Cryptocurrency has long been hailed as a revolutionary new way to manage and exchange money, offering unparalleled decentralization, security, and efficiency.

However, like any new industry, it is not without its pitfalls. Over the years, numerous projects within the crypto space have collapsed, resulting in enormous financial losses and tarnished reputations.

These events have left investors, developers, and the general public asking: What went wrong?

In this article, we explore 10 famous crypto failures, detailing the events that led to their downfall and the lessons that we can learn from them. By understanding the causes behind these failures, we can better prepare ourselves to navigate the ever-evolving world of cryptocurrency.

Understanding Crypto Failures: Why They Matter

The cryptocurrency industry is known for its volatility and unregulated nature, which can make it an exciting but risky investment landscape.

Learning from famous crypto failures is crucial not only for investors looking to avoid similar mistakes but also for developers and entrepreneurs aiming to create sustainable and secure projects.

Crypto failures offer valuable lessons about the importance of security, transparency, regulation, and risk management. Studying these failures can help us understand common pitfalls, identify warning signs, and make more informed decisions when dealing with crypto assets.

Common Causes of Crypto Failures

While every crypto failure has its unique circumstances, there are several recurring themes that can help us pinpoint the causes behind these collapses:

- Lack of Regulation and Security Risks: Many crypto failures stem from a lack of regulatory oversight and poor security measures. These issues can lead to hacks, fraud, and loss of investor confidence.

- Poor Management and Unsustainable Business Models: Projects with weak leadership or flawed economic models are at risk of collapsing when the market turns against them or when they fail to adapt.

- External Factors: The crypto market is highly sensitive to external factors, such as government regulations, market sentiment, and technological vulnerabilities. These external forces can exacerbate underlying issues and accelerate a project’s downfall.

By understanding these common causes, we can better anticipate risks and avoid similar failures in our own crypto endeavors.

10 Famous Crypto Failures and Key Lessons Learned

Let’s take a look.

1. Mt. Gox Hack [2014]

| Feature | Details |

| Year | 2014 |

| Cause of Failure | Hack due to weak security and lack of transparency |

| Stolen Funds | 850,000 BTC [~$450 million at the time] |

| Impact | Led to bankruptcy, widespread loss of trust in crypto exchanges |

| Key Lessons Learned | – Implement strong security protocols [cold storage, multi-factor authentication]

– Ensure transparency in crisis management |

Mt. Gox, once the world’s largest Bitcoin exchange, was a major player in the early days of cryptocurrency. However, in 2014, Mt. Gox filed for bankruptcy after it was revealed that hackers had stolen 850,000 Bitcoins from the exchange, worth around $450 million at the time.

The hack was the result of inadequate security protocols, poor internal controls, and a lack of transparency. Mt. Gox failed to recognize the magnitude of the hack and delayed notifying its users, causing widespread panic and loss of trust in the exchange.

Lessons Learned

- Importance of Security Protocols: The Mt. Gox hack highlighted the necessity of robust security measures, such as two-factor authentication, cold storage, and insurance for digital assets.

- Need for Transparency: Mt. Gox’s failure to inform users about the breach in a timely manner contributed to the erosion of trust. Transparency in handling crises is crucial for maintaining customer confidence.

2. BitConnect [2017]

| Feature | Details |

| Year | 2017 |

| Cause of Failure | Ponzi scheme, misleading investors with unrealistic returns |

| Stolen Funds | Estimated billions lost by investors |

| Impact | One of the largest crypto scams, founders arrested |

| Key Lessons Learned | – Be skeptical of high returns with low risk

– Importance of regulatory oversight |

BitConnect was a cryptocurrency investment platform that promised high returns with minimal risk. However, it was ultimately revealed to be a Ponzi scheme. The platform’s token, BCC, was manipulated by its creators, and the promised returns were funded by new investors rather than actual profits. When the scheme collapsed, investors lost billions of dollars.

