Estate planning is a crucial component of financial security, ensuring your wealth is protected and efficiently transferred to your heirs. Many high-net-worth individuals seek effective estate planning tax strategies for wealth preservation in USA to minimize tax liabilities and maximize asset distribution.

Without proper planning, estate taxes and legal complexities can erode generational wealth. Additionally, changes in tax laws and economic conditions make it even more vital to develop a well-structured estate plan that adapts to evolving regulations.

This guide explores 12 Estate Planning Tax Strategies for Wealth Preservation in USA, providing insights on how to reduce estate taxes, leverage trusts, and optimize tax-efficient wealth transfer methods.

These strategies are essential for anyone looking to secure their financial legacy and protect their family’s future.

1. Understanding Estate Taxes in the USA

Estate taxes can significantly impact wealth transfer. Effective estate planning tax strategies for wealth preservation in USA require a deep understanding of how these taxes work. A failure to account for estate taxes can lead to unexpected financial burdens for heirs, making proper planning essential.

What Are Estate Taxes?

- Estate taxes are levied on the total value of a deceased person’s estate before distribution to beneficiaries.

- The federal estate tax rate can reach up to 40% for estates exceeding the exemption limit.

- Certain deductions and exclusions can lower the taxable estate, but planning is necessary to maximize these benefits.

Federal vs. State Estate Taxes

| Type of Tax | Federal Rate | State Variability |

| Federal Estate Tax | Up to 40% | Exemptions available |

| State Estate Tax | Varies by state | Some states have no estate tax, others range from 1% to 20% |

| Inheritance Tax | Not imposed at the federal level | Six states impose inheritance taxes |

Some states, such as Florida and Texas, do not impose an estate tax, making them ideal for estate planning. Meanwhile, states like New York and Massachusetts have lower estate tax exemptions, requiring additional strategies for wealth preservation.

2. Gifting Strategies to Reduce Estate Taxes

A core strategy in estate planning tax strategies for wealth preservation in USA is gifting, which helps minimize taxable estate value. Thoughtful gifting can significantly reduce future estate tax liabilities while benefiting heirs immediately.

Annual Gift Tax Exclusion

- Individuals can gift up to $18,000 per recipient annually without incurring a gift tax.

- Married couples can gift $36,000 per recipient tax-free.

- This reduces the taxable estate over time and allows for efficient wealth transfer.

| Strategy | Benefit | Limitation |

| Annual Gifting | Reduces estate size over time | Limited to annual exclusion amount |

| Lifetime Exemption | Allows larger gifts without tax | Counts toward estate tax exemption |

| 529 Plan Contributions | Supports education tax-free | Must be structured properly to qualify |

Lifetime Gift Tax Exemption

- In 2024, the lifetime gift tax exemption is $13.61 million.

- Strategic gifting helps high-net-worth individuals transfer wealth efficiently.

- Gifts exceeding the exemption are taxed at rates up to 40%.

3. Establishing an Irrevocable Life Insurance Trust (ILIT)

An ILIT removes life insurance proceeds from your taxable estate, ensuring that heirs receive funds tax-free.

What Is an ILIT?

- A trust that owns a life insurance policy to reduce estate tax liability.

- Proceeds are distributed tax-free to beneficiaries.

- Helps cover estate tax liabilities without reducing other assets.

Steps to Set Up an ILIT

- Choose a trustee.

- Transfer an existing life insurance policy or purchase a new one.

- Fund the trust with premium payments.

- Ensure compliance with the three-year rule to avoid inclusion in the taxable estate.

| ILIT Feature | Benefit |

| Tax-Free Payouts | Life insurance benefits are excluded from estate tax. |

| Estate Liquidity | Provides liquidity to pay estate taxes and other expenses. |

| Asset Protection | Shields insurance proceeds from creditors. |

4. Utilizing Grantor Retained Annuity Trusts (GRATs)

A GRAT is a useful tool for individuals with appreciating assets, helping them transfer wealth while minimizing tax liability.

How GRATs Work

- The grantor contributes assets to the trust and retains an annuity for a set period.

- After the period, remaining assets transfer to beneficiaries tax-free.

