Quiet hiring is back in Q1 2026 because many companies want growth without headcount growth. Hiring pipelines are slower, budgets are tighter, and AI is reshaping roles faster than job requisitions can keep up. So leaders are filling gaps by promoting and redeploying existing employees, then calling it strategy.

-

Key takeaways:

- Quiet hiring is less a “trend” than a response to a stalled hiring engine: job openings and hires are down, quits are low, and companies are operating in a low-hire, low-fire environment.

- Internal promotions are rising in priority because they are faster and lower risk than external hiring when uncertainty is high and skill needs are shifting.

- The real battle is employee engagement: done well, quiet hiring boosts retention and capability; done poorly, it looks like unpaid scope creep and triggers burnout.

- Skills-based workforce models and internal talent marketplaces are becoming the infrastructure of quiet hiring, turning “who you know” mobility into a measurable system.

- What comes next is a fork: either internal mobility becomes a durable operating model, or backlash forces companies back to selective external hiring once conditions loosen.

- Quiet hiring is less a “trend” than a response to a stalled hiring engine: job openings and hires are down, quits are low, and companies are operating in a low-hire, low-fire environment.

The Frozen Labor Market Behind Quiet Hiring’s Comeback

Quiet hiring is returning in Q1 2026 for a simple reason: many companies feel stuck between two unpopular options. Option one is hiring aggressively, which looks risky after the overhiring and whiplash of the early 2020s. Option two is cutting costs through layoffs, which damages morale, employer brand, and execution capacity. Quiet hiring offers a third path: keep headcount steady, but reshuffle capability inside the org.

The macro backdrop matters. Late 2025 and early 2026 data has increasingly described a job market that is not collapsing, but is not dynamic either. Open roles have eased, hiring is sluggish, and workers are quitting less. That combination creates a strange corporate psychology. Executives still want outcomes, but they do not want to fund bigger payrolls to get them. So they move work to where capacity exists, or where capacity can be created through upskilling.

A key detail is that “the market is cooler” does not automatically mean “hiring is easy.” Many employers report that the volume of applicants is up, but the match quality is not. That pushes companies toward internal fills, not because internal candidates are always perfect, but because internal candidates come with context. They know the systems. They know how decisions get made. They already have stakeholder trust. In a year where speed and certainty are valued, context becomes a form of capital.

There is also a Q1 rhythm to this. January marks the transition from annual planning to quarterly execution. If leadership says, “We are not approving broad headcount growth,” function leaders still need to deliver. That creates immediate pressure to promote from within, redeploy talent laterally, and build cross-functional “tiger teams” to cover gaps. Quiet hiring thrives in that planning-to-execution handoff.

Here is a snapshot of the labor market conditions that encourage this behavior. The point is not any single metric. The point is the overall direction: weaker hiring momentum, modest job creation, and reduced worker movement.

| Indicator | Latest Readings Entering Q1 2026 | What It Signals For Employers |

| Job openings (US JOLTS) | About 7.1 million in November 2025 | Less external demand, fewer urgent requisitions |

| Hires (US JOLTS) | About 5.1 million in November 2025 | Hiring is happening, but cautiously |

| Unemployment rate (US) | 4.4% in December 2025 | Labor market is softer, but not in crisis |

| Payroll job growth (US) | +50,000 in December 2025; 584,000 total in 2025 | Slower expansion reduces appetite for net-new headcount |

| Job openings to unemployed ratio | Around 0.9 in late 2025 | Worker leverage is lower; firms can “wait and see” |

This “wait and see” stance is the hidden fuel of quiet hiring. When companies postpone external hiring decisions, the work does not disappear. It gets redistributed. In Q1 2026, internal redistribution is increasingly being formalized as internal promotions and role expansions rather than treated as temporary patchwork.

Finally, AI adds a unique twist. In past slowdowns, companies postponed hiring because demand was uncertain. In 2026, they also postpone hiring because work design is uncertain. Leaders are asking, “Do we need a person, or do we need a workflow?” That uncertainty makes companies reluctant to lock in permanent headcount. Quiet hiring becomes the bridge between today’s needs and tomorrow’s redesigned roles.

