Shopping for car insurance can be overwhelming, especially with so many options and fine print to navigate. One of the best ways to ensure you make the right choice is by knowing the right questions to ask your car insurance agent.

These questions not only empower you to understand your policy better but also help you avoid costly mistakes.

This guide will cover the 10 most important questions to ask your car insurance agent before signing up, ensuring you get the best coverage for your needs and budget.

Understanding these questions and why they matter can save you money, provide better protection, and give you peace of mind. Let’s dive into the essential questions you should bring to your car insurance agent.

Understanding Coverage Options

1. What Types of Coverage Do You Offer?

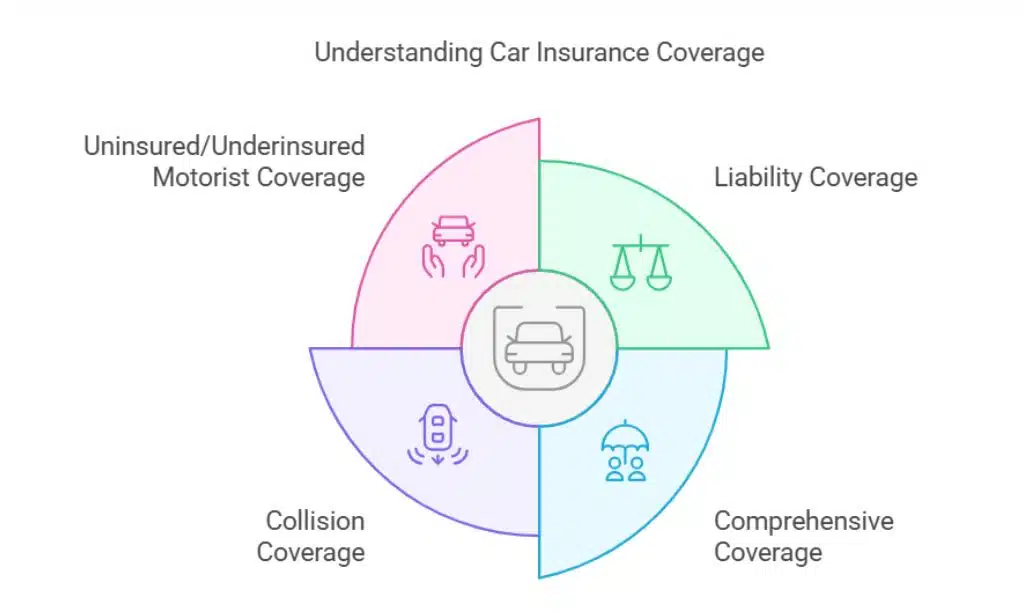

Car insurance comes with a variety of coverage options, and understanding these is crucial. When you ask your car insurance agent this question, they should explain the following:

- Liability Coverage: Covers damages you cause to others, including property damage and bodily injury.

- Comprehensive Coverage: Protects against non-collision events like theft, natural disasters, or vandalism.

- Collision Coverage: Pays for damage to your vehicle in case of a collision, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Offers protection if you’re hit by a driver without adequate insurance.

Each type of coverage addresses specific risks. For instance, comprehensive coverage is essential if you live in an area prone to natural disasters, while liability coverage is legally required in most states. Understanding these nuances helps you make informed decisions about your policy.

Here’s a table comparing different types of coverage:

| Coverage Type | What It Covers | Who It Benefits |

| Liability Coverage | Damages you cause to others | Other drivers and property owners |

| Comprehensive Coverage | Non-collision events like theft or storms | Vehicle owners |

| Collision Coverage | Damage to your vehicle after collisions | Vehicle owners |

| Uninsured Motorist Coverage | Costs when hit by uninsured drivers | Vehicle owners and passengers |

2. How Does Each Coverage Work?

Understanding how each type of coverage functions can clarify what you’re paying for. When you ask your car insurance agent this question, request examples for scenarios like:

- A tree falling on your car (covered by comprehensive coverage).

- An accident caused by an uninsured driver (covered by uninsured motorist coverage).

- Rear-ending another vehicle (covered by liability and collision coverage).

Here’s a detailed table explaining coverage scenarios:

| Scenario | Coverage Type | Example |

| Damage from a hailstorm | Comprehensive Coverage | Repair costs for hail-damaged car |

| Collision with another vehicle | Collision Coverage | Fixing your car after a collision |

| Hit by an uninsured driver | Uninsured Motorist Coverage | Medical expenses and car repair |

| Causing injury to another driver | Liability Coverage | Covering the other driver’s expenses |

Additionally, ask about deductibles and coverage limits—two factors that directly affect your premiums and out-of-pocket costs.

3. What Coverage Do I Legally Need?

Each state has its own minimum car insurance requirements. When asking your car insurance agent about legal coverage, ensure they provide a clear breakdown of what your state mandates.

Here’s a table of common state requirements:

| State | Minimum Liability Coverage | Additional Requirements |

| California | 15/30/5 (Bodily injury/property damage) | None |

| Florida | 10/20/10 (Personal injury/property damage) | Personal Injury Protection (PIP) |

| Texas | 30/60/25 | None |

Knowing the legal requirements ensures you avoid fines or penalAties while still protecting yourself adequately.

Assessing Policy Costs and Discounts

4. What Factors Impact My Premiums?

Car insurance premiums can vary significantly based on several factors. When you ask your car insurance agent this question, they should explain how the following affect your rates:

- Personal Factors: Age, driving history, location, and credit score.

- Vehicle Factors: Make, model, year, and safety features.

