The rapid rise of online lending platforms has revolutionized how consumers access credit. Traditional banking institutions are no longer the only option for those in need of financial assistance.

While online lending provides numerous benefits such as faster loan approval, less stringent application processes, and lower fees, it also presents some significant risks.

For borrowers and lenders alike, understanding these risks and how fintech solutions can address them is critical to ensuring a safe, efficient, and trustworthy lending environment.

In this article, we will take a deep dive into 5 key risks in online lending and explore how fintech is mitigating them with innovative, cutting-edge solutions. By the end of this piece, you’ll have a comprehensive understanding of these risks and how fintech innovations are reshaping the online lending landscape to make it safer for everyone involved.

Understanding the Risks in Online Lending

The growth of online lending is undeniable. According to a report by Transparency Market Research, the global online lending market is expected to reach $1.16 trillion by 2027, driven by increasing demand for faster and more convenient access to capital. However, as the industry grows, so do the challenges it faces.

These risks, which range from identity theft and fraud to regulatory compliance issues, can impact both borrowers and lenders. Fortunately, fintech innovations are helping to mitigate these risks, providing a level of security, transparency, and efficiency that was once thought to be impossible in the digital financial space.

In the following sections, we’ll break down the 5 key risks in online lending and explain how fintech is stepping in to address these challenges.

Risk #1: Fraud and Identity Theft

One of the most pressing risks in online lending is the growing threat of fraud and identity theft. Online lending platforms rely on digital processes for loan applications, which makes them vulnerable to cybercriminals seeking to exploit any weaknesses in their systems.

Fraud can take many forms, including loan stacking (taking out multiple loans from different lenders), falsifying borrower information, or using stolen identities to secure loans. As more financial activities shift online, the risk of fraudulent activities continues to rise.

The Growing Threat of Fraud in Online Lending

Online lending is especially susceptible to fraud due to the lack of face-to-face interaction in the application process. Cybercriminals can manipulate loan applications by providing false information or hijacking personal data for financial gain. Fraudulent loan applications can result in losses for lenders and damage to borrowers’ credit scores and personal finances.

- Statistics: According to the Federal Trade Commission (FTC), over 9 million Americans are victims of identity theft every year, with a significant portion of these cases occurring within the financial sector.

How Fraudulent Activities Impact Lenders and Borrowers

For borrowers, being a victim of fraud can mean financial ruin, damaged credit, and emotional distress. Fraudulent loans may not only leave a borrower indebted but also affect their ability to access credit in the future. Lenders face losses in the form of defaulted loans and financial costs related to fraud detection. Additionally, if fraud becomes widespread on a platform, it can lead to regulatory scrutiny and a loss of consumer trust.

How Fintech is Combatting Fraud with Advanced Security Measures

Fintech platforms are leveraging a variety of advanced technologies to reduce the risk of fraud and identity theft:

| Fraud Mitigation Strategy | Description |

| Multi-Factor Authentication (MFA) | MFA requires users to provide more than one verification factor before accessing their accounts, enhancing security beyond passwords alone. |

| Machine Learning & AI for Fraud Detection | AI algorithms analyze user behavior and transaction patterns to detect fraudulent activities in real time. These systems improve over time as they learn from new data. |

| Blockchain for Transparent Transactions | Blockchain ensures that every transaction is recorded on an immutable ledger, making it impossible to alter or fake loan histories. This provides transparency and traceability. |

Case Study: LendingClub

LendingClub, a leading online lending platform, has implemented AI-driven fraud detection systems to monitor user behavior. The system can flag suspicious applications in real time, reducing fraud and identity theft significantly.

Risk #2: Data Privacy Concerns

With the digital nature of online lending, data privacy concerns are another major risk. Borrowers provide highly sensitive information such as social security numbers, bank account details, and credit histories, making them attractive targets for cybercriminals. A data breach can not only harm the affected individuals but can also cause long-lasting reputational damage to the lending platform.

The Importance of Data Security in the Digital Lending Space

In the world of online lending, data privacy and security are paramount. Given the increasing number of cyberattacks and breaches within the financial sector, platforms must invest heavily in securing customer data. A robust data security strategy ensures that sensitive information is protected at all stages of the lending process.

Consequences of Data Breaches for Borrowers and Lenders

For borrowers, a breach of personal information could lead to identity theft, fraudulent loan accounts, and lasting financial damage. Lenders, on the other hand, face not only financial losses but also the cost of recovering from the damage to their reputation. Regulatory penalties could further exacerbate the situation, as most jurisdictions have stringent data protection laws in place.