Why Internal Promotions And Redeployment Beat External Hiring In 2026?

Quiet hiring is often framed as an HR story, but the real driver is economic logic. In a slower market, the cost of a mis-hire rises because teams are leaner and tolerance for ramp time is lower. Hiring externally can still make sense for scarce skills or strategic transformation, but for many mid-level and operational roles, internal moves look like the safer bet.

Internal promotions and redeployments offer four advantages that matter more in 2026 than they did in the peak hiring years.

First, speed to productivity. External recruiting takes time even when the market is healthy. In a cautious market, it can take longer because approvals are slower, job scopes are debated more, and interview loops expand as stakeholders try to reduce risk. Internal moves compress that timeline. Even when training is needed, internal candidates usually start with a running start because they already understand how the company operates.

Second, information quality. External hiring is a bet made with partial data. You can test skills and interview for judgment, but you cannot fully simulate how someone performs inside your specific systems and culture. Internal moves use richer information: performance history, collaboration patterns, and manager feedback. In a year when leaders want predictability, that information advantage grows.

Third, retention leverage. In a “stuck” job market, fewer people quit, but that does not mean they are satisfied. Many employees stay because leaving feels risky. Over time, that can turn into disengagement. Internal promotions and visible mobility pathways are one of the few levers companies can pull to convert “staying” into “staying and contributing.”

Fourth, cost structure. External hires often require higher offers, especially if pay bands have compressed or if the company underpaid existing staff in earlier years. Internal promotions still cost money if done correctly, but firms can often invest more efficiently by paying for scope expansion and upskilling rather than paying a premium for an unknown.

This is the comparison employers are making, even if they do not say it out loud.

| Factor That Leaders Care About In 2026 | External Hiring | Internal Promotion Or Redeployment |

| Ramp time | Slower, onboarding and trust-building required | Faster, context and networks already exist |

| Risk of mismatch | Higher, limited real-world signal | Lower, known performance and fit history |

| Total cost | Recruiting costs plus potential offer premium | Pay adjustment plus training and backfill planning |

| Cultural impact | Can add new ideas, but can disrupt team norms | Reinforces culture, can boost morale if fair |

| Workforce agility | Harder to change course once hired | Easier to reallocate roles and priorities |

| Employer brand | More visible growth hiring signal | Strong internal brand if mobility is transparent |

A subtle but important point: quiet hiring is not only “promote someone.” It is also “move someone.” Promotions are the headline because they are easy to understand, but many companies are using lateral redeployments, temporary assignments, and internal project marketplaces to fill gaps without changing titles. In Q1 2026, that shows up as employees doing different work than their job descriptions suggest, sometimes with new titles, sometimes without.

That is where the ethical line emerges. Quiet hiring is sustainable only if employees experience it as opportunity rather than extraction. If internal “promotions” become title changes without meaningful pay, authority, or workload design, then the strategy backfires. Employees do the math quickly. If the company’s message is “we believe in you,” but the reality is “we need you to do more for the same,” engagement collapses.

For employers, the practical challenge is backfill. Promoting internally solves one problem but can create another if the person’s previous work still needs to be done. In strong quiet-hiring systems, backfill is treated as a deliberate part of the move. In weak systems, backfill becomes an invisible tax on teams, and that tax shows up later as missed deadlines, quality issues, and burnout.

So the “why” of internal promotions in 2026 is not nostalgia for old-school loyalty. It is a risk-management strategy designed for an economy where growth is slower, work is changing, and leadership wants flexibility.

The Operating Model Shift: Skills, AI, And Internal Talent Marketplaces

Quiet hiring becomes powerful in 2026 because it is no longer just ad hoc. It is increasingly being built into systems. The shift is from an organization chart mindset to a skills and work marketplace mindset.

In the organization chart model, jobs are fixed boxes. Hiring is the main way to fill boxes. Internal movement happens, but often through informal networks, manager sponsorship, or politics.

In the skills marketplace model, the company treats skills as inventory and work as demand. People can move through projects, gigs, rotations, and internal postings that match skills to business needs. Promotions still matter, but mobility becomes more fluid and less tied to a single ladder.

