The world of cryptocurrency trading in 2025 is fast-paced and more competitive than ever. With markets open 24/7 and new coins, platforms, and technologies emerging constantly, successful traders need to stay ahead of the curve.

Equipping yourself with the essential tools every crypto trader needs can make the difference between thriving in the market or being left behind.

This article will guide you through 10 indispensable tools that every crypto trader should have in their arsenal for smarter and more efficient trading.

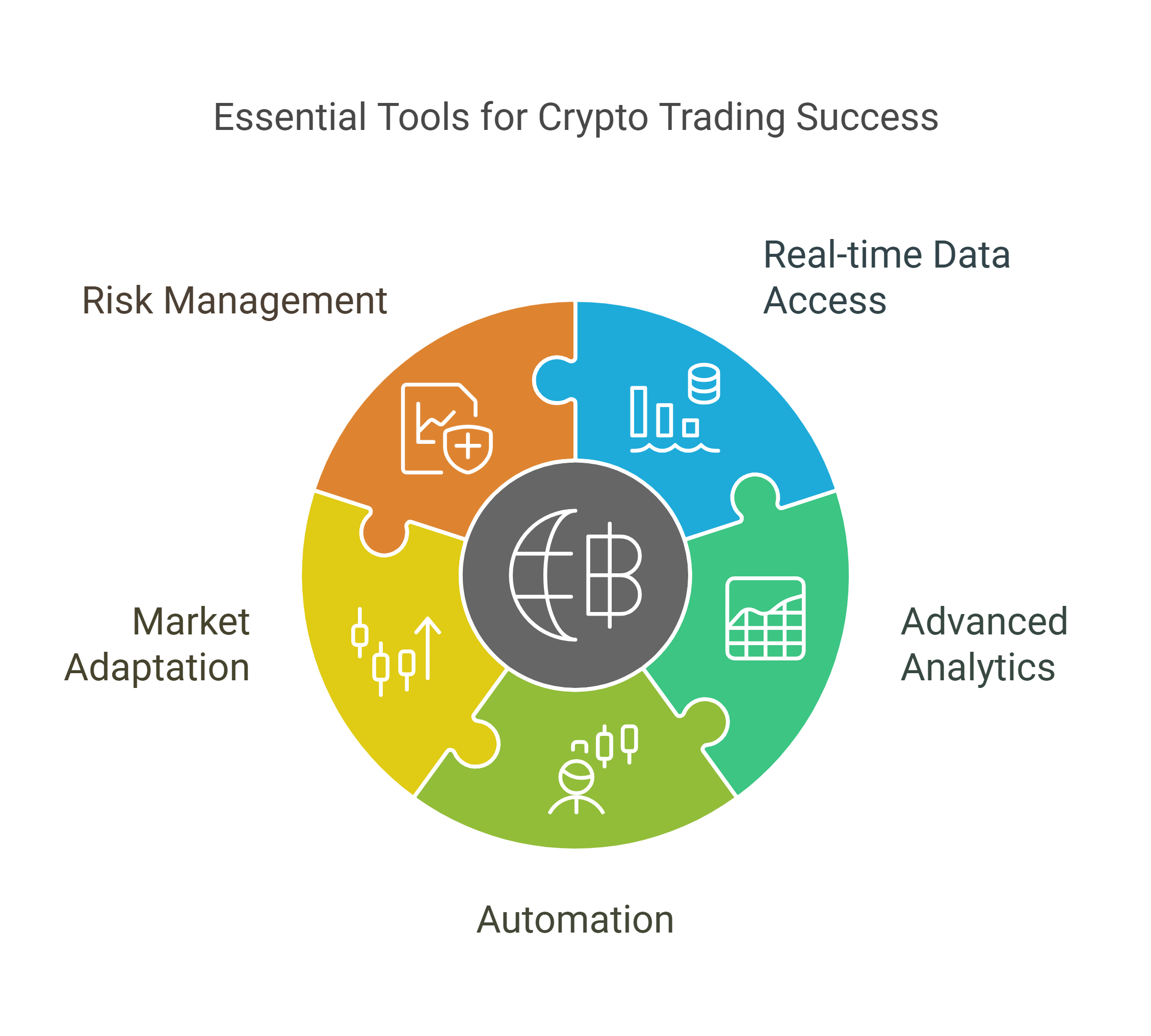

Why Tools Are Critical for Crypto Traders

In the fast-paced world of cryptocurrency, having the right resources can make all the difference. The essential tools every crypto trader needs are not just add-ons but critical enablers of success.

These tools help traders monitor volatile markets, analyze trends, and optimize their strategies, ensuring they stay competitive in a constantly changing landscape.

