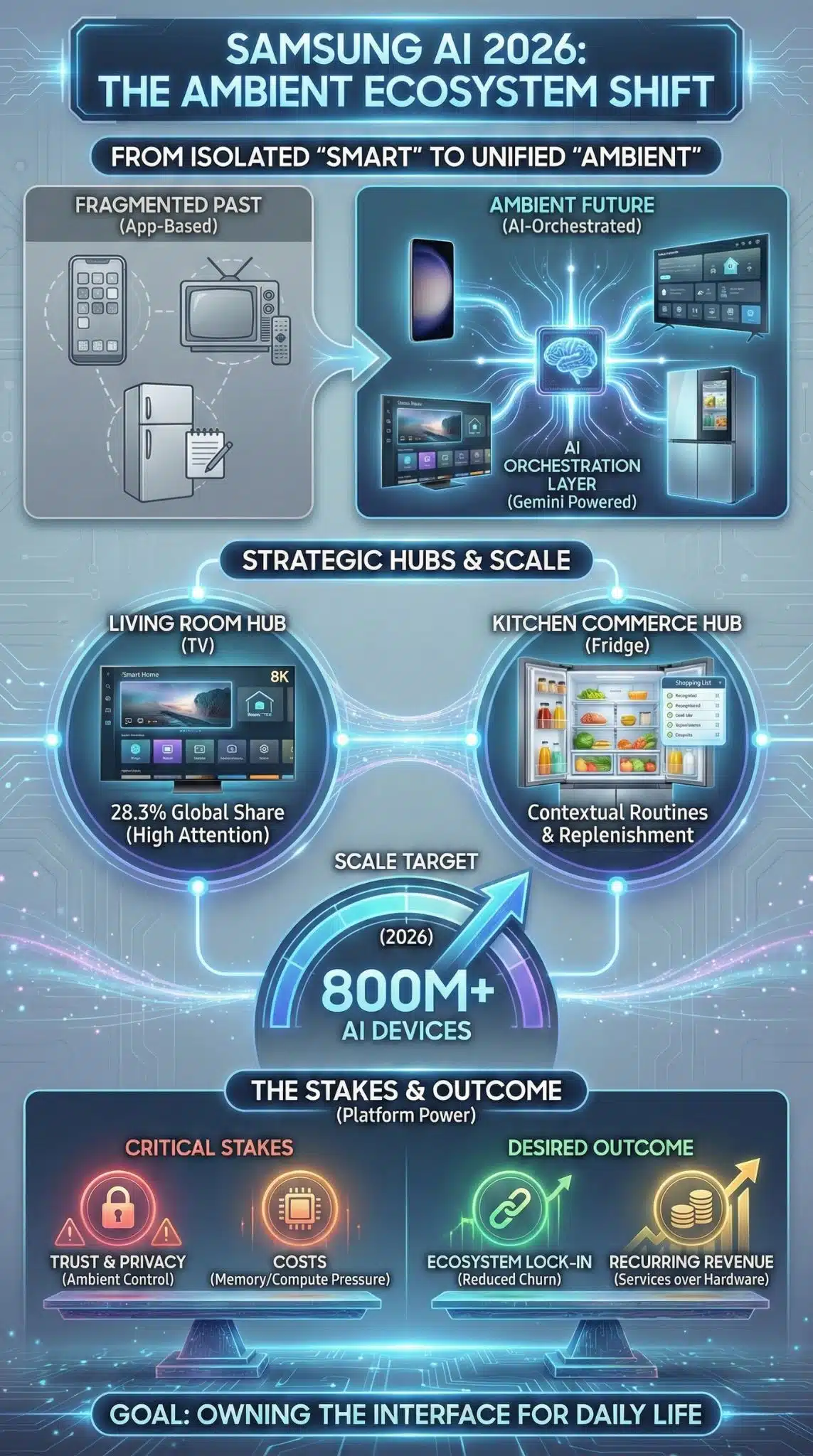

Samsung’s CES 2026 push to turn “Samsung AI” into a shared layer across phones, TVs, and appliances matters now because GenAI is shifting from app features to ambient, always-available help. If Samsung can make AI orchestration feel effortless and trustworthy, it changes platform power, data control, and device economics.

