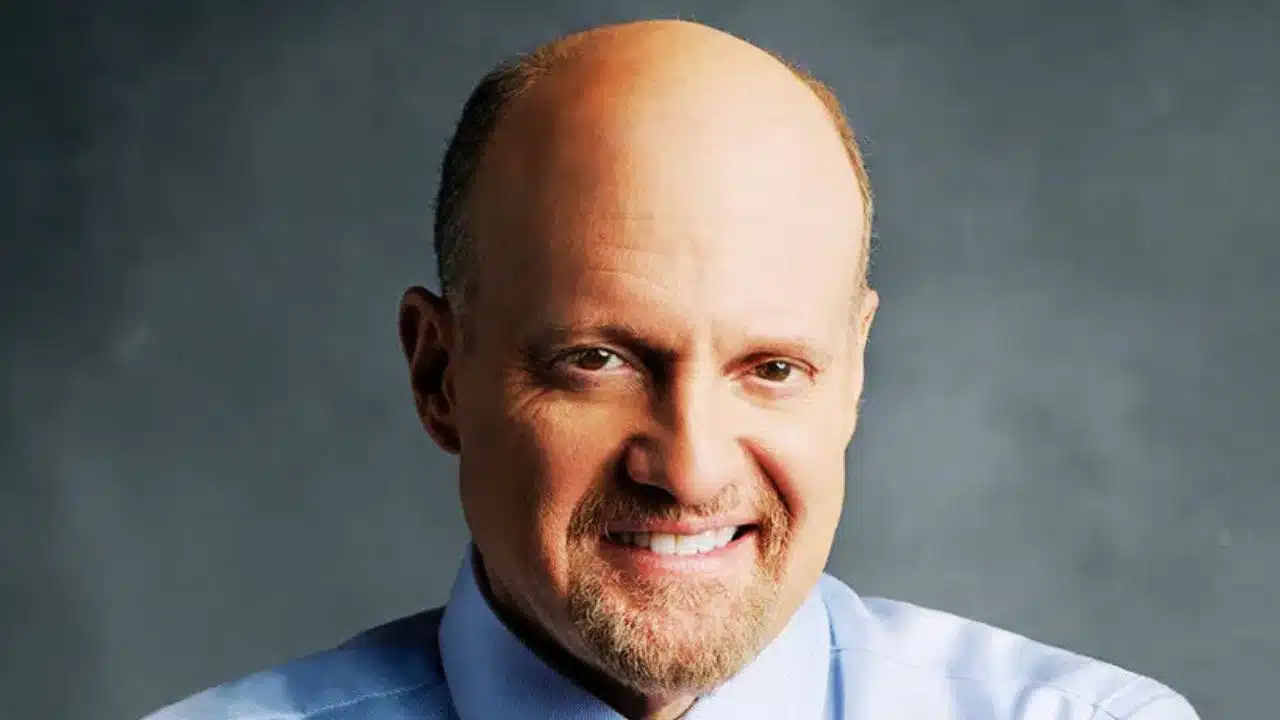

CNBC’s Jim Cramer offered important advice to investors, urging them not to panic over stock downgrades or the regular fluctuations that take place in the stock market. Cramer reiterated his belief that it’s crucial to stick with high-quality, fundamentally sound companies even when their share prices go through temporary ups and downs. His message was clear: downgrades, while they may sound concerning, are often more reflective of short-term market thinking rather than the long-term value of a company.

Cramer has long advocated for the idea that serious, long-term investors shouldn’t be swayed by every headline or downgrade from analysts. “When I look at the history of this incredible bull market—and it has been an incredible bull market—it’s littered with ‘buy-to-hold, hold-to-sell,’ downgrades that scare you out of amazing stocks at levels that may temporarily be too high, but will recover later,” he stated. His point underscores that while analysts may sound alarms with their downgrades, many great companies have historically recovered from these perceived setbacks.

Downgrades Can Lead to Missed Opportunities

Cramer’s comments come at a time when there has been an uptick in the number of downgrades from analysts, creating anxiety among investors. On Monday, the Dow Jones Industrial Average fell by 0.94%, the S&P 500 declined by 0.96%, and the Nasdaq Composite dropped by 1.18%. Many investors reacted to what Cramer described as a “ridiculous plethora of sell-side downgrades,” causing a downward trend across the market. These downgrades contributed to market volatility, with investors being swayed to sell their holdings based on short-term predictions.

