Finding affordable car insurance can be a challenge for many families, but military families often face unique circumstances that make securing the right coverage even more important. With frequent relocations, deployment concerns, and tight budgets, military families require specialized solutions.

This article explores tips for military families to get best car insurance deals, highlighting how you can save money and ensure adequate coverage for your unique needs.

With expert insights, real-life examples, and practical advice, you can make informed decisions that protect your family and finances.

Why Military Families Need Specialized Car Insurance Deals

Military families often encounter situations that differ from civilian households, such as frequent moves and deployment-related needs. Here’s why tailored insurance options are essential:

Challenges Faced by Military Families in Finding Affordable Insurance

- Frequent Relocations: Moving across states disrupts policy continuity and often leads to higher rates. Insurers may not operate in all states, requiring families to switch policies frequently. For example, a family relocating from Texas to California may find limited options for transferring their policy, resulting in higher premiums.

- Deployment Concerns: Vehicles left unused during deployment may not require full coverage but still need proper handling to maintain compliance and prevent lapses. For instance, reducing collision coverage during deployment can save costs while keeping basic protection intact.

- Limited Time for Research: Busy schedules and relocations leave little time to compare and understand policies, creating a need for streamlined options tailored to military families.

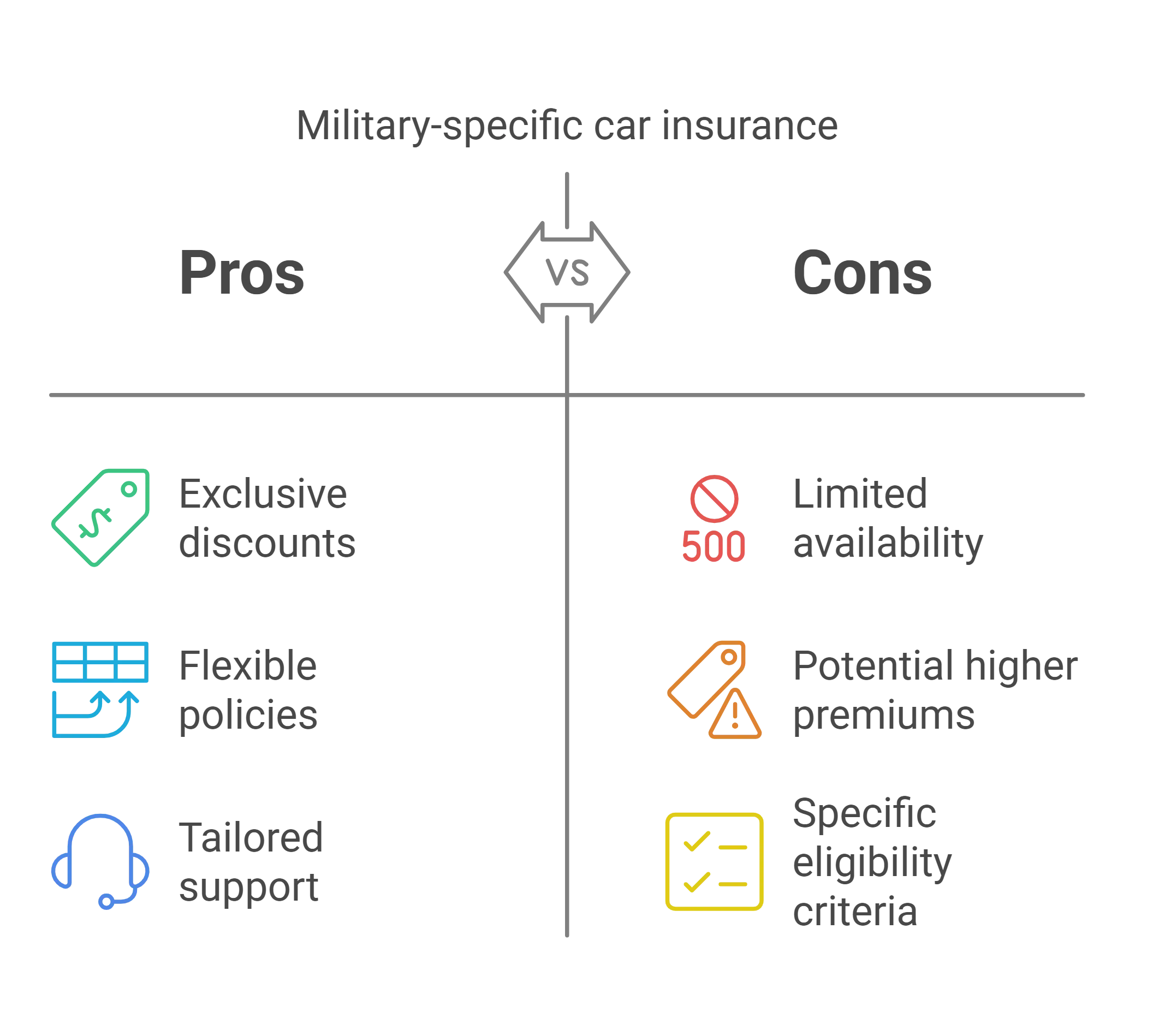

Benefits of Military-Specific Car Insurance Plans

- Exclusive Discounts: Many insurers provide significant discounts exclusively for active-duty service members, veterans, and their families, which can lead to savings of 10-15% or more. For instance, USAA offers competitive rates with benefits like roadside assistance.

- Flexible Policies: Military car insurance plans often offer deployment-specific coverage, accommodating unique military lifestyles, such as suspending coverage for unused vehicles. GEICO’s deployment flexibility is a popular example.

- Tailored Customer Support: Insurers familiar with military needs provide better service, ensuring smoother claims and fewer coverage gaps. Customer support lines dedicated to military families enhance accessibility and efficiency.

10 Effective Ways to Secure the Best Car Insurance Deals

Military families can use the following strategies to secure affordable and tailored car insurance plans:

