When it comes to getting out of debt, two methods often come up in discussions: Debt Snowball vs Debt Avalanche. These strategies are commonly recommended by financial advisors, and they each offer different benefits depending on your personal situation.

The Debt Snowball method focuses on paying off the smallest debt first to build momentum, while the Debt Avalanche method prioritizes paying off the highest-interest debt to save money on interest.

Choosing between these two methods can be challenging, but understanding the key differences and aligning them with your financial goals can help you make the best decision.

In this article, we’ll explore both the Debt Snowball vs Debt Avalanche methods in detail, highlight their pros and cons, and provide actionable tips to guide you through your debt repayment journey.

Understanding the Debt Snowball Method

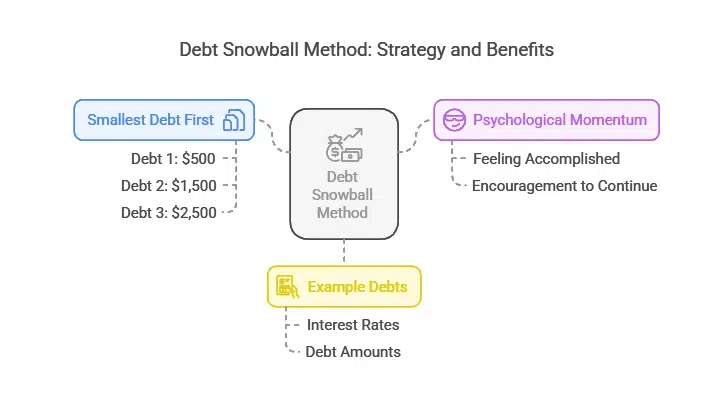

The Debt Snowball method is a debt repayment strategy where you pay off your smallest debt first, no matter the interest rate. Once that debt is paid off, you move to the next smallest debt, and the process continues. The idea behind this strategy is to gain psychological momentum. As you pay off smaller debts, you feel accomplished, which encourages you to keep going.

For example, let’s say you have the following debts:

- Debt 1: $500 with a 10% interest rate

- Debt 2: $1,500 with a 15% interest rate

- Debt 3: $2,500 with a 20% interest rate

Using the Debt Snowball method, you would tackle Debt 1 first. After paying it off, you’d use the money that was going toward Debt 1 to pay down Debt 2, then finally tackle Debt 3.

Pros of the Debt Snowball Method

- Quick Wins and Motivation: Paying off smaller debts first gives you a sense of accomplishment and helps you stay motivated. These early wins can be a huge morale boost.

- Simplicity: The Debt Snowball method is easy to follow, as it doesn’t require calculating interest rates. You just focus on paying off the smallest debt first.

- Psychological Boost: The quick wins provide a psychological boost, helping you feel more in control of your debt situation.

Table: Debt Snowball Pros and Cons

| Pros | Cons |

| Quick psychological wins | May cost more in interest over time |

| Simple and easy to follow | Longer repayment period |

| Builds momentum with each paid-off debt | Doesn’t target high-interest debts first |

Cons of the Debt Snowball Method

- Higher Interest Payments: By focusing on the smallest debts first, you may end up paying more in interest on larger debts with higher interest rates.

- Slower Debt Repayment: The Debt Snowball method may extend the time it takes to become debt-free, especially if your high-interest debts are large.

Understanding the Debt Avalanche Method

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, regardless of the balance. The primary advantage of this method is that it minimizes the amount of interest you pay over time, which can save you significant money in the long run.

For example, using the same debts from earlier:

- Debt 1: $500 with a 10% interest rate

- Debt 2: $1,500 with a 15% interest rate

- Debt 3: $2,500 with a 20% interest rate

Under the Debt Avalanche method, you would focus on Debt 3 first because it has the highest interest rate. Once that debt is cleared, you move to Debt 2 and then Debt 1.

Pros of the Debt Avalanche Method

- Lower Interest Payments: By targeting high-interest debts first, the Debt Avalanche method helps you reduce the overall interest you pay. This method is more financially efficient and can save you hundreds or even thousands of dollars in interest over time.

- Faster Debt Repayment: Since you’re tackling high-interest debts first, you’ll pay off your debt more quickly, which means less money spent on interest and a faster route to financial freedom.

- Financial Efficiency: This strategy is ideal for people who want to minimize the cost of borrowing and are focused on long-term savings.

Table: Debt Avalanche Pros and Cons

| Pros | Cons |

| Saves money on interest payments | Requires more patience and discipline |

| Faster payoff time due to interest reduction | Less immediate satisfaction from quick wins |

| More efficient in reducing debt | May feel slow at the beginning |

Cons of the Debt Avalanche Method

- Lack of Immediate Motivation: Since the Debt Avalanche method doesn’t focus on small wins, it may take longer to see significant progress. This can be demotivating, especially if you’re someone who needs quick wins to stay motivated.

