Listen to the Podcast:

British households are feeling the squeeze as recent figures show that pay growth has slowed while inflation continues to outstrip wage increases significantly.

This will mean a decline in the purchasing power of UK residents at a time when food and commodity prices are already on the rise, creating a strain on families already struggling to find a great guide on how to build credit fast and worried about their disposable income.

It’s clear that something must be done to mitigate this widening gulf between wages and rising prices – but just what can be done? Read this post to learn more about how this could affect you.

Overview of UK Pay Growth Slowdown

The UK economy has been facing a slowdown in pay growth since the start of 2023. According to the Office for National Statistics, wage growth fell to 5.7% from a revised 6% in December, leaving the average pay rise 3.2% below the inflation rate. This is concerning news for households across the country as it means rising prices are eroding their purchasing power.

Basic pay, excluding bonuses, rose by 6.5% compared with 6.7% in the three months to December, representing the first slowdown in that period since June 2019.

The Bank of England’s Monetary Policy Report for February 2023 also noted that nominal wage growth is expected to remain high over the duration of its forecast, with average earnings projected to grow at 5.7% in 2023 and 4.4% in 2024.

The situation is further complicated by Goldman Sachs’ prediction of a 1.2% contraction in the U.K.’s real GDP over the course of this year – well below all other G-10 economies – and a survey conducted by BCG’s Centre for Growth which found that three-quarters of 1,500 UK business leaders polled believe the economy will shrink in 2023 but only 20% plan to reduce staff numbers or freeze hiring plans as a result.

Impact on UK Households and their Budgets

The UK faces an economic climate of slow wage growth and rising prices, leading to an overall cost of living crisis. This means that households across the country are struggling to maintain their purchasing power, as their income is not increasing at the same rate as the costs of consumer goods and services.

Furthermore, Goldman Sachs’ prediction will also significantly impact household incomes and budgets. As unemployment rises and real wages decrease, households may find it increasingly difficult to keep up with everyday expenses such as utility bills and food items.

In addition, businesses are being forced to freeze hiring plans or reduce staff numbers due to economic uncertainties – meaning fewer job opportunities for those searching for work in the hospitality, retail, or entertainment sectors.

The stagnation in wage growth combined with fewer jobs available has created a perfect storm that is taking its toll on UK households and their budgets.

How Wage Stagnation Affects Consumer Spending in the UK?

The UK wage stagnation has significantly impacted consumer spending, with workers losing an average of £9,200 per year since 2008. The lack of pay increases is driving the country’s living standards to slump, and many of the lowest-earning employees have seen their wages stagnate or even decline in real terms.

The paradox of stagnant real wages yet rising ‘living standards’ in the UK is a cause for concern as it highlights labor market inequalities and shows a need to boost wage growth for middle and low-earners who are non-graduates.

Overall, wage stagnation has had a huge impact on consumer spending in the UK, and steps must be taken to address this issue so that people can enjoy higher living standards and more financial security.

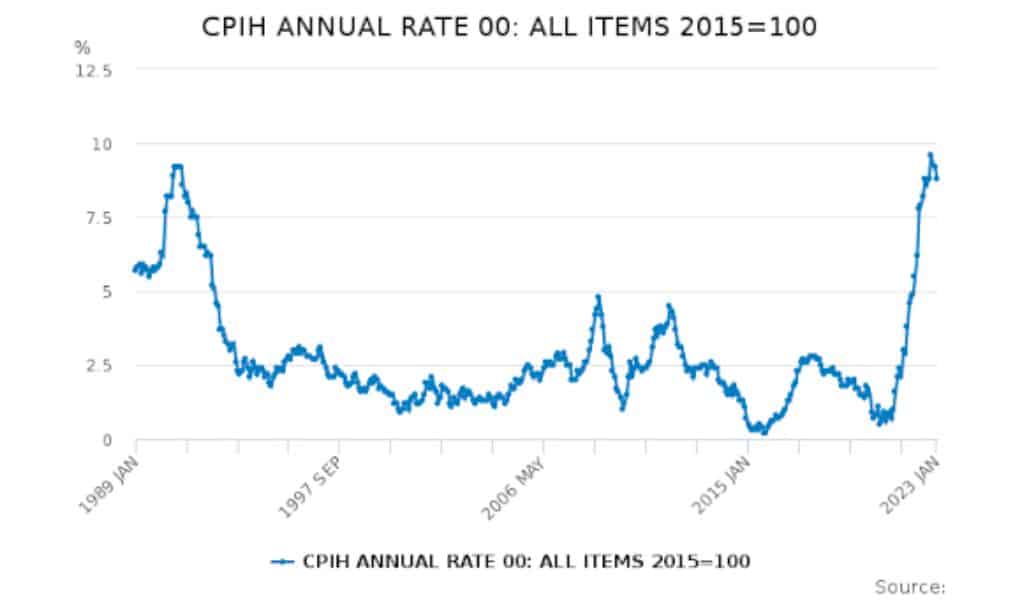

How Inflation has also Risen over the Past year in the UK?

In the United Kingdom, inflation has been on the rise over the past year. The latest figures from January 2023 show that the Consumer Price Index (CPI) was 10.1%, down from 10.5% in December 2022.

This is a significant increase from the previous year when inflation was at 2.4%. The rising cost of living has been attributed to various factors, including higher costs for food and energy, as well as an increase in taxes and government spending. Additionally, wages have not kept up with inflation, leading to a squeeze on household incomes.

The Bank of England has predicted that inflation will begin to fall from the middle of this year and be around 4% by the end of 2023. However, some economists predict that inflation could take longer to return to pre-pandemic levels due to continued uncertainty in the global economy.

Overall, it is clear that inflation has had a significant impact on households in the UK over the past year. This trend will likely continue into 2021 unless there is a dramatic shift in economic policy or conditions improve significantly.

The Potential Long-term Economic Implications for UK Households

The long-term economic implications for UK households loom as a pressing concern amid ongoing global uncertainties and tumultuous financial markets. Analysts are closely monitoring the convergence of factors such as post-Brexit trade disruptions, inflationary pressures, and the burgeoning impact of climate change on energy and food prices.

A potent combination of these forces threatens to chip away at the financial stability of families across the country, exacerbating the already widening wealth gap and eroding consumer confidence.

Experts caution that without a robust and strategic policy response from the government, millions could face diminished prospects for upward mobility, a decline in living standards, and increased financial vulnerability in the years to come.

The path to securing the economic well-being of UK households remains steeped in complexity, demanding a comprehensive, forward-thinking approach that can only be achieved through collective action and cooperation.

Conclusion

The slowdown of UK pay growth is a worrying economic trend for households across the nation and could have far-reaching implications in the long term.

While it may be difficult for households to cope with increased costs brought about by inflation, it is nevertheless essential that both individuals and policymakers remain alert to changes in the economy and work together to come up with inventive solutions.

This means considering not only the cost of living increases but also the implications of wage stagnation on consumer spending.

It is clear that while the pay growth slowdown has already had serious impacts on family budgets, there will likely be more challenges ahead if nothing is done to counter its effects.