How We Got Here: From Smart Features To Ambient Intelligence

For years, “smart” consumer devices offered isolated upgrades. A TV got better recommendations. A phone got a smarter camera. A refrigerator added a screen and a grocery list. These improvements were real, but they rarely worked as one coherent system. The user had to bridge the gaps with apps, accounts, and manual routines.

Samsung’s CES 2026 message tries to move the market past that fragmentation. Instead of selling AI as a bundle of tricks, Samsung is positioning AI as a unifying layer that follows the user across rooms and screens. The strategic bet is that AI becomes the new interface for everyday life, like the operating system and app ecosystem were for the smartphone era.

That timing is not accidental. GenAI smartphones have moved quickly from niche to mainstream. The market is now large enough that AI is becoming a default expectation, not a premium novelty. At the same time, the smartphone industry remains mature and upgrade cycles are under pressure. When new “must-have” hardware breakthroughs are scarce, ecosystems and services become the growth lever. Samsung’s story is fundamentally an ecosystem story, told through AI.

Samsung also enters 2026 with a unique advantage and a unique burden. The advantage is breadth. Few companies ship top-tier products across phones, TVs, wearables, and major appliances at global scale. The burden is coherence. Breadth only becomes platform power if the experience feels unified and consistently valuable. CES is where Samsung is declaring it can deliver that coherence.

Key Statistics That Define The Stakes In 2026

| Metric | Latest Figure (As Of 2025–2026) | Why It Matters |

| Samsung’s target for AI-enabled Galaxy devices in 2026 | 800 million units | A scale play that could turn Samsung into one of the largest consumer AI distribution channels. |

| Samsung’s stated base of AI-enabled mobile devices by 2025 | 400 million units | Suggests growth comes from both new sales and wider software enablement across the installed base. |

| GenAI smartphone cumulative shipments | 500M+ by Q3 2025; 1B+ projected by Q3 2026 | Shows AI phones are crossing a threshold where AI becomes table stakes. |

| Global smartphone shipments forecast | 1.24B in 2025 (IDC forecast) | Highlights a mature market where differentiation and recurring revenue matter more. |

| Samsung’s global TV market share | 28.3% in 2024 (Omdia figure cited by Samsung) | Underscores the power of the living room as an AI surface at scale. |

Samsung’s CES 2026 Signal: AI As The New Interface Layer

Samsung’s core positioning is that AI should feel like a “companion” across devices. In practical terms, that means an AI layer that can interpret intent, use contextual signals, and take action across multiple products without the user micromanaging every step.

This is a profound shift in how consumer hardware competes. In the app era, the dominant layer was the operating system plus the app store. In the GenAI era, the controlling layer may be the agent and the orchestration system behind it. The agent is what users talk to. The orchestration is what actually makes life easier.

Samsung’s advantage is distribution across categories. If AI can be made consistent across those categories, Samsung can reduce friction for users in ways competitors cannot replicate without similar breadth. That can create switching costs that look less like “my devices are incompatible” and more like “my household routines live in this system.”

But Samsung’s pitch also carries a credibility test. Consumers do not reward grand ecosystem visions unless they translate into daily utility. AI must show up as time saved, errors reduced, and routines simplified. Otherwise it risks becoming a layer of complexity on top of products that used to be simple.

The Samsung AI Ecosystem Is A Bid For Platform Power, Not Just Better Devices

The biggest takeaway from Samsung’s AI ecosystem push is that it is not only about product features. It is about who owns the ongoing relationship with the customer.

In consumer technology, the most valuable position is the default interface. Whoever sits between the user and the rest of the digital world captures attention, data signals, and monetization options. Historically, that position was held by operating systems and search. AI agents could become the next “gatekeeper.”

Samsung’s AI ecosystem narrative is an attempt to claim that gatekeeper role across the home and the pocket. If successful, Samsung can shift from being “a company that sells devices” to “a company that sells outcomes,” such as easier household management, less wasted food, more personalized entertainment, and more automated routines.