- More Complex to Track: The Debt Avalanche method requires careful tracking of interest rates and balances to ensure you’re prioritizing the correct debts.

Comparing the Debt Snowball vs Debt Avalanche

When deciding between the Debt Snowball vs. Debt Avalanche methods, you need to consider both the financial and psychological aspects. These two methods cater to different needs, so it’s important to choose the one that fits your personality and goals.

Table: Debt Snowball vs. Debt Avalanche Comparison

| Factor | Debt Snowball | Debt Avalanche |

| Best For | Those who need motivation and quick wins | Individuals focused on long-term financial savings and efficiency |

| Psychological Impact | Encourages motivation with small victories | Focuses on efficiency and long-term financial gains |

| Interest Payments | Likely higher due to ignoring high-interest debts | Lower overall interest payments |

| Time to Debt-Free | Longer due to slower payoffs on high-interest debts | Typically quicker because you’re tackling high-interest debts |

| Complexity | Simple, easy to implement | Requires tracking of interest rates and debt balances |

6 Tips to Choose the Best Debt Repayment Method for You

Choosing between Debt Snowball vs. Debt Avalanche requires careful thought. The right method for you depends on your financial situation, motivation, and long-term goals.

In this section, we’ll provide six actionable tips to help you determine which method is most effective for your debt repayment journey.

Tip #1: Evaluate Your Debt and Finances

Before you choose the Debt Snowball vs. Debt Avalanche method, take a close look at your debts. List all your outstanding balances, their interest rates, and monthly payments. This will give you a better sense of how much you’re paying in interest and which debts are costing you the most.

Practical Tip: Use a debt repayment calculator to evaluate which method will save you the most money. This will give you a clearer picture of the financial benefits of each strategy.

Tip #2: Consider Your Personality and Motivation

The best method for you depends on how you handle motivation. If you’re someone who needs to see quick wins to stay motivated, the Debt Snowball method may be more effective. However, if you’re more focused on minimizing interest and are comfortable with slower progress, the Debt Avalanche method may work better.

Real-Life Example: Jessica used the Debt Snowball method to pay off a $3,000 personal loan. The sense of accomplishment from eliminating smaller balances quickly kept her motivated. On the other hand, Mark, who had a $10,000 credit card debt with a high interest rate, chose the Debt Avalanche method to save on interest.

Tip #3: Start Small, But Start Today

No matter which method you choose, the key is to start today. Waiting for the “perfect time” often leads to procrastination, so it’s better to take action, even if it’s just a small step. Starting with a manageable debt will allow you to gain some momentum.

Actionable Tip: Automate your debt payments for minimum amounts and set up an additional payment toward the debt you’re targeting. This ensures consistent progress.

Tip #4: Use a Debt Repayment Calculator

Debt repayment calculators can help you see how long it will take to pay off your debts using either the Debt Snowball vs. Debt Avalanche methods. These tools will show you exactly how much interest you’ll pay under each scenario and help you make a well-informed decision.

Actionable Tip: Websites like Undebt.it and Debt Payoff Planner offer free calculators that let you plug in your own numbers and compare both strategies.

Tip #5: Prioritize High-Interest Debts (if using Debt Avalanche)

If you choose the Debt Avalanche method, make sure you’re always paying off the debt with the highest interest rate. This will reduce the total amount of interest you’ll pay and speed up your journey to being debt-free.

Example: If you have a $3,000 balance on a credit card with 18% interest and a $2,000 car loan with 6% interest, prioritize the credit card debt first to save money on interest.

Tip #6: Stay Committed and Adjust as Needed

Debt repayment is a long process, and it’s important to stay committed. If you find that one method isn’t working for you or you’re losing motivation, feel free to adjust your strategy. The most important thing is that you continue making progress.

Practical Tip: Regularly track your debt repayment progress. Celebrate small milestones, and if necessary, switch strategies to keep your momentum going.

Final Thoughts: The Right Choice for You

Choosing between the Debt Snowball vs. Debt Avalanche methods is a personal decision that depends on your financial goals, personality, and current situation. If you need quick wins to stay motivated, the Debt Snowball method may be the best option.

On the other hand, if you’re looking to minimize interest payments and pay off debt as efficiently as possible, the Debt Avalanche method is likely the better choice.

Both methods are effective tools for becoming debt-free, but the key to success lies in choosing the one that fits your needs. By evaluating your debts, understanding your motivations, and taking consistent action, you’ll be well on your way to financial freedom.