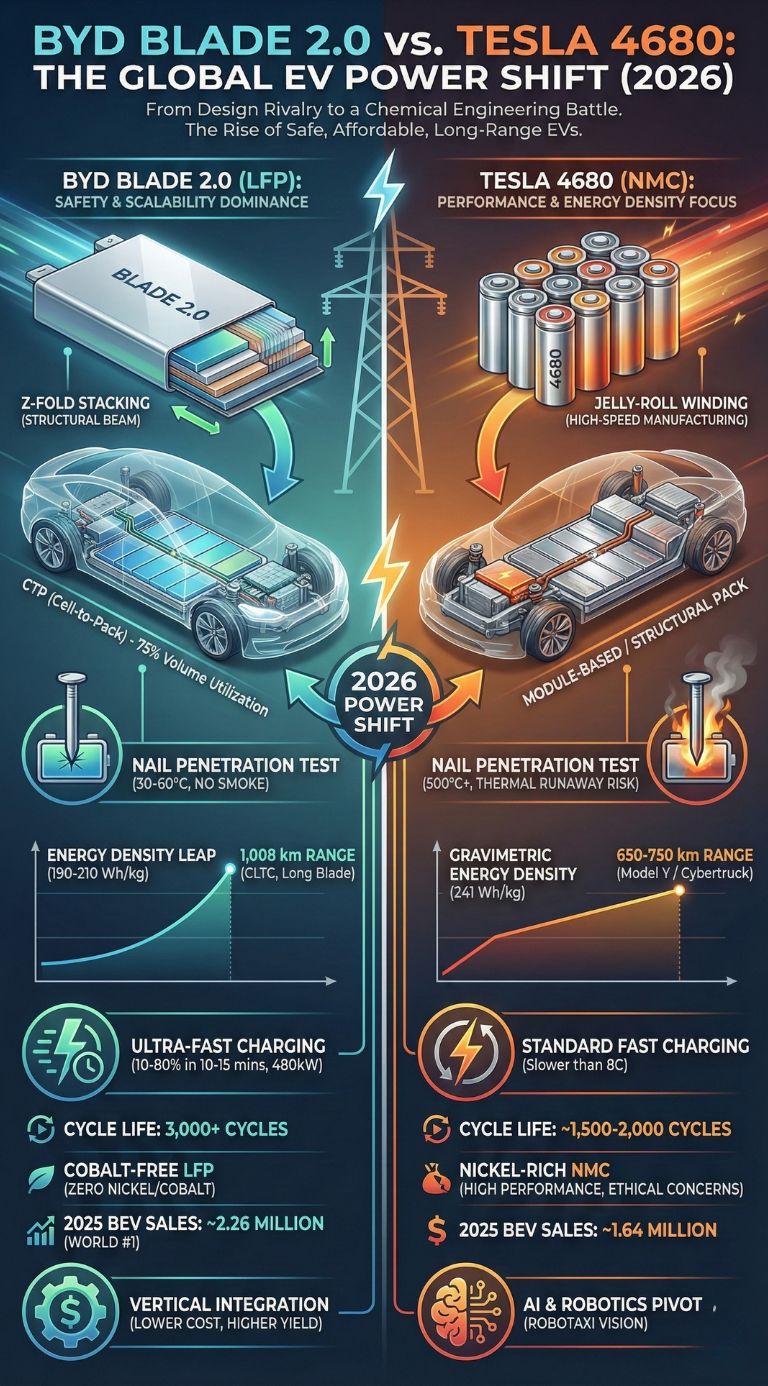

The unveiling of BYD’s Blade 2.0 battery at CES 2026 marks a definitive shift in the electric vehicle (EV) power structure. By bridging the gap between LFP safety and NMC energy density, BYD has challenged Tesla’s 4680 dominance, signaling an era where mass-market affordability and 1,000km range are no longer mutually exclusive.