How Fintech is Ensuring Data Protection

To mitigate these risks, fintech companies are implementing several measures to secure personal data:

| Data Protection Strategy | Description |

| Data Encryption | Encryption ensures that sensitive data is unreadable to unauthorized users. This is especially critical when storing customer financial information. |

| Cloud-Based Secure Storage | Many fintech platforms rely on encrypted cloud storage to ensure that data is protected from hackers and easily accessible only to authorized users. |

| Compliance with Data Privacy Regulations | Fintech companies ensure compliance with international data privacy standards such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). |

Case Study: SoFi

SoFi, an online personal finance platform, has integrated advanced encryption technologies and complies with global privacy regulations like GDPR. Their commitment to data privacy has helped them maintain consumer trust, even during times when data breaches in the financial sector were making headlines.

Risk #3: Credit Risk and Lending Decisions

Credit risk remains one of the most significant challenges in the online lending industry. In traditional lending, banks rely heavily on credit scores to assess borrowers’ creditworthiness. However, this method excludes individuals with thin or non-existent credit histories, often leaving out younger borrowers or those new to the financial system.

The Challenge of Assessing Creditworthiness in Online Lending

Traditional credit assessments, which focus primarily on credit scores and historical loan performance, do not always provide an accurate picture of a borrower’s financial reliability. Many individuals with limited or no credit history find it difficult to access loans, while others with poor credit scores may be denied loans even though they may be financially capable of repaying them.

Impact of Poor Lending Decisions on Lenders and Borrowers

Incorrect credit assessments can lead to significant financial losses for lenders. High default rates increase operational costs and can negatively affect a platform’s profitability. For borrowers, misjudgments may lead to denied loan applications or higher interest rates.

How Fintech is Mitigating Credit Risk with AI and Alternative Data

Fintech companies are revolutionizing credit risk assessment by using AI and alternative data sources, which allow for a more comprehensive evaluation of a borrower’s creditworthiness:

| Credit Risk Mitigation Strategy | Description |

| AI-Driven Credit Scoring Models | AI models consider a wide range of data beyond traditional credit scores, such as transaction history and social behaviors, to predict a borrower’s likelihood to repay. |

| Use of Alternative Data | Data such as utility payments, rent payments, and mobile phone bills can help assess borrowers who lack a traditional credit history. |

| Real-Time Risk Assessment | AI and machine learning algorithms analyze borrower data in real-time to assess creditworthiness and identify risk factors early in the process. |

Case Study: Zopa

Zopa, a UK-based peer-to-peer lending platform, uses alternative data and AI to assess creditworthiness. This has enabled them to provide loans to individuals with limited credit histories, increasing access to finance for underserved communities.

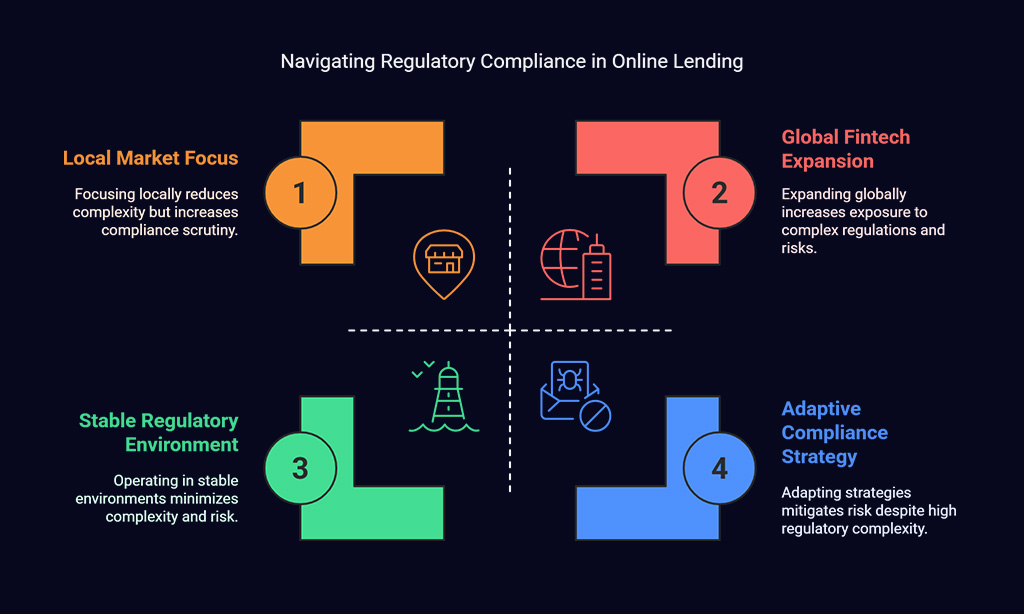

Risk #4: Regulatory Compliance Issues

As online lending platforms continue to expand, navigating the regulatory landscape becomes increasingly complex. Lenders must adhere to a variety of local, national, and international regulations, which can vary greatly depending on the jurisdiction.

