Purchasing a property is a monumental milestone for many, especially for first-time property buyers in Singapore. The country’s real estate market is renowned for its transparency, robust infrastructure, and high property values, making it both an attractive and complex venture.

For first-time property buyers in Singapore, the journey involves meticulous planning, financial prudence, and a clear understanding of the available options. This guide aims to simplify the process by offering 10 essential tips to help you navigate the real estate market confidently and make informed decisions.

Understanding the Property Market in Singapore

Singapore’s property market is a mix of public and private housing options tailored to diverse needs:

- Public Housing (HDB Flats): Over 80% of Singapore’s residents live in Housing Development Board (HDB) flats, which are subsidized and designed for affordability.

- Private Properties: Condominiums, landed homes, and executive condominiums (ECs) cater to higher-income groups and foreign buyers.

The market is regulated through government policies and grants, ensuring stability and accessibility, particularly for first-time property buyers in Singapore.

Key Factors Influencing Property Prices

- Location: Properties near MRT stations, schools, and malls command higher prices.

- Government Policies: Measures like Additional Buyer’s Stamp Duty (ABSD) and cooling measures influence demand and affordability.

- Urban Development: Regions undergoing redevelopment, such as Punggol or the Jurong Lake District, see significant appreciation.

Top 10 Tips for First-Time Property Buyers in Singapore

1. Set a Realistic Budget

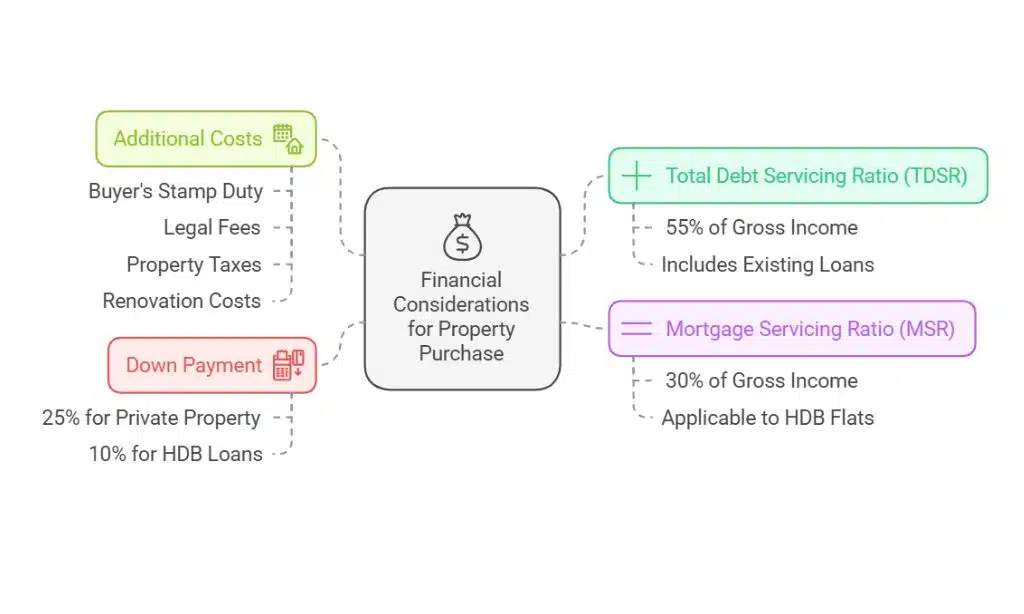

Budgeting is the foundation of a successful property purchase. For first-time property buyers in Singapore, it’s crucial to assess financial readiness to avoid overextending yourself. Start by evaluating your savings, CPF Ordinary Account balance, and monthly income.

- Understand Total Debt Servicing Ratio (TDSR): Singapore’s TDSR limits your monthly debt repayments to 55% of your gross monthly income, including existing loans.

- Calculate Mortgage Servicing Ratio (MSR): For HDB flats, MSR caps your housing loan repayments at 30% of your gross monthly income.

- Factor in Down Payment: Private property purchases require at least 25% of the purchase price as a down payment (5% in cash). For HDB loans, you’ll need at least 10%.

- Consider Additional Costs: Include Buyer’s Stamp Duty (BSD), legal fees, property taxes, and renovation costs in your budget.

| Expense | Estimated Cost (SGD) | Details |

| Down Payment | 5%–25% of property price | Minimum 5% in cash for private property. |

| Buyer’s Stamp Duty | 1%–4% of property price | Tiered based on property value. |

| Renovation Costs | $10,000–$30,000 | Depends on property size and design. |

| Legal Fees | $2,500–$3,000 | Covers conveyancing and paperwork. |

Pro Tip: Avoid maxing out your budget to leave room for unexpected expenses or lifestyle needs.