This shift is happening because of two forces: skill mismatch and AI-driven work redesign.

Skill mismatch has become a structural feature of the labor market. Many roles now blend technical capability, cross-functional judgment, and communication skill. Employers can find candidates, but they struggle to find candidates who fit the exact combination. Internal candidates often already have two-thirds of the needed profile and can be trained for the rest.

AI-driven redesign adds urgency. Companies are automating tasks, not necessarily jobs. That means roles are being re-bundled. Some tasks disappear. New tasks appear. Workflows change. The “right” job description in February may not be the “right” job description by July. Quiet hiring, especially through internal mobility, lets companies iterate without committing to permanent headcount changes.

This is why internal talent marketplaces matter. When companies build a system where employees can be matched to projects and roles, quiet hiring becomes more transparent and more scalable. It also changes power dynamics. Employees gain visibility into opportunities beyond their immediate manager. That can reduce favoritism, but it can also create conflict if managers hoard talent.

A practical way to view quiet hiring in 2026 is as a menu of mechanisms. Each mechanism has a benefit and a risk, and the “best” choice depends on whether the organization prioritizes speed, fairness, or long-term capability.

| Quiet Hiring Mechanism Companies Use In 2026 | What It Solves | The Risk If Done Poorly | The Guardrail That Makes It Work |

| Internal promotion into a higher-scope role | Leadership gaps, succession, retention | Title inflation, pay compression, resentment | Clear criteria, meaningful pay and authority |

| Lateral redeployment into an in-demand team | Urgent capability shifts | “Career penalty” perception | Public career pathways and skills mapping |

| Short-term stretch assignment | Peak workload, new initiatives | Burnout, unpaid labor | Time-bounded scope, bonus or stipend, debrief |

| Internal project marketplace or gig board | Flexible staffing, faster matching | Manager hoarding, unfair access | Transparent postings, executive sponsorship, metrics |

| Targeted reskilling and certification | Long-term skill gaps | Training without opportunity | Training tied to real roles and internal placement |

Notice what is missing: “just do more.” The successful quiet hiring playbook still costs money. It costs pay adjustments, learning budgets, manager time, and tools. Quiet hiring is not a free lunch. It is a reallocation of investment from recruiting externally to developing and deploying internally.

A second key change in 2026 is measurement. HR teams are increasingly expected to quantify mobility and its impact. Internal fill rate, time to productivity, retention of internal movers, and engagement shifts after promotions are becoming board-level signals, not just HR dashboards. That is partly because talent has become a core execution constraint, and partly because investors and leadership want proof that headcount constraints are not harming growth.

AI can help, but it can also distort. Algorithmic matching can widen opportunity if it is well-designed and audited. It can also reinforce bias if it learns from historical patterns that favored certain backgrounds or networks. Companies that build internal marketplaces will need fairness checks, not just efficiency goals.

In Q1 2026, the companies leaning into quiet hiring are effectively making a bet: building an internal labor market will be faster and more reliable than waiting for the external market to “normalize.” That bet will pay off only if the internal market feels real to employees, not like a slogan.

