan.

We’ll break down coverage options, annual deductibles, reimbursement rates, and pet insurance discounts to help you find a wallet-friendly plan. Keep reading.

Key Takeaways

- Plans run $32 to $76.78 a month. Deductibles range $50–$1,000. Reimbursements run 50%–90%. Annual limits span $2,500–unlimited. Wellness add-ons cost $192 or $312 a year.

- Wait times vary by condition: 0–3 days for accidents, 14 days for illness, up to 6 months for cruciate tears. Claims clear in 1–30 days. Lemonade’s AI app pays in seconds; Healthy Paws pays within 24 hours.

- You can save 5%–10% with multi-pet, military, CareCredit, and Farmers discounts. Bundling pet, home, or auto policies can cut premiums further.

- Breed risk, dog age, and location drive your rate. Higher deductibles and accident-only plans lower costs. Compare quotes, ask your vet, and use money-back trials to pick the best plan.

What does Pets Best pet insurance cover?

Accidents, illnesses, hereditary conditions and cruciate ligament tears fall under the accident and illness plan, with a 3-day wait for accidents, 14 days for illnesses and hip dysplasia, and 6 months for cruciate tears (zero in Maine).

Policyholders pick $50 to $1,000 annual deductibles, 70%, 80% or 90% reimbursement rates and $5,000, $10,000 or unlimited annual coverage. Claims processing takes 3 to 7 days. Pets Best charges about $47.58 per month for dogs and $29.36 for cats.

CareCredit, Farmers, military and multi-pet discounts shave off 5%.

Two wellness plan tiers cover vet exam fees, vaccines, dental cleanings and prescription medication at $192 or $312 yearly. Plans include routine care, preventive screenings and pet insurance discounts in one bundle.

Independence American Insurance Company and United States Fire Insurance Company underwrite each policy. Pets Best ranks high among insurance companies for fast claims processing and flexible coverage options.

What are the benefits of Embrace pet insurance?

Embrace pet insurance offers flexible annual deductible choices from $100 to $1,000. You can choose a reimbursement percentage of 70%, 80% or 90%. Policies offer annual limits of $5,000, $8,000, $10,000, $15,000 or unlimited.

Sample premium for dogs runs around $62.17 a month.

Plans cover dogs in all 50 states plus D.C. and while you travel abroad for up to six months. Waiting periods run 14 days for illness, zero to two days for accidents and six months for certain injuries.

Embrace reimburses claims in 10 to 15 business days. Policyholders grab pet insurance discounts for military service, multi-pet and higher reimbursement percentages. Mobile apps let you file a claim fast and track reimbursements on the go.

Why choose Healthy Paws for dog insurance?

Healthy Paws ranks 4.1 on U.S. News for dog insurance. It costs about $64.71 per month. Owners pick deductibles from $100 to $1,000 and reimbursement rates between 50% and 90%. The accident and illness plan has unlimited annual coverage and no payout caps.

A mobile app lets pet owners file claims and get funds within 24 hours. Coverage begins in 15 days for illness, 0 or 15 days for accidents by state, and 30 days or 12 months for hip dysplasia.

Plans cover vet exam fees, diagnostic tests, and prescription medication. Policies include a 30-day money-back guarantee and accept dogs up to 14 years old, plus offer a multi-pet discount.

How does Lemonade pet insurance work for dogs?

Monthly costs start at $32 for a dog plan with a $5,000 annual cap. An unlimited option runs $48 per month. Policyholders pick from four deductibles: $100, $250, $500 or $750. The insurer covers 90% of eligible vet bills, up to $100,000 a year.

A 5–10% multi-pet discount trims premiums when you insure more dogs.

Customers enjoy a 4.9 out of 5 Trustpilot score based on 79,253 reviews. You get a 30-day money-back guarantee if the policy does not fit. AI-powered bots vet each claim via the Lemonade app.

Swift claims processing often delivers reimbursements in seconds. That B Corp, founded in 2015, donates unclaimed premiums to animal shelters.

What does ASPCA Pet Health Insurance offer?