- Policy Factors: Coverage limits, deductibles, and optional add-ons.

For instance, a 25-year-old driver with a clean record driving a car with advanced safety features may pay less than a younger driver with multiple traffic violations. Consider this sample breakdown:

| Factor | Impact on Premiums | Example Impact |

| Age | Younger drivers pay higher rates | 20-year-old vs. 40-year-old driver |

| Driving Record | Accidents increase premiums | At-fault accident in past 3 years |

| Vehicle Safety Features | Discounts for advanced features | Anti-lock brakes, airbags |

| Location | High-risk areas have higher rates | Urban vs. rural zip codes |

Understanding these factors helps you identify ways to reduce your premiums. For instance, installing anti-theft devices could qualify you for a discount.

5. Are There Any Discounts Available?

Ask your car insurance agent to list all possible discounts, including:

- Safe driver discounts.

- Multi-policy discounts (e.g., bundling auto and home insurance).

- Good student discounts.

- Discounts for vehicles with advanced safety features.

Consider creating a checklist to keep track of the discounts you qualify for:

| Discount Type | Eligibility Criteria | Potential Savings |

| Safe Driver Discount | No accidents or violations for a specified period | 10-20% |

| Multi-Car Discount | Insure multiple vehicles under the same policy | 5-15% |

| Good Student Discount | Maintain a GPA of 3.0 or higher | 10-25% |

| Anti-Theft Device Discount | Install approved anti-theft devices | 5-10% |

6. How Can I Lower My Insurance Costs?

Lowering your insurance costs is a priority for many drivers. When you ask your car insurance agent for tips, they might suggest:

- Raising your deductible.

- Reducing coverage on older vehicles.

- Shopping around for better rates every year.

- Enrolling in a defensive driving course.

Here’s a table with potential savings strategies:

| Strategy | Potential Savings | Additional Notes |

| Increase Deductibles | Lower monthly premiums | Consider affordability for claims |

| Defensive Driving Course | 5-10% discount depending on insurer | Check course approval |

| Bundle Policies | 10-25% discount for multiple policy holders | Common with home/auto bundles |

| Maintain Clean Driving Record | Significant long-term savings | Avoid tickets and accidents |

Evaluating the Claims Process

7. How Do I File a Claim?

Understanding the claims process ensures you know what to do after an accident. When you ask your car insurance agent to explain this, they should outline the steps, such as:

- Contacting the insurer immediately.

- Providing necessary documentation (e.g., police reports, photos).

- Following up on the status of your claim.

Here’s a simple flowchart illustrating the claims process:

- Accident occurs.

- Document evidence and gather information.

- Contact your insurance agent.

- File a claim and provide documentation.

- Claim reviewed and settled.

8. What Is Your Claims Settlement Process?

The speed and fairness of claims settlement can vary among insurers. When asking your car insurance agent this question, focus on:

- Average settlement timelines.

- Availability of customer support during the claims process.

- Options for dispute resolution if you disagree with the settlement amount.

Use this table to compare insurer claims processes:

| Insurer | Average Settlement Time | Customer Support Availability | Dispute Resolution Options |

| Insurer A | 10-15 days | 24/7 | Mediation, Arbitration |

| Insurer B | 20-30 days | Business hours only | Appeals Process |

| Insurer C | 15-20 days | 24/7 | Mediation |

Understanding the Fine Print

9. Are There Any Exclusions in the Policy?

Every car insurance policy has exclusions—situations where coverage doesn’t apply. Common exclusions include:

- Intentional damage.

- Accidents caused while driving under the influence.

- Damage from natural disasters (if you don’t have comprehensive coverage).

Ask your car insurance agent to explain these exclusions to avoid surprises when filing a claim.

| Exclusion Type | Description | Example Scenario |

| Intentional Damage | Damage caused intentionally by the policyholder | Damaging your own car deliberately |

| DUI-Related Accidents | Accidents caused while under the influence | Collision while intoxicated |

| Natural Disaster Damage | If comprehensive coverage isn’t included | Hurricane damage to your vehicle |

10. What Happens If I Cancel My Policy Early?

Life circumstances may change, requiring you to cancel your policy. When you ask your car insurance agent about early cancellation, inquire about:

- Cancellation fees.

- Refunds for unused premiums.

- Required notice periods.

Understanding these terms prevents unexpected penalties if you need to switch insurers.

| Cancellation Factor | Details | Example Impact |

| Fees | Typically prorated or flat fee | $50 flat fee for cancellation |

| Refunds | Based on unused coverage days | $200 refund for unused months |

| Notice Period | Varies, often 30 days | Failure to notify may lead to penalties |

Finalizing Your Decision

Additional Tips for Choosing the Right Policy

Selecting the right policy goes beyond the basics. Here’s a checklist of additional considerations:

- Compare quotes from at least three insurers.

- Research customer reviews and satisfaction ratings.

- Confirm the financial stability of the insurer.

- Review optional add-ons like roadside assistance or rental car coverage.

Questions to Revisit After Signing Up

Even after signing up, periodically review your policy. Ask your car insurance agent questions about:

- Adjusting coverage as your needs change.

- Adding or removing drivers from your policy.

- Potential discounts for policy loyalty.

Takeaways

Choosing the right car insurance policy doesn’t have to be complicated. By knowing the right questions to ask your car insurance agent, you’ll gain clarity, confidence, and control over your coverage.

Remember, the more informed you are, the better decisions you can make to protect yourself and your assets. Take proactive steps today to ensure your car insurance policy meets your needs and budget.DDD