The rivalry between BYD and Tesla has transitioned from a competition of car designs to a fundamental battle of chemical engineering. While the early 2020s were defined by Tesla’s cylindrical 4680 cells—praising energy density and performance—the mid-2020s have seen the rise of BYD’s prismatic Z-fold architecture. For nearly a decade, the industry accepted a binary trade-off: choose Lithium Iron Phosphate (LFP) for safety and cost, or Nickel Manganese Cobalt (NMC) for range.

BYD’s original Blade battery, launched in 2020, proved that structural innovation could make LFP viable for high-end sedans. Now, the 2026 deployment of the Blade 2.0 represents the “Cambrian Explosion” of solid-state-adjacent performance within a traditional LFP framework, effectively ending the range-anxiety era for the average consumer. This transition is not merely a technical update; it is a structural redesign of how energy is stored, managed, and monetized in the global transport sector.

The Architectural Duel: Z-Fold Stacking vs. Jelly-Roll Winding

The most significant technical divergence between BYD and Tesla lies in how the cells are physically constructed. Tesla’s 4680 battery uses a “jelly-roll” winding process, where electrodes are rolled into a cylinder. While efficient for high-speed manufacturing, this design creates inherent challenges in thermal management, as heat must escape from the center of a dense coil.

In contrast, the BYD Blade 2.0 utilizes a “Z-fold” stacking method. This involves precise lamination of electrode sheets in a flat, blade-like configuration. This structure acts as a structural beam within the battery pack itself, contributing to the vehicle’s overall rigidity. The 2026 iteration introduces nano-scale electrode reengineering that maximizes the active surface area, allowing for higher energy throughput without increasing the physical footprint.

| Performance Metric | BYD Blade 2.0 (LFP) | Tesla 4680 (NMC811) |

| Chemistry Type | Cobalt-Free LFP | Nickel-Rich NMC |

| Internal Structure | Z-fold Stacking | Jelly-roll Winding |

| Heat Generation | Low (Internal resistance optimized) | High (2.3x more heat than Blade) |

| Structural Role | Integrated Beam (CTP) | Module-based / Structural Pack |

| Cycle Life | 3,000+ Cycles | ~1,500 – 2,000 Cycles |

The Energy Density Leap: Crossing the 210 Wh/kg Threshold

Historically, LFP batteries struggled to surpass 160 Wh/kg, leaving them relegated to “standard range” models. The Blade 2.0 breaks this ceiling, achieving gravimetric energy densities of 190–210 Wh/kg in production units—a 30–40% increase over the first generation. This leap is primarily due to improved volumetric efficiency. By eliminating secondary parts and modules through Cell-to-Pack (CTP) technology, BYD has increased the volume utilization of the battery pack to an industry-leading 75%.

For the consumer, this translates into real-world range figures that rival or exceed luxury NMC-powered vehicles. The 2026 Han EV, equipped with the Long Blade 2.0, has demonstrated a CLTC range of 1,008 km. This milestone puts immense pressure on Tesla’s lineup, where the Model S Plaid (~650 km) was previously considered the gold standard.

| Battery Version | Energy Density | Max Range (CLTC) | Target Segment |

| Short Blade 2.0 | 160 Wh/kg | 450 – 600 km | Compact EVs (Dolphin/Atto 3) |

| Long Blade 2.0 | 210 Wh/kg | 800 – 1,000+ km | Luxury Sedans & SUVs (Han/U7) |

| Tesla 4680 (v2) | ~241 Wh/kg | 650 – 750 km | Model Y / Cybertruck |

Thermal Safety: The New Global “Nail Penetration” Standard

Safety remains the “North Star” for BYD. Lithium iron phosphate chemistry is inherently more stable than the nickel-rich chemistries used by Tesla. While NMC batteries can experience oxygen release and thermal runaway at temperatures as low as 200°C, the Blade 2.0 remains stable beyond 300°C.