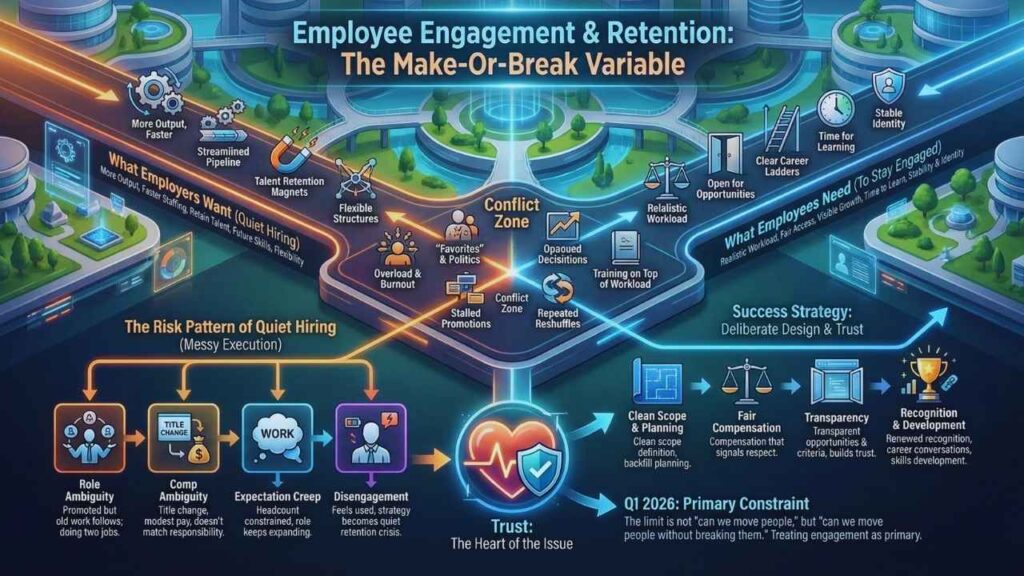

Employee Engagement And Retention: The Make-Or-Break Variable

Quiet hiring lives or dies on employee psychology. The same action can be motivating or demoralizing depending on how it is framed and compensated.

From the employee perspective, the promise of internal promotion is simple: growth, recognition, and increased pay for increased responsibility. When that promise holds, quiet hiringVisualize this section in an advanced landscape, a realistic and illustrative way, “Example: name the section.” Write less, only take the key points of this section. Don’t make any spelling mistakes. Design it properly.cide who gets opportunities, who gets protected from overload, and who gets visibility. If manager capability is weak, quiet hiring becomes messy fast.

The risk pattern is predictable.

First comes role ambiguity. An employee is “promoted” but their old work still follows them. They start doing two jobs.

Then comes comp ambiguity. They get a title change, maybe a modest increase, but not enough to match the added responsibility.

Then comes expectation creep. Because headcount is constrained, the role keeps expanding.

Finally comes disengagement. The employee feels used rather than developed, and the quiet hiring strategy turns into a quiet retention crisis.

Companies can avoid this, but only with deliberate design. Quiet hiring requires clean scope definition, backfill planning, and compensation that signals respect. It also requires transparency. Internal promotions that appear arbitrary or opaque damage trust even among employees who were not directly affected.

A useful way to frame the engagement challenge is to compare what employers want from quiet hiring with what employees need to embrace it.

| What Employers Want Quiet Hiring To Achieve | What Employees Need To Stay Engaged | Where Conflict Happens |

| More output without more headcount | Realistic workload and resources | Overload and burnout |

| Faster staffing through internal moves | Fair access to opportunity | “Favorites” and politics |

| Retain top talent | Visible growth pathways | Stalled promotions and unclear criteria |

| Build future skills | Time to learn and practice | Training added on top of full workload |

| Flexibility to redeploy | Stability and identity in role | Repeated reshuffles without support |

The heart of the issue is trust. Quiet hiring asks employees to accept change, take on more complexity, and sometimes move away from a comfortable identity in exchange for future benefit. If employees believe the company will reward them and protect them from burnout, they say yes. If they believe the company is simply trying to save money, they resist, either openly or quietly.

Retention in 2026 is also shaped by a paradox: fewer people are quitting, but more people may be mentally checking out. That is why quiet hiring is often paired with renewed attention to recognition, career conversations, and skills development. Organizations are trying to convert a cautious workforce into a committed workforce.

There is also an equity dimension. Quiet hiring can either broaden opportunity or narrow it. If opportunities are posted transparently and matched by skills, internal mobility can become more meritocratic. If opportunities are allocated through informal networks, quiet hiring can reinforce inequality and provoke backlash.

For Q1 2026, the companies most likely to succeed are those treating engagement as the primary constraint. In other words, the limit is not “can we move people.” The limit is “can we move people without breaking them.”

What Comes Next In 2026: Predictions, Risks, And Milestones To Watch?

Quiet hiring in Q1 2026 is not the end state. It is a transition strategy. The bigger question is where it leads.

One path is a mature internal labor market. In this path, companies build skills inventories, publish internal opportunities, fund reskilling, and normalize movement. Promotions become less like rare events and more like outcomes of a visible system. Employees gain clearer career maps. Managers are measured on talent development. Internal fill rates rise, and external hiring becomes more targeted, focused on truly scarce skills and strategic transformation.