Cramer acknowledged that it was indeed a tough session for the market, but he cautioned against putting too much weight on these downgrades, especially for those who are looking at the stock market from a long-term perspective. According to Cramer, following too many downgrades or sell recommendations can lead to missed opportunities. In many cases, solid companies may experience temporary setbacks, but they often bounce back, making it a mistake to abandon them at the wrong time.

Amazon: A Prime Example of Resilience

One of the specific stocks Cramer discussed during his segment was Amazon, a megacap company that recently faced a downgrade from Wells Fargo. The bank expressed concerns over Amazon’s short-term challenges, such as increased competition and potential regulatory issues, but Cramer disagreed with their assessment. While he acknowledged that Amazon is currently facing hurdles, he stressed that the company has a proven history of overcoming obstacles and coming out stronger. Cramer believes it’s only a matter of time before Amazon rebounds.

He highlighted a recent instance where Amazon’s stock took a significant dip in early August after the company reported a revenue miss. The stock price initially dropped, but it soon recovered as investors regained confidence in Amazon’s long-term growth prospects. This example, Cramer argued, is exactly why investors shouldn’t panic and sell at the first sign of trouble. In his view, Amazon is still a great long-term investment, and selling it based on a temporary downgrade would be a mistake.

Betting Against Apple’s Success is Risky

Cramer also took issue with Jeffries’ recent downgrade of Apple. Jeffries downgraded the tech giant, citing concerns about the upcoming iPhone 16 release, which they believe could face headwinds in a highly competitive smartphone market. However, Cramer was quick to point out that Apple has consistently delivered high-quality products that resonate with consumers. In his opinion, betting against Apple is akin to betting against the company’s well-established culture of innovation and excellence.

Apple has faced doubts in the past about new product releases, but the company has a long history of proving skeptics wrong. Cramer reminded investors that Apple has rarely, if ever, released a subpar product. He further emphasized that the company’s ability to innovate and maintain consumer loyalty is one of its biggest strengths. For Cramer, the Jeffries downgrade reflects a short-term view that overlooks Apple’s broader potential.

“Downgrading Apple ahead of the iPhone 16 release is basically betting against Apple’s entire culture of excellence,” Cramer explained. “It’s not something I would advise doing because history has shown us that Apple always finds a way to deliver.”

Don’t Follow Wall Street’s Addiction to Trading

Cramer didn’t stop at specific stock examples. He broadened his critique to address a common problem he sees with Wall Street analysts and traders: an obsession with constant trading. According to Cramer, Wall Street is driven by short-term trading strategies, which can mislead everyday investors who don’t have the time or resources to actively manage their portfolios.

“Wall Street is addicted to trading,” Cramer stated firmly. “But if you’re managing your own money, you should not be listening to all of this trading advice. You can’t afford to do what they want you to do because trading is a full-time job.”

What Cramer is referring to is the high-frequency nature of trading that dominates Wall Street, where professional traders make quick buy-and-sell decisions based on daily market movements. While this might work for full-time traders, Cramer emphasized that it’s not a suitable strategy for individual investors who are building wealth for the long term.

The Importance of Long-Term Focus

Cramer’s main takeaway for everyday investors is that long-term success in the stock market often comes from holding onto great companies through both good times and bad. Trying to time the market or react to every downgrade is a strategy that rarely works out well for long-term investors. Instead, he advises focusing on the fundamentals of the companies you invest in and not letting short-term volatility push you into making poor decisions.

In Cramer’s view, the constant churn of stock ratings—buy, sell, hold—often distracts from the bigger picture. Downgrades may cause panic in the short term, but solid companies tend to recover, making patience a key factor in successful investing. He believes that sticking with high-quality companies and tuning out the noise of daily market fluctuations is a more reliable strategy for those investing for the future.

Downgrades Don’t Define Great Companies

Jim Cramer’s advice to investors is clear: don’t let downgrades or market volatility dictate your long-term investment decisions. The market will always have ups and downs, but high-quality companies with strong track records tend to recover and thrive over time. Whether it’s Amazon overcoming temporary hurdles or Apple continuing its culture of excellence, Cramer believes that long-term investors should remain focused on the fundamentals and not be swayed by the constant noise from Wall Street analysts.

For those managing their own portfolios, his final piece of advice is simple: avoid getting caught up in short-term trading strategies and stick to your long-term goals. By doing so, investors can avoid unnecessary panic and ensure they stay on track for sustained financial success.