ASPCA Pet Health Insurance gives pet parents flexible coverage options. Owners pick deductibles of 100, 250, or 500 dollars. They set reimbursement rates at 70, 80, or 90 percent. Annual limits range from 2,500, 4,000, 7,000, and 10,000 dollars.

You can pick unlimited coverage too. No age limit applies. Horses qualify for the same coverage. The company has insured over 600,000 pets. It processed 2.2 million claims so far. A 30-day money-back guarantee backs each policy.

Sample premiums start at 76.78 dollars per month for dogs. Cat plans start at 39.20 dollars. Plans can include routine care add-ons, behavioral therapy, and prescription meds. U.S. News rates this insurance 4.8 out of 5.

Founded in 1997, it sits underwritten by Crum & Forster. Pet owners can grab multi-pet discounts. They can use a simple online calculator for pet insurance quotes. The portal offers fast claims processing and clear vet exam fee coverage.

What makes Figo Pet Insurance unique?

Figo pet insurance stands out for its digital features. Launched in 2013, it earned an 8.8 score from Pet Insurance Gurus and a 9.3 popularity rating. The plan costs about $40.79 a month and covers 90 percent of vet bills with a $5,000 annual limit.

You get around-the-clock vet chat, a pet records mobile tool and a handy claims tracker.

Underwritten by Independence American Insurance Co, Figo processes insurance claims fast with its digital platform. Dogs get access to preventive care options like vaccines and checkups.

Mixed-breed dogs, purebreds, even exotic pets can get coverage. Shoppers comparing pet insurance quotes find a 9.1 value for money score and an 8.0 user review rating.

How can MetLife Pet Insurance protect your dog?

MetLife Pet Insurance plans run about $47.22 per month for dogs. They cover accidents and illness, reimbursing 90% of vet bills up to $5,000 per year. Little to no waiting period means your pup gets help fast.

Coverage options include routine care, exam fees, and alternative therapies.

You can protect up to three dogs on one policy and earn a multi-pet discount. It dates back to 1868 and comes backed by a major insurer. Fast pet insurance quotes pop up online, so you plan costs with no guesswork.

Then you file a claim fast thanks to a simple claims process and quick payouts. Holistic therapy, like acupuncture and chiropractic care, also gets covered.

What are the features of Nationwide Pet Insurance?

Nationwide Pet Insurance offers coverage in all 50 U.S. states. Dogs, cats, and exotic pets qualify for accident-and-illness plans. You can add wellness plans for routine care, dental illness, and vaccinations.

Annual deductible and reimbursement rate vary by policy. Most plans let you set an annual coverage limit and adjust your reimbursement rate. Multi-pet discount makes pet insurance quotes lighter on your wallet.

Underwriting details differ by plan and state. You can tailor coverage options to fit your budget and your pet’s needs. A user-friendly online claims portal speeds claims processing.

The portal lets you upload vet exam fees, medication bills, and therapy receipts. Pre-existing conditions may not qualify, so check policy terms before signing.

Why consider Pumpkin Pet Insurance for your dog?

Pumpkin Pet Insurance charges about $54.26 per month for dog plans. It pays back 90 percent of veterinary care costs after the annual deductible, up to a $10,000 annual limit.

Pet Insurance Gurus rates it 8.5 while users give it 9.2 for fast claims processing. Underwritten by U.S. Fire Insurance Company since 2020, it covers dental care, hereditary conditions and offers pet insurance discounts like a multi-pet discount.

Pros can get pet insurance quotes online in minutes.