Regulatory non-compliance can result in penalties, legal fees, and operational disruptions, all of which can significantly harm a business’s reputation and bottom line.

The Complex Regulatory Landscape of Online Lending

Regulatory compliance can be difficult for online lending platforms, as laws governing lending practices differ across countries and states. This creates significant challenges for global fintech platforms operating in multiple regions. Furthermore, regulations are constantly evolving, which means fintech companies must continuously monitor and adapt their systems to remain compliant.

Risks of Non-Compliance for Lenders and Platforms

Non-compliance can have severe consequences, including hefty fines, lawsuits, and potential business shutdowns. For lenders, the risk extends to operational disruptions, loss of consumer trust, and damage to brand reputation.

How Fintech is Navigating Regulatory Challenges

To ensure compliance and mitigate the risks associated with regulatory issues, fintech companies are leveraging several strategies:

| Compliance Strategy | Description |

| Automated Compliance Systems | Automated systems help platforms monitor and adjust to regulatory requirements in real-time, ensuring continuous compliance. |

| Global Regulatory Adaptation | Fintech companies are investing in compliance teams to ensure they understand and meet the regulatory demands of the regions in which they operate. |

| Partnership with Legal Experts | Fintech companies collaborate with legal professionals to navigate complex regulatory frameworks, ensuring they meet both local and international lending standards. |

Case Study: Affirm

Affirm, a leading fintech lending platform, works closely with legal experts to ensure they comply with U.S. and international financial regulations. This proactive approach has helped them avoid costly penalties and operate efficiently in different regions.

Risk #5: Operational and System Failures

As with any technology-dependent platform, online lending systems are at risk of operational and technical failures. These disruptions can occur due to software bugs, cyberattacks, or infrastructure issues, all of which can lead to delayed loan processing, system downtime, and significant customer dissatisfaction.

The Risk of Technical Failures in Online Lending Platforms

Operational failures can have wide-ranging effects, from delayed loan disbursements to complete platform shutdowns. Borrowers may face the frustration of waiting for loans to be approved or transferred, while lenders may struggle to meet customer demands. System downtime can also damage a platform’s credibility.

How Operational Disruptions Affect Borrowers and Lenders

For borrowers, operational issues can lead to delayed access to funds or missed payments, which could harm their credit scores. For lenders, system failures can result in lost revenue, operational inefficiency, and customer dissatisfaction.

How Fintech is Minimizing System Failures and Downtime

Fintech companies are prioritizing system reliability and uptime by adopting robust infrastructure and failover systems:

| Operational Mitigation Strategy | Description |

| Cloud-Based Infrastructure | Cloud-based platforms are scalable and ensure that online lending services remain available even during peak traffic periods. |

| AI-Powered Monitoring Systems | Continuous monitoring using AI ensures that system issues are identified and resolved before they disrupt operations, enhancing platform reliability. |

| High-Availability Architecture | Fintech platforms implement high-availability solutions that guarantee no downtime, even in the event of hardware or software failures. |

Case Study: Upstart

Upstart, a fintech lending platform, leverages a highly scalable cloud infrastructure to ensure system reliability. Their proactive system monitoring ensures uptime during peak application periods, such as the holiday season.

Wrap Up

The 5 key risks in online lending—fraud and identity theft, data privacy concerns, credit risk, regulatory compliance, and operational failures—pose real challenges for both lenders and borrowers.

However, as we’ve seen, fintech companies are leading the way in mitigating these risks through innovative solutions such as AI, machine learning, blockchain, and robust security measures. By embracing these technologies, online lending platforms can create a safer, more secure lending environment that benefits all parties involved.

The future of online lending looks promising, with continued advancements in technology helping to address these risks and improve the overall experience for consumers. Whether you are a borrower or a lender, understanding these risks and the ways fintech is mitigating them will help you navigate the world of online lending with confidence.