1. Leverage Military Discounts Offered by Insurance Providers

Military families have access to exclusive discounts that significantly reduce premiums. These discounts often extend to veterans, National Guard members, and reservists.

| Insurer | Discount Offered | Additional Perks |

| USAA | Up to 15% | Deployment flexibility, roadside assistance |

| GEICO | 10-15% | Emergency deployment coverage, accident forgiveness |

| Armed Forces Insurance | Varies | Specialized policies tailored for military families |

Practical Tip: Contact insurers directly and ask about military-specific programs or unlisted discounts. USAA, for example, tailors its discounts for members stationed abroad or on active duty.

2. Compare Quotes from Multiple Providers

Shopping around ensures you get the best rate. Military families often qualify for discounts at providers beyond USAA and GEICO. Take advantage of comparison tools to evaluate options side by side, considering premiums, coverage, and perks.

| Provider | Monthly Premium Estimate | Military Discount | Key Features |

| Progressive | $90-120 | Yes | Bundle options, online tools |

| State Farm | $100-140 | No | Local agents, accident forgiveness |

| Liberty Mutual | $95-130 | Yes | Multiple coverage options |

Real-Life Insight: A military family based in Florida saved $300 annually by switching from a traditional insurer to Liberty Mutual due to its competitive military discounts.

3. Opt for Bundled Policies

Combining car insurance with other policies like home or renter’s insurance can lead to savings of up to 25%. Bundling simplifies policy management and often comes with additional benefits, such as multi-policy discounts or improved claims processes.

Example: A military family with GEICO bundled their renter’s insurance with auto coverage, saving $250 per year while reducing administrative hassle. Exploring tips for military families to get best car insurance deals often leads to discovering such opportunities.

4. Maintain a Clean Driving Record

Insurance providers reward safe drivers with lower premiums. Avoiding traffic violations, maintaining accident-free records, and taking proactive driving measures significantly impact costs.

| Driving Record | Impact on Premiums | Savings Potential |

| Clean Record | Lower premiums | 15-30% |

| Minor Violation | Slight increase | Limited savings |

| Major Violation | Substantial increase | No savings |

Pro Tip: Use telematics programs like Allstate’s Drivewise to monitor and improve your driving habits for additional savings. These programs are valuable tips for military families to get best car insurance deals while building a safety-first approach.