Lessons Learned

- Recognizing Red Flags: The collapse of BitConnect serves as a reminder to investors to always be skeptical of platforms promising unrealistically high returns. High-risk investments that promise low risk are often too good to be true.

- The Dangers of Decentralized Platforms: While decentralization is a core principle of cryptocurrency, it can also make it easier for bad actors to exploit investors. Adequate oversight is essential to protect users.

3. TerraUSD Collapse [2022]

| Feature | Details |

| Year | 2022 |

| Cause of Failure | Algorithmic stablecoin failure, market panic |

| Lost Value | Billions wiped out from the crypto market |

| Impact | LUNA token crashed, UST lost its peg to the USD |

| Key Lessons Learned | – Algorithmic stablecoins carry high risks

– Conduct thorough risk assessment before investing |

TerraUSD [UST] was an algorithmic stablecoin designed to maintain a 1:1 peg with the US dollar. The algorithm behind UST relied on an automatic mechanism to balance its supply and demand, using another cryptocurrency, LUNA, to maintain its peg. However, in May 2022, the system failed when the value of LUNA plummeted, causing UST to depeg from the dollar and triggering a market-wide panic. The collapse wiped out billions of dollars in value.

Key Takeaways

- The Risks of Algorithmic Stablecoins: TerraUSD’s failure highlights the risks inherent in algorithmic stablecoins, which depend on complex mechanisms that can break down under extreme market conditions.

- Thorough Risk Analysis: Investors should conduct thorough due diligence before committing to any project, particularly those involving algorithmic mechanisms with unproven stability.

4. QuadrigaCX Scandal [2019]

| Feature | Details |

| Year | 2019 |

| Cause of Failure | CEO’s sudden death led to inaccessible funds, lack of transparency |

| Lost Funds | $190 million in user funds locked |

| Impact | Sparked controversy, suspected fraud |

| Key Lessons Learned | – Avoid single points of failure in fund management

– Importance of corporate governance |

QuadrigaCX, once Canada’s largest cryptocurrency exchange, became infamous when its founder and CEO, Gerald Cotten, died suddenly while traveling in India. Cotten’s death led to the loss of access to the exchange’s cold wallets, which held millions of dollars in cryptocurrency. The incident sparked a wave of suspicion, with many questioning whether Cotten’s death was part of an elaborate fraud.

Lessons Learned

- Need for Transparency in Leadership: QuadrigaCX’s lack of transparency in its operations and fund management raised red flags for many investors. It’s crucial to have clear, transparent systems in place to avoid situations where a single individual has control over a company’s assets.

- Risk of Single Points of Failure: Relying on a single individual for key operations [such as managing private keys] is a significant risk. Decentralized operations and multiple layers of security are essential.