2. Research the Right Location

Location is one of the most critical factors in property selection. It affects not just the price but also your convenience, lifestyle, and the property’s future resale value.

- Evaluate Proximity to MRT Stations: Properties near MRT stations, such as those within 500 meters, command a premium due to their accessibility.

- Assess Nearby Amenities: Look for schools, healthcare facilities, supermarkets, parks, and retail hubs in the vicinity.

- Future Growth Potential: Research areas with upcoming developments, such as new MRT lines, shopping malls, or business districts.

- Lifestyle Alignment: Choose a location that matches your preferences—urban areas like Orchard Road for city living or quieter suburbs like Sengkang for a family-friendly vibe.

| Popular Areas | Key Features | Suitable For |

| Punggol | Eco-friendly, waterfront living | Families and young couples |

| Tampines | Established amenities and schools | Families |

| Jurong | Second CBD, growing infrastructure | Investors and professionals |

Pro Tip: Use online tools like URA’s Master Plan to identify upcoming developments in your preferred locations.

3. Understand Property Types and Eligibility

Singapore offers a range of property options, each with unique eligibility requirements and benefits. Understanding these options helps first-time property buyers in Singapore make informed decisions.

| Property Type | Eligibility | Key Benefits |

| HDB Flats | Citizens, income caps apply | Affordable, grant-eligible. |

| Executive Condos | Citizens, PRs, income caps apply | Condo facilities at lower prices. |

| Private Condos | Open to all | Luxurious, high resale value. |

| Landed Properties | Citizens, limited exceptions | High-end, customizable living. |

Pro Tip: Choose HDB flats or ECs to access government grants if you’re eligible.

4. Explore Housing Grants and Schemes

Singapore’s government offers several grants to make property ownership more accessible for first-time property buyers in Singapore. These grants can significantly reduce upfront costs, especially when purchasing HDB flats.

Key Grants Available

| Grant | Eligibility | Maximum Amount (SGD) |

| Enhanced CPF Housing | Based on income levels | $80,000 |

| Family Grant | Resale flat buyers, income limits | $50,000–$80,000 |

| Proximity Housing Grant | Living near family | $30,000 |

These grants help reduce your financial burden and improve affordability for first-time property buyers in Singapore.

Practical Example

A couple earning SGD 8,000 per month applied for both the Enhanced CPF Housing Grant and the Family Grant, reducing their upfront costs by SGD 130,000 for a resale flat in Bishan.

Pro Tip: Check your eligibility for multiple grants and combine them to maximize your savings as first-time property buyers in Singapore.

5. Secure Pre-Approval for a Loan

For first-time property buyers in Singapore, securing approval in Principle (AIP) is a crucial step before starting your property search. An AIP indicates how much you can borrow, ensuring you focus only on properties within your budget.

Why AIP Is Essential

- Know Your Borrowing Capacity: Avoid wasting time on properties outside your budget.

- Negotiate with Confidence: Sellers are more likely to engage with pre-approved buyers.

- Regulatory Compliance: Stay within Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) limits.

| Loan Type | Interest Rate | Key Features |

| HDB Loan | Fixed at 2.6% | Lower down payment, flexible terms. |

| Bank Loan | 1.5%–2.5% (varies) | Flexible rates, stricter criteria. |

Practical Example

A family with a combined income of SGD 12,000 secured an AIP from a bank, enabling them to purchase a private condominium worth SGD 900,000.

Pro Tip: Compare AIP offers from multiple banks to get the best terms and conditions as first-time property buyers in Singapore.

6. Plan for Additional Costs

Beyond the property’s purchase price, first-time property buyers in Singapore need to account for additional costs to avoid financial surprises. These include one-time expenses and recurring charges.

Key Costs to Budget For

- Buyer’s Stamp Duty (BSD): 1%–4% of the purchase price, depending on the property’s value.

- Additional Buyer’s Stamp Duty (ABSD): Applicable for foreign buyers or second-property purchases.

- Legal Fees: Costs for conveyancing services and title deed registration.