At CES 2026, BYD showcased a live “Nail Penetration Test.” While standard high-nickel cells often erupt in smoke or open flames during puncture, the Blade 2.0 surface temperature only reached 30–60°C with zero smoke emission. This is reinforced by a new honeycomb reinforcement structure that allows the battery pack to withstand a 50-metric-ton mechanical crush, making it one of the most crash-resilient energy storage systems ever developed.

| Safety Test | Standard NMC Battery | BYD Blade 2.0 |

| Nail Penetration | Explosion/Fire (500°C+) | No Fire/Smoke (30-60°C) |

| Oven Heating | Ignition at 200°C | Stable beyond 300°C |

| Overcharge Test | Catastrophic Failure | Passed 260% Overcharge |

| Mechanical Crush | Internal Short/Leakage | Withstands 50-ton pressure |

Economic Fallout: The 2025 Sales Dethroning

The technical superiority of the Blade 2.0 is the engine behind a historic market shift. In 2025, BYD officially overtook Tesla as the world’s leading seller of pure battery-electric vehicles (BEVs). Data from late 2025 confirms BYD delivered approximately 2.26 million BEVs, surpassing Tesla’s 1.64 million units.

This shift is driven by vertical integration. BYD, which started as a battery manufacturer in the 1990s, controls its entire supply chain—from mineral processing to chip design. This allows BYD to produce the Blade 2.0 at a cost approximately 15% lower than its own first-generation cells and significantly cheaper than Western-manufactured batteries. While Tesla’s 4680 battery remains a high-performance benchmark, the sheer scalability and price competitiveness of the Blade 2.0 have allowed BYD to dominate the global mass market.

| 2025 Market Stats | BYD (Pure BEV) | Tesla |

| Total Deliveries | ~2,260,000 | ~1,636,000 |

| YoY Growth Rate | +28% | -9% |

| Manufacturing Cost | ~$80 – $90 per kWh | ~$100 – $110 per kWh |

| Global Expansion | 110+ Countries | Global (Traditional markets) |

Ultra-Fast Charging and the 8C Evolution

Charging speed was long considered the “bottleneck” for LFP adoption. The Blade 2.0 addresses this with compatibility for 800V high-voltage platforms. The “Short Blade” variant supports up to 8C charging, meaning it can technically replenish 10–80% of its state-of-charge (SOC) in just 10 to 15 minutes.

With a peak charging power of 480 kW, the energy replenishment efficiency of a Blade 2.0-equipped vehicle now rivals the time spent at an internal combustion engine (ICE) refueling station. This capability is critical for BYD’s expansion into the European and North American markets (via Mexico), where “charging friction” remains a primary deterrent for traditional car buyers switching to electric.