That kind of shift matters financially. Hardware margins are volatile. Services and subscriptions are steadier. Ecosystems that increase multi-device ownership tend to reduce churn and increase lifetime value. Samsung’s AI story is, at its core, a story about defending and expanding lifetime value in a world where unit growth is harder.

The risk is that consumers may not grant Samsung that role if the AI “brain” feels like it belongs to someone else. Which brings the analysis to the most important dependency in Samsung’s 2026 narrative.

The Gemini Dependence, And The Question Of Who Owns The AI Relationship

A defining feature of Samsung’s 2026 AI strategy is how prominently it relies on Google’s Gemini. Reporting around Samsung’s 800 million AI-device target describes Galaxy AI features as largely powered by Gemini. Samsung’s appliance roadmap also highlights Gemini and Google Cloud integration, including what Samsung described as the first integration of Gemini into a refrigerator.

This partnership can be read in two ways.

The Optimistic Read

Samsung is being pragmatic. Building, training, and serving frontier AI models is capital-intensive and risky. By partnering with Google, Samsung can ship stronger features faster and keep up with rapid model improvement cycles. Consumers benefit from a more capable assistant now, rather than waiting for Samsung to build everything in-house.

Samsung can still differentiate through:

- Device integration quality

- On-device components and privacy choices

- The UX layer across SmartThings, TVs, and appliances

- The reliability of automation and memory across contexts

The Strategic Risk

The AI era rewards whoever owns the “assistant brand” in the user’s mind. If consumers perceive the most valuable layer as “Gemini,” Samsung risks becoming the premium hardware wrapper around someone else’s platform. That would echo earlier eras where Android OEMs struggled to own the software relationship.

This matters because AI is more intimate than earlier software layers. It can become the place users ask for advice, run routines, and coordinate purchases. The more AI becomes conversational and agentic, the more brand power concentrates around the perceived intelligence source.

Samsung’s challenge is to keep the partnership while ensuring Samsung remains the primary orchestrator. If Samsung cannot do that, it may win device share while ceding the most valuable long-term relationship layer.

The Home Is The Next AI Surface, And TVs And Fridges Are Strategic

It is easy to dismiss AI refrigerators as gimmicks. That would be a mistake. The strategic value of appliances and TVs is not novelty, it is placement and context.

The Living Room Advantage

Samsung’s TV scale gives it a major edge. Samsung cites Omdia data showing a 28.3% share of the global TV market in 2024 and a 49.6% share in the premium segment above $2,500. That is massive distribution in a high-attention environment.

The living room is where entertainment, gaming, family routines, and in many households, shopping decisions converge. A TV that becomes a home dashboard or an ambient assistant could evolve into a platform for:

- Cross-device controls

- Personalized media discovery

- Household scheduling and reminders

- Commerce integrations tied to content and interests

The Kitchen As A Commerce Hub

Samsung’s AI Vision announcements for refrigerators point to a longer-term play: understanding what is in the home, what is being consumed, and what should be replenished. Samsung has described existing on-device food recognition and the plan to expand recognition and tracking with Gemini integration.

The kitchen is where routine decisions happen daily. When an appliance can reliably track inventory and preferences, it can influence:

- Meal planning

- Food waste reduction

- Grocery purchasing pathways

- Brand preferences and promotions

This is why “smart home AI” is becoming competitive. It is not just about convenience. It is about who becomes the trusted intermediary for household consumption.

