So you’ve been in an accident and now your insurance adjuster is telling you that your car is “totaled.” Your immediate reaction is probably something like “wait, what does that even mean?” followed by a bunch of panic about how you’re going to get to work tomorrow and whether you’re about to get screwed over financially.

Getting into a serious accident is already stressful enough without having to navigate all the insurance company nonsense that comes afterward. But when they slap that “total loss” label on your car, it opens up this whole new world of questions and decisions you probably never thought about before.

What exactly does “totaled” mean? What are your rights in this situation? And what happens next in terms of getting paid or finding a replacement vehicle?

Florida has specific rules about when a vehicle gets declared a total loss, and understanding how those rules work can help you make better decisions and avoid getting taken advantage of. Whether your car looks like it went through a blender or it’s just damaged enough that repairs don’t make financial sense, knowing the total loss process is really important – especially if you’re wondering can you keep a totaled car in Florida?

What Does It Actually Mean for a Car to Be Totaled?

In Florida, a vehicle gets declared a total loss when the cost to repair it reaches 80% or more of what the car was actually worth before the accident – that’s called the actual cash value, or ACV.

Insurance companies figure this out by getting repair estimates, looking at what your car was worth before the crash, and calculating what they could sell the wrecked car for as salvage.

Here’s something that surprises a lot of people – a “totaled” car doesn’t necessarily mean it’s completely undrivable or looks like twisted metal. It just means that from a financial standpoint, it’s not “worth fixing” because the repairs would cost almost as much as the car was worth.

So you might have a car that runs and drives fine but has $8,000 worth of damage, and if the car was only worth $10,000 before the accident, boom – it’s totaled, even though you could technically still drive it.

What Happens After They Declare It a Total Loss?

Once the insurance company decides your car is totaled, they’re supposed to pay you based on the actual cash value of your vehicle before the accident happened.

Here’s where it gets frustrating – this isn’t the price you paid for the car, and it’s definitely not what you might still owe on your car loan. It’s supposed to be the “market value,” which can sometimes feel ridiculously low compared to what you think your car was worth.

If you still owe money on a car loan, the insurance check often goes directly to your lender first to pay off the loan. If there’s money left over, you get that. If the check doesn’t cover what you owe, you’re still on the hook for the difference unless you have gap insurance.

This is where a lot of people get really angry, because they end up owing money on a car they can’t drive while also needing to come up with money for a replacement vehicle.

Can You Fight the Insurance Payout?

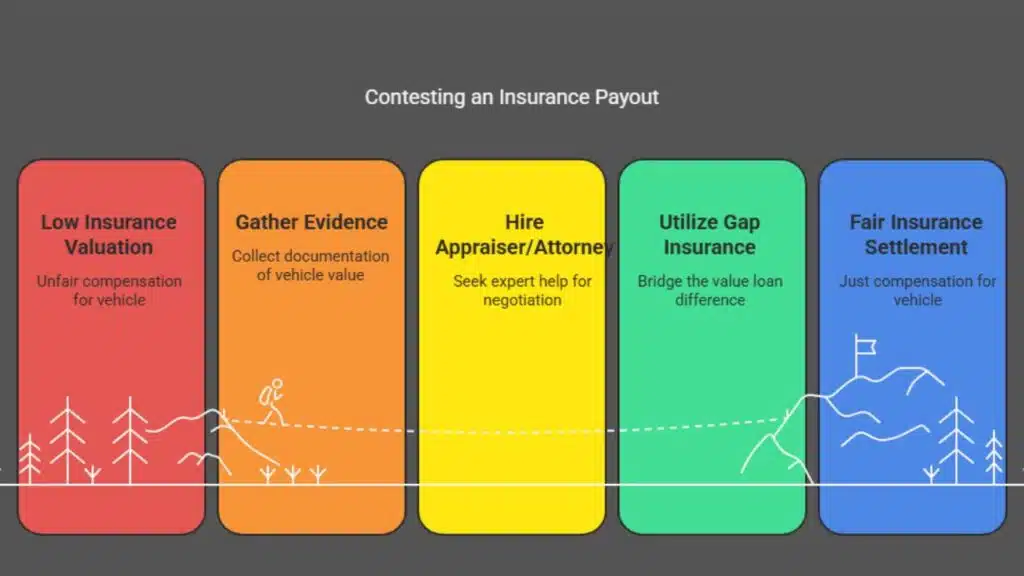

Yes, you absolutely can dispute the insurance company’s valuation if you think they’re lowballing you. They’re not the final word on what your car was worth, even though they act like they are.

You can submit evidence like recent upgrades you made to the car, documentation of its excellent condition, or listings for comparable vehicles that are selling for more than what they’re offering you.

Some people hire their own appraiser or even get an attorney involved, especially when there’s a big difference between what the insurance company is offering and what the car was actually worth.

If you have gap insurance – and not everyone does – it’s designed to help cover the difference between the actual cash value and what you still owe on your loan. This can be a lifesaver if you’re upside down on your car loan.

Can You Keep a Totaled Car in Florida?

Yeah, you can keep your totaled car in Florida, but there’s a specific process you have to go through, and it’s not always the smartest financial decision.

If you decide you want to keep the vehicle, the insurance company will deduct what they think they could have gotten for it as salvage from your payout. So instead of getting, say, $10,000, you might only get $7,000 if they think they could have sold the wreck for $3,000.

You’ll end up with what’s called a salvage title, which comes with a bunch of restrictions and can make it really hard to insure the car or sell it later.

If you actually want to drive the car again legally, you’ll probably need to get it inspected and have the title changed to “rebuilt” status through the Florida DMV, which is its own hassle.

What Are Your Options After Your Car Gets Totaled?

You can take the insurance payout and use it toward buying a replacement vehicle. This is what most people do, especially if the car was really damaged or if dealing with a salvage title sounds like a nightmare.

You can keep the car and try to repair it yourself, assuming it’s safe and legal to drive and you think you can fix it for less than what the insurance company estimated.

Or you can just walk away from the car entirely if you don’t have any emotional attachment to it and you just want to move on with your life.

Each option has pros and cons depending on your situation, the condition of the car, and how much money is involved.

Tips for Not Getting Messed Over

Document everything about your car’s condition before and after the accident if possible. Photos, maintenance records, anything that shows your car was well-maintained and worth more than the insurance company wants to pay.

Get your own repair estimates from independent shops, especially if you think the insurance company’s estimates are way off. Sometimes they use cheap parts or unrealistic labor rates.

Don’t be afraid to ask questions and push back on your claims adjuster. They work for the insurance company, not for you, so their job is to save the company money, not to make sure you get a fair deal.