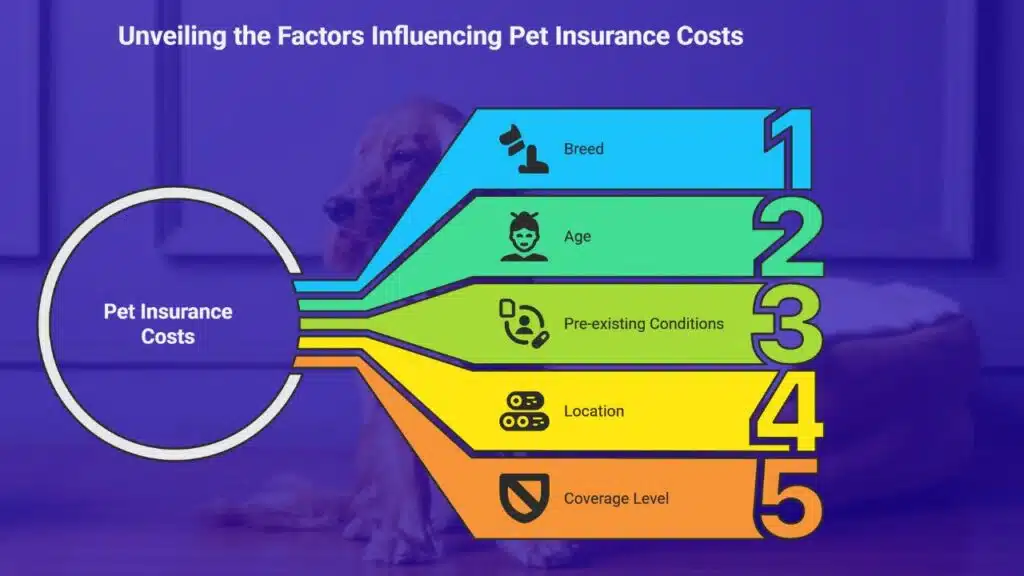

Factors That Influence Pet Insurance Costs

Your pup’s breed and age can nudge rates up or down, and your chosen annual deductible steers your bill. Pre-existing conditions and reimbursement percentage can shift your costs in a snap.

How does my dog’s breed affect insurance prices?

Giant hound breeds often draw steeper premiums for hip dysplasia and disk disease. Hybrid pups usually cost less because they dodge many breed-specific conditions. Pet insurance quotes rise when providers spot hereditary or congenital risks in purebreds.

Exclusions can appear for certain breeds under accident-only policies.

Annual deductible and reimbursement rate still shape total costs, but breed-based risk leads the pack. It stings to see high rates for your purebred pal. Some plans cover tooth and gum care or alternative therapies for flat-nosed breeds, yet charge more for those extras.

Fast claims processing does not cut costs if claim odds climb. Insurance carriers set rates on likely vet exam fees and past claims tied to each breed.

What role does age play in pet insurance cost?

Older dogs incur higher insurance premiums, as insurers spot more health issues in dogs past seven years. Pet insurance quotes rise steeply after each birthday, thanks to the risk of chronic conditions like hip dysplasia or heartworm.

Puppies get cheaper rates on accident and illness plans, due to lower veterinary care costs and few hereditary conditions.

Some pet insurance companies, like Healthy Paws and Lemonade pet insurance, cap enrollment at fourteen years, so they won’t take on senior pets. Firms may exclude age-related pre-existing conditions, or decline coverage if your dog hops past a set age.

Policies with higher annual deductible might ease costs for older pups, but premiums still climb as pets age.

How do pre-existing conditions impact insurance premiums?

Insurers ask pet owners to share vet exam records and wellness exam results before they issue a plan. Underwriters spot preexisting conditions in the medical history, so insurers refuse claims tied to those issues.

Annual deductibles and reimbursement percentages stay the same, they do not hike rates because of a dog’s past illness.

AKC Pet Insurance will cover curable conditions after 365 days without symptoms. Documentation often needs lab reports or vet notes to prove no prior disease. This step helps when you shop pet insurance quotes, but policies still deny claims for old ailments.

Does my location influence pet insurance rates?

Your address can affect pet insurance quotes. Companies pull data from 51 jurisdictions to set rates. Urban dogs face higher veterinary care costs, so premiums run higher there. Rural areas often get lower quotes.

Some insurers tweak prices each year based on local vet fees and cost of living. State laws can change available coverage options.

How does coverage level affect the price?

Coverage caps and annual coverage affect pet insurance quotes. Choosing unlimited coverage spikes monthly rates. Accident-and-illness plans cost more than accident-only policies. A 90% reimbursement rate hikes price versus 70%.

Lowering the annual deductible from $500 to $100 raises premiums. Adding wellness plans or exam fee coverage also adds cost. Some pet owners include alternative therapies or dental illness coverage.

Each change in policy features shifts your monthly bill.

