House hacking can feel like a mystery, especially if you’re new to real estate investing. You might wonder how people buy homes, make rental income, and still save money on housing costs.

It’s hard to know where to start or what steps lead to success.

Here’s something important: house hacking isn’t just for experts or big-time investors. Many first-time buyers use tools like FHA loans or VA loans to get started with little down payment.

With the right plan, you can turn your primary residence into an investment property.

This guide will show you 7 Essential Tips For House Hacking Success. From choosing the right property to screening tenants, we’ll cover key steps that help boost cash flow and build wealth over time.

Ready? Let’s start!

Key Takeaways

- FHA loans help first-time buyers start house hacking with as little as 3.5% down, making multi-unit properties affordable if you live in one unit.

- Screening tenants carefully through background and credit checks prevents issues like missed rent or property damage.

- Multifamily homes or single-family houses with extra rentable space can boost income while keeping your living costs low.

- Crunch numbers to ensure positive cash flow by factoring in rental income, expenses, maintenance, and taxes before buying a property.

- Follow local zoning laws and occupancy rules to avoid fines or legal problems when renting out parts of your home.

Tip 1: Understand Your Financing Options

Know your loan choices before you start. Your credit score and down payment can shape your path.

FHA Loans

FHA loans can help you buy a home with less money upfront. Backed by the Federal Housing Administration, they allow lower down payments—often just 3.5%. These loans are great for first-time buyers or those with lower credit scores.

You’ll need mortgage insurance, which adds to your monthly payment. A credit score of at least 580 is usually required. FHA loans work well for multi-unit properties since you can live in one unit and rent out the others.

Conventional Loans

Conventional loans are not backed by the government. Banks and private lenders offer them to borrowers with good credit scores. These loans often need higher down payments compared to FHA loans, usually around 5-20%.

But they don’t require mortgage insurance if you put at least 20% down.

Interest rates for conventional mortgages can vary based on your credit score and market trends. Freddie Mac and Fannie Mae set limits for these loans, known as conforming loan limits.

They’re a solid choice if you aim to invest in an investment property or multi-unit property with lower fees over time.

A strong credit report is key to securing better loan terms.

Tip 2: Choose the Right Property

Pick a property that suits your goals and lifestyle. A smart choice can boost rental income while keeping life comfortable for you.

Multifamily Homes

Multifamily homes are great for house hacking. These properties include duplexes, triplexes, or buildings with four units. You can live in one unit as your primary residence and rent out the others.

Rental income from tenants helps cover your mortgage payment.

They also offer more cash flow than single-family homes. With multiple tenants, you spread the risk of vacancy loss. FHA loans often work well since they allow low down payments on multi-unit property if you occupy one unit yourself.

Single-Family Homes with Rentable Space

Single-family homes with extra space can be great for house hacking. Look for properties with a basement, garage, or separate guesthouse. These areas can become rental units and provide steady rental income.

Always check local zoning laws before renting. Some areas limit how many tenants you can have in one property. Keeping the home as your primary residence often allows you to qualify for tax benefits and lower mortgage rates, such as those provided by an FHA loan.

Tip 3: Analyze the Numbers

Crunch your numbers like a pro to keep surprises at bay. Focus on cash flow and expenses, so you know what’s coming in and going out.

Calculate Rental Income

Check how much rent similar properties in your area charge. Use a rent estimator or online tools like real estate forums for guidance. Study local rental listings to see what tenants are willing to pay.

Subtract costs like property taxes, insurance, and mortgage payments from expected rent. Don’t forget capital expenditures or repairs! Aim for positive cash flow—this means your rental income covers expenses and leaves profit in your pocket.

Consider Maintenance Costs

Fixing things can get pricey fast. A burst pipe, a broken heater, or cracking paint all cost money. Factor these expenses into your budget before buying a rental property. Set aside at least 1-2% of the property value each year for upkeep.

Small issues turn big without care. A leaky roof left unchecked may lead to costly repairs later. Regular maintenance helps avoid surprises and keeps tenants happy. Happy renters stay longer, boosting cash flow over time!

Tip 4: Screen Your Tenants Carefully

Picking renters isn’t a guessing game. Run checks, ask questions, and protect your property like it’s your castle.

Background and Credit Checks

Run a background check on every tenant. This helps uncover criminal history or eviction records. A clean record means less trouble down the road. Always do a credit check, too. It shows their ability to pay rent on time.

Make sure they have a steady income. Ask for proof, like tax returns or recent pay stubs. Look for red flags like unpaid debts or frequent late payments in their report. These checks protect your rental property and cash flow from risky tenants!