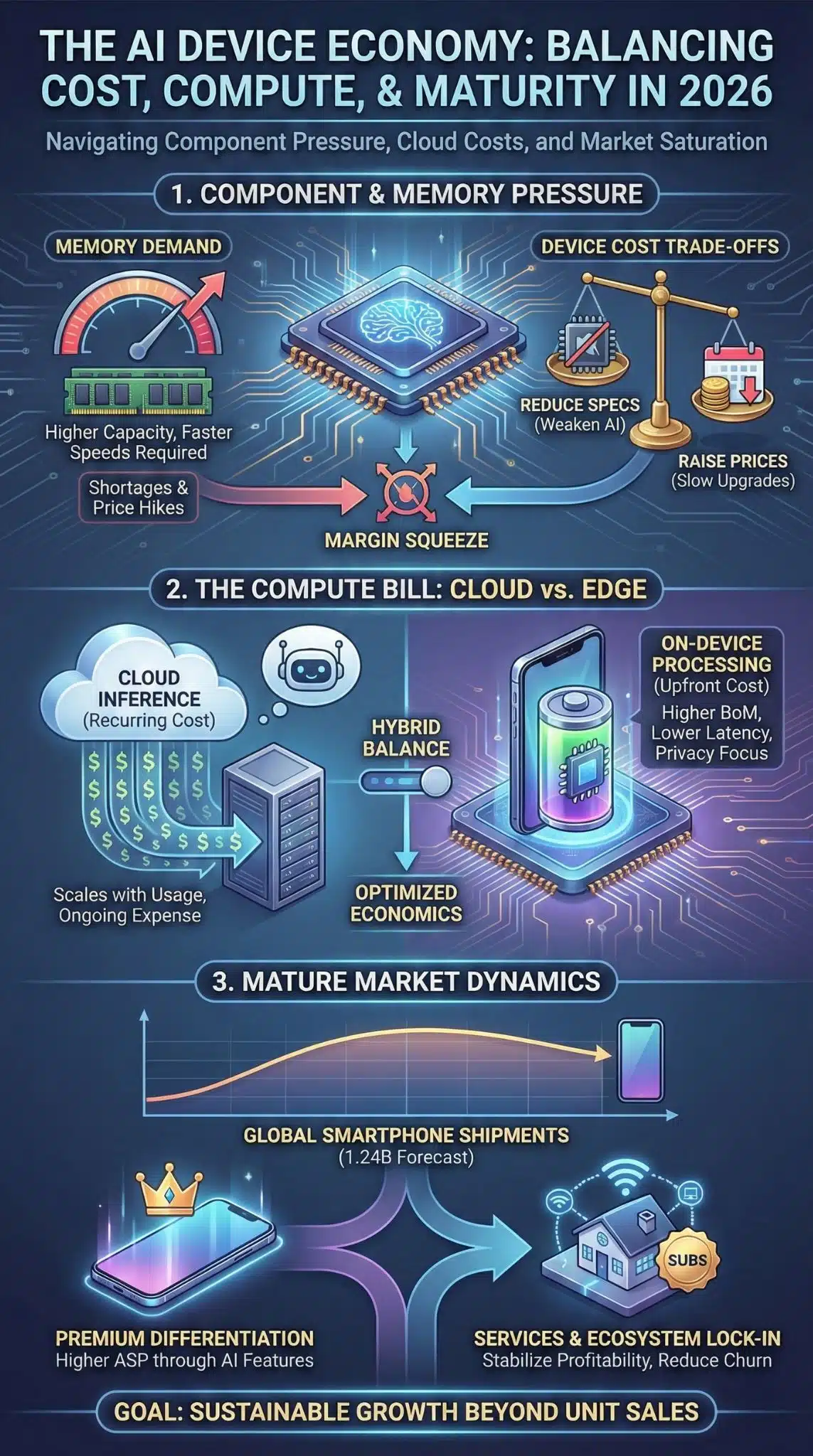

The Economics Of AI Devices, Memory Costs, And A Mature Smartphone Market

Samsung’s AI ecosystem strategy also has hard economic constraints. AI increases costs in two major ways: components and compute.

Component Pressure

On-device AI often requires more memory and better chips. Reporting around Samsung’s AI push has pointed to a memory chip shortage and broader memory price pressure, which can raise device costs and influence pricing.

If memory and component costs rise, Samsung faces trade-offs:

- Keep prices stable and reduce specs, which can weaken on-device AI performance

- Raise prices, which risks slowing upgrades

- Segment features so premium models carry heavier AI workloads

Compute Pressure

Cloud-backed AI features can reduce on-device requirements, but they introduce ongoing inference costs. The more users rely on agent-like features, the more cloud costs can expand, unless Samsung can shift more work to on-device processing or negotiate favorable cloud economics.