How to Save on Pet Insurance

You can cut insurance bills by picking a higher deductible and scoring a pet savings if you cover two or more dogs. Use a cost calculator on a comparison site to match copayment and vet exam fees in minutes.

What discounts are available for pet insurance?

Pets Best pet insurance gives a 5% discount to military members, Farmers Insurance policyholders, and CareCredit users. Lemonade pet insurance offers a 5 to 10% multi-pet discount for pet parents with more than one dog.

ASPCA Pet Health Insurance does not offer a military discount. Some insurers also cut rates for assistance animals and animal-care staff.

Discounts for additional pets appear at most carriers. Assistance animal discounts grant extra savings. Animal-care worker discounts may require proof of employment.

Can bundling policies reduce costs?

Liberty Mutual offers bundling discounts on pet and other insurance products, so you can lower your yearly costs. Insurers combine home or auto with dog policies to shrink your bills.

You can compare pet insurance quotes with bundle offers to find pet insurance discounts. Discounts on other lines may trim your total expenses.

Bundling cuts paperwork and streamlines billing, so you get simple policy management. You still need to check coverage options and bundled limits. Plans vary by insurer, and not every company offers a bundle.

How does choosing a higher deductible save money?

Choosing a higher annual deductible cuts monthly pet insurance costs. Deductibles range from $50 to $1,000 at most insurance carriers. A $1,000 deductible plan can cost you about $20 less each month than a $250 plan.

It shifts more of your first veterinary care costs to you. That drop in premium stacks up over time, making pet insurance quotes seem friendlier.

Shopping different coverage options helps you pick the right level. Some carriers set deductibles per incident, others ask for one annual amount. Raising your deductible works best if your dog stays healthy.

This tweak makes affordable pet insurance within reach as you still get accident and illness plans.

Are there ways to lower premiums without sacrificing coverage?

Compare pet insurance quotes and coverage options across top pet insurance companies, like Healthy Paws or Lemonade. Use group policy savings or special promos at sign-up. Swap accident and illness plans for an injury-only plan if routine care doesn’t matter.

Raise your annual deductible to shrink the monthly fee. Drop riders, like dental illness coverage or behavioral therapy add-ons, that you won’t use.

Keep your canine fit and up to date on vet exam fees to avoid pricey claims. Healthy habits cut claims for pre-existing conditions and periodontal issues, so premiums stay low. Review your plan every year and tweak the yearly cap or out-of-pocket threshold with a coverage price estimator to lock in savings.

Tips for Choosing the Right Pet Insurance Plan

Use a quotation platform or coverage calculator to nail down deductibles, reimbursement rates, and wellness add-ons. Run it by your vet—they know the score on waiting periods, annual caps, and condition limits before you sign.

What coverage types should I look for?

Accident-and-illness plans offer the broadest coverage. Accident-only policies cost less and pay for injuries. Wellness or preventive care add-ons handle shots, exams, and routine care.

Behavioral therapy and dental illness coverage can join your plan. Some insurers toss in hereditary, congenital, or breed-specific condition coverage.

Compare coverage options for unlimited annual coverage to shield you from massive veterinary care costs. Vet exam fees often pop up, and some plans demand an extra fee add-on. Alternative therapies such as physical rehab and acupuncture help pets with chronic pain.

Balance annual deductible amounts with your budget and boost your reimbursement percentage. Hunt for pet insurance discounts or multi-pet discount deals to trim premiums.

How do I compare different pet insurance plans?

Assess your dog’s health and lifestyle. Gather pet insurance quotes from top providers.

- Check monthly premium quotes: Get sample costs, like $42 per month for a 3-year-old bulldog.

- Compare annual deductible options: Look at $100 to $1,000 choices.

- Examine reimbursement percentages: Plans pay 70% to 90% after deductible.

- Review annual coverage limits: Some offer unlimited coverage, others cap at $30,000.

- Note waiting period lengths: Expect 14 days for illness, three days for accidents.

- Inspect policy exclusions: Pre-existing conditions, hereditary conditions like IVDD, and behavioral therapy often face gaps.

- Assess wellness plan add-ons: Routine care plans may cover vet exam fees, dental illness coverage, prescription medication.

