The importance of investing to ensure a secure financial future is understood by most these days. Endowment plans and ULIPs are two competent financial instruments, especially for those who are seeking long-term wealth creation. However, many people, especially beginners, might find it confusing to understand the differences between these two aspects.

Senior citizens require practical and secure financial instruments to ensure a safe shield for themselves and their beloved family members. Although both endowment plans and ULIPs are long-term wealth-creating tools, they are essentially very different. You have to understand these differences to know which one suits you the best.

What is an endowment plan?

With endowment plans, you receive the dual benefits of investment and life insurance coverage under a single umbrella plan. If the insured-cum-policyholder passes away, then the designated beneficiary or the nominee receives the amount of the sum assured as the death benefit. Endowment plan premiums are decided based on the amount of sum assured.

However, if the individual outlives the plan term, then the insurer pays the maturity benefit along with any other applicable bonuses or additional benefits on policy maturity.

These plans ensure financial security to the dependent family members of the policyholder-cum-insured even during challenging circumstances. It ensures long-term wealth creation. There is also provisions for getting loans against this sort of plan. Moreover, they even qualify for tax benefits u/s 80C and 10 (10D) of the IT Act of 1961.

What is a ULIP?

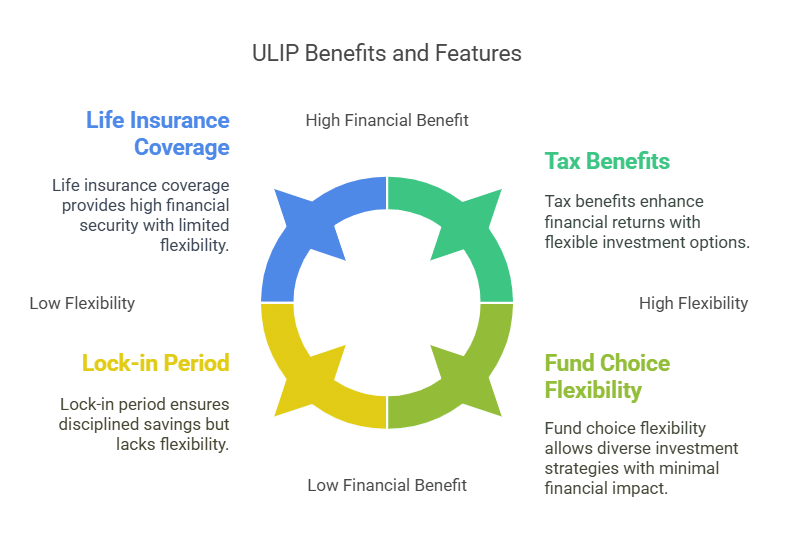

A ULIP is the abbreviation for Unit-Linked Insurance Plan. This too is an investment-cum-insurance instrument, allowing you to invest in several market-linked funds like debt funds, equity funds, etc. along with life insurance coverage protection.

A part of the premium paid gets invested towards the insurance coverage, while the remaining gets invested towards debt funds, equity funds, or balanced funds, based on your requirements and preferences.

The life insurance factor in ULIP ensures that the family members of the insured-cum-policyholder, receive the sum assured amount as death benefit during tough times. However, it does not offer any maturity benefits.

ULIPs are flexible in respect of fund choice based on your risk appetite and financial goals. You can even choose the sum assured amount. ULIPs also offer tax benefits u/s 80C and 10 (10D) of the IT Act. They come with a standard lock-in period of 5 years, inculcating the habit of disciplined savings. These are transparent instruments, and you can review your fund performance and make the necessary changes as required.

Comparative study

| POINTS OF DIFFERENCE | ULIPs | ENDOWMENT PLANS |

| INVESTMENT STRATEGY | The funds get invested in various market-linked funds like debt funds, equity funds, allowing you to choose your investment strategy and ensure fund switching as required. | Here, the pre-defined investment strategy is managed by the insurance company, allowing comparatively less flexibility in selecting the investment types. |

| RETURNS | They have potential for generating higher returns depending on market performance, but are even subject to market risks and volatility. | Offers guaranteed returns, and often with additional bonuses, ensuring fixed returns, irrespective of the market conditions. |

| RISK | Involves comparatively higher risks due to market conditions, as the returns are dependent on the market performance. | Involves comparatively lower risks, as it offers guaranteed returns, allowing enhanced stability. |

| LOCK-IN PERIOD | Typically comes with a standard lock-in period of 5 years, restricting the withdrawal option within this term. | Usually, do not have any lock-in period, allowing withdrawal flexibility, although involving certain penalties and restrictions. |

| WITHDRAWALS | Considering the plan’s terms and conditions, partial withdrawals may be allowed. | Penalties and restrictions may apply for withdrawals before the maturity of the concerned plan. |

| SUITABILITY | More conservative | Comparatively more

growth-seeking |

Which to choose in your 60s or 70s?

Considering your age, you must be very critical about your investment. You must consider:

- Risk appetite: You must consider your risk-taking capacity before considering your investment strategy.

- Liquidity needs: Critically consider your liquidity requirements before finalising your choice.

- Tenure: Consider your age, and accordingly, it will reveal the time left for the growth of your investment. Based on all the relevant factors, make your choice.

Conclusion

Endowment plans ensure better stability and involve lower risk. However, ULIPs are exclusively ideal for those who can bear the market risks with a minimum of 5-10 years of investment horizon.

The basic differences between endowments and ULIPs make them ideally suitable for varying life insurance requirements. Based on your life phases, your financial horizons and requirements keep changing and evolving. You have to make your choice based on the altering demands. You can even seek professional help for better guidance.