5. Take Advantage of Deployment Coverage Suspensions

Deployment suspensions allow you to pause coverage on a vehicle not in use, saving on premiums without losing insurance history. This option is particularly valuable for active-duty members stationed overseas.

| Insurer | Suspension Options | Eligibility |

| USAA | Yes | Active duty overseas |

| GEICO | Yes | Deployed for 30+ days |

| Progressive | Yes | Requires documentation |

Practical Tip: Notify your insurer in advance and keep documentation of your deployment orders to ensure smooth policy adjustments. Following tips for military families to get best car insurance deals, such as this, ensures maximum savings during deployment periods.

6. Look for Usage-Based Insurance Options

Usage-based insurance, such as pay-per-mile plans or telematics programs, can save money for families who drive less due to deployment or short commutes. Insurers use data from devices to calculate discounts based on safe driving habits.

| Insurer | Program Name | Key Benefits |

| Allstate | Drivewise | Up to 20% savings for safe drivers |

| Nationwide | SmartRide | Earn rewards for good habits |

| Metromile | Pay-Per-Mile | Low-cost coverage for infrequent drivers |

7. Consider Higher Deductibles

Opting for a higher deductible reduces monthly premiums but increases out-of-pocket costs for claims. Assess your financial situation to determine a balance between upfront savings and risk.

| Deductible Amount | Monthly Premium | Savings Potential |

| $500 | $120 | Limited savings |

| $1,000 | $100 | 15-20% |

| $1,500 | $85 | Up to 30% |

Practical Tip: Set aside a dedicated emergency fund to cover higher deductibles if you choose this option. This strategy is among the top tips for military families to get best car insurance deals.

8. Utilize Group Discounts or Membership Perks

Membership in military organizations like Veterans of Foreign Wars (VFW) or Armed Forces Associations can qualify you for additional savings. Check with your employer or local military groups for eligibility.

| Organization | Discount Offered | Eligible Members |

| VFW | Varies | Veterans, active duty |

| MOAA | Up to 15% | Officers, family members |

| USO | Partner discounts | Service members, families |

9. Enroll in Defensive Driving Courses

Completing an insurer-recognized defensive driving course can reduce premiums by up to 10%. Many insurers offer online courses, making them accessible for busy military families.

| Course Provider | Cost | Discount Potential |

| AARP | $20-30 | 5-10% |

| AAA | $25-50 | 5-10% |

| Local DMV | Free or low-cost | Varies |

10. Ask About Loyalty Programs and Renewals

Long-term customers often benefit from loyalty discounts. If you’ve been with a provider for years, ask about perks for renewing, such as accident forgiveness or reduced rates.

| Insurer | Loyalty Program Perks | Eligibility |

| USAA | Premium reductions | 3+ years |

| GEICO | Accident forgiveness | 5+ years, clean record |

| State Farm | Reduced premiums, perks | Varies |

Additional Tips for Military Families to Save on Car Insurance

Each state has different car insurance requirements, which can affect premiums. Be sure to familiarize yourself with the laws in your new location after a move. Some states require minimum liability, while others mandate additional coverage like uninsured motorist protection.

Review and Update Coverage Regularly

Life changes such as deployments, relocations, or adding a new driver to your policy can affect coverage needs. Regular reviews ensure your policy remains cost-effective and comprehensive. For example, updating mileage after a move could lower costs. These adjustments are among the most practical tips for military families to get best car insurance deals.

Takeaways

Securing affordable car insurance doesn’t have to be complicated for military families. By leveraging the tips for military families to get best car insurance deals outlined in this article, you can save money while ensuring comprehensive coverage.

Take advantage of military-specific discounts, compare rates, and stay proactive about your policy needs. With the right approach, you can navigate the complexities of car insurance and focus on what matters most—your family and service to the nation.