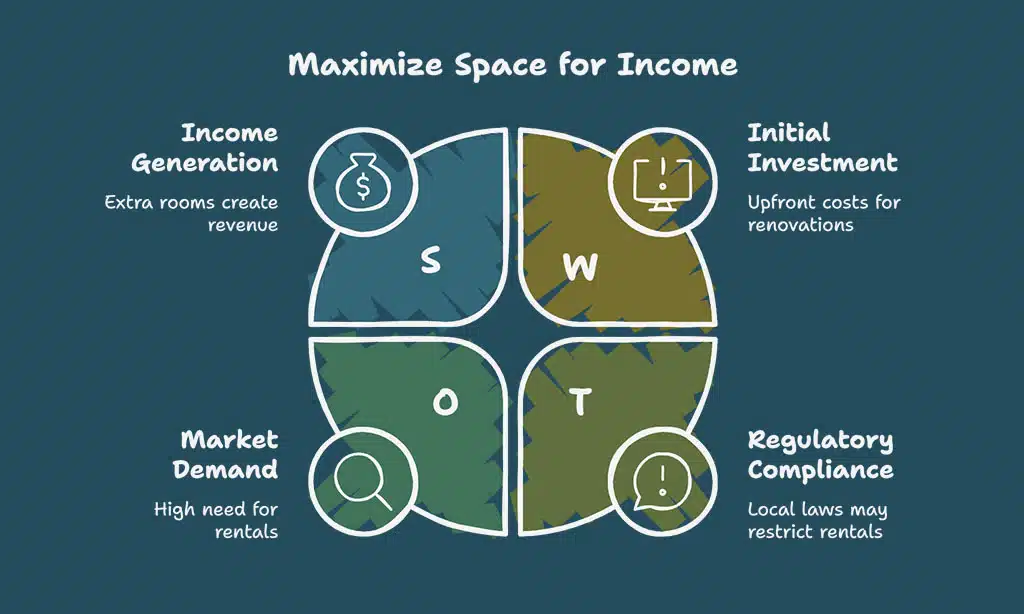

Tip 5: Optimize Your Living Space

Turn unused corners into cash-making spots, and let extra space work for you.

Rent Extra Rooms

Turn spare rooms into rental income. List them on sites like Airbnb or find long-term renters. A single-family home with extra space is perfect for this. Cover part of your mortgage payment while keeping a primary residence.

Offer basic furniture or utilities to attract tenants faster. Use property management software to track payments and agreements easily. Always screen tenants with background checks for safety and peace of mind.

Convert Unused Spaces

Basements, attics, or garages can bring extra rental income. Turn them into rentable rooms, studios, or storage spaces. A finished basement makes a great unit for tenants.

Use spare bedrooms as short-term rentals on platforms like Airbnb. This creates passive income while you live in your primary residence. Check local zoning rules before renting out converted areas to stay compliant with laws.

Tip 6: Stay Compliant with Local Laws

Know your area’s rules, like zoning or tenant laws, to avoid fines or legal mess.

Zoning Regulations

Zoning laws decide how a property can be used. Some areas allow multi-unit properties, while others limit them to single-family homes. Check local rules before buying.

These rules can affect rental income or renovations. If you plan to convert spaces or rent extra rooms, get proper permits first. Sticking to the law keeps things smooth with tenants and neighbors.

Occupancy Limits

Cities and towns set rules about how many people can live in a rental property. These occupancy limits protect safety and keep living spaces from becoming overcrowded. For example, some places follow the “two-plus-one” rule—allowing two people per bedroom plus one more.

Violating these limits might lead to fines or trouble with local agencies. Check landlord-tenant laws before renting out space in your primary residence. This keeps both you and your tenants safe while staying within legal boundaries.

Tip 7: Plan for Long-Term Success

Think ahead, grow your equity, and aim to turn this house hack into a springboard for bigger investments.

Build Equity

Paying down your home loan increases equity. Each mortgage payment chips away at the principal balance, growing what you own in the property. Over time, this can turn into significant wealth.

Property value growth also helps build equity. A rising real estate market boosts your investment returns without any extra effort. Renovations like upgrading kitchens or adding energy-efficient features may raise a property’s worth too.

Transition to Other Real Estate Investments

Start small with a rental property, then grow. Use the equity from your primary residence or multi-unit property to invest in more. Refinanced loans can help free up cash for new opportunities.

Explore single-family homes, duplexes, or foreclosed properties next. Focus on cash flow and ROI [return on investment]. A solid plan leads to passive income and long-term success in real estate investing.

Takeaways

House hacking can change your financial future. Many first-time investors use it to save money and earn extra income.

Julie Carter, a seasoned real estate investor with over 15 years of experience, shares her insights. She holds a degree in Finance and has closed hundreds of deals across the U.S. Julie also speaks at property investment seminars and writes for top real estate forums.

Her advice carries weight because she’s lived through market highs and lows.

Julie says these seven tips are the backbone of smart house hacking. They help new investors avoid costly mistakes while boosting cash flow and building equity. For example, FHA loans make buying easier by lowering upfront costs, making them ideal for beginners.

Safety matters too, she stresses. Landlords must follow local laws on tenant rights and zoning rules to stay compliant. Using clear rental agreements is key for honesty between both parties.

Julie suggests starting small—maybe rent out one room or buy a duplex. Use tools like rental calculators to estimate profit before buying any property.

Her take? House hacking isn’t flawless but has great potential when done right. Pros include low living expenses and faster wealth growth; cons might be managing tenants or unexpected repairs.

She recommends this strategy if you want long-term rewards in real estate investing without taking huge risks upfront!

FAQs

1. What is house hacking, and how does it help real estate investors?

House hacking means living in your primary residence while renting out part of the property to earn rental income. It helps real estate investors cover their mortgage payment and build cash flow.

2. Can I use an FHA loan for house hacking?

Yes, you can use an FHA loan to buy a multi-unit property as your primary residence. With a lower down payment requirement, this loan makes housing affordability easier for beginners.

3. How do I screen tenants when house hacking?

Tenant screening is key to avoiding headaches later on. Check credit scores, verify employment, review rental agreements carefully, and always conduct background checks before signing a lease agreement.

4. What types of properties work best for house hacking?

Multi-unit properties like duplexes or triplexes are great options since they allow you to live in one unit while renting out others as investment property rentals.

5. Are there tax benefits with house hacking?

Yes! You may qualify for tax deductions on mortgage interest, depreciation expenses, insurance premiums, and even certain capital expenditures related to managing the rental property.

6. How do I calculate ROI from my house hack?

Use tools like a rental property calculator or rent estimator to figure out cash flow after expenses like the mortgage payment and maintenance costs are subtracted from your total rental income.