The other path is backlash. In this path, quiet hiring is implemented as hidden workload expansion. Employees experience it as pressure. Promotions feel symbolic. Pay does not match scope. Internal opportunities feel political. When the external market loosens, the company sees a wave of exits, often among high performers who were asked to carry the most weight. Quiet hiring then becomes remembered as a short-term cost-control tactic that weakened culture.

Which path is more likely in 2026 depends on three milestones.

The first milestone is whether labor market “pause” conditions persist. If hiring remains sluggish and job openings stay constrained, companies will keep leaning on internal moves because they feel necessary. If hiring accelerates later in 2026, companies may return to selective external recruiting, especially in growth areas.

The second milestone is whether companies invest in mobility infrastructure. Quiet hiring can work at small scale through relationships. At enterprise scale, it needs systems: internal job boards, project marketplaces, skills taxonomies, and learning pathways tied to real roles. Without that infrastructure, internal movement becomes chaos, and employees lose faith in the process.

The third milestone is whether leadership addresses pay fairness. Quiet hiring often exposes the pay gaps created during the hiring boom years, where external hires were paid more than internal peers. If companies promote internally without correcting compression, resentment rises. If they correct compression, the strategy becomes expensive but sustainable. In 2026, many companies will try to thread this needle by using targeted adjustments, bonuses, and clearer leveling frameworks.

There are also broader implications beyond individual companies.

For job seekers, especially early-career candidates, a shift toward internal fills can make the market feel more closed. Fewer entry points means tougher competition and longer searches. That can push talent toward sectors still hiring, toward contract work, or toward alternative credentials that signal job readiness.

For staffing firms and recruiters, quiet hiring is both threat and opportunity. It reduces requisitions in some areas, but it increases demand for temporary and project-based staffing when companies cannot justify permanent headcount. It also increases demand for skills validation and workforce analytics.

For productivity, quiet hiring can be positive if it aligns people to the right work and removes friction. It can be negative if it overloads teams and increases rework, turnover, and absenteeism.

For innovation, heavy reliance on internal mobility can reduce the injection of outside ideas. The best model in 2026 is likely a hybrid: build internally for speed and retention, and buy externally for strategic capability and fresh perspective.

Here is a clear view of who tends to benefit and who tends to absorb the costs when quiet hiring becomes the default.

| Likely Winners In A Quiet Hiring Economy | Why They Benefit | Likely Losers In A Quiet Hiring Economy | Why They Lose |

| High performers with visible skills | More internal offers, faster scope growth | Early-career candidates | Fewer entry roles, fewer open postings |

| Employees in in-demand functions | More redeployment options | Workers in shrinking functions | Redeployment stress or stagnation |

| Companies with strong mobility systems | Faster execution without headcount growth | Companies using informal mobility | Politics, inequity, disengagement |

| Firms investing in upskilling | Capability builds over time | Firms treating training as “extra” | Burnout, wasted learning budgets |

| Teams with strong managers | Better protection from overload | Teams with weak managers | Talent hoarding, uneven workload |

So what should readers watch in 2026?

Watch internal fill rates and internal postings, not just external job ads. Companies may look “quiet” externally while making many moves internally.

Watch pay and title transparency. If employees see consistent, fair compensation practices, quiet hiring becomes credible.

Watch the rise of internal project marketplaces and skills passports. The companies investing here are signaling that quiet hiring is not temporary.

Watch employee engagement signals. In a low-hire environment, the leading indicator of future problems is often disengagement, not resignation.

The most important forward-looking takeaway is this: quiet hiring is a strategy to buy time while organizations redesign work for an AI-shaped economy. Promoting internally in Q1 2026 is the visible part. The deeper shift is that companies are trying to build a labor market inside the firm because the external labor market feels slower, noisier, and less predictable than it did a few years ago.

If companies treat that internal market as a real promise with real investment, quiet hiring can become a competitive advantage. If they treat it as a cost-saving maneuver, it will become a trust crisis waiting for the next hiring rebound.