- This allows high-growth assets to appreciate outside of the estate, reducing taxable value.

| GRAT Feature | Benefit |

| Minimized Estate Tax | Transfers asset appreciation tax-free. |

| Retained Income | Grantor receives annuity payments. |

| Wealth Transfer Strategy | Beneficiaries receive remaining assets tax-efficiently. |

Who Should Consider a GRAT?

- Individuals with high-growth assets such as stocks, real estate, or business ownership.

- Those seeking to transfer wealth with minimal gift tax implications.

5. Charitable Giving for Estate Tax Reduction

Charitable donations are a powerful strategy for reducing estate taxes while supporting meaningful causes.

Setting Up a Charitable Remainder Trust (CRT)

- Allows donors to contribute assets and receive an income stream for life.

- Remaining assets go to charity tax-free.

- Reduces taxable estate while providing financial benefits.

| CRT Benefit | Explanation |

| Income Stream | Donor receives income for a defined period. |

| Tax Deduction | Immediate charitable tax deduction available. |

| Estate Tax Reduction | Assets removed from taxable estate. |

Donor-Advised Funds (DAFs)

- Enables tax-deductible charitable giving with flexible grant distribution.

- Offers more control over how funds are distributed over time.

- Great option for families looking to create a long-term giving legacy.

6. Family Limited Partnerships (FLPs) and Their Tax Benefits

FLPs offer a way to maintain control over assets while providing estate and gift tax benefits.

What Is a Family Limited Partnership?

- A legal entity where family members hold partnership interests.

- Assets placed in an FLP are managed by general partners, often the senior family members.

- Limited partners, usually children or heirs, hold passive interests in the FLP.

Key Benefits of FLPs

| Benefit | Explanation |

| Asset Protection | Shields assets from creditors and lawsuits. |

| Tax Reduction | Reduces estate tax exposure by applying valuation discounts. |

| Succession Planning | Allows structured wealth transfer while maintaining control. |

7. Qualified Personal Residence Trusts (QPRTs) for Property Tax Benefits

A QPRT allows homeowners to transfer property at a reduced tax cost.

How QPRTs Work

- Homeowners place their primary residence in the trust for a defined term.

- They continue to live in the home rent-free for the trust term.

- After the term, the property transfers to heirs at a lower taxable value.