- Evaluate provider app features and claims processing: Apps from Lemonade pet insurance and Figo pet insurance deliver fast claims processing and pay back in two days.

- Check multi-pet discounts: Many companies offer 5% to 10% off for multiple pets.

- Compare provider ratings: U.S. News & World Report placed Healthy Paws first, insurance experts rank Embrace highly.

What questions should I ask before buying insurance?

Picking the right plan saves you stress and cash.

Knowing the right questions can guide your choice.

- Ask what waiting periods apply to accidents, illnesses, and hereditary conditions so you can schedule treatments without surprises.

- Check if vet exam fees, dental illness coverage, and alternative therapies like behavioral therapy or prescription medication fall under routine care or wellness plans.

- Find out if pre-existing conditions and hereditary conditions face exclusion or extra waiting periods under each pet insurance policy.

- Learn how to submit claims, what reimbursement rate you get, and how fast claims processing runs with a company like Healthy Paws or Lemonade pet insurance.

- Pin down the annual deductible and see if you can choose a per-incident deductible to lower your pet insurance quotes.

- Explore pet insurance discounts, like multi-pet discount, cash back, or loyalty perks from Pumpkin pet insurance or Embrace pet insurance, and ask if wellness plans can lower your rate to land more affordable pet insurance quotes.

- Confirm if your accident and illness plan offers unlimited annual coverage or caps payouts per condition or per year, so you don’t end up holding the bag on a big vet bill.

- See if the plan offers a money-back guarantee or trial period so you can test coverage without risk.

- Know which underwriter backs your policy, like United States Fire Insurance Company or Independence American Insurance Company, so you can feel confident if vet costs shoot up.

How important is the claims process and customer service?

Fast claims processing can save you stress after an accident. Fetch processes claims in as few as two days. ASPCA may take up to thirty days to approve a claim. Pets Best and Figo apps let you upload receipts with your phone.

Telehealth chat lets you ask a vet questions day or night.

Good customer service lifts an insurer’s score on Consumer Sentiment Index. High recommendation rates often match quick claims processing at top pet insurance companies. Some insurers offer direct vet pay, so you pay less at checkout.

You can find pet insurance discounts on multi-pet and wellness plans. Reading reviews helps you pick a company with great support.

Takeaways

Your dog deserves strong, yet affordable protection. You can set a low annual deductible and high reimbursement rate to cut bills. You may cover routine check-ups and accident and illness plans under one policy.

Many insurers offer multi-pet discount and fast claims processing. Now you can pick a plan with clear coverage options and peace of mind.

FAQs

1. How can I compare pet insurance quotes for my dog?

You can shop online, side by side. Look at Healthy Paws, Lemonade pet insurance, Figo pet insurance, Embrace pet insurance, MetLife pet insurance, Pets Best pet insurance, Independence American Insurance Company, United States Fire Insurance Company. Note the annual deductible, reimbursement rate, waiting periods, vet exam fees, and routine care cover.

2. Will a hereditary condition or pre-existing condition raise my cost?

Most pet insurance companies exclude true pre-existing conditions. Some cover hereditary conditions once your dog shows no signs for a set time. Check accident and illness plans, not accident-only policies.

3. What coverage options can I choose?

You can pick accident-only policies to handle one-off injuries. You can choose accident and illness plans for bigger bills. You can add wellness plans for routine care, behavioral therapy, alternative therapies, and prescription medication. Look for pet insurance discounts or a multi-pet discount if you insure more than one dog.

4. How does reimbursement percentage affect what I pay?

A 90 percent reimbursement rate means you pay 10 percent of approved veterinary care costs. A 70 percent rate means you pay 30 percent. Balance the rate against your annual deductible and your budget.

5. Is there unlimited annual coverage?

Yes. Some plans, like Healthy Paws, offer unlimited annual coverage. That means no cap on claims per year. It can be a lifesaver if your dog needs pricey treatment.

6. How fast is claims processing?

Fast claims processing is key. Pets Best pet insurance and Pumpkin pet insurance pay out quickly. Some process claims in days, others in hours. Filing via an app makes it go like a breeze.