The Importance of Technology in Crypto Trading

Crypto markets are highly volatile, and prices can shift dramatically within seconds. To make informed decisions, traders need access to real-time data, advanced analytics, and automation. Tools designed for crypto trading help monitor trends, analyze market behavior, and execute trades seamlessly.

Adapting to Rapid Market Changes

With thousands of cryptocurrencies and exchanges available, keeping track of it all manually is nearly impossible. The right tools enable traders to adapt quickly to market changes, manage risks, and stay ahead of trends, giving them a competitive edge.

The 10 Essential Tools Every Crypto Trader Needs

To thrive in the highly competitive world of cryptocurrency trading, equipping yourself with the essential tools every crypto trader needs is crucial. These tools simplify complex trading processes, provide real-time insights, and help traders make data-driven decisions.

In this section, we’ll explore 10 must-have tools that will give you an edge in 2025.

1. Cryptocurrency Portfolio Tracker

Managing multiple assets across exchanges can be daunting without a reliable portfolio tracker. These tools allow traders to monitor the performance of their investments in one place.

- Why You Need It: Tracks profit and loss, monitors holdings, and provides real-time updates.

- Popular Options: CoinStats, Blockfolio, or Delta.

2. Exchange Aggregators

Exchange aggregators help traders find the best rates across multiple platforms, saving time and money.

- Why You Need It: Identifies the most favorable trading opportunities by comparing exchange rates instantly.

- Examples: CoinSwitch or ChangeNOW.

3. Advanced Charting Software

Technical analysis is a cornerstone of successful crypto trading. Advanced charting tools help traders analyze price patterns and predict market movements.

- Why You Need It: Provides detailed price charts, technical indicators, and customizable analysis tools.

- Recommended Tools: TradingView or CryptoCompare.

4. Crypto News Aggregators

Staying informed about the latest developments in the crypto space is crucial for making timely decisions.

- Why You Need It: Access real-time news, regulatory updates, and market sentiments in one place.

- Popular Tools: CryptoPanic or CoinTelegraph’s news app.

5. AI-Powered Trading Bots

Automating trades allows traders to take advantage of opportunities 24/7 without being glued to a screen.

- Why You Need It: Executes trades based on predefined strategies, reducing emotional decision-making.

- Examples: Pionex, Bitsgap, or 3Commas.

6. Risk Management Calculators

Every successful trader understands the importance of managing risks. Risk management tools help determine the appropriate trade size and set stop-loss levels.

- Why You Need It: Calculates risk-reward ratios and position sizes to minimize losses.

- Suggested Tools: CryptoPositionSize or MyCryptoBuddy.

7. On-Chain Analytics Platforms

Analyzing blockchain data can offer insights into market trends and the activities of large investors.

- Why You Need It: Tracks whale movements, network activity, and market signals.

- Examples: Glassnode, Santiment, or Nansen.

8. Crypto Tax Software

With global regulations tightening, crypto tax compliance has become a priority. Tax software simplifies the process of calculating and reporting taxes.

- Why You Need It: Automatically tracks transactions and generates tax reports.

- Popular Platforms: CoinTracking, Koinly, or TokenTax.

9. Secure Crypto Wallets

Protecting your crypto assets is non-negotiable. A secure wallet ensures that your investments are safe from hackers and breaches.

- Why You Need It: Provides secure storage for cryptocurrencies and supports multiple assets.

- Examples: Ledger, Trezor, or MetaMask.

10. Educational Resources and Communities

In the fast-evolving crypto world, continuous learning is essential. Access to educational platforms and trader communities can help you stay updated.

- Why You Need It: Enhances knowledge, provides insights, and fosters collaboration with other traders.

- Examples: Binance Academy, Reddit Crypto forums, or Discord groups.

How to Choose the Right Tools for Your Trading Needs

Choosing the essential tools every crypto trader needs can be daunting, but it starts with understanding your trading style and priorities.

These tools are not just about convenience but about optimizing your trading strategies, ensuring security, and staying ahead in the competitive crypto market.

This section will guide you on selecting tools that align with your unique trading goals.

Evaluate Your Trading Style

Your trading approach determines the tools you’ll need. Day traders may prioritize advanced charting software and bots, while long-term investors may focus on portfolio trackers and educational resources.

Focus on Security and Reliability

Always choose tools with strong reputations and robust security measures. Avoid tools with negative reviews or unclear ownership to safeguard your data and funds.

Takeaways

Navigating the world of crypto trading in 2025 requires more than just knowledge—you need the right tools to stay ahead. These essential tools every crypto trader needs can streamline your processes, enhance decision-making, and boost your trading efficiency.

Whether you’re tracking your portfolio, analyzing market trends, or automating trades, the right tools make all the difference. Equip yourself today to thrive in the ever-evolving crypto market.