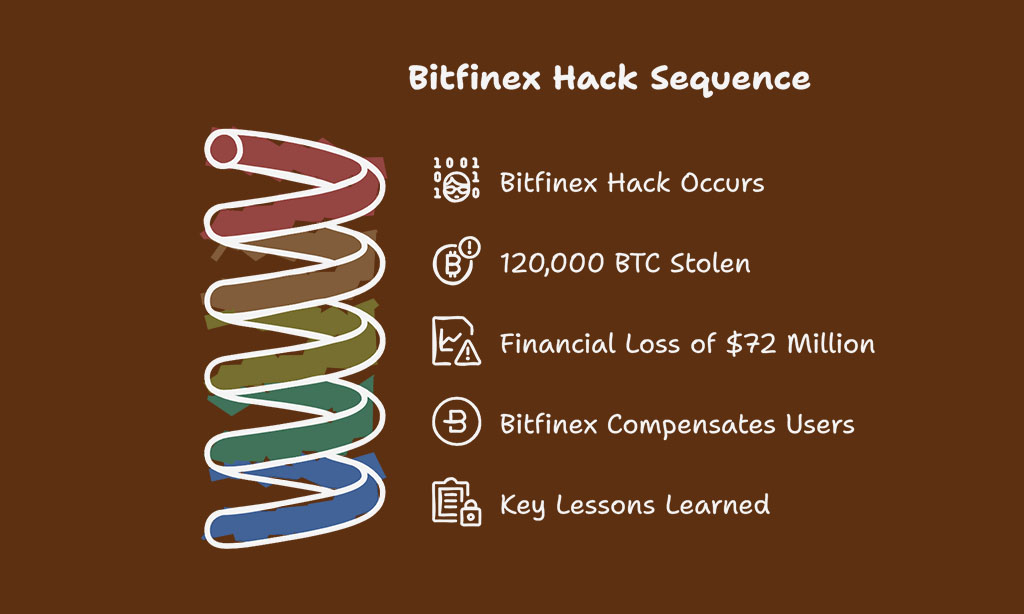

5. Bitfinex Hack [2016]

| Feature | Details |

| Year | 2016 |

| Cause of Failure | Exchange hack, loss of 120,000 BTC |

| Lost Funds | $72 million worth of Bitcoin stolen |

| Impact | Customers received compensation via BFX tokens |

| Key Lessons Learned | – Importance of robust security measures

– Need for proper custodianship of funds |

In 2016, the Bitfinex exchange was hacked, resulting in the theft of 120,000 Bitcoins, worth approximately $72 million at the time. Despite the hack, the platform continued to operate, and Bitfinex announced that it would compensate its users by issuing tokens to represent the stolen funds.

Lessons Learned

- Robust Security Measures: The Bitfinex hack underscored the need for enhanced security measures, such as multi-signature wallets, to prevent such large-scale thefts.

- The Role of Custodians: Exchanges and custodians must implement transparent, secure systems to protect user assets. Investors must ensure that they’re using exchanges with proven security practices.

6. OneCoin [2014-2017]

| Feature | Details |

| Years Active | 2014-2017 |

| Cause of Failure | Ponzi scheme with no actual blockchain |

| Lost Funds | Estimated $4 billion stolen |

| Impact | Founders arrested, investors lost savings |

| Key Lessons Learned | – Need for due diligence before investing

– Watch for red flags like lack of transparency |

OneCoin was a cryptocurrency investment platform that promised high returns through mining and trading. However, it was later revealed to be a scam, with the founders running a Ponzi scheme. The company falsely claimed to have a cryptocurrency, but in reality, no blockchain existed behind it. Investors lost billions of dollars.

Key Takeaways

- How to Identify Scams: OneCoin serves as a stark reminder to thoroughly investigate any project that lacks transparency, a verifiable product, or an underlying blockchain.

- Due Diligence: Investors must always verify the legitimacy of a crypto project before investing. Lack of transparency and a poorly explained business model are major warning signs.

7. Mt. Gox Trustee’s Incompetence

| Feature | Details |

| Year | Post-2014 |

| Cause of Failure | Poor fund management, delays in recovery |

| Impact | Compensation to victims delayed for years |

| Key Lessons Learned | – Ensure proper fund recovery processes

– Need for competent oversight in post-failure management |

Even after the Mt. Gox hack, the situation worsened due to the incompetence of the appointed trustee, who failed to properly manage the assets and liabilities of the platform. The trustee’s mismanagement caused delays in compensating victims, further complicating the aftermath of the hack.

Lessons Learned

- Proper Handling of Fund Recovery: The failure to efficiently recover and distribute funds after a hack highlights the importance of having competent legal and financial oversight in place to manage post-failure scenarios.

- Third-Party Custodians: Proper oversight by third-party custodians is essential to ensure that assets are managed and returned appropriately in the event of a failure.

8. BitPetite [2017]

| Feature | Details |

| Year | 2017 |

| Cause of Failure | ICO scam, lack of a working product |

| Lost Funds | Millions lost by investors |

| Impact | ICO shut down, investors left with worthless tokens |

| Key Lessons Learned | – Research ICOs before investing

– Avoid projects with no tangible product or prototype |

BitPetite, an ICO [Initial Coin Offering], promised a sustainable ecosystem but failed to deliver on its promises. Investors were drawn in by the attractive whitepaper and the promise of quick returns, only to see the project fall apart shortly after raising millions.