Mature Market Dynamics

IDC’s forecast of 1.24 billion smartphone shipments in 2025 reflects a market where growth is incremental. In such markets, companies seek:

- Higher average selling prices through premium differentiation

- Services revenue to stabilize profitability

- Ecosystem lock-in to protect share

Samsung’s AI ecosystem pitch is aligned with these needs. The question is whether consumers experience enough value to accept potential price increases or subscription layers that may emerge over time.

How The Value Proposition Changes: Smart Devices Versus AI-Orchestrated Systems

| Category | “Smart Device” Era Value | “AI Ecosystem” Era Value | Key Proof Required In 2026 |

| Smartphones | Better cameras, apps, incremental features | Agent that coordinates tasks across devices | Clear time savings and reliability, not just demos. |

| TVs | Picture quality and content recommendations | Personalized home dashboard and ambient assistant | Daily usefulness without clutter or privacy backlash. |

| Appliances | Convenience features and monitoring | Context-aware routines that reduce waste and effort | Accuracy, trust, and low friction onboarding. |

| Smart Home | Device compatibility and automation rules | Intent-based orchestration across brands | Interoperability plus consistent “one system” feel. |

Trust, Privacy, And Regulation Will Decide How Far “Ambient AI” Goes

Ambient AI depends on context. Context depends on data. That is where trust becomes the determining factor.

Samsung’s ecosystem vision blends on-device intelligence with cloud-backed models. That can improve capability, but it also expands the privacy and security surface area. When cameras, microphones, and sensors exist across rooms, consumers become more sensitive to:

- What data is collected

- Where it is processed

- How long it is retained

- Whether it is used for personalization, advertising, or both

- How it is protected from breach and misuse

Competition will increasingly be shaped by how convincingly companies frame and implement privacy.

Apple has positioned its approach around on-device foundation models and “Private Cloud Compute” for heavier workloads, emphasizing privacy and security architecture. Even if consumers do not read technical reports, the narrative can influence trust. Samsung must offer a trust narrative that is equally compelling, especially if it is integrating cloud services and third-party model providers.

Regulation is becoming more time-bound. A European Parliament Research Service briefing on the EU AI Act timeline notes the regulation’s phased implementation, with a general application date of 2 August 2026 and further provisions coming into effect later. That timing matters. It means 2026 is not only a product race, it is also a compliance race, especially for features that could be interpreted as higher-risk or that require new documentation and transparency.

If Samsung wants AI to be ambient, it must also make privacy and control ambient. Users need simple, visible controls, not complicated settings buried in menus.

Interoperability Is Improving, But Lock-In Is Moving Up The Stack

Smart home adoption has long been slowed by fragmentation. Matter was designed to reduce that friction. Reporting has noted that Apple, Google, and Samsung agreed to accept Matter certification, which reduces overlapping “Works With” programs and supports a more unified baseline.

Separately, Aliro is set to launch in Q1 2026 as a standard for smart locks and digital keys, backed by major ecosystem players. This points to a broader trend: the protocol layer is standardizing.

That sounds like it should weaken ecosystem lock-in. In reality, it changes where lock-in happens.

When devices connect more easily, differentiation moves upward into:

- The AI agent experience

- The quality of routines and automation

- Personalization and memory across contexts

- The partner ecosystem for commerce, security, and services

In other words, interoperability can make hardware swapping easier, but it can make switching ecosystems harder if the AI layer holds the user’s routines and preferences. Samsung’s AI ecosystem strategy is designed for exactly that future.

A Timeline Of The Shift Toward Ambient AI In Consumer Tech

| Period | What Changed | Why It Matters For Samsung’s 2026 Strategy |

| 2024 | AI begins moving from cloud novelty to mainstream device positioning | Sets the stage for AI to become a default feature expectation. |

| 2025 | GenAI phone shipments surpass 500M cumulatively by Q3 | Confirms the market is scaling quickly and competition shifts to orchestration. |

| 2026 | Samsung targets 800M AI-enabled Galaxy devices; Aliro launches in Q1; EU AI Act general application date in August | 2026 becomes a proving year for scale, standards, and regulation-ready product design. |

| 2027 (phasing) | Continued AI Act implementation steps in Europe | Sustained compliance pressure shapes long-term feature roadmaps. |

