Because of no-fault insurance laws, seeking compensation after a car accident can get complex. These laws require drivers to file claims with their auto insurance policies first, regardless of who caused the crash. But what happens if your personal injury or property damage exceeds your PIP coverage? Can you still sue the at-fault driver?

Understanding your options is crucial to securing fair compensation. Keep reading this article to learn more.

When Can You Sue After a No-Fault Accident?

While no-fault insurance limits lawsuits for minor injuries, exceptions exist. You may be able to sue if:

- Your medical expenses exceed your PIP benefits.

- Your injuries meet the state’s serious injury threshold (e.g., permanent disability, disfigurement, or significant impairment).

- The accident involved a teenage driver under the influence or engaging in reckless behavior.

- There’s shared liability, and comparative negligence laws apply.

Consider this example. As in many other no-fault states, drivers in Utah are required to have personal injury protection (PIP). PIP benefits cover medical bills, lost wages, and other expenses up to the policy’s limits, regardless of fault. However, if you sustain serious injuries that pass the threshold, you may step outside the no fault for injury claims in Utah and file a negligence claim against the responsible driver.

Should your circumstances fall under these exceptions, a personal injury lawyer can assess whether filing a lawsuit would benefit your situation.

Steps to Take After a No-Fault Accident

Taking the proper steps after a no-fault accident can protect your health, your legal rights, and your ability to recover fair compensation. Here’s what you should do immediately and in the days following the crash:

1. Seek Medical Treatment

Even if you don’t feel seriously injured, some symptoms (like whiplash or internal bleeding) may not appear right away. Prompt medical attention creates the paper trail you’ll need. Preserve every document related to your treatment – from diagnosis reports to pharmacy receipts – as this evidence strengthens your position.

2. Report the Accident

It’s imperative to summon police to the scene whenever an accident causes physical injuries or significant property destruction. Their official report creates a third-party record that carries substantial weight with insurance companies and in court. You should also notify your insurance company as soon as possible, even if you believe the other driver was at fault.

3. Gather evidence

If you’re physically able, take photos and videos of the accident scene, vehicle damage, road conditions, traffic signs, and injuries. Also, obtain contact details from bystanders who saw the accident—their objective observations may become crucial evidence in fault determinations.

4. Keep Detailed Records

Document all accident-related expenses, including medical bills, rental car costs, and lost wages from missed work. Also, keep a journal noting how your injuries affect your daily life—this can help support claims for pain and suffering.

5. Consult a Lawyer

If your injuries are severe or your insurance company denies or undervalues your claim, speak with a personal injury attorney. Legal counsel can determine if you’re eligible to file a claim against the at-fault party beyond standard no-fault coverage limits.

By following these steps, you’ll be in a stronger position to protect your rights and maximize your compensation after a no-fault accident.

What Compensation Can You Pursue?

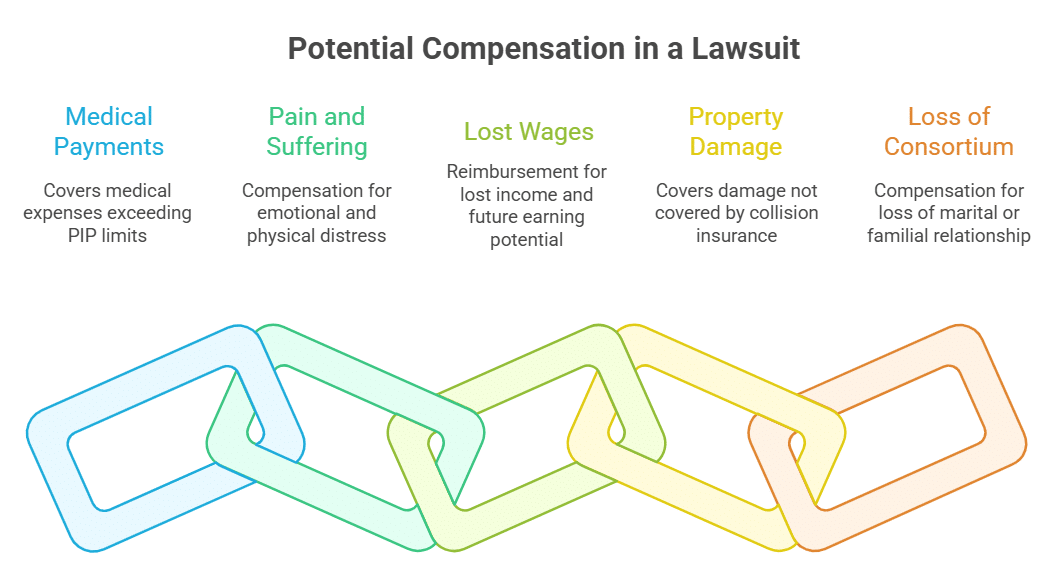

If you sue an at-fault driver, you may recover:

- Medical payments beyond PIP limits

- Pain and suffering

- Lost wages and future earning capacity

- Property damage (if not covered by collision insurance)

- Loss of consortium (in severe cases)

These compensation categories demonstrate why it’s essential to look beyond just immediate medical bills after an accident.

Potential Challenges in No-Fault Cases

While no-fault insurance systems are designed to simplify claims, several obstacles can complicate your pursuit of fair compensation:

- Insurance company disputes: Claims adjusters may downplay injuries to minimize payouts.

- Contributory negligence: Some states bar recovery if you’re even 1% at fault. Others (like Utah) follow comparative negligence, reducing payouts based on fault percentage.

- No-fault arbitration: Some disputes go through arbitration instead of a court.

Being aware of these potential hurdles from the outset will help you build a stronger case and navigate the claims process more effectively.

How Your Auto Policy Affects Your Options

Your liability insurance coverage and PIP benefits dictate how much you can recover. If the at-fault driver lacks sufficient property damage liability or bodily injury liability, you may need to rely on your underinsured motorist coverage.

Will a Lawsuit Increase Your Insurance Rate?

Filing a claim doesn’t always raise your insurance rate, especially if you weren’t at fault. Some insurers offer accident forgiveness for your first incident.

Conclusion

While no-fault insurance streamlines minor claims, serious accidents may require legal action. If you’ve suffered significant injuries, consulting a lawyer can help you navigate trial verdicts, accident reconstruction, and civil infraction disputes.

Need help with your case? Check progressive answers from legal experts or contact a local attorney to explore your rights beyond no-fault arbitration.