- Renovation and Furnishing: Necessary for resale flats or new homes requiring customization.

| Expense | Frequency | Approximate Cost (SGD) |

| Buyer’s Stamp Duty | One-time | 1%–4% of property price |

| Legal Fees | One-time | $2,500–$3,000 |

| Renovation Costs | One-time | $10,000–$30,000 |

| Maintenance Fees | Monthly | $100–$500 for condos |

Practical Example

A first-time buyer of a resale HDB flat in Tampines spent SGD 20,000 on renovation and SGD 18,000 on Buyer’s Stamp Duty for an SGD 500,000 property.

Pro Tip: Set aside 5%–10% of your budget for these additional costs to ensure smooth planning as first-time property buyers in Singapore.

7. Work with a Trusted Real Estate Agent

Navigating Singapore’s real estate market can be daunting, especially for first-time property buyers in Singapore. A professional real estate agent can provide valuable insights, handle legal paperwork, and negotiate on your behalf.

How Agents Help First-Timers

- Market Insights: Gain clarity on property prices, trends, and available options.

- Legal Guidance: Understand documents like the Option to Purchase (OTP) and Sale & Purchase Agreement (S&P).

- Negotiation Skills: Secure a better price within your budget.

| Criteria for Choosing an Agent | Details |

| Licensing | Verify their CEA (Council for Estate Agencies) registration. |

| Experience | Look for agents experienced in your preferred property type or location. |

| Client Reviews | Check testimonials or recommendations from previous clients. |

Practical Example

An agent helped a young couple find a resale flat in Punggol, negotiating the price down by 8% and assisting with grant applications for smoother processing.

Pro Tip: Use government portals like the CEA directory to verify agent credentials and avoid fraud as first-time property buyers in Singapore.

8. Understand Legal and Financial Documents

Buying property in Singapore involves several legal and financial documents, which can be overwhelming for first-time property buyers in Singapore. Understanding these documents is critical to ensure transparency and avoid pitfalls.

| Document | Purpose |

| Option to Purchase | Secures your intent to purchase. |

| Sale & Purchase Agreement | Formalizes the transaction terms. |

| Loan Agreement | Outlines loan terms and repayment schedule. |

Practical Example

A buyer working with their lawyer discovered an error in the Sale & Purchase Agreement, which could have led to higher fees. Resolving it early saved them thousands.

Pro Tip: Always consult a lawyer to review documents and protect your interests as a first-time property buyers in Singapore.

9. Conduct Thorough Property Inspections

Thorough inspections are essential for identifying hidden issues in a property. This is especially critical for first-time property buyers in Singapore purchasing resale flats or older properties.

| Area to Inspect | What to Check | Potential Issues |

| Walls and Ceilings | Cracks, water stains, peeling paint | Structural issues, leaks |

| Plumbing | Water pressure, drainage, leaks | Leaks, blockages |

| Electrical Systems | Functionality of switches, outlets, and lights | Faulty wiring, broken fixtures |

| Windows and Doors | Smooth operation, drafts, broken locks | Misalignment, energy inefficiency |

| Floors | Loose tiles, uneven or creaking surfaces | Installation defects, damage |

| Appliances | Test all included appliances | Malfunctioning or outdated appliances |

Practical Example

A couple inspecting a resale flat in Toa Payoh discovered faulty wiring and a leaking pipe, which allowed them to renegotiate an SGD 10,000 price reduction.

Pro Tip: Bring along a checklist or hire a professional inspector to ensure no detail is missed as first-time property buyers in Singapore.

10. Future-Proof Your Investment

For first-time property buyers in Singapore, considering the long-term potential of your property is essential to maximize your investment.

Key Considerations

- Resale Value: Look for properties in growing neighborhoods like Jurong or Punggol.

- Lifestyle Alignment: Choose a property that meets future needs, such as starting a family or remote work.

- Market Trends: Monitor infrastructure projects, economic conditions, and government policies.

| Future-Proofing Factor | Example |

| Infrastructure Growth | Proximity to new MRT stations. |

| Resale Value | Properties in Jurong or Woodlands. |

| Family Needs | Nearby schools, parks, and childcare facilities. |

Pro Tip: Review URA’s property market reports to stay informed about trends as first-time property buyers in Singapore.

Takeaways

For first-time property buyers in Singapore, preparation and knowledge are your most valuable tools. By budgeting wisely, exploring grants, and understanding the market, you can navigate the complexities of property ownership with confidence.

Start your journey today with these tips to secure a home that aligns with your needs and aspirations.