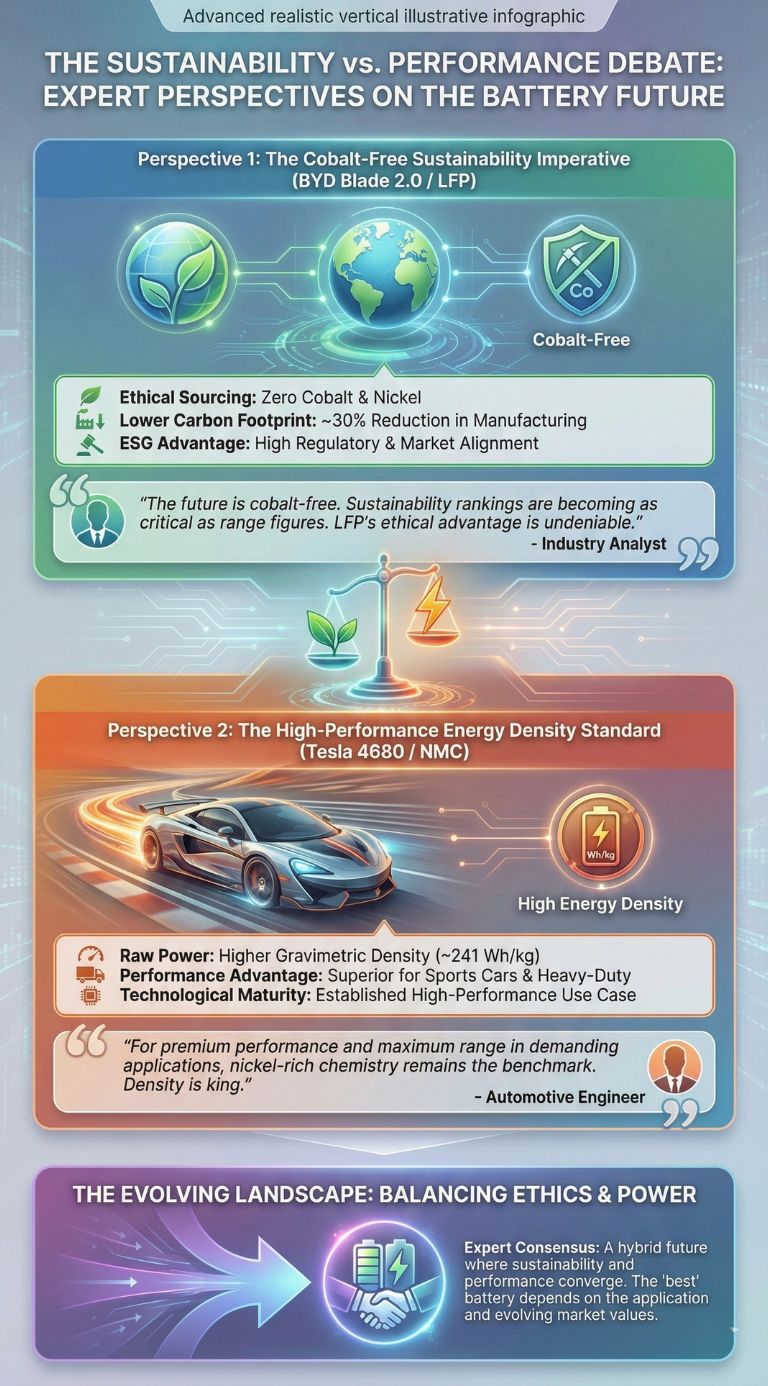

Expert Perspectives: The Cobalt-Free Sustainability Narrative

Analysts are divided on the long-term winner of this battery war. Some industry researchers highlight that Tesla’s 4680 still offers a higher gravimetric energy density (241 Wh/kg) than the Blade 2.0 (210 Wh/kg). For high-performance sports cars and heavy-duty trucks, the raw energy-to-weight ratio of Tesla’s cells remains superior.

However, the counter-argument focuses on the “Cobalt Crisis” and environmental ethics. The Blade 2.0 uses zero nickel and zero cobalt, eliminating the ethical concerns of cobalt mining and reducing the carbon footprint of manufacturing by an estimated 30%. Market indicators point toward a future where “Sustainability Rankings” become as important as “Range Figures.” In this landscape, BYD’s LFP-first approach provides a massive regulatory and ESG (Environmental, Social, and Governance) advantage.

Future Outlook: What Happens Next?

Looking ahead to late 2026 and 2027, we expect the Blade 2.0 to migrate into every segment of the BYD ecosystem, including its premium sub-brands like Yangwang and Fangchengbao.

Key Milestones to Watch:

-

God’s Eye ADAS Integration: BYD is now integrating its “God’s Eye” autonomous driving system with the battery management system (BMS) to optimize energy consumption based on real-time traffic and driving patterns.

-

European Local Manufacturing: The opening of BYD’s Hungary and Turkey plants will allow for local production of Blade 2.0 cells, bypassing EU tariffs and reducing logistics costs.

-

Vehicle-to-Grid (V2G): Given the 3,000+ cycle lifespan (over 1.2 million km), BYD is poised to lead in V2G applications, allowing EV owners to sell energy back to the power grid without fearing premature battery degradation.

-

Solid-State Bridge: BYD is reportedly using the Blade 2.0 architecture as a testing ground for solid-state electrolytes, with pilot production for all-solid-state batteries targeted for 2027.

Final Thoughts

The “Blade 2.0” is more than just a battery; it is the physical manifestation of BYD’s vertical dominance. While Tesla has pivoted its primary focus toward AI, Robotics, and the “Robotaxi” vision, BYD has doubled down on the hardware fundamentals of electrification. The result is a battery that offers premium range at a mass-market price point. As we head into the second half of 2026, the global automotive industry is witnessing the dawn of the “Chinese Moment,” where battery tech leadership has officially shifted East.