Who Stands To Gain, And Who Faces Pressure

| Stakeholder | Likely Upside | Likely Pressure Points |

| Consumers | Lower friction across chores, entertainment, and routines | Risk of higher costs, subscription creep, and privacy concerns if poorly implemented. |

| Samsung | Stronger ecosystem gravity, higher multi-device attach rates, services opportunity | Must deliver reliability, manage costs, and own trust despite platform dependencies. |

| Gemini embedded at scale through Samsung hardware | Heightened scrutiny on platform influence and data governance as AI enters homes. | |

| Apple | Privacy-forward differentiation strengthens premium positioning | If Samsung scales faster, Apple may face narrative pressure outside its core base. |

| Regulators | Clear enforcement targets as AI becomes embedded in daily objects | Complexity rises as AI spreads across product categories and contexts. |

Expert Perspectives And Counter-Arguments

To keep analysis neutral, it is important to address the strongest critiques of Samsung’s vision.

Critique 1: Consumers Do Not Want Everything To Talk

There is a real risk of AI fatigue. Many users want appliances that are invisible and reliable. If AI adds prompts, errors, or complexity, it can backfire. Samsung must demonstrate that AI reduces cognitive load rather than increasing it.

Critique 2: AI Assistants Could Become Commoditized

If every Android phone ships comparable AI features, Samsung’s differentiation must come from orchestration and integration, not from the existence of AI. That is harder than it sounds. It requires consistent engineering across product lines that historically ship on different timelines and software stacks.

Critique 3: Costs Could Limit “AI For Everyone”

Memory pricing pressure and component constraints can force manufacturers to tier features. If premium models get the best AI and mid-tier devices get watered-down experiences, the ecosystem promise may feel uneven.

Critique 4: Regulation And Trust Could Cap Ambition

The more ambient the AI, the higher the trust requirement. Regulatory timelines in 2026 and beyond create incentives to be conservative. Samsung must walk a line between shipping exciting features and avoiding reputational and compliance risks.

These critiques do not mean Samsung’s strategy is flawed. They mean execution must be exceptional.

What Comes Next In 2026: The Real Tests And Milestones

Samsung’s CES 2026 vision will be validated or weakened by a few measurable outcomes.

1) Does Samsung Hit Scale, And Does Scale Translate Into Stickiness

The 800 million AI-device target is not only about bragging rights. It is about creating a gravitational pull for developers, partners, and service integrations. If Samsung hits scale but users do not engage deeply, the ecosystem leverage will be limited.

2) Does Cross-Device Orchestration Feel Like One System

The promise of “AI ecosystem” lives or dies on seamlessness. If the phone, TV, and appliance experiences feel disconnected, users will treat AI as separate product features rather than a platform layer.

3) Can Samsung Own Trust While Partnering With Google

Samsung must ensure users perceive the system as “Samsung’s AI experience,” not a collection of third-party services. That requires clear privacy controls, transparent data practices, and consistent UX branding across devices.

4) Do Standards Reduce Setup Friction Enough To Expand The Market

Matter acceptance and Aliro’s rollout could reduce some of the pain that limited smart home adoption. If setup becomes easier, the market expands, which makes Samsung’s ecosystem play more valuable.

5) How Does Samsung Navigate The Cost Curve

If memory and compute costs remain high, Samsung will need smart segmentation, efficient on-device strategies, and sustainable cloud economics. The companies that win in AI devices will not only have the best demos, they will have the best unit economics.

Final Thoughts

Analysts can reasonably argue that 2026 is a transition year from “AI as feature” to “AI as interface.” Samsung is effectively trying to become the default interface across the home and pocket for hundreds of millions of people.

If Samsung succeeds, it strengthens ecosystem power and creates a path to recurring revenue that is less dependent on replacement cycles. It also pressures competitors to expand AI beyond phones into the home, while raising the bar on trust and compliance.

If Samsung falls short, the likely outcome is not that AI disappears. The likely outcome is that the “AI relationship” consolidates around whoever controls the model layer and the agent brand. In that scenario, Samsung remains a hardware leader, but the long-term platform leverage shifts elsewhere.

Either way, CES 2026 marks a turning point. The future of consumer technology is no longer just about better devices. It is about who orchestrates daily life.