| QPRT Feature | Benefit |

| Tax Savings | Reduces gift tax value of property transfer. |

| Retained Use | Grantor can live in the home during trust term. |

| Future Estate Planning | Removes appreciation from the taxable estate. |

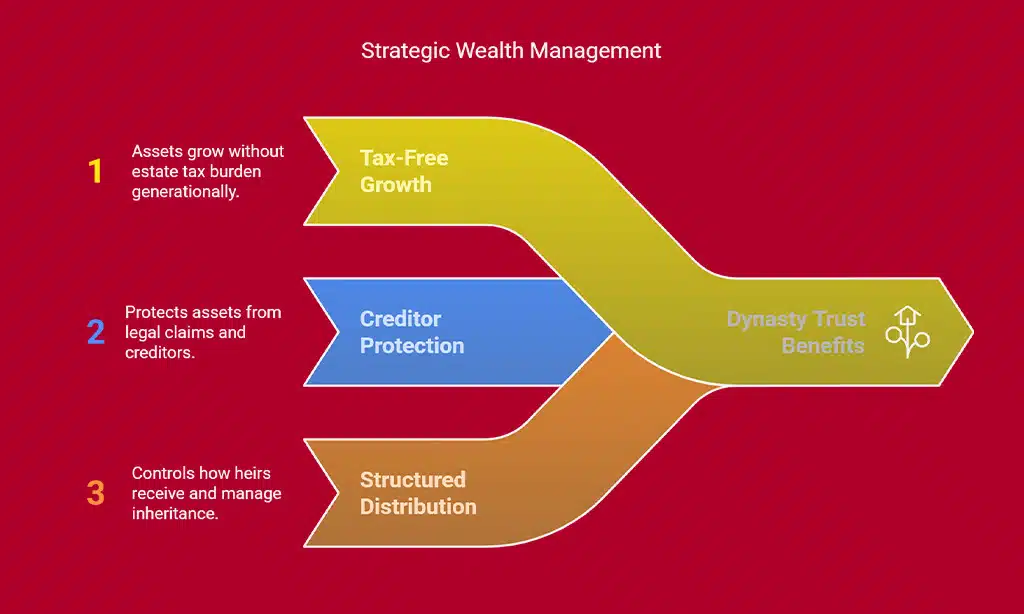

8. Dynasty Trusts for Multi-Generational Wealth Preservation

A dynasty trust helps families pass down wealth across generations while avoiding estate taxes.

Why Consider a Dynasty Trust?

- Assets grow tax-free and provide for multiple generations.

- Protects inherited wealth from creditors and divorce settlements.

- Offers long-term control over distributions and wealth management.

| Dynasty Trust Benefit | Explanation |

| Tax-Free Growth | Assets appreciate free of estate tax across generations. |

| Creditor Protection | Shields assets from lawsuits and claims. |

| Structured Distribution | Ensures controlled inheritance for heirs. |

9. Roth IRA Conversions for Tax-Efficient Wealth Transfer

Roth IRA conversions offer an effective way to transfer wealth while reducing tax liabilities for heirs. Unlike traditional IRAs, Roth IRAs do not require mandatory distributions, making them an excellent tool for estate planning.

Why Convert to a Roth IRA?

- Roth IRAs allow tax-free withdrawals, benefiting heirs.

- No required minimum distributions (RMDs) during the account holder’s lifetime.

- Heirs can stretch tax-free growth by taking distributions over time.

| Roth IRA Feature | Benefit |

| Tax-Free Withdrawals | Beneficiaries receive distributions tax-free. |

| No RMDs | Assets can grow tax-free for longer. |

| Estate Tax Reduction | Reduces taxable estate size. |

10. Special Use Valuation for Business and Real Estate Owners

This IRS provision allows heirs to value inherited property based on actual business or farming use, rather than market value, reducing estate tax burdens.

How Special Use Valuation Works

- Available to family-owned businesses and farms.

- Reduces the taxable estate value by up to $1.31 million (2024 limit).

- Ensures continued family operation without excessive tax liability.

| Special Use Valuation Feature | Benefit |

| Lower Taxable Value | Reduces estate tax liability on inherited property. |

| Preserves Family Business | Keeps businesses and farms in the family. |

| IRS Compliance | Requires active business operations to qualify. |

11. Portability of the Estate Tax Exemption for Married Couples

Portability allows a surviving spouse to inherit the deceased spouse’s unused federal estate tax exemption, potentially doubling the amount shielded from estate taxes.

How Portability Works

- The surviving spouse can elect portability by filing IRS Form 706.

- Combined exemption can reach over $27 million for married couples in 2024.

- Must be claimed within nine months of the first spouse’s passing.

| Portability Feature | Benefit |

| Doubles Exemption | Protects up to twice the federal estate tax exemption. |

| Simplifies Estate Planning | Reduces the need for complex trust structures. |

| IRS Filing Requirement | Must be claimed on time to be valid. |

12. Keeping Your Estate Plan Updated

Estate planning is an ongoing process that requires regular updates to account for changes in tax laws, financial circumstances, and family situations.

Importance of Regular Estate Plan Reviews

- Ensures compliance with current estate tax laws.

- Adjusts for major life events, such as marriages, births, or divorces.

- Helps maintain optimal asset protection and wealth transfer strategies.

| Estate Plan Review Aspect | Reason to Update |

| Tax Law Changes | Ensures strategies remain effective and compliant. |

| Family Events | Reflects changes in beneficiaries or marital status. |

| Asset Growth | Adjusts for increases in wealth or new investments. |

Takeaways

Effective estate planning tax strategies for wealth preservation in USA require proactive measures, legal compliance, and regular reviews. Utilizing gifting strategies, trusts, Roth IRA conversions, and portability options can significantly reduce tax liabilities and protect generational wealth.

Consulting with a qualified estate planning attorney ensures these strategies align with your financial goals and evolving tax laws.