What Went Wrong?

BitPetite lacked a clear business model, and its development team had no proven track record. As a result, the ICO failed to provide any meaningful product, and investors were left with worthless tokens.

Lessons Learned

- Conduct Thorough Research on ICOs: Investors must carefully review the development team, the business model, and the overall viability of any ICO before investing.

- Red Flags to Watch For: Be wary of projects with no tangible product or working prototype, particularly those that make inflated promises about future returns.

9. The DAO Hack [2016]

| Feature | Details |

| Year | 2016 |

| Cause of Failure | Smart contract vulnerability exploited |

| Lost Funds | $60 million in ETH stolen |

| Impact | Led to Ethereum’s hard fork [creation of Ethereum Classic] |

| Key Lessons Learned | – Importance of security audits for smart contracts

– Conduct rigorous testing before deployment |

The DAO [Decentralized Autonomous Organization] was an ambitious project built on the Ethereum blockchain, aimed at creating a decentralized venture capital fund. However, in 2016, a hacker exploited a vulnerability in the smart contract code, draining around $60 million worth of Ether.

Lessons Learned

- Vulnerabilities in Smart Contracts: The DAO hack underscored the importance of thoroughly auditing smart contracts to ensure that no vulnerabilities exist. Even decentralized systems can be susceptible to attacks if not properly tested.

- Importance of Testing and Audits: Every smart contract should undergo rigorous testing and third-party audits before being deployed on the blockchain.

10. FTX Collapse [2022]

| Feature | Details |

| Year | 2022 |

| Cause of Failure | Mismanagement, fraud, insolvency |

| Lost Funds | Billions in customer assets lost |

| Impact | One of the biggest crypto failures, founder arrested |

| Key Lessons Learned | – Need for strict regulatory oversight

– Be cautious when trusting centralized exchanges |

FTX, a once-prominent cryptocurrency exchange, collapsed in late 2022 after allegations of fraud, mismanagement, and insolvency surfaced. The platform, led by founder Sam Bankman-Fried, was accused of using customer funds to support high-risk trades, leading to its bankruptcy.

Key Takeaways

- Need for Regulatory Oversight: The FTX collapse highlights the need for more robust regulation in the cryptocurrency industry to prevent mismanagement and fraud.

- Caution with Centralized Exchanges: Centralized exchanges, like FTX, are prone to mismanagement and risks that decentralized platforms can avoid. Always be cautious when trusting a third party with your funds.

What We Can Learn from Crypto Failures

Here is what we can learn from these failures.

1. Importance of Regulation in Crypto

One of the most significant lessons from famous crypto failures is the need for regulation. Many of these failures were exacerbated by a lack of regulatory oversight. Regulated platforms are less likely to fall victim to fraudulent practices, and regulation can provide greater protection for investors.

2. Risk Management and Diversification

Diversification is essential to managing risk in the crypto space. Investors should avoid putting all their funds into a single project or token. Spreading investments across various assets reduces the impact of any one failure on the overall portfolio.

3. The Role of Transparency in Crypto Projects

Transparent communication from project leaders is vital for building trust and maintaining investor confidence. Projects that are open about their processes, funding, and governance are more likely to survive in the long run.

4. The Future of Crypto: Building a Safer Industry

To build a safer crypto industry, projects must prioritize security, regulatory compliance, and transparency. The future of crypto will depend on the ability of developers, investors, and regulators to work together to create a stable and trustworthy ecosystem.

The Takeaways from Crypto Failures

The famous crypto failures we’ve explored in this article serve as valuable learning opportunities for everyone involved in the cryptocurrency space.

Whether you are an investor, developer, or enthusiast, understanding the causes behind these collapses can help you avoid similar mistakes in the future.

The lessons from these failures revolve around the importance of security, transparency, regulation, and risk management. By applying these lessons, we can collectively work towards a safer, more resilient